User Provisioning Software Market Size 2025-2029

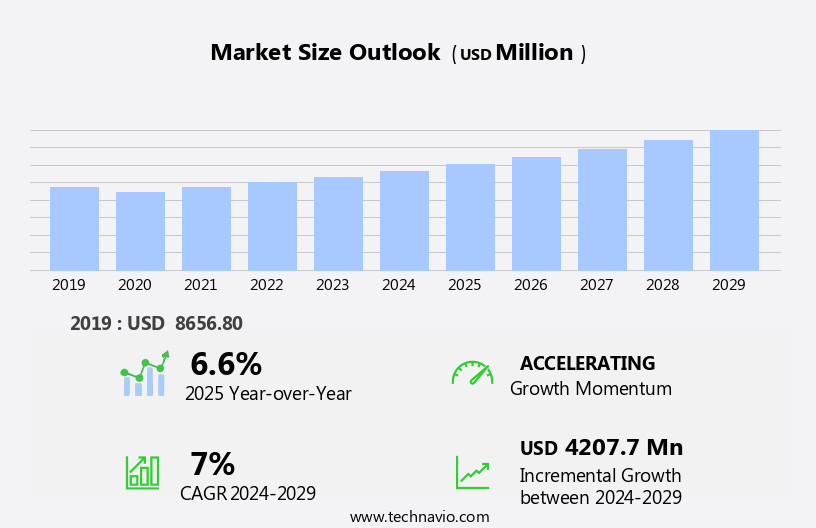

The user provisioning software market size is forecast to increase by USD 4.21 billion, at a CAGR of 7% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing demand for large-scale user provisioning solutions. This trend is fueled by the expanding digital workforce and the need for organizations to efficiently manage and secure access to their IT resources. Another key driver is the growing adoption of artificial intelligence (AI) technologies in user provisioning software. AI enables automation of complex processes, reducing manual effort and errors, and enhancing security through real-time risk analysis. However, the market faces challenges as well. Rising competition from open-source platforms poses a significant threat, as they offer cost-effective alternatives to proprietary solutions.

- Organizations must differentiate themselves by providing superior functionality, ease of use, and robust security features to justify the investment in commercial software. Additionally, ensuring compliance with various data protection regulations, such as GDPR and HIPAA, adds complexity to user provisioning processes and requires careful consideration when selecting a solution. To capitalize on market opportunities and navigate challenges effectively, companies must stay informed of the latest trends and best practices in user provisioning software.

What will be the Size of the User Provisioning Software Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities unfolding across various sectors. Self-service password resets and cloud provisioning are increasingly popular, enabling organizations to streamline IT processes and enhance user experience (UX). Single sign-on (SSO) solutions ensure seamless access to multiple applications, while reporting and analytics provide valuable insights for risk management. On-premise and hybrid provisioning cater to diverse organizational needs, offering flexibility and scalability. Directory services, OpenID Connect, account lifecycle management, access control, and password management are integral components, ensuring data security and incident response. Multi-factor authentication (MFA) and provisioning automation further bolster security, while endpoint management and API integration facilitate efficient workflows.

Cloud security, workflow automation, vulnerability management, and identity management are emerging trends, addressing the evolving threat landscape and ensuring robust user access control. The user interface (UI) plays a crucial role in adoption and ease of use, as does the integration of various APIs and technologies. The market's continuous dynamism underscores the importance of adaptive solutions that address the ever-changing IT landscape.

How is this User Provisioning Software Industry segmented?

The user provisioning software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- BFSI

- Manufacturing

- Healthcare

- Retail

- Others

- Type

- Role-based provisioning

- Account-based provisioning

- Self-service provisioning

- Deployment

- On-premises

- Cloud

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

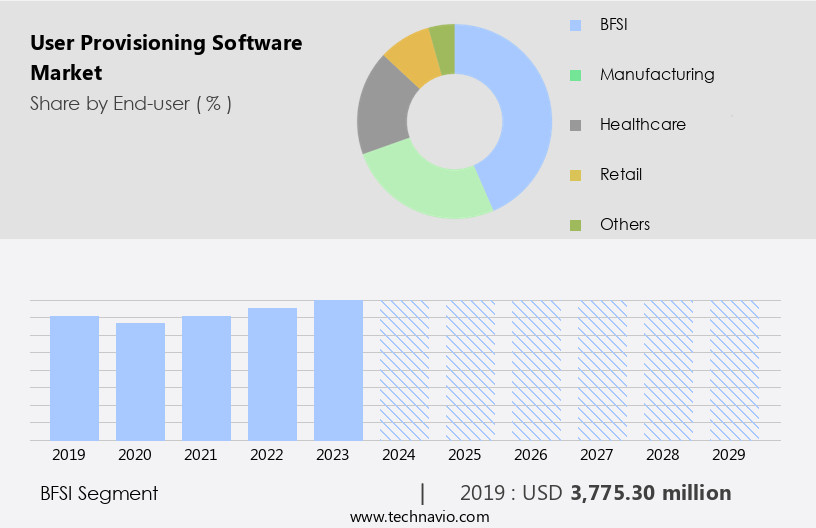

The bfsi segment is estimated to witness significant growth during the forecast period.

In today's digital landscape, user provisioning software has become an indispensable tool for businesses, particularly in the BFSI sector. With the increasing adoption of banking services and the complete digitalization of financial systems, vast amounts of user content need to be managed electronically across diverse systems and processes. The BFSI sector, which includes banking, insurance, accounting, and other financial verticals, has been enhancing and refining its services to meet evolving customer needs. However, this growth has also brought new challenges, such as an increased risk of cyber-attacks. To address these challenges, user provisioning software plays a crucial role in enabling financial organizations to manage user access and identity across multiple systems and applications.

This software facilitates self-service password resets, cloud provisioning, and single sign-on (SSO), enhancing the user experience (UX) and improving efficiency. Furthermore, it offers reporting and analytics capabilities, enabling organizations to gain insights into user behavior and identify potential risks. Moreover, advanced features such as multi-factor authentication (MFA), risk management, provisioning automation, endpoint management, and access control ensure robust security. User provisioning software also integrates with APIs, active directories, OpenID Connect, and other systems, streamlining workflows and improving overall security posture. In addition, the software supports hybrid environments, allowing organizations to manage both on-premise and cloud-based systems. It also offers incident response, directory services, account lifecycle management, password management, and user interface (UI) customization options.

With these capabilities, user provisioning software helps financial organizations maintain data security, mitigate vulnerabilities, and respond to threats effectively. In conclusion, the market is witnessing significant growth due to the increasing demand for secure and efficient identity and access management solutions. The software's ability to facilitate self-service password resets, SSO, reporting and analytics, and advanced security features make it an essential tool for businesses, particularly in the BFSI sector. With the evolving threat landscape and the need for seamless user experience, user provisioning software is poised to continue its growth trajectory in the coming years.

The BFSI segment was valued at USD 3.78 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

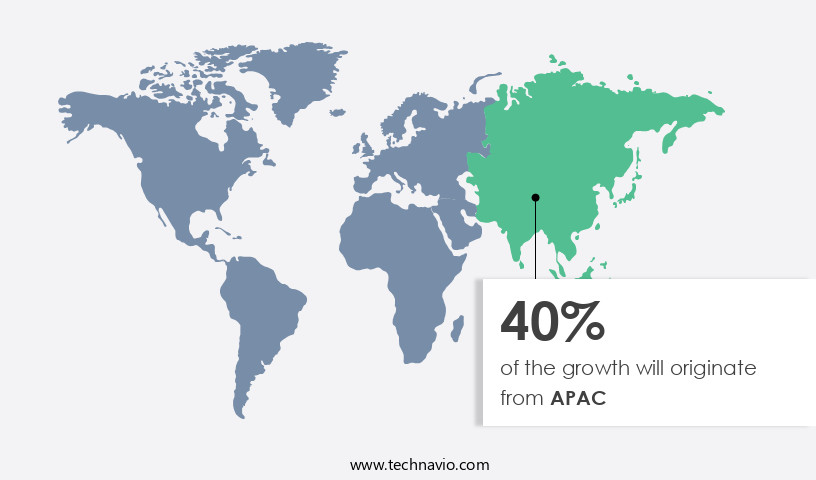

APAC is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America experienced significant growth in 2024, driven by the region's technological advancements and the mature industrial sector. Countries in North America are at the forefront of technology adoption, leading to a faster implementation of modern solutions. The region's investment in technology development further fuels market expansion. Moreover, the integration of advanced technologies, such as user database information management, cloud, mobility, social apps, and economic progress, significantly contributes to the market's growth. Self-service password resets, cloud provisioning, single sign-on (SSO), reporting and analytics, user provisioning, on-premise provisioning, user self-service, hybrid provisioning, user experience (UX), risk management, multi-factor authentication (MFA), provisioning automation, endpoint management, active directory, data security, incident response, directory services, openid connect, account lifecycle management, access control, password management, user interface (UI), API integration, cloud security, workflow automation, vulnerability management, identity management, and threat detection are integral components of user provisioning software.

These technologies enhance security, streamline processes, and improve the user experience. The market's growth is further propelled by the increasing emphasis on risk management and data security. Endpoint management, MFA, and identity management are essential aspects of user provisioning software that help organizations mitigate risks and protect sensitive data. As businesses continue to digitalize, the demand for user provisioning software that offers seamless integration with various applications and systems will increase. Additionally, the market's growth is driven by the need for automation and workflow efficiency, which user provisioning software provides. In conclusion, the market in North America is poised for continued growth due to the region's technological maturity, investment in technology development, and the integration of advanced technologies.

The market's growth is further fueled by the increasing emphasis on data security, risk management, and workflow automation. User provisioning software offers organizations a comprehensive solution to manage user access, streamline processes, and improve security.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic business landscape, user provisioning software has emerged as a vital solution for managing digital workforces efficiently. These solutions automate the process of creating, modifying, and deprovisioning user access to applications and systems, ensuring security and productivity. Key features include single sign-on, identity and access management, and provisioning workflows. User provisioning software caters to various industries, including healthcare, finance, education, and retail, addressing their unique needs. It integrates with various systems, such as HRIS, LDAP, and Active Directory, streamlining user management. With scalability, ease of use, and robust security, user provisioning software is an essential investment for businesses seeking to optimize their digital workforce.

What are the key market drivers leading to the rise in the adoption of User Provisioning Software Industry?

- The increasing demand for large-scale user provisioning is the primary factor fueling market growth.

- User provisioning software automation has gained significant traction in the corporate world due to increasing regulatory requirements, audit enablement, and the need for federated Single Sign-On (SSO) and automated user governance. This automation streamlines the process of creating user accounts and managing user data, leading to increased productivity and cost savings. In large-scale management scenarios, the benefits of deploying user provisioning software are numerous. These include seamless access to information systems across various on-premises applications, a secure network for managing user identities, and effective management of user data, thereby minimizing internal and external breach risks.

- Furthermore, hybrid provisioning solutions that integrate multi-factor authentication (MFA) and endpoint management with Active Directory enhance security and user experience (UX). The market dynamics driving the demand for user provisioning software include operational efficiency, risk management, and compliance with stringent regulations.

What are the market trends shaping the User Provisioning Software Industry?

- Artificial intelligence is experiencing a surging demand in today's market, representing a significant trend for professionals and businesses alike. This increasing interest in AI technology is driven by its potential to enhance efficiency, productivity, and innovation.

- In today's business landscape, user provisioning software has become an essential tool for organizations to manage access control, account lifecycle management, password management, and data security. The integration of advanced technologies like OpenID Connect and directory services enhances the functionality of these solutions. The market for user provisioning software is witnessing significant growth due to the increasing emphasis on incident response and access control. AI and automation are being integrated into these systems to improve productivity and enable accurate analysis of data. Large enterprises are prioritizing the adoption of these solutions to streamline their operations and ensure data security.

- AI solutions are revolutionizing the market by providing advanced features such as predictive analysis and machine learning. These technologies enable organizations to automate repetitive tasks, reduce manual errors, and enhance the overall efficiency of their systems. Moreover, password management and access control are critical aspects of user provisioning software. These features help organizations to manage user access, set up permissions, and ensure that only authorized personnel have access to sensitive data. With the increasing number of cyber threats, data security has become a top priority for businesses, making user provisioning software an indispensable tool. In conclusion, the market is experiencing significant growth due to the increasing need for automation, data security, and advanced features.

- AI and automation are transforming the way organizations manage user access, account lifecycle management, and password management. The integration of these technologies is enabling businesses to streamline their operations, reduce manual errors, and enhance overall efficiency.

What challenges does the User Provisioning Software Industry face during its growth?

- The expansion of open-source platforms poses a significant challenge to the industry's growth by intensifying competition.

- In today's digital landscape, open-source user provisioning software is becoming increasingly popular due to its cost-effective and feature-rich benefits. Small and emerging businesses are embracing these platforms for integrated IT resource management. Open-source software utilizes advanced technologies such as the Common Information Model (CIM) and web-based enterprise management (WBEM) for seamless integration and combination of IT assets. These technologies promote efficient administration and reduce the need for expensive commercial software. Moreover, open-source user provisioning software offers essential features comparable to proprietary solutions, including user interface (UI) customization, API integration, cloud security, workflow automation, vulnerability management, identity management, and threat detection.

- By utilizing open-source software, businesses can save on purchasing and licensing costs while still enjoying the benefits of these critical functionalities. Open-source software's flexibility and cost savings make it an attractive choice for businesses aiming to optimize their IT infrastructure and enhance security. As the market continues to evolve, open-source user provisioning software is poised to play a significant role in streamlining IT operations and improving overall business efficiency.

Exclusive Customer Landscape

The user provisioning software market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the user provisioning software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, user provisioning software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Atos SE - This organization specializes in Identity and Access Management (IAM), delivering user provisioning solutions that ensure the appropriate access to resources, at the right time, for valid reasons. By implementing robust IAM practices, businesses can mitigate security risks, enhance productivity, and adhere to regulatory compliance requirements. Our IAM offerings include identity governance, access certification, provisioning, and de-provisioning services, enabling organizations to manage user access efficiently and securely. These solutions are designed to streamline business processes, reduce manual efforts, and improve overall operational efficiency.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Atos SE

- Avatier Corp.

- Broadcom Inc.

- Centrify Corp.

- CyberArk Software Ltd.

- Dell Technologies Inc.

- EmpowerID Inc.

- Happiest Minds Technologies Ltd.

- Hitachi Ltd.

- International Business Machines Corp.

- Microsoft Corp.

- Motorola Solutions Inc.

- Okta Inc.

- Oracle Corp.

- Quest Software Inc.

- Rippling People Center Inc.

- SailPoint Technologies Inc.

- SAP SE

- SolarWinds Corp.

- Zoho Corp. Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in User Provisioning Software Market

- In January 2024, Okta, a leading identity and access management solution provider, announced the launch of Okta Identity Cloud for Workforce and Customer Identity, expanding its user provisioning software offerings to better cater to businesses managing both employee and customer identities (Okta Press Release).

- In March 2024, Microsoft and Oracle entered into a strategic partnership, integrating Microsoft Azure Active Directory with Oracle Cloud Infrastructure, enabling seamless user provisioning and single sign-on between the two platforms (Microsoft News Center).

- In April 2025, One Identity, a Quest Software business, raised USD100 million in a funding round, fueling its growth in the market and enhancing its product development capabilities (Business Wire).

- In May 2025, the European Union's General Data Protection Regulation (GDPR) was fully enforced, mandating stricter user data privacy regulations and driving increased demand for user provisioning software solutions to ensure compliance (European Commission).

Research Analyst Overview

- The market is experiencing significant advancements, with a focus on federated identity and zero trust security. Businesses prioritize identity management solutions that offer high availability, on-demand provisioning, and automated scaling. Blockchain-based identity and decentralized identity are gaining traction, providing enhanced security and control. Change management and software development kits facilitate seamless integration with user experience design. Behavioral biometrics and contextual access control ensure secure access to applications, while risk-based authentication and adaptive authentication add an extra layer of protection.

- REST API and GraphQL API enable easy integration with various systems. Implementation services and consulting services ensure smooth deployment and customization. Cloud identity providers offer automated remediation and identity synchronization, minimizing manual intervention. Automated scaling and disaster recovery solutions ensure business continuity during unexpected events. AI-powered access control and customer service enhance the overall user experience. Provisioning connectors and technical support ensure seamless integration with existing infrastructure.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled User Provisioning Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

229 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7% |

|

Market growth 2025-2029 |

USD 4207.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.6 |

|

Key countries |

US, Canada, Germany, China, UK, Japan, India, France, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this User Provisioning Software Market Research and Growth Report?

- CAGR of the User Provisioning Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the user provisioning software market growth of industry companies

We can help! Our analysts can customize this user provisioning software market research report to meet your requirements.