Compressor Control Systems Market Size 2024-2028

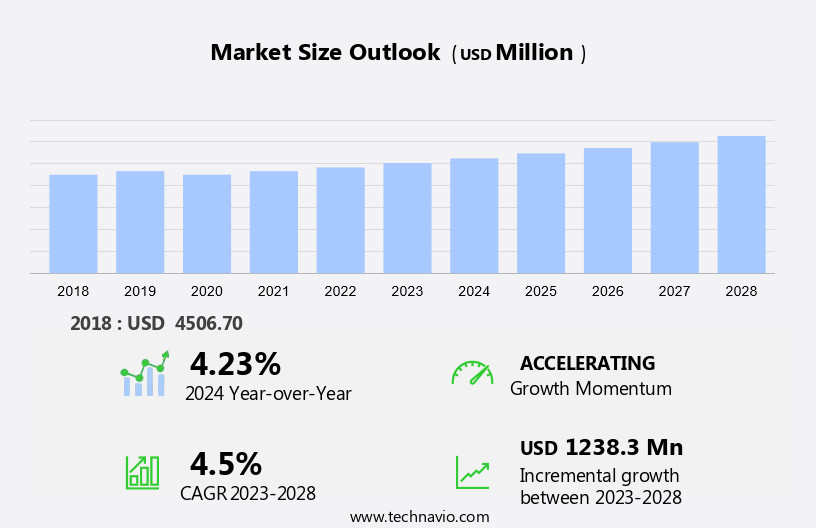

The compressor control systems market size is forecast to increase by USD 1.24 billion at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing focus on energy efficiency in various industries. Compressor systems consume a substantial amount of energy, and optimizing their performance through advanced control systems can lead to substantial energy savings. Another trend driving market growth is the provision of waste heat recovery, which allows businesses to utilize the heat generated during the compression process for other applications, thereby reducing energy costs. These technologies enable such as AI and improved efficiency, reliability, and safety in compressor operations. However, a lack of awareness about the benefits of advanced compressor control systems remains a challenge for market growth. Companies are investing in marketing and education efforts to increase awareness and promote the adoption of these systems. Overall, the market is poised for steady growth In the coming years.

What will be the Size of the Compressor Control Systems Market During the Forecast Period?

- The market encompasses a wide range of applications in power generation, petrochemicals, metals, mining, oil, gas, refining industries, and various other sectors. Compressor control systems play a crucial role in processes such as liquefied natural gas (LNG) production, compressed natural gas (CNG) stations, long-distance gas transmission, oil pipelines, and gas distribution. These systems are integral to the operation of compressors In the oil and gas, refining, and petrochemical industries, including shale gas basins. Key trends In the market include the integration of advanced technologies like supervisory control and data acquisition (SCADA), human-machine interfaces (HMI), transmitters, sensors, valves, actuators, drives, and motors.

- Additionally, the market is driven by the growing demand for energy and resources, particularly In the power generation and industrial sectors. Overall, the market is expected to experience steady growth due to the increasing importance of optimizing compressor performance and reducing operational costs.

How is this Compressor Control Systems Industry segmented and which is the largest segment?

The compressor control systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Control elements

- Communication

- End-user

- Process manufacturing

- Discrete manufacturing

- Geography

- APAC

- China

- Japan

- North America

- Canada

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Product Insights

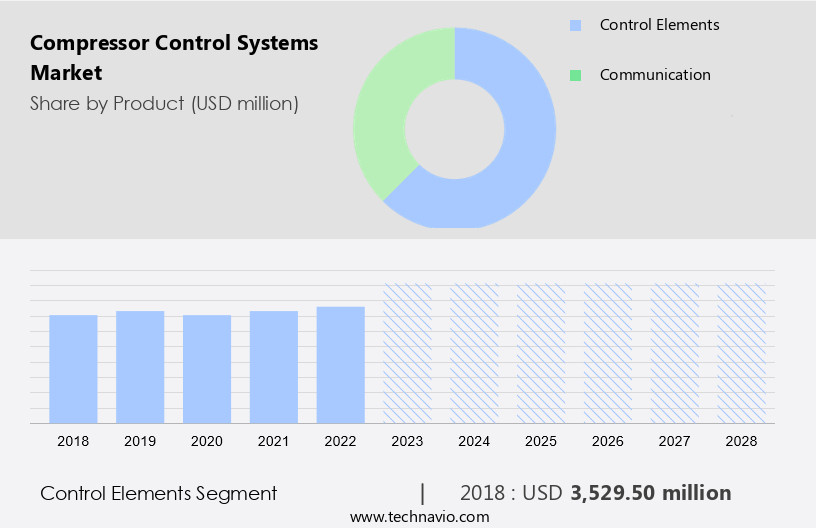

The control elements segment is estimated to witness significant growth during the forecast period. Compressor control systems encompass devices that regulate, monitor, receive inputs, and provide outputs for optimal compressor performance. These systems consist of various control elements, including sensors, programmable automation controllers (PAC) and programmable logic controllers (PLC), human-machine interfaces (HMI) and Input/output (I/O) modules, and final control elements such as variable frequency drives and valves. Sensors, like flow, level, pressure, and temperature sensors, are essential components. The adoption of closed-loop compressor control systems is increasing due to their cost-saving potential in industrial applications. Additionally, these systems enhance compressor safety and longevity through features like motor overload protection and anti-surge protection. The energy sector, including power generation, petrochemicals, metals, mining, oil, gas, refining, liquefied natural gas, compressed natural gas, long-distance pipelines, gas distribution, and petroleum industries, significantly benefit from compressor control systems.

Key industries like shale gas basins, automobile manufacturing, and chemical processing also utilize these systems for product quality specifications and production site safety. With growing natural gas and oil demand, the need for energy production expansion and stricter regulations on CO2 emissions from power plants, mining productivity, and water consumption, compressor control systems are becoming increasingly important.

Get a glance at the market report of share of various segments Request Free Sample

The control elements segment was valued at USD 3.53 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in APAC is anticipated to witness significant growth, with China, Japan, India, and South Korea leading the charge. The expansion of industries such as food and beverages, FMCG and consumer durables, and oil refining is driving market growth. In China and India, the increasing automobile penetration is fueling the demand for fuel, leading to new refining capacity additions. Additionally, China's investment in natural gas pipeline construction for import and distribution is expected to boost the market. The oil refining sector's growth in APAC is attributed to the increasing crude oil imports and the construction of new refineries. The demand for natural gas in APAC is also surging due to its use in power generation and industrial applications.

Key industries such as petrochemicals, metals, mining, oil, gas, refining, liquefied natural gas (LNG), compressed natural gas (CNG), long-distance gas, and oil pipelines, gas distribution, petroleum industries, and shale gas basins are major consumers of compressor control systems. Market growth is further influenced by product quality specifications, natural gas and oil demand, and energy production expansion. Environmental specifications, social distancing measures at production sites, and price volatility are key challenges. Product developments and stringent regulations are also shaping the market landscape.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Compressor Control Systems Industry?

Increasing focus on improving energy efficiency of compressors is the key driver of the market.

- Compressor control systems play a crucial role in various industries such as power generation, petrochemicals, metals, mining, oil, gas, refining, and liquefied natural gas (LNG) production. These systems are essential for compressing gases and liquids to meet specifications for transport via long-distance pipelines, gas distribution, and energy production. In the oil and gas sector, compressor control is vital for shale gas extraction and natural gas processing. Advanced compressor technologies are being developed to meet increasing energy production demands and stringent environmental specifications. The petroleum industries, including refining, require compressor control for various processes. Compressors are used In the production sites of chemical, mining, and mining productivity enhancement.

- Natural gas demand, oil demand, naphtha demand, fuel oil demand, motor gasoline demand, and kerosene oil demand drive the need for compressor control systems. Price volatility and stringent regulations In the oil and gas sector necessitate the use of efficient compressor control systems. Automobile manufacturing also relies on compressor control systems for various applications. Supervisory Control and Human Machine Interface (HMI) systems are used to monitor and control compressor operations. Transmitters, sensors, valves, actuators, drives, and motors are integral components of compressor control systems. Water consumption and wastewater management are significant concerns in various industries. Energy production expansion is another factor driving the demand for compressor control systems. Safety systems, such as those used in portable air compressors, are also essential for ensuring safe and efficient compressor operations. The compressor control market is expected to grow due to these factors and the increasing need for energy efficiency and productivity.

What are the market trends shaping the Compressor Control Systems Industry?

Provision of waste heat recovery is the upcoming market trend.

- Compressor control systems play a crucial role in various industries, including power generation, petrochemicals, metals, mining, oil, gas, refining, and liquefied natural gas (LNG) and compressed natural gas (CNG) sectors. These systems are essential for compressing air, gas, and other fluids for long-distance transportation via pipelines, gas distribution, and energy production. In the oil and gas industries, compressor control systems are vital for shale gas extraction and natural gas extraction. Advanced compressors are being developed to meet environmental specifications and increasing product quality specifications in response to growing natural gas and oil demand, as well as naphtha, fuel oil, motor gasoline, and kerosene oil demand.

- The energy production sector is focusing on reducing CO2 emissions by utilizing waste heat from compressors. Up to 94% of this waste heat can be captured with a well-designed closed cooling system. This captured heat can be used to generate electricity in power plants or for heating buildings and industrial processes. Mining productivity is also benefiting, which help maintain optimal operating conditions for mining activities. Product developments and price volatility In the oil and gas industries, as well as stringent regulations, are driving the need for advanced compressor control systems. Oil exporters and mining companies are investing heavily to ensure safety, efficiency, and compliance with environmental regulations.

- Additionally, water consumption and wastewater management are becoming increasingly important considerations in compressor control systems, as water scarcity and environmental concerns continue to grow. Safety systems, such as human machine interfaces, transmitters, sensors, valves, actuators, drives, and motors, are essential components. These components help ensure optimal performance, reduce downtime, and minimize maintenance costs. Portable air compressors, like those from Bobcat, are also gaining popularity due to their flexibility and ease of use in various applications. Overall, they are a vital component of the energy production, mining, and industrial sectors, and their importance is expected to continue growing In the coming years.

What challenges does the Compressor Control Systems Industry face during its growth?

Lack of awareness about benefits of advanced compressor control systems is a key challenge affecting the industry growth.

- Compressor control systems play a crucial role in various industries such as power generation, petrochemicals, metals, mining, oil, gas, refining, and liquefied natural gas (LNG) production. These systems are essential for compressing natural gas for long-distance transmission through pipelines and for gas distribution, as well as for compressing oil for transportation through pipelines. In the oil and gas industry, compressor control systems are used extensively in shale gas basins and natural gas extraction sites. Advanced compressor technologies are being developed to reduce energy consumption and meet environmental specifications. The demand is driven by the increasing energy production, particularly In the power generation sector, and the growth in mining productivity.

- However, price volatility and stringent regulations pose challenges to market growth. In the petroleum industries, compressor control systems are used to optimize production at refining sites and ensure product quality specifications. The automobile industry also utilizes them for manufacturing processes. Safety is a significant concern In the compressor control market. Safety systems, including supervisory control, human machine interface, transmitters, sensors, valves, actuators, drives, and motors, are integrated into compressor control systems to ensure safe and efficient operations. The use in various industries is expected to continue due to the increasing demand for energy production and the need to reduce CO2 emissions from power plants.

- Additionally, the mining industry's water consumption and wastewater management requirements are driving the adoption to optimize water usage and reduce environmental impact. Mining activities and oil and gas exploration, particularly in shale gas basins, require compressor control systems for drilling operations and the transportation of natural gas and oil. The compressor control market is expected to grow as energy production expansion continues, particularly in regions with significant oil and gas reserves. Hence, they are essential for various industries, including power generation, petrochemicals, metals, mining, oil, gas, refining, and LNG production. These systems help optimize production, reduce energy consumption, and ensure safety and environmental compliance. The market is driven by increasing energy production and the need to reduce CO2 emissions, but faces challenges from price volatility and stringent regulations. The use is expected to continue to grow as industries seek to optimize operations and reduce environmental impact.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Atlas Copco AB

- Baker Hughes Co.

- BOGE

- Case Controls

- ComAp AS

- Connell Industries Inc.

- Emerson Electric Co.

- FS ELLIOTT Co. LLC

- HOERBIGER Holding AG

- Honeywell International Inc.

- Ing. Enea Mattei Spa

- Ingersoll Rand Inc.

- KAESER KOMPRESSOREN SE

- MAPNA Group Co.

- Petrotech Inc.

- RENNER GmbH Kompressoren

- Rockwell Automation Inc.

- Schneider Electric SE

- Woodward Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of applications across various industries, including power generation and the processing of petroleum, petrochemicals, metals, mining, and natural gas. These systems play a crucial role in optimizing the performance and efficiency of compressors used In these sectors. They are essential in power generation to ensure the reliable and efficient operation of gas turbines and internal combustion engines. In the petroleum and petrochemical industries, they are utilized in refining processes, shale gas extraction, and natural gas processing. In the mining sector, compressor control systems are employed to power mining equipment and ensure the safe and efficient transport of minerals.

Advanced compressor control systems are continually being developed to meet the evolving needs of these industries. These systems incorporate various components such as supervisory control, human-machine interfaces, transmitters, sensors, valves, actuators, drives, and motors. The integration of these components enables compressor control systems to optimize performance, reduce energy consumption, and improve product quality. The market is influenced by several market dynamics. Development expenditure In the oil and gas industry, driven by the need to meet increasing natural gas and oil demand, is a significant factor. Natural gas demand is expected to grow due to its role as a cleaner alternative to coal and oil in power generation.

Similarly, oil demand is expected to remain strong, driven by the transportation sector and industrial applications. Environmental specifications and regulations are also shaping the market. Stringent regulations aimed at reducing CO2 emissions from power plants and mining activities are driving the adoption of more efficient compressor control systems. Social distancing and production site safety are becoming increasingly important considerations, leading to the development of advanced safety systems and remote monitoring capabilities. The mining industry is undergoing significant productivity improvements, driven by the adoption of advanced technologies such as automation and data analytics. These technologies are being integrated into to optimize performance and reduce downtime.

Price volatility In the oil and gas industry is another factor influencing the market. Fluctuating prices can impact the profitability of oil and gas producers, leading them to prioritize cost savings and efficiency improvements. They can help achieve these goals by optimizing compressor performance and reducing energy consumption. The market is expected to grow as the demand for energy production and the processing of natural resources continues to increase. The integration of advanced technologies and the adoption of stringent regulations are driving innovation and improving efficiency and performance. Hence, the market plays a critical role in optimizing the performance and efficiency of compressors across various industries, including power generation, petroleum, petrochemicals, metals, mining, and natural gas. The market is influenced by several market dynamics, including development expenditure, environmental regulations, social distancing, mining productivity, and price volatility. Advanced technologies and innovations are driving the development of more efficient and cost-effective compressor control systems.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 1.24 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, China, Japan, Germany, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.