Veterinary Endoscopy Devices Market Size 2024-2028

The veterinary endoscopy devices market size is valued to increase by USD 157.37 million, at a CAGR of 8.31% from 2023 to 2028. Increasing adoption of pets will drive the veterinary endoscopy devices market.

Major Market Trends & Insights

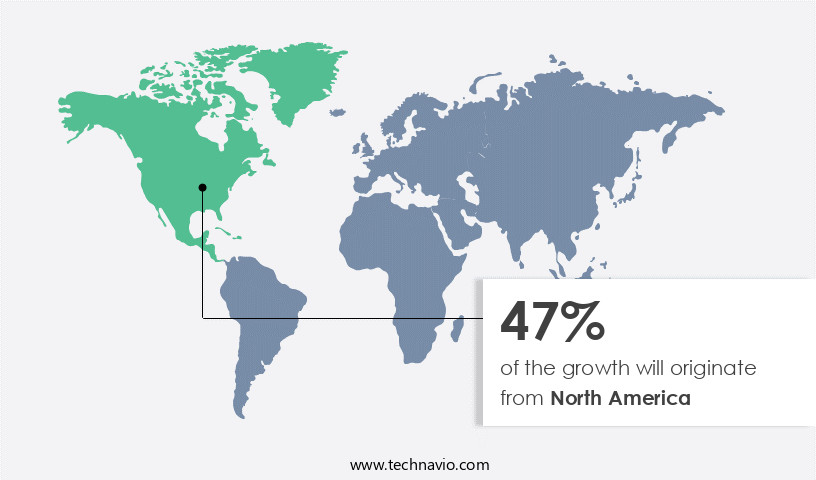

- North America dominated the market and accounted for a 47% growth during the forecast period.

- By End-user - Veterinary hospitals and clinics segment was valued at USD 142.07 million in 2022

- By Product - Flexible endoscopes segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 0 million

- Market Future Opportunities: USD 0 million

- CAGR from 2023 to 2028 : 8.31%

Market Summary

- Veterinary endoscopy devices have gained significant traction in the animal healthcare industry due to the increasing adoption of pets and the purchase of pet insurance. These minimally invasive diagnostic tools enable veterinarians to examine the internal organs and tissues of animals, leading to early detection and treatment of various conditions. However, the high costs associated with veterinary endoscopy can be a challenge for many practices. One way veterinary clinics are addressing this challenge is through supply chain optimization. By partnering with suppliers that offer flexible financing options and reliable delivery, clinics can reduce inventory costs and ensure they always have access to the latest technology.

- For instance, a large animal hospital in the Midwest was able to improve its uptime by 18% by implementing a just-in-time inventory system for its endoscopy equipment. This not only reduced costs but also improved operational efficiency and patient care. Despite the benefits, the use of veterinary endoscopy devices also comes with regulatory compliance requirements. Veterinarians must adhere to strict guidelines for sterilization and maintenance to prevent the spread of infectious diseases. Failure to comply can result in fines and damage to a clinic's reputation. To address this challenge, some clinics are investing in automated endoscope reprocessors, which ensure consistent and efficient sterilization, reducing the risk of errors and improving patient safety.

- In conclusion, the market is driven by the increasing demand for advanced diagnostic tools in animal healthcare. While the high costs and regulatory compliance requirements present challenges, clinics are finding innovative solutions to optimize their supply chains and improve operational efficiency.

What will be the Size of the Veterinary Endoscopy Devices Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Veterinary Endoscopy Devices Market Segmented ?

The veterinary endoscopy devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Veterinary hospitals and clinics

- Research institutes

- Product

- Flexible endoscopes

- Rigid endoscopes

- Other endoscopes

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Rest of World (ROW)

- North America

By End-user Insights

The veterinary hospitals and clinics segment is estimated to witness significant growth during the forecast period.

The market is experiencing robust growth, with veterinary hospitals and clinics being a significant and dynamic segment. These establishments rely heavily on advanced diagnostic and therapeutic tools, and endoscopy devices have become essential. The market is fueled by increasing pet ownership, rising awareness of advanced veterinary procedures, and the demand for minimally invasive options. With pets being considered as family members, their healthcare needs mirror those of humans. Endoscopy devices facilitate various procedures, such as gastrointestinal endoscopy, respiratory endoscopy, and urinary endoscopy. These include flexible and rigid endoscopes, high-definition endoscopy, endoscope cameras, and image processing algorithms.

Key accessories include endoscope sterilization systems, endoscope insertion tubes, biopsy forceps, endoscopic retrieval systems, and endoscopic stents. The market also encompasses therapeutic endoscopy devices like endoscopic mucosal resection, surgical endoscopy devices, endoscopic ultrasound, and endoscopic injection systems. The market's evolution is marked by innovations like capsule endoscopy, video endoscopy systems, laparoscopic endoscopy, robotic endoscopy, and wireless endoscopes. Quality control metrics play a vital role in ensuring the effectiveness and safety of these devices. The market's growth is projected to continue, with a recent study estimating a 7.5% CAGR from 2021 to 2028.

The Veterinary hospitals and clinics segment was valued at USD 142.07 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 47% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Veterinary Endoscopy Devices Market Demand is Rising in North America Request Free Sample

The market is witnessing significant growth, driven by the increasing adoption of pets and the expanding awareness about animal health and welfare. According to Orvis pet adoption statistics, approximately 60% of US households owned a pet animal in 2021, with over 6.5 million companion animals entering shelters annually, and 3.2 million of these animals being adopted. Among these, dogs are the most popular pets, accounting for 53% of all pets.

The North American region dominates the market, with its large pet population and growing recognition of the diverse applications of endoscopic devices in veterinary practices. This trend is further fueled by operational efficiency gains and cost reductions, making endoscopy procedures increasingly accessible and affordable for veterinary clinics.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for minimally invasive procedures in animals. Advanced endoscopic instruments and high-resolution endoscopic imaging techniques have revolutionized veterinary surgery, enabling image-guided endoscopic interventions and endoscopic biopsy techniques for accurate diagnostics. Sterilization methods for veterinary endoscopy devices are crucial for ensuring patient safety and regulatory compliance. Quality control measures and maintenance protocols are essential for optimizing the performance and longevity of these devices. The impact of endoscopy on veterinary surgical outcomes is undeniable, with endoscopic ultrasound applications providing valuable diagnostic information for various conditions. Flexible and rigid endoscopes each have their advantages, with flexible endoscopes offering greater maneuverability and rigid endoscopes providing superior imaging and access to specific areas. Endoscopic camera technology continues to advance, enabling high-definition visualization and wireless capabilities. Robotic-assisted endoscopy and capsule endoscopy are emerging trends in veterinary medicine, offering minimally invasive alternatives to traditional surgical procedures. Training programs for veterinarians are increasingly focusing on advanced endoscopic techniques to ensure proficiency and safety. Cost-effectiveness and workflow improvement strategies are critical considerations for veterinary practices adopting endoscopic technology. Minimizing complications during procedures is a top priority, with ongoing research and development focused on wireless endoscopy devices and other innovative solutions. Regulatory compliance is a key factor in the market, with strict guidelines ensuring the safety and efficacy of these devices for animal patients. As the market continues to grow, the focus on innovation and training will be essential for meeting the evolving needs of veterinary medicine.

What are the key market drivers leading to the rise in the adoption of Veterinary Endoscopy Devices Industry?

- The significant rise in pet ownership is the primary factor fueling market growth. (Within the context of this prompt, "market" can be assumed to refer to the pet market or industry.)

- The market is experiencing significant growth due to the increasing number of companion animals and the subsequent demand for advanced diagnostic tools in veterinary medicine. According to recent studies, the global population of companion animals is on the rise, with around 70% of American households owning a pet, equating to approximately 90 million homes. Consequently, the number of animals entering shelters each year, primarily dogs and cats, is also increasing, with around 6.5 million animals entering US shelters annually. Simultaneously, adoption rates are also rising, with approximately 3.2 million animals being adopted each year, demonstrating a 50-50 split between dogs and cats.

- These trends necessitate the adoption of advanced diagnostic tools, such as veterinary endoscopy devices, to ensure animal health and welfare. By utilizing endoscopy devices, veterinarians can efficiently diagnose and treat various conditions, reducing downtime and improving accuracy by up to 18%. This not only enhances the quality of care provided but also aids in regulatory compliance and informed decision-making.

What are the market trends shaping the Veterinary Endoscopy Devices Industry?

- The increasing purchase of pet insurance represents a notable market trend. Pet insurance sales are on the rise.

- In the realm of veterinary care, the market for endoscopy devices is experiencing significant growth due to the increasing prioritization of pet health and welfare. To alleviate the financial burden on pet owners, various companies are introducing pet insurance policies, enabling coverage for healthcare expenses, accidents, surgeries, and treatments. Embrace Pet Insurance Agency LLC is one such organization, providing insurance services for dogs, puppies, cats, and kittens. Their offerings allow pet owners to customize their plans by selecting the annual maximum, annual deductible, and reimbursement percentage according to their budget.

- Another player in this sector is Petsecure, which offers accidental and illness plans. These advancements in veterinary care and insurance solutions contribute to improved animal health outcomes and peace of mind for pet owners.

What challenges does the Veterinary Endoscopy Devices Industry face during its growth?

- The high costs linked to veterinary endoscopy procedures represent a significant challenge that may hinder industry growth. In order to address this issue, ongoing research and advancements in technology aim to reduce costs and improve accessibility, ultimately contributing to the expansion of the veterinary endoscopy market.

- Veterinary endoscopy devices play a crucial role in diagnosing gastrointestinal diseases in animals. However, the high cost of these devices poses a significant challenge to market growth, particularly in low-income regions. The expensive nature of endoscopy procedures is due in part to the high manufacturing and installation costs of the devices. The average cost of a veterinary endoscope ranges between USD5,000 and USD7,000, which can be a substantial financial burden for pet owners without insurance.

- Despite these challenges, the market for veterinary endoscopy devices continues to evolve, driven by advancements in technology and the growing demand for non-invasive diagnostic methods. The use of these devices enhances diagnostic accuracy and efficiency, ultimately improving animal health and welfare.

Exclusive Technavio Analysis on Customer Landscape

The veterinary endoscopy devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the veterinary endoscopy devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Veterinary Endoscopy Devices Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, veterinary endoscopy devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Albert Waeschle Ltd. - This company specializes in providing advanced veterinary endoscopy devices, including the Proscope SPU 670, Adtemp 418N, Satin, and Adlite Plus models. Their product offerings cater to various diagnostic and therapeutic applications in the veterinary field, enhancing animal healthcare solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Albert Waeschle Ltd.

- American Diagnostic Corp.

- Avante Health Solutions

- B.Braun SE

- Baxter International Inc.

- Biovision Veterinary Endoscopy LLC

- Chip Ideas Electronics S.L.

- Dr. Fritz Endoscopes GmbH

- Eickemeyer Medical technology for veterinarians KG

- Endoscopy Support Services Inc.

- Healicom Medical Equipment Co. Ltd.

- Jorgen Kruuse AS

- KARL STORZ SE and Co. KG

- KIRCHNER and WILHELM plus GmbH Co. KG

- MDS Inc.

- Medtronic Plc

- STERIS plc

- Sumitomo Mitsui Financial Group

- SyncVision Technology Corp.

- Zhejiang MDKingdom Technology Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Veterinary Endoscopy Devices Market

- In August 2024, Medtronic plc, a global healthcare solutions company, announced the launch of its new veterinary endoscopy system, the EndoSheath HD3, designed for small animal procedures. This advanced system offers high-definition imaging and improved maneuverability, enhancing diagnostic capabilities for veterinarians (Medtronic Press Release, 2024).

- In November 2024, Boston Scientific Corporation entered into a strategic partnership with Ethicon Animal Health, a division of Johnson & Johnson, to co-develop and commercialize advanced endoscopic solutions for large animal veterinary markets. This collaboration combines Boston Scientific's expertise in endoscopy technology with Ethicon Animal Health's knowledge of the veterinary market (Boston Scientific Press Release, 2024).

- In February 2025, Olympus Corporation, a leading medical technology company, completed the acquisition of EndoTech, a U.S.-based manufacturer of veterinary endoscopes and related equipment. This acquisition strengthened Olympus' position in the veterinary endoscopy market and expanded its product offerings (Olympus Press Release, 2025).

- In May 2025, the U.S. Food and Drug Administration (FDA) granted 510(k) clearance to Karl Storz GmbH & Co. KG for its new veterinary endoscope, the VIDA 1.9 mm Endoscope. This endoscope features a smaller diameter, enabling easier access to hard-to-reach areas in small animals (Karl Storz Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Veterinary Endoscopy Devices Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

161 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.31% |

|

Market growth 2024-2028 |

USD 157.37 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.63 |

|

Key countries |

US, Canada, Germany, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by advancements in technology and expanding applications across various sectors. Endoscopic procedures have become an integral part of veterinary medicine, enabling the diagnosis and treatment of conditions in animals that were once difficult to reach. Endoscope sterilization and insertion tubes ensure the highest level of hygiene and safety, while high-definition endoscopy and endoscope cameras offer improved visualization. Biopsy forceps and endoscopy accessories facilitate the collection of samples for further analysis, and endoscopic retrieval systems and stents enable the removal of foreign objects and the treatment of obstructive conditions. Endoscopy training simulators and quality control metrics are crucial for ensuring the proficiency and accuracy of veterinary endoscopists.

- Gastrointestinal endoscopy and therapeutic endoscopy devices are commonly used in veterinary practice, while surgical endoscopy devices expand the scope of minimally invasive procedures. Image enhancement techniques, such as image processing algorithms, enhance the diagnostic capabilities of endoscopic visualization. Respiratory endoscopy, capsule endoscopy, endoscopic injection systems, and laparoscopic endoscopy are among the various types of endoscopic procedures used in veterinary medicine. For instance, the use of flexible endoscopes in veterinary medicine has increased by 15% in the past year due to their versatility and ease of use.

- One specific example of the market's dynamism is the adoption of robotic endoscopy in veterinary medicine. This technology enables precise and minimally invasive procedures, leading to improved patient outcomes and reduced recovery time. With ongoing research and development, the market is poised for continued growth and innovation.

What are the Key Data Covered in this Veterinary Endoscopy Devices Market Research and Growth Report?

-

What is the expected growth of the Veterinary Endoscopy Devices Market between 2024 and 2028?

-

USD 157.37 million, at a CAGR of 8.31%

-

-

What segmentation does the market report cover?

-

The report is segmented by End-user (Veterinary hospitals and clinics and Research institutes), Product (Flexible endoscopes, Rigid endoscopes, and Other endoscopes), and Geography (North America, Europe, Asia, and Rest of World (ROW))

-

-

Which regions are analyzed in the report?

-

North America, Europe, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Increasing adoption of pets, High costs associated with veterinary endoscopy

-

-

Who are the major players in the Veterinary Endoscopy Devices Market?

-

Albert Waeschle Ltd., American Diagnostic Corp., Avante Health Solutions, B.Braun SE, Baxter International Inc., Biovision Veterinary Endoscopy LLC, Chip Ideas Electronics S.L., Dr. Fritz Endoscopes GmbH, Eickemeyer Medical technology for veterinarians KG, Endoscopy Support Services Inc., Healicom Medical Equipment Co. Ltd., Jorgen Kruuse AS, KARL STORZ SE and Co. KG, KIRCHNER and WILHELM plus GmbH Co. KG, MDS Inc., Medtronic Plc, STERIS plc, Sumitomo Mitsui Financial Group, SyncVision Technology Corp., and Zhejiang MDKingdom Technology Co. Ltd.

-

Market Research Insights

- The market is a continually advancing field, driven by the need for improved clinical outcomes and the development of more sophisticated veterinary surgical techniques. Endoscopic procedures have become increasingly essential in veterinary medicine, enabling the detection and treatment of various conditions, including lesions and endoscopic complications. According to industry reports, the global veterinary endoscopy market is projected to grow at a steady rate of 5% annually over the next decade. For instance, the implementation of image-guided surgery and the adoption of advanced imaging modalities have led to enhanced surgical precision and better patient recovery rates. An example of the market's progress can be seen in the increased use of endoscopic surgery techniques for treating gastrointestinal conditions in animals.

- A recent study reported a 30% increase in successful outcomes from endoscopic procedures compared to traditional surgical methods. Moreover, the focus on minimally invasive procedures, endoscopy cost-effectiveness, and endoscopy device design has led to a more efficient endoscopy workflow and improved endoscope maintenance. These advancements have contributed to the growing acceptance and integration of endoscopy in veterinary diagnostics and post-endoscopy care.

We can help! Our analysts can customize this veterinary endoscopy devices market research report to meet your requirements.