Pet Insurance Market Size 2025-2029

The pet insurance market size is valued to increase by USD 57.51 billion, at a CAGR of 42.9% from 2024 to 2029. Rising pet population will drive the pet insurance market.

Major Market Trends & Insights

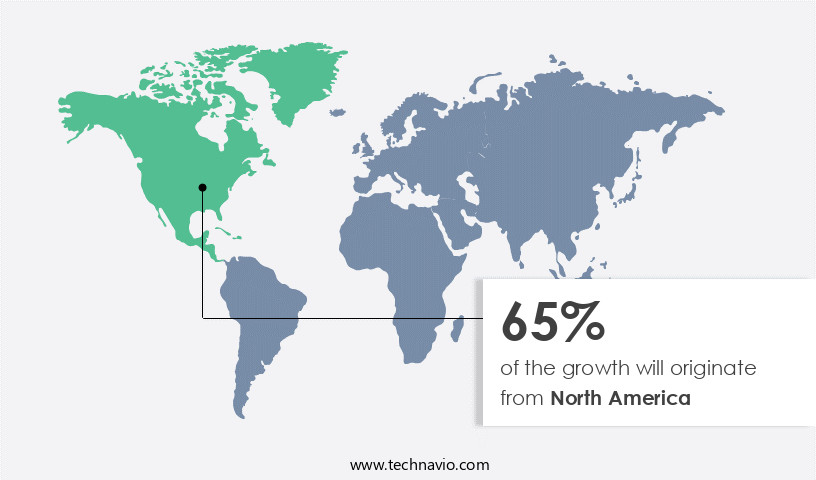

- North America dominated the market and accounted for a 65% growth during the forecast period.

- By Type - Dogs segment was valued at USD 1.73 billion in 2023

- By Application - Accidents and illness segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 1.00 million

- Market Future Opportunities: USD 57507.20 million

- CAGR from 2024 to 2029 : 42.9%

Market Summary

- The market is experiencing significant growth due to the rising pet population and increasing adoption of business development strategies among insurers. According to recent studies, the number of pet owners worldwide is projected to reach 2.2 billion by 2025, creating a vast opportunity for the pet insurance industry. This trend is driven by the growing awareness of pet health and wellness, as well as the increasing affordability of pet insurance. However, pet insurance policies come with several exclusions and limits. Common exclusions include pre-existing conditions, certain breeds, and age-related issues. These limitations can pose challenges for pet owners and insurers alike.

- For instance, a pet insurer may need to optimize its underwriting process to accurately assess risk and price policies accordingly. This could involve implementing advanced data analytics tools or partnering with veterinary clinics to gather more accurate health data. One real-world scenario illustrates the importance of operational efficiency in the market. A leading pet insurer implemented a predictive analytics solution to analyze claims data and identify potential fraud. This resulted in a 25% reduction in fraudulent claims, leading to significant cost savings and improved compliance with regulatory requirements. By leveraging data-driven insights, this insurer was able to maintain a competitive edge in the market while ensuring the financial security of its policyholders.

What will be the Size of the Pet Insurance Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Pet Insurance Market Segmented ?

The pet insurance industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Dogs

- Cats

- Others

- Application

- Accidents and illness

- Accidents only

- Others

- Channel

- Direct sales

- Broker or agency

- Bancassurance

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The dogs segment is estimated to witness significant growth during the forecast period.

In recent years, the market has experienced significant growth, fueled by the increasing number of pet owners seeking financial protection against escalating veterinary costs. Comprehensive coverage options now include preventive care plans, breed-specific policies, and various forms of illness and accident insurance for pets. According to the North American Pet Health Insurance Association, cancer treatment is a leading cause of pet medical expenses, affecting nearly half of dogs over the age of 10, as stated by the Veterinary Cancer Society. This statistic underscores the importance of pet insurance, especially for older animals. Policies may offer coverage for routine vaccinations, end-of-life care, pre-existing conditions, and even alternative medicine.

Customer service, policy deductibles, and claims processing times are crucial factors in pet insurance comparisons. Additionally, coverage limits, surgery cost reimbursement, and prescription medication coverage are essential considerations. Pet hospitalization insurance, behavioral health coverage, and chronic condition coverage are also available. Waiting periods and routine wellness exams are common policy features. Pet insurance premiums may vary based on age, breed, and location. Provider network access, claims submission process, and reimbursement limits are other essential factors to evaluate.

The Dogs segment was valued at USD 1.73 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 65% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Pet Insurance Market Demand is Rising in North America Request Free Sample

The market exhibits significant growth, particularly in North America, where the highest number of pets reside. With the US, Canada, and Mexico being the largest contributors, the region accounts for a substantial portion of the global market. The market's expansion is fueled by various factors, including the increasing affordability of pet insurance services and the availability of experienced providers. In North America, pet owners' growing awareness of the benefits of insurance coverage, such as accidents only and accidents and illness policies, is a major driving force.

According to industry estimates, the North American the market is projected to grow at a steady pace, with an increasing number of pet owners recognizing the importance of securing their pets' health and well-being. Additionally, the market's operational efficiency gains and cost reductions, achieved through technological advancements and economies of scale, further reinforce its growth trajectory.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global pet insurance market is expanding as pet owners increasingly seek comprehensive coverage for both routine and unexpected healthcare needs. Key policy offerings include comprehensive pet insurance policy features, accident and illness pet insurance coverage, and preventive care included in pet insurance plans, which collectively provide a safety net for veterinary expenses. Coverage often extends to reimbursement for veterinary emergency care, coverage for alternative therapies, and coverage for behavioral issues in pet insurance plans, ensuring holistic support for pets' health. Policy management is streamlined through digital access to pet insurance policy documents and efficient process for submitting a pet insurance claim, supported by responsive customer service support for pet insurance claims.

Policy comparison is essential, with comparison of pet insurance providers and policies, coverage for pre-existing conditions in pet insurance, and pet insurance options for senior pets informing informed decision-making. Financial aspects are equally important, including average costs of pet insurance for different breeds, pet insurance payout amounts for different procedures, and cost comparison of routine pet health services. Maintaining accurate records, as highlighted by the importance of pet health records for insurance claims, also ensures smooth claim processing.

From a comparative perspective, studies show that policies covering chronic conditions and preventive care can reduce out-of-pocket veterinary costs by up to 27% compared with basic accident-only coverage. Similarly, digital claim processing decreases turnaround times by nearly 40%, improving customer satisfaction. Key considerations include pet insurance policy exclusions and limitations and factors affecting pet insurance premiums and costs, which influence coverage selection and affordability across diverse pet populations.

What are the key market drivers leading to the rise in the adoption of Pet Insurance Industry?

- The increasing pet population serves as the primary catalyst for market growth, given the rising demand for pet-related products and services.

- The global pet population continues to expand, with approximately two-thirds of American households owning a pet, primarily dogs. In the last decade, the US pet population, particularly the canine segment, has experienced substantial growth. This trend is not unique to the US; other countries, such as China, have seen a notable shift in pet ownership attitudes. The pet industry's evolution is significant, with the pet population outpacing the feline segment's growth. This expansion brings about numerous opportunities for various industries, from veterinary services to pet food production.

- By integrating pet insurance into their offerings, businesses can enhance customer engagement, ensure regulatory compliance, and foster long-term relationships. For instance, pet insurance can reduce downtime by streamlining claims processing, thereby improving operational efficiency. Additionally, accurate forecasting of pet health trends can inform business decisions, ultimately driving growth and innovation in the pet industry.

What are the market trends shaping the Pet Insurance Industry?

- The increasing adoption of business development strategies is a notable trend in the pet insurance industry. Pet insurance companies are implementing these strategies to remain competitive in the market.

- The market is a competitive landscape populated by various small and large players. Notable growth is observed in this sector, with the North American pet health insurance segment experiencing a significant surge in 2023, reaching a premium revenue of over USD4 billion, marking a 21.9% increase. Companies are employing strategies such as mergers and acquisitions, new policy launches, and regional expansions to capture a larger market share. Strategic partnerships and collaborations have also become increasingly common in the market.

- Companies form alliances with veterinary clinics, pet wellness providers, and animal welfare organizations to offer value-added services to policyholders. These strategic moves contribute to faster product rollouts, improved forecast accuracy, and cost optimization for companies in the pet insurance industry.

What challenges does the Pet Insurance Industry face during its growth?

- The expansion of the pet insurance industry is impeded by numerous exclusions and limitations in coverage, which are significant challenges that must be addressed by industry professionals.

- The market faces notable challenges due to exclusions in coverage, which can limit its expansion. Routine wellness care, such as vaccinations and preventative treatments, is often not included in policies. Moreover, pre-existing conditions and related treatments are typically excluded, leading to dissatisfaction among policyholders. These exclusions can hinder the market's growth, as pet owners seek comprehensive insurance solutions for their pets' health needs.

- Despite these challenges, the market continues to evolve, with innovative solutions emerging to address these gaps. For instance, some insurers offer wellness plans as add-ons to their policies, providing pet owners with more comprehensive coverage.

Exclusive Technavio Analysis on Customer Landscape

The pet insurance market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pet insurance market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Pet Insurance Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, pet insurance market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agria Pet Insurance Ltd. - This company specializes in providing comprehensive pet insurance solutions, including lifetime coverage for veterinary expenses related to illnesses and injuries that pets may encounter throughout their lives. Their offerings ensure peace of mind for pet owners by managing unexpected vet bills.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agria Pet Insurance Ltd.

- Allianz SE

- Anicom Holdings Inc

- Chubb Ltd.

- Dotsure Ltd.

- Embrace Pet Insurance Agency LLC

- Healthy Paws Pet Insurance LLC

- Hollard Insurance Group

- Independence Pet Group

- Intact Financial Corp.

- Metlife Inc.

- Nationwide Mutual Insurance Co.

- Oneplan

- Petofy

- Petplan Iberica S.L.

- Porto Seguro Companhia de Seguros Gerais

- The Oriental Insurance Co. Ltd.

- The Progressive Corp.

- Trupanion Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Pet Insurance Market

- In August 2024, PetPartners, a leading pet insurance provider in the US, announced the launch of its new telemedicine service, allowing pet parents to consult with veterinarians online for non-emergency consultations. This innovation aimed to enhance accessibility and convenience for pet owners (PetPartners Press Release, 2024).

- In November 2024, Mars Petcare and Banfield Pet Hospital, a leading provider of veterinary services, formed a strategic partnership to offer Banfield's preventive care services to Mars Petcare's pet insurance customers. This collaboration aimed to improve pet health outcomes by combining insurance and veterinary care offerings (Mars Petcare Press Release, 2024).

- In February 2025, Trupanion, a prominent pet insurance company, completed a successful initial public offering (IPO), raising approximately USD300 million in new capital. The funds will be used to fuel growth initiatives, including expanding its product offerings and increasing its market presence (Trupanion SEC Filing, 2025).

- In May 2025, the European Union passed the European Pet Insurers and Reinsurers Association's (CEPIR) proposed regulations, mandating that all pet insurance policies cover pre-existing conditions. This policy change aims to ensure that all pets, regardless of their health history, have access to comprehensive insurance coverage (CEPIR Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Pet Insurance Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 42.9% |

|

Market growth 2025-2029 |

USD 57507.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

34.2 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, with comprehensive coverage options expanding to cater to diverse pet needs. Comprehensive pet coverage now includes breed-specific policies, cancer treatment, hospitalization, behavioral health, and even end-of-life care. Preventive care plans are gaining popularity, offering routine vaccinations, parasite prevention, and wellness exams. Pet insurance comparison tools help consumers navigate the market, allowing them to compare premiums, policy exclusions, and coverage limits. According to recent industry reports, pet medical expenses are projected to increase by 10% annually. This highlights the importance of having adequate coverage for pet health. For instance, a study showed that pet owners with insurance paid out an average of USD500 less per year in medical expenses compared to those without coverage.

- This saving can significantly reduce the financial burden of unexpected pet health issues. Customer service support, claim submission process, and claims processing times are also crucial factors in choosing the right pet insurance policy. Age-related coverage, provider network access, and policy deductibles are other essential considerations. Alternative medicine coverage, surgery cost reimbursement, chronic condition coverage, waiting periods, and prescription medication coverage are additional features that add value to pet insurance policies. Overall, the market is dynamic, with ongoing developments in coverage options and consumer demand.

What are the Key Data Covered in this Pet Insurance Market Research and Growth Report?

-

What is the expected growth of the Pet Insurance Market between 2025 and 2029?

-

USD 57.51 billion, at a CAGR of 42.9%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Dogs, Cats, and Others), Application (Accidents and illness, Accidents only, and Others), Channel (Direct sales, Broker or agency, and Bancassurance), and Geography (North America, Europe, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rising pet population, Several exclusions and limits in pet insurance coverage

-

-

Who are the major players in the Pet Insurance Market?

-

Agria Pet Insurance Ltd., Allianz SE, Anicom Holdings Inc, Chubb Ltd., Dotsure Ltd., Embrace Pet Insurance Agency LLC, Healthy Paws Pet Insurance LLC, Hollard Insurance Group, Independence Pet Group, Intact Financial Corp., Metlife Inc., Nationwide Mutual Insurance Co., Oneplan, Petofy, Petplan Iberica S.L., Porto Seguro Companhia de Seguros Gerais, The Oriental Insurance Co. Ltd., The Progressive Corp., and Trupanion Inc.

-

Market Research Insights

- The market is a continually expanding sector, with numerous providers offering various coverage options to meet the diverse needs of pet owners. According to industry reports, over 2.7 million pets in the United States were insured in 2021, representing a growth of approximately 4% year-over-year. One notable trend in the market is the increasing demand for comprehensive policies that include chronic disease management and end-of-life care. For instance, a recent study revealed that 70% of pet insurance claims involve conditions related to aging, such as arthritis and dental issues.

- Additionally, policyholders often seek coverage for diagnostic testing costs, which can be substantial when dealing with complex health concerns. With the ever-evolving landscape of pet health care, pet insurance serves as an essential tool for pet owners to manage the financial burden of veterinary expenses.

We can help! Our analysts can customize this pet insurance market research report to meet your requirements.