Veterinary Vaccines Market Size 2025-2029

The veterinary vaccines market size is forecast to increase by USD 3.38 billion at a CAGR of 6.2% between 2024 and 2029.

- The market is experiencing significant growth, driven by the rising incidence of animal diseases and the continuous introduction of new vaccines. The need to prevent and control the spread of diseases in livestock and companion animals is fueling market expansion. However, regulatory hurdles and compliance requirements pose challenges to market growth. Strict regulations and lengthy approval processes can delay the entry of new vaccines into the market, limiting innovation and competition. Additionally, inconsistencies in the supply chain can impact the availability and distribution of vaccines, potentially hindering their effectiveness and adoption.

- To capitalize on market opportunities and navigate these challenges, companies must stay informed of regulatory developments and invest in robust supply chain management strategies. By addressing these issues, market participants can effectively contribute to the prevention and control of animal diseases, ensuring the health and well-being of livestock and companion animals worldwide. Data Analytics and decision support systems are revolutionizing veterinary education and vaccine development, enabling disease modeling and herd immunity monitoring.

What will be the Size of the Veterinary Vaccines Market during the forecast period?

- In the dynamic US market, next-generation vaccines play a pivotal role in animal health management and disease control. These advanced vaccines, including distemper, bordetella, subunit, rotavirus, ppr, and influenza, are crucial for preventing zoonotic diseases and ensuring food security. Regulatory approvals and vaccine innovation are driving the market, with a focus on personalized vaccines and one health. Animal welfare standards and antimicrobial stewardship are also key considerations. Risk assessment and vaccination strategies are essential for pandemic preparedness and emergency response, particularly in animal shelters and the poultry industry. Vaccines for leptospirosis, infectious bronchitis, adenovirus, and other diseases are integral to biosecurity measures and sustainable livestock production.

- Machine learning, artificial intelligence applications, and Deep Learning are transforming disease surveillance and emergency response. The global health community recognizes the importance of vaccine innovation and pandemic response in animal health, as emerging infectious diseases continue to pose a threat to both animal and human populations.

How is this Veterinary Vaccines Industry segmented?

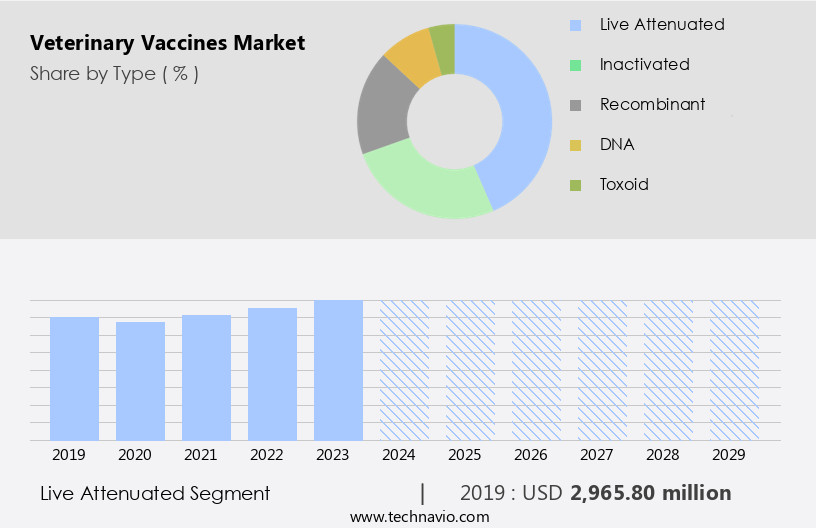

The veterinary vaccines industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Live attenuated

- Inactivated

- Recombinant

- DNA

- Toxoid

- Application

- Livestock

- Poultry

- Companion animal

- Equine

- Aquaculture

- Route Of Administration

- Subcutaneous

- Intramuscular

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The live attenuated segment is estimated to witness significant growth during the forecast period. Live attenuated vaccines represent a significant segment of the market. These vaccines utilize live pathogens that have been weakened or attenuated, allowing them to stimulate a strong immune response in animals without causing disease. The attenuation process involves growing the pathogen in non-natural conditions, ensuring its inability to cause illness while retaining the ability to trigger an immune response. One key advantage of live attenuated vaccines is their ability to mimic natural infection, resulting in a long-lasting immune response. Antimicrobial resistance poses a challenge to the effectiveness of some veterinary vaccines, necessitating continuous research and development. Disease surveillance plays a crucial role in identifying new and emerging diseases, enabling the creation of vaccines to prevent their spread.

Equine vaccines are in high demand due to the value of horses and the prevalence of diseases such as equine influenza and rabies. Genetically modified organisms (GMOs) are increasingly used in the production of veterinary vaccines, offering advantages such as improved efficacy and reduced production costs. Animal welfare is a growing concern, driving the demand for vaccines that minimize animal stress and discomfort. Clinical trials are essential in evaluating the safety and efficacy of new veterinary vaccines before they reach the market. Avian influenza vaccines are critical for the prevention and control of outbreaks in poultry, with governments and animal breeders investing heavily in their development.

Artificial intelligence and big data are revolutionizing veterinary medicine, enabling more accurate diagnosis and personalized treatment plans. Animal shelters and veterinary practices rely on a steady supply of vaccines to maintain the health of their animals. Government agencies play a vital role in regulating the production and distribution of veterinary vaccines, ensuring their safety and efficacy. Vaccine safety is a top priority, with regulatory approvals and stringent quality control measures in place to protect animal health. Adverse events are closely monitored and addressed to minimize risks. Live vaccines, such as those for distemper, bordetella, parvovirus, and rotavirus, are widely used in veterinary practices.

Subunit, recombinant, and inactivated vaccines offer alternative solutions for disease prevention. Brucellosis, leptospirosis, gumboro disease, and foot-and-mouth disease vaccines are essential for livestock health. Pandemic preparedness is a significant concern, with the development of coronavirus and influenza vaccines being a priority. Canine and feline vaccines protect companion animals from common diseases. Veterinary professionals rely on a range of vaccines to maintain the health of their patients, while pet owners seek vaccines to ensure the well-being of their pets. Poultry vaccines are crucial for the prevention and control of diseases in the poultry industry, with Newcastle disease and infectious bronchitis vaccines being widely used.

Veterinary diagnostics play a crucial role in the early detection and treatment of diseases, enhancing the effectiveness of vaccines. Rabies, anthrax, and other zoonotic diseases pose a threat to public health, emphasizing the importance of veterinary vaccines in protecting both animals and humans. Biotechnology companies and pharmaceutical firms are at the forefront of veterinary vaccine research and development, collaborating with veterinary professionals and government agencies to address the evolving needs of the market. Precision Agriculture and sustainable agriculture practices incorporate the use of veterinary vaccines to maintain the health of livestock and improve productivity. Delivery systems, such as intramuscular injections and oral vaccines, facilitate the administration of veterinary vaccines, ensuring their efficacy and convenience.

The Live attenuated segment was valued at USD 2.97 billion in 2019 and showed a gradual increase during the forecast period.

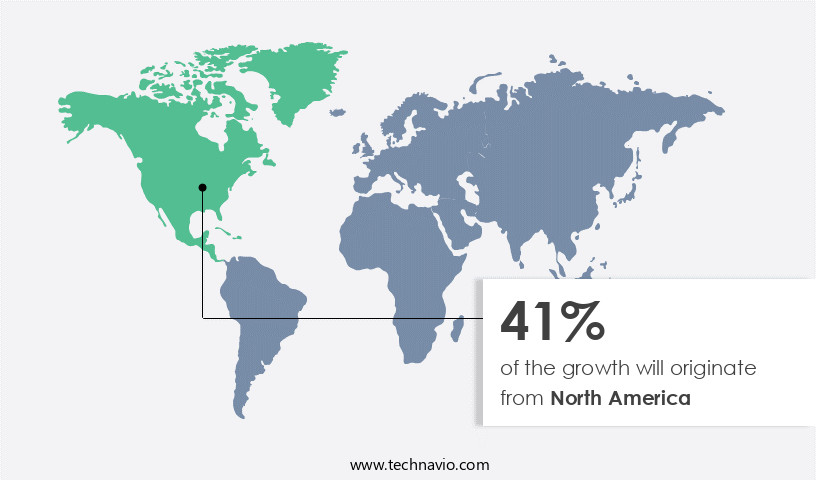

Regional Analysis

North America is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market is experiencing significant growth due to increasing pet ownership in the United States, substantial livestock populations, and proactive government initiatives. With pet ownership reaching 86 million households in 2024, representing approximately 66% of the population, the focus on companion animal health is at an all-time high. Pet owners are seeking vaccines to protect their pets against diseases such as rabies, distemper, and parvovirus. The livestock sector also plays a crucial role in the market's growth, with vaccines essential for preventing diseases like foot-and-mouth disease, avian influenza, and Gumboro disease. Government agencies are actively involved in disease surveillance and regulatory approvals, ensuring the safety and efficacy of veterinary vaccines.

Biotechnology and pharmaceutical companies are investing in research and development, producing innovative solutions such as genetically modified organisms, recombinant vaccines, and subunit vaccines. Clinical trials are underway to improve vaccine safety and efficacy, while artificial intelligence and big data are being utilized to optimize vaccine delivery systems and supply chain management. Equine vaccines, canine vaccines, and feline vaccines are in high demand, with avian influenza vaccines and infectious bronchitis vaccines crucial for poultry health. Disease prevention is a priority for animal breeders and veterinary professionals, with vaccines essential for maintaining animal welfare and public health. Adverse events are closely monitored to ensure vaccine safety, with regulatory approvals and veterinary diagnostics playing a vital role in addressing any concerns.

Animal shelters, livestock practices, and veterinary practices rely on a steady supply of vaccines to protect against diseases like distemper, bordetella, parvovirus, PPR, leptospirosis, and rabies. In the face of antimicrobial resistance and the threat of pandemics, pandemic preparedness is a significant concern, with vaccines for diseases like coronavirus and anthrax under development. The market's evolution is shaped by a commitment to sustainable agriculture, precision agriculture, and vaccine efficacy, with a focus on reducing adverse events and improving overall animal health.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Veterinary Vaccines market drivers leading to the rise in the adoption of Industry?

- The escalating prevalence of animal diseases serves as the primary catalyst for market growth in this sector. The market experiences continuous growth due to the increasing threat of infectious and contagious diseases among livestock and companion animals. Diseases such as foot-and-mouth disease, avian influenza, rabies, Newcastle disease, swine fever, and bovine respiratory disease pose significant health and economic risks. These diseases lead to high mortality and morbidity rates, increased veterinary costs, trade restrictions, and culling of infected livestock. Zoonotic diseases, which can be transmitted from animals to humans, add urgency to disease control measures. Antimicrobial resistance is another concern, necessitating the development of effective vaccines. Disease surveillance is crucial for early detection and prevention of disease outbreaks.

- Genetically modified organisms are increasingly used in vaccine production for improved efficacy and safety. Clinical trials and vaccine safety are essential for regulatory approval. The supply chain must ensure the Cold Chain is maintained for live vaccines. Adverse events must be monitored and reported to ensure vaccine safety. Animal welfare is a critical consideration in vaccine development and administration. Artificial intelligence and data analytics are used in disease surveillance and vaccine development. Animal breeders rely on vaccines to protect their herds and flocks. Avian influenza vaccines are a significant market segment due to the ongoing threat of avian influenza outbreaks. Government agencies play a crucial role in vaccine development, regulation, and distribution.

What are the Veterinary Vaccines market trends shaping the Industry?

- The introduction of new vaccines represents a significant market trend in the healthcare industry. This trend reflects advancements in medical research and technology, leading to innovative solutions for preventing various diseases. The market is experiencing notable progress, driven by the introduction of advanced vaccines to enhance animal health and promote sustainable farming practices. One recent development in this sector includes Boehringer Ingelheim's launch of VAXXITEK HVT+IBD+H5, a trivalent veterinary vaccine for poultry. Introduced on February 24, 2025, this vaccine protects against Marek's disease, Infectious Bursal Disease (Gumboro), and H5 avian influenza in a single shot. Initially launched in Egypt, VAXXITEK HVT+IBD+H5 utilizes COBRA technology to provide cross-clade protection against the most common H5 avian influenza strains and immunity against two other significant poultry diseases. Another significant launch is Merck Animal Health's new vaccine, though specific details are not mentioned in the context.

- These advancements demonstrate the market's commitment to improving animal health and addressing prevalent diseases, including Distemper, Bordetella, Subunit, Rotavirus, PPR, Infectious Bronchitis, Influenza, Leptospirosis, and Adenovirus. Regulatory approvals and the growing importance of pandemic preparedness, particularly in animal shelters, are also contributing factors to the market's growth. Poultry vaccines and those for infectious diseases in livestock remain key areas of focus.

How does Veterinary Vaccines market faces challenges face during its growth?

- Compliance with regulatory hurdles is a significant challenge impeding industry growth. In order to expand, businesses must navigate complex regulatory frameworks and ensure strict adherence to compliance requirements. This demands a substantial investment of time, resources, and expertise, often diverting attention from core business functions and innovation efforts. Consequently, regulatory compliance represents a critical and ongoing challenge for industry growth. The market faces significant regulatory challenges due to the intricate approval processes in various countries. Regulatory bodies such as the U.S. Department of Agriculture, the European Medicines Agency, and the Ministry of Agriculture and Rural Affairs impose stringent safety, efficacy, and quality control requirements for veterinary vaccines.

- For example, in the United States, the Animal and Plant Health Inspection Service of USDA manages the approval process. These regulations ensure the production of safe and effective vaccines for animals, including Canine Vaccines and Feline Vaccines, against diseases like Parvovirus, Distemper, Coronavirus, Brucellosis, and Newcastle Disease. The use of advanced technologies like Recombinant Vaccines, Precision Agriculture, Big Data, and Vaccine Delivery Systems contributes to enhancing vaccine efficacy and disease prevention in sustainable agriculture. Veterinary Diagnostics plays a crucial role in monitoring vaccine effectiveness and identifying potential disease outbreaks.

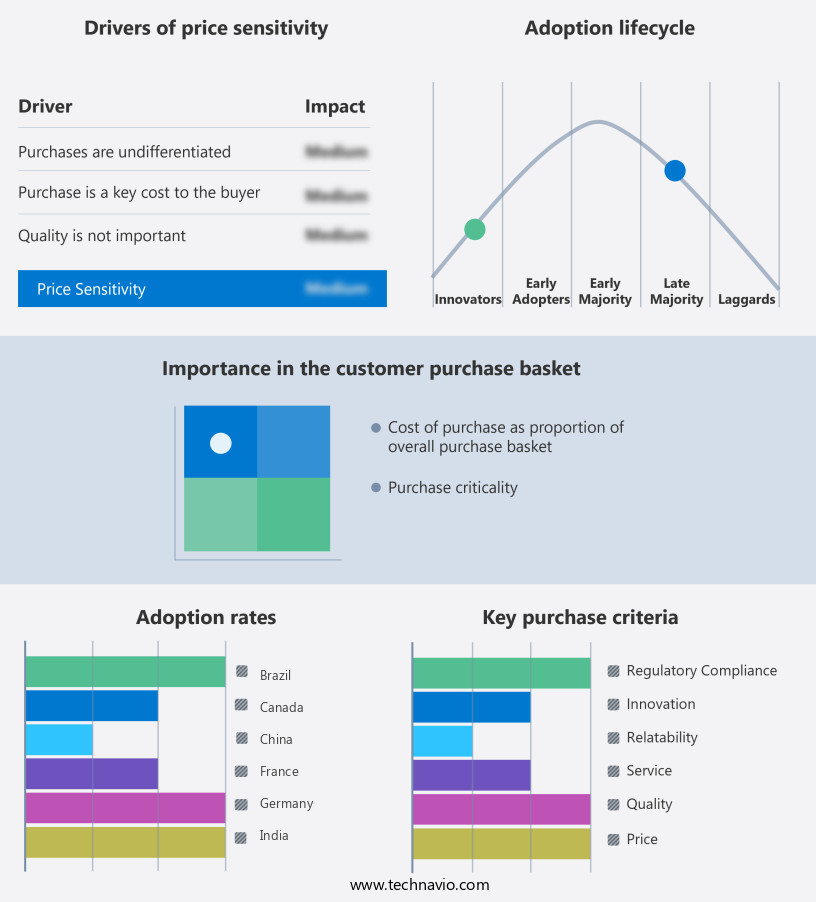

Exclusive Customer Landscape

The veterinary vaccines market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the veterinary vaccines market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, veterinary vaccines market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bayer AG - The company offers veterinary vaccines and provides a diverse portfolio of vaccines for pets and farm animals, emphasizing safety and reliability

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bayer AG

- Biogenesis Bago SA

- Biopharm

- Biovac Ltd.

- Bioveta AS

- Boehringer Ingelheim International GmbH

- Ceva Sante Animale

- China Animal Husbandry Industry Co. Ltd

- Dechra Pharmaceuticals Plc

- Elanco Animal Health Inc.

- HIPRA SA

- IDT Biologika GmbH

- Indian Immunologicals Ltd.

- M.C.I Sante Animale

- Merck and Co. Inc.

- Phibro Animal Health Corp.

- Tianjin ringpu bio-technology Co. Ltd.

- Vaxxinova International BV

- Virbac Group

- Zoetis Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Veterinary Vaccines Market

- In January 2024, Zoetis, a leading animal health company, announced the launch of its new Porcine Reproductive and Respiratory Syndrome (PRRS) vaccine, RespPRRS, in the US market (Zoetis Press Release, 2024). This innovative vaccine is designed to protect pigs against both types of PRRS virus strains, addressing a significant challenge in the swine industry.

- In March 2025, Merck Animal Health, another major player, entered into a strategic collaboration with the Pirbright Institute, a UK-based research organization, to develop a new Class II Infectious Bovine Rhinotracheitis (IBR) vaccine (Merck Animal Health Press Release, 2025). This collaboration aims to leverage Pirbright's expertise in IBR research and Merck's vaccine development capabilities to create a more effective and long-lasting vaccine for cattle farmers.

- In May 2024, Boehringer Ingelheim Animal Health announced the acquisition of the veterinary vaccines business of Valbio, a Brazilian animal health company, expanding its presence in Latin America (Boehringer Ingelheim Animal Health Press Release, 2024). This acquisition not only adds to Boehringer Ingelheim's portfolio but also strengthens its position in the rapidly growing Latin American the market.

- In October 2025, the US Food and Drug Administration (FDA) granted full approval to Elanco Animal Health's Inflexrev Canine Rabies Vaccine (Elanco Animal Health Press Release, 2025). This approval marks a significant milestone for Elanco, as it allows the company to offer a more effective and convenient rabies vaccine for dogs, addressing a critical public health concern.

Research Analyst Overview

The market is characterized by its ongoing dynamics and evolving patterns, driven by various factors that shape the industry's landscape. Antimicrobial resistance poses a significant challenge, necessitating the development of effective vaccines to mitigate the impact of bacterial infections. Disease surveillance plays a crucial role in identifying emerging threats and guiding the creation of vaccines for equines, avian influenza, porcine reproductive and respiratory syndrome (PRRS), and other diseases. Government agencies and regulatory bodies continue to play a pivotal role in ensuring vaccine safety and efficacy through clinical trials and regulatory approvals. Biotechnology and pharmaceutical companies invest in research and development, leveraging genetically modified organisms, recombinant vaccines, and artificial intelligence to enhance vaccine production and delivery systems.

Animal welfare remains a top priority, with a focus on minimizing adverse events associated with live vaccines and ensuring the safety and efficacy of subunit, inactivated, and adjuvanted vaccines. Animal breeders and veterinary professionals rely on these advancements to protect the health of their livestock and companion animals, including canines, felines, and poultry. Disease prevention is a key focus, with vaccines available for diseases such as distemper, bordetella, parvovirus, adenovirus, rabies, and anthrax. Infectious bronchitis vaccines and influenza vaccines are essential for poultry, while foot-and-mouth disease vaccines and leptospirosis vaccines protect livestock. Animal shelters and public health organizations also benefit from veterinary vaccines, ensuring the health and wellbeing of animals and reducing the risk of disease transmission to humans.

The role of veterinary diagnostics in disease detection and vaccine development is increasingly important, with the integration of big data and precision agriculture enhancing the efficiency and effectiveness of vaccine production. The supply chain is a critical aspect of the market, with logistical challenges requiring innovative solutions to ensure timely and cost-effective delivery of vaccines to veterinary practices and animal owners. The ongoing pandemic preparedness efforts have highlighted the importance of a robust and adaptable vaccine supply chain. In conclusion, the market is a dynamic and evolving industry, driven by factors such as antimicrobial resistance, disease surveillance, animal welfare, and regulatory requirements.

Companies and organizations are investing in research and development, leveraging technology and innovation to create effective and safe vaccines for a wide range of animal species. The focus on disease prevention and public health underscores the importance of this market in ensuring the health and wellbeing of animals and humans alike.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Veterinary Vaccines Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

231 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.2% |

|

Market growth 2025-2029 |

USD 3.37 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.0 |

|

Key countries |

US, China, Canada, Germany, France, India, UK, Japan, Brazil, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Veterinary Vaccines Market Research and Growth Report?

- CAGR of the Veterinary Vaccines industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the veterinary vaccines market growth and forecasting

We can help! Our analysts can customize this veterinary vaccines market research report to meet your requirements.