Wallets Market Size 2024-2028

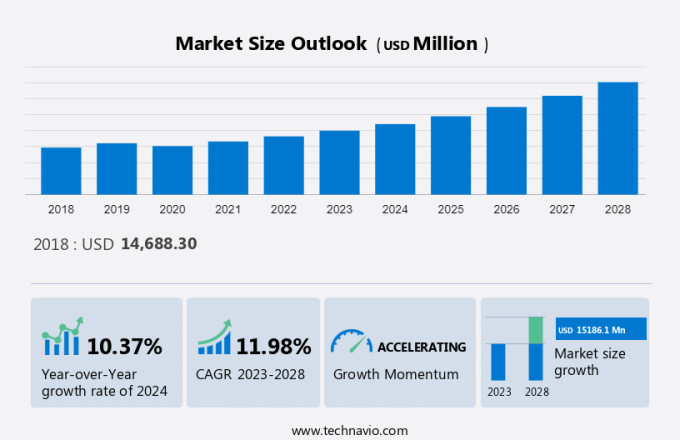

The wallets market size is forecast to increase by USD 15.19 billion, at a CAGR of 11.98% between 2023 and 2028. Market growth hinges on several factors: the extensive availability of online wallets, heightened advertising and marketing efforts by vendors, and the pervasive trend towards urbanization and minimalism. The widespread accessibility of wallets through digital channels has significantly boosted consumer adoption. Simultaneously, aggressive marketing campaigns from various vendors have amplified consumer awareness and engagement. Urbanization trends, coupled with the minimalist lifestyle preference, are reshaping consumer behavior and preferences, influencing purchasing decisions in the market. These factors collectively contribute to the expansion of the market landscape, fostering a competitive environment where convenience, digital accessibility, and lifestyle trends converge to drive market growth. As these dynamics evolve, businesses are increasingly adapting to capitalize on these trends, aligning product offerings and strategies to meet the evolving demands of urban, digitally engaged consumers seeking streamlined and efficient financial solutions. It also includes an in-depth analysis of market trends and analysis, market growth analysis and challenges. Furthermore, the report includes historic market data from 2018 - 2022.

What will be the Size of the Market During the Forecast Period?

To learn more about this report, View Report Sample

Wallets Market Dynamic and Customer Landscape

In the market, B2C enterprises focus on catering to diverse segments including men and women with a penchant for fashion trends in watches, jewelry, and leather belts. Consumers prioritize functionality in RFID technology wallets, ensuring security for personal items such as money and identification papers like driver's license. The leather segment remains popular, with an emphasis on European leather known for its high quality due to meticulous tanning processes suited to varying weather conditions. Emerging alternatives like Mylo mushroom leather challenge traditional tanning procedures by offering sustainable options against synthetic materials. Distribution strategies blend offline and online channels to reach a broad audience, appealing to working women and the corporate population seeking durability and style in luggage bags and leather wallets.

Key Market Driver

Increasing urbanization and the trend of minimalism is the key factor driving the growth of the market. As more and more people live in densely populated urban areas and adopt more minimalist lifestyles, there is a need for slim, compact wallets that can efficiently hold all the essentials while taking up minimal space in the bag. These wallets meet the need for convenience and practicality, matching the preference of urban dwellers to only carry essentials such as ID cards, a few credit cards, and cash.

For example, brands like Bellroy and Ridge Wallet have become popular for offering sleek designs that prioritize function without compromising on style. These trends highlight the importance of optimizing wallet design to easily fit into a minimalist, urban lifestyle. Due to these factors, the demand for wallets is expected to grow and thus, drive the market growth during the forecast period.

Key Market Trends

The emergence of subscription and rental models is the primary trend in the market. Some wallet companies have deployed subscription or leasing strategies to appeal to the growing trend toward availability rather than ownership. For a monthly subscription fee, companies like âThe Wallet Clubâ give their customers access to a variety of luxury wallets. This strategy allows consumers to change wallets frequently, follow current trends, and experiment with different styles.

Moreover, âPocketPassâ is another innovative company that offers users a variety of wallets, going from minimalist to premium, on a subscription basis. Such techniques not only reduce the financial burden on consumers but also promote sustainability by extending the wallet lifecycle. This trend aligns with modern consumers' demands for flexibility, variety, and low environmental impact. Therefore, this trend is expected to drive the growth of the market during the forecast period.

Key Wallets Market Challenge

Intense competition between players is a challenge that affects the growth of the market. The global wallet market is favorably dynamic due to the existence of several regional and international market players competing on factors such as marketing and promotional strategies as well as new product offerings. Competition among players is fierce due to the entry of startups. The existence of many players has raised competition in the market, leading to price wars.

Moreover, the global wallet market is fragmented due to the existence of many unorganized regional providers. Additionally, regional players have vast distribution and service networks, which affects global suppliers. Tough competition among market players is expected to negatively impact the growth of the global wallet market during the forecast period.

Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth and forecasting strategies.

Market Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Mulberry Group Plc: The company offers wallets such as Meisterstuck Wallet 6cc, Montblanc Sartorial wallet 6cc, Meisterstuck Selection Soft wallet 6cc with removable card holder and Montblanc Extreme 3.0 compact wallet 6cc.

The research report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- BAGGIT

- Bellroy Pty Ltd.

- Buffalo Jackson Trading Co.

- Burberry Group Plc

- Calleen Cordero Designs Inc.

- Da Milano Leathers Pvt. Ltd.

- Ekster Wallets BV

- Etienne Aigner AG

- Fossil Group Inc.

- Furla Spa

- Hermes International

- Hidesign

- Kenneth Cole Productions Inc.

- Kering SA

- Matt and Nat SE

- Montblanc

- Ralph Lauren Corp.

- Tory Burch LLC

- Zazzle Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

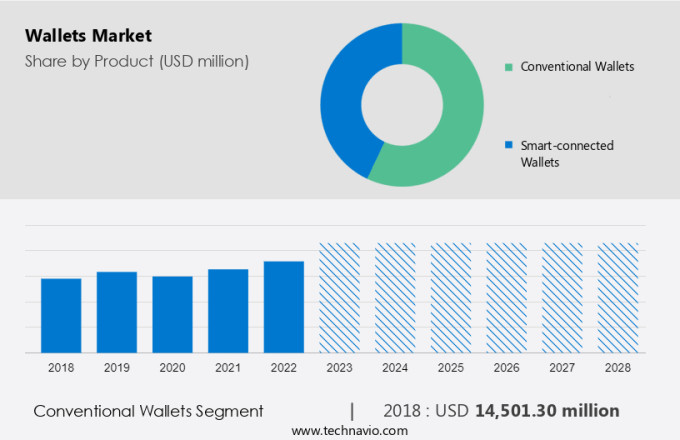

The conventional wallets segment StartFragment is estimated to witness significant growth during the forecast period. A conventional wallet is a small box used to hold personal items such as cash, transaction cards, identity cards, and other items. Regular wallets are usually made of leather or fabric; however, many other types of flexible flat sheet materials are also used to make them useable for both men and women.

Get a glance at the market contribution of various segments View the PDF Sample

The conventional wallets segment StartFragment was the largest segment and was valued at USD 14.50 billion in 2018. Increasing internet penetration across the globe is inspiring wallet manufacturers to leverage e-commerce platforms to offer a variety of conventional wallets to consumers. Hidesign and Caprese (famous brands of VIP Industries Ltd. (VIP)) is one of the market players that has expanded its product reach through online channels. Additionally, the demand for environmentally friendly and personalized conventional wallets in the global wallet market is increasing. LVMH offers personalization of its portfolio. Hence, with the increasing availability of different types of conventional wallets in the market, the conventional wallet segment is expected to witness significant growth during the forecast period.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

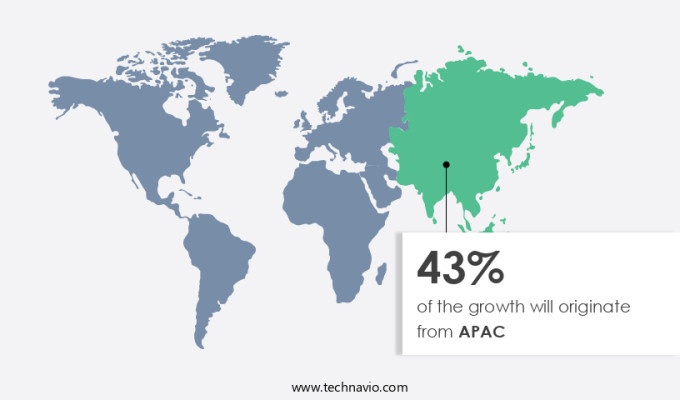

APAC is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. China, Japan, India, Australia, Thailand, and Hong Kong are some of the key countries contributing to the growth of the regional wallet market. The wallet market in APAC is expanding significantly due to a combination of heritage and innovation.

Furthermore, the growing menace of counterfeit products in the APAC region is the primary factor restraining the market growth in this region. The easy availability of counterfeit products, especially in countries such as China, India, Hong Kong, and Thailand, makes it difficult for genuine sellers to penetrate the market optimally. Additionally, low prices of counterfeit wallets will attract consumers, thereby hindering the potential sales of branded wallets and the growth of the regional market during the forecast period.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Product Outlook

- Conventional wallets

- Smart-connected wallets

- Distribution Channel Outlook

- Online

- Offline

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

You may also interested in below market reports:

E-Wallet Market E-Wallet Market Analysis APAC, North America, Europe, South America, Middle East and Africa - US, China, India, UK, Spain - Size and Forecast

Crypto Wallet Market Crypto Wallet Market by Service and Geography - Forecast and Analysis

India - Handbags Market India - Handbags Market by Product Type, and Distribution Channel Forecast and Analysis

Market Analyst Overview:

The market is thriving with a strong emphasis on fashion trends catering to men and women alike. Both offline distribution channels and online channels play pivotal roles in reaching consumers seeking leather wallets crafted from high-quality leather through advanced tanning processes. Innovations like Bolt Threads and GANNI are reshaping the industry by offering alternatives to traditional animal leather with materials like Mylo mushroom leather. Segments such as trifold and bifold wallets, RFID-blocking technology, and clutch wallets cater to specific consumer needs in the men's and women's categories. The market's evolution also reflects a shift towards e-commerce retail channels, accommodating modern lifestyles and preferences for premium and luxury goods including hand bags and finished leather goods. This dynamic sector blends technological expertise with timeless craftsmanship to meet diverse consumer demands. Further, the global leather wallet market report highlights current fashion trend in men segment and women segment, emphasizing the tanning process and online distribution channel for these stylish accessories. The tanning procedure for trifold wallets and slim wallets cater to both men's and women category, reflecting a blend of modern life style preferences, with a focus on offline catagory.

|

Industry Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.98% |

|

Market growth 2024-2028 |

USD 15.19 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.37 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 43% |

|

Key countries |

US, China, India, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

BAGGIT, Bellroy Pty Ltd., Buffalo Jackson Trading Co., Burberry Group Plc, Calleen Cordero Designs Inc., Da Milano Leathers Pvt. Ltd., Ekster Wallets BV, Etienne Aigner AG, Fossil Group Inc., Furla Spa, Hermes International, Hidesign, Kenneth Cole Productions Inc., Kering SA, Matt and Nat SE, Montblanc, Mulberry Group Plc, Ralph Lauren Corp., Tory Burch LLC, and Zazzle Inc. |

|

Market dynamics |

Parent market analysis, Market forecast, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market report during the forecast period

- Detailed information of market analysis and report on factors that will drive the growth of the market between 2024 and 2028

- Precise estimation of the size of the market and its contribution in focus to the parent market

- Accurate predictions about upcoming trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.