Water Quality Monitoring Equipment Market Size 2024-2028

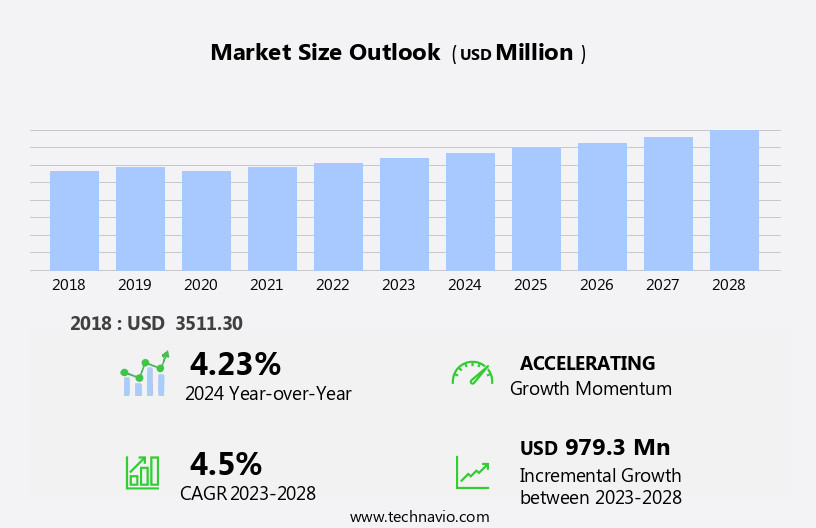

The water quality monitoring equipment market size is forecast to increase by USD 979.3 million at a CAGR of 4.5% between 2023 and 2028.

What will be the Size of the Water Quality Monitoring Equipment Market During the Forecast Period?

How is this Water Quality Monitoring Equipment Industry segmented and which is the largest segment?

The water quality monitoring equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Groundwater

- Drinking water

- Wastewater

- Aquaculture

- Others

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- North America

By Application Insights

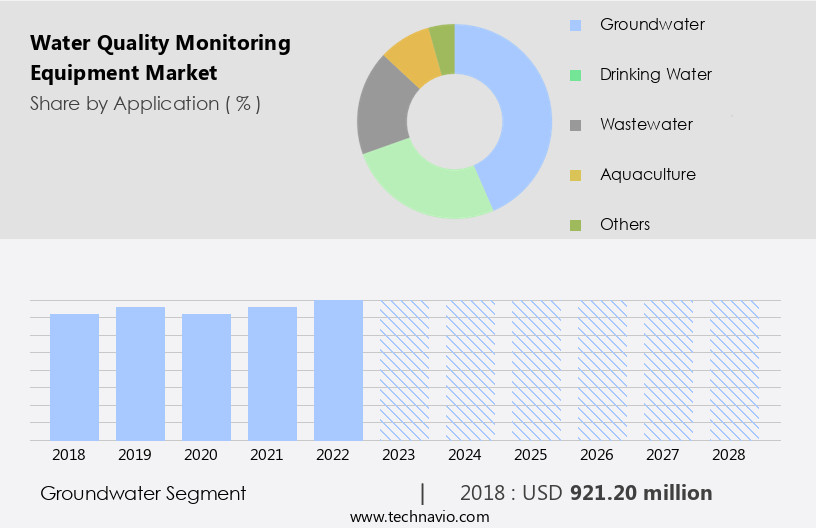

- The groundwater segment is estimated to witness significant growth during the forecast period.

Water quality monitoring is a critical aspect of ensuring the health of surface water bodies and groundwater resources. Various hardware units, including temperature sensors, turbidity sensors, dissolved oxygen sensors, pH sensors, conductivity sensors, chlorine sensors, ORP sensors, and spectrophotometers, are employed to measure water quality parameters such as temperature, turbidity, dissolved oxygen, pH, salinity, and nutrients like nitrates, phosphates, and chlorophyll. These parameters are essential indicators of ecosystem health and public health monitoring. Water testing is carried out in both online and laboratory settings to determine the presence of heavy metals, nutrients, and other contaminants. Groundwater, a primary source of drinking water, is often tested for native groundwater and target aquifer characteristics, such as detention times, hydrological models, tracer breakthrough data, and chemical reactions.

Surface water bodies, including lakes, rivers, and wetlands, are monitored for nutrient levels, water clarity, and oxygen. Regulatory requirements mandate regular water quality monitoring to ensure compliance with drinking water standards and public health safety. Distribution systems and drinking water are also subject to monitoring for disinfectant residual and other contaminants. The integration of advanced technologies, such as chemical sensors and regression models, enhances the accuracy and efficiency of water quality monitoring. A ground object spectrometer is another tool used to analyze water quality by measuring the spectral reflectance of water samples. Overall, water quality monitoring is crucial for maintaining ecosystem health and ensuring the safety and availability of clean water for various uses.

Get a glance at the Water Quality Monitoring Equipment Industry report of share of various segments Request Free Sample

The Groundwater segment was valued at USD 921.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

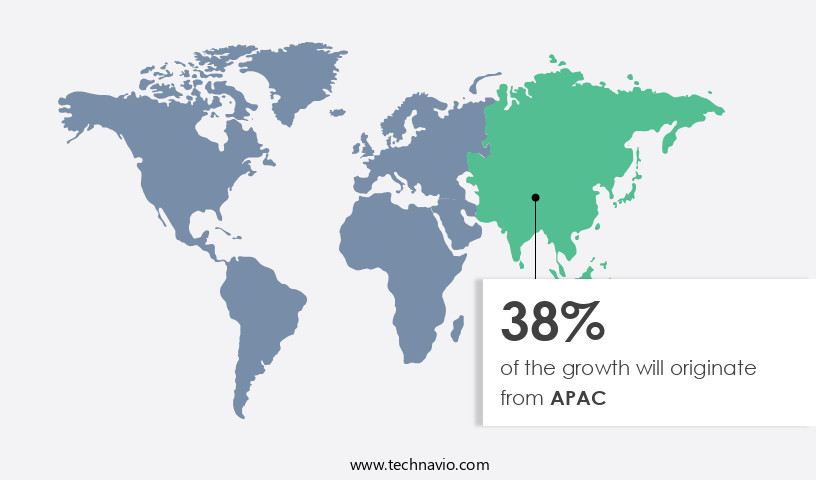

- APAC is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market In the US is expected to experience growth due to the increasing demand for fresh water and the need to address environmental concerns. This growth will primarily stem from new construction projects, upgrades, and expansions withIn the water and wastewater industry. The United States and Canada are significant contributors to this market, driven by the high adoption of water quality sensors and stringent regulations set by the Environmental Protection Agency (EPA). The Clean Water Act (CWA) and Safe Drinking Water Act (SDWA) are two federal policy programs In the US that prioritize water quality, ensuring compliance with strict norms.

Water quality parameters such as temperature, pH, dissolved oxygen, turbidity, nitrates, phosphates, and chlorine are closely monitored to maintain ecosystem health and public health. Water testing for analytes like salinity, water clarity, and nutrients (phosphorus, nitrogen, and chlorophyll) is essential for both surface water bodies and groundwater sources, including native groundwater and target aquifers. The use of advanced sensors, such as dissolved oxygen sensors, pH sensors, conductivity sensors, and ORP sensors, plays a crucial role in real-time monitoring and ensuring regulatory requirements are met. Additionally, laboratory analysis and public health monitoring through sampling and analysis are essential components of the water quality monitoring process.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Water Quality Monitoring Equipment Industry?

Increasing pollution adversely affecting quality of drinking water is the key driver of the market.

What are the market trends shaping the Water Quality Monitoring Equipment Industry?

Adoption of smart water networks is the upcoming market trend.

What challenges does the Water Quality Monitoring Equipment Industry face during its growth?

Lack of water infrastructure in developing countries is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The water quality monitoring equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the water quality monitoring equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, water quality monitoring equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Aeron Systems Pvt. Ltd. - The company provides comprehensive water quality monitoring solutions encompassing equipment like the EPA 200.8 Water Analyzer. This integrated offering includes hardware, software, consumables, professional services, and documentation, enabling accurate and efficient water quality analysis.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aeron Systems Pvt. Ltd.

- Agilent Technologies Inc.

- Atlas Scientific LLC

- Campbell Scientific Inc.

- Danaher Corp.

- Environmental Holdings Pty Ltd.

- General Electric Co.

- Geotech Environmental Equipment Inc.

- Hanna Instruments Inc.

- HORIBA Ltd.

- Hydro International Ltd.

- In Situ Inc.

- Libelium Comunicaciones Distribuidas SL

- Metex Corp. Ltd.

- National Institute of Water and Atmospheric Research Ltd.

- Optiqua Technologies Pte Ltd.

- RS Hydro Ltd.

- Sea Bird Scientific

- Stevens Water Monitoring Systems Inc.

- Thermo Fisher Scientific Inc.

- Xylem Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of hardware units designed to measure various water quality parameters. These parameters include temperature, pH, turbidity, dissolved oxygen, conductivity, chlorine residual, and other analytes such as nitrates, phosphates, and heavy metals. Water testing is an essential aspect of ensuring the health of surface water bodies and native groundwater. The monitoring of water quality parameters plays a crucial role in assessing the ecosystem health and identifying potential contamination sources. This information is vital for both public health monitoring and regulatory compliance. Temperature sensors are used to measure the temperature of water, which is an essential parameter for determining the health of aquatic ecosystems.

Macroinvertebrates, for instance, are sensitive to changes in water temperature and can indicate the overall health of a water body. PH sensors are used to measure the acidity or basicity of water. PH levels can significantly impact the health of aquatic organisms and the chemical reactions that occur in water. Dissolved oxygen sensors measure the amount of oxygen present in water. Oxygen levels are crucial for the survival of aquatic organisms and can indicate the overall health of a water body. Conductivity sensors measure the ability of water to conduct an electrical current. This parameter is essential for determining the salinity of water and can indicate the presence of dissolved ions and minerals.

Chlorine sensors are used to measure the level of chlorine residual in water. Chlorine is commonly used as a disinfectant in drinking water distribution systems and is essential for maintaining public health. ORP (Oxidation-Reduction Potential) sensors measure the ability of water to oxidize or reduce other substances. ORP is an essential parameter for assessing the water quality in relation to the presence of redox-active compounds. Turbidity sensors measure the cloudiness or clarity of water. Turbidity can impact the health of aquatic organisms and can indicate the presence of suspended particles or contaminants. The use of advanced technologies such as spectroscopy and regression models has revolutionized water quality monitoring.

Ground object spectrometers, for instance, can be used to measure the spectral characteristics of water, providing valuable information on the presence of various analytes. Water quality monitoring is essential for ensuring the health of both surface water bodies and native groundwater. The use of online sensors and real-time data analysis has made it possible to monitor water quality continuously, enabling early detection of contamination events and prompt response to mitigate their impact. Regulatory requirements play a significant role in driving the demand for water quality monitoring equipment. Drinking water regulations, for instance, require regular monitoring of water quality parameters to ensure the safety of public health.

In conclusion, the market is a dynamic and essential industry that plays a crucial role in ensuring the health of aquatic ecosystems and public health. The use of advanced technologies and real-time data analysis has made it possible to monitor water quality continuously, enabling prompt response to contamination events and maintaining regulatory compliance.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

159 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 979.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, China, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Water Quality Monitoring Equipment Market Research and Growth Report?

- CAGR of the Water Quality Monitoring Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the water quality monitoring equipment market growth of industry companies

We can help! Our analysts can customize this water quality monitoring equipment market research report to meet your requirements.