Western Europe Powder Coatings Market Size 2024-2028

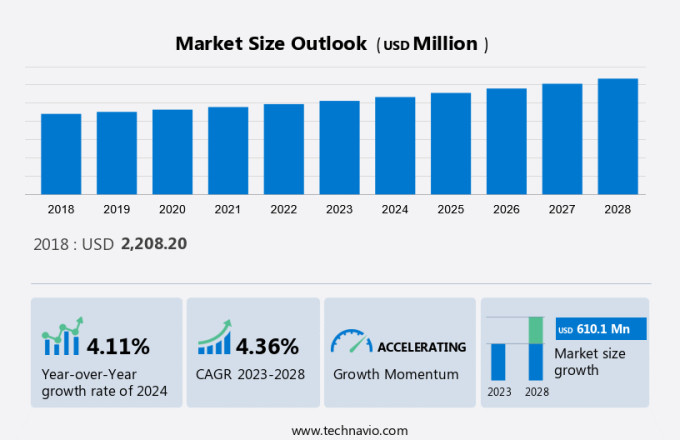

The Western Europe powder coatings market size is forecast to increase by USD 610.1 million, at a CAGR of 4.36% between 2023 and 2028. The market is experiencing significant growth, driven by several key trends and factors. One major trend is the increased use of the fluidized bed process, which offers advantages such as improved coating uniformity and reduced environmental impact. Another factor fueling market growth is the rising urbanization and infrastructure development in various regions, leading to a higher demand for durable and aesthetically pleasing industrial coatings for buildings and infrastructure. Additionally, the high energy consumption in curing powder coatings is being addressed through the adoption of energy-efficient technologies and alternative curing methods. These trends and factors are expected to continue driving the growth of the market in the coming years.

What will be the Size of the Market During the Forecast Period?

To learn more about this report, View Report Sample

Market Dynamic and Customer Landscape

Powder coatings are a type of coating applied as a free-flowing, dry powder. They are widely used in various industries for automotive and decorative applications. In the automotive sector, powder coatings are used for coating metal bodies of vehicles, including those of Volkswagen, Mercedes-Benz, and Porsche. In construction, powder coatings find extensive use in building construction, particularly in residential and non-residential sectors. Commercial buildings, such as offices and malls, also use powder coatings for their durability and finishing properties. The market is driven by the need for sustainable practices and the increasing demand for corrosion-resistant coatings. The market is segmented based on coating techniques, including Fluidized bed processes. The use of nanostructured powder coatings is also gaining popularity due to their superior properties. The primary application areas for powder coatings are automotive and construction, with the construction industry accounting for a larger share of the market. The market is expected to grow at a steady pace due to the increasing demand for durable and finishing coatings.

Key Market Driver

The increased use of fluidized bed process is notably driving market growth. Powder coatings, a popular finishing technique for metal bodies in various industries, have gained significant traction due to their durability and sustainable properties. Fluidized bed processes are a primary coating technique used for powder coatings, which enable the application of thicker coatings on three-dimensional objects with complex shapes. Further, this method involves immersing heated objects into a bed of fluidized powder particles, which adhere due to fluidization and electrostatic attraction. The process ensures an even and consistent coating thickness on all sides, making it suitable for large parts or objects that are difficult to coat using other methods. As urbanization and digitalization continue to shape the construction landscape, the demand for sustainable practices in building materials is growing. Nanostructured powder coatings, thin film coatings, water-borne coatings, and nano-coatings are some advanced technologies that offer enhanced properties and reduced health hazards compared to traditional solvent-based coatings.

The epoxy segment of the thermosets market, a significant contributor to the powder coatings industry, is expected to grow due to its superior durability and resistance to chipping and corrosion. In summary, the market is driven by the automotive and construction industries, with the fluidized bed process being a crucial coating technique for achieving thicker coatings on complex objects. The adoption of sustainable practices, advanced coating technologies, and the growing demand for durable and eco-friendly coatings are expected to shape the market's future trajectory. Thus, such factors are driving the growth of the market during the forecast period.

Significant Market Trends

The rising urbanization and infrastructure development is the key trend in the market. Powder coatings have gained significant traction in various industries, particularly in Western Europe, due to their unique properties and suitability for urbanization and infrastructure development. In the construction industry, powder coatings are extensively used in both residential and non-residential building construction. Powder coatings offer several advantages over traditional liquid coatings, including higher durability, resistance to corrosion, and reduced environmental impact. These coatings are applied using various techniques such as Fluidized bed processes, Moreover, thin film coating, and Nano-coating. The epoxy segment of the market, which includes thermosets, is particularly popular due to its superior adhesion and chemical resistance.

With the increasing demand for sustainable practices, powder coatings offer an eco-friendly alternative to solvent-based coatings, reducing carbon emissions and eliminating health hazards associated with solvents and volatile organic compounds. The market is also witnessing the development of advanced technologies such as water-borne coatings and nanostructured powder coatings. In conclusion, the market in Western Europe is expected to continue its growth trajectory, driven by the automotive industry and construction sector. The market's ability to offer durable, corrosion-resistant, and environmentally friendly coatings makes it an ideal choice for urbanization and infrastructure development projects. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

The high energy consumption in curing is the major challenge that affects the growth of the market. Powder coatings have gained significant traction in various industries due to their superior finishing qualities and sustainability advantages. Beyond automotive, powder coatings find extensive use in construction, particularly in residential and non-residential building construction. However, the energy-intensive curing process poses a challenge in the market, especially in Western Europe. Traditional curing methods involve heating coated objects in ovens at high temperatures, leading to substantial energy consumption and increased operational costs. This issue not only affects cost-effectiveness but also raises concerns regarding environmental sustainability. To mitigate these challenges, research and development efforts are focused on implementing energy-efficient curing techniques, such as infrared curing, UV curing, and microwave curing. These alternatives can reduce energy consumption and operational costs while maintaining the desirable properties of powder coatings. However, their applicability to various substrates and formulations should be thoroughly evaluated to ensure their universal adoption.

Nanostructured powder coatings, thin film coatings, water-borne coatings, and nano-coatings are some of the emerging technologies that address the need for energy efficiency, durability, and reduced carbon emissions. However, the use of solvents and volatile organic compounds in powder coatings can pose health hazards and contribute to carbon emissions. Therefore, the industry is shifting towards the adoption of sustainable resins, such as those derived from renewable sources, to minimize these risks. In conclusion, the market is driven by its versatility and sustainability advantages in various industries, particularly automotive paint and construction. However, the energy-intensive curing process and the need for sustainable alternatives present challenges that require continuous research and innovation. The development of energy-efficient curing methods, sustainable resins, and emerging coating technologies will contribute to the growth and evolution of the powder coatings market. Hence, the above factors will impede the growth of the market during the forecast period.

Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth and forecasting strategies.

Market Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Aalberts Surface Treatment GmbH - The company offers powder coatings such as Halar ECTFE powder coatings.

The research report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- Aalberts Surface Treatment GmbH

- Akzo Nobel NV

- Arkema SA

- Axalta Coating Systems Ltd.

- BASF SE

- Covestro AG

- CWS Powder Coatings GmbH

- J Wagner GMBH

- Kansai Paint Co. Ltd.

- Primatek Coatings OU

- RIPOL Srl

- Solvay SA

- ST Powder Coatings S.p.A.

- The Sherwin Williams Co.

- Thermaset Ltd.

- Wacker Chemie AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

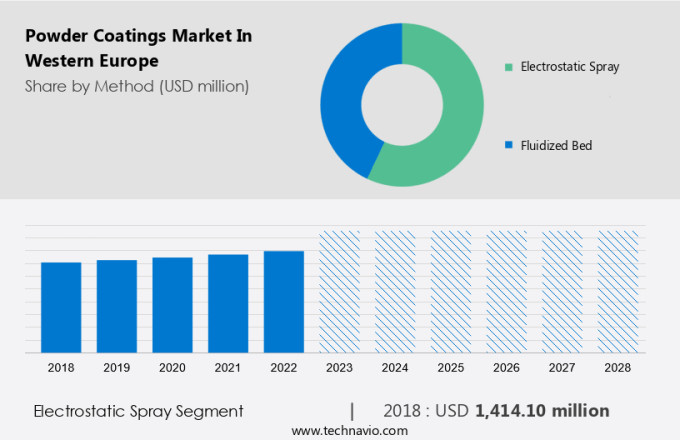

The electrostatic spray segment is estimated to witness significant growth during the forecast period. Powder coatings, a popular coating technology, have gained significant traction in various industries due to their unique advantages.

Get a glance at the market contribution of various segments View the PDF Sample

The electrostatic spray segment was the largest segment and valued at USD 1.41 billion in 2018. Beyond automotive applications, powder coatings are widely adopted in construction for both residential and non-residential buildings. Powder coatings offer sustainable practices, such as Fluidized bed processes, and are increasingly used in urbanization and digitalization projects. Powder coatings are available in various types, including Thin film coating, Water-borne coating, and Nano-coating. Primary coating techniques like Electrostatic processes ensure uniform coating thickness and appearance, with high transfer efficiency and minimal waste.

Segment Overview

The market research report provides comprehensive data with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Method Outlook

- Electrostatic spray

- Fluidized bed

- Type Outlook

- Thermoset powder coatings

- Thermoplastic powder coatings

Market Analyst Overview

Powder coatings are a popular choice for finishing metal bodies in various industries due to their durability and finishing qualities. the construction sector, powder coatings are used extensively in residential and non-residential buildings, including commercial buildings. The market is segmented into decorative applications and automotive. The decorative segment includes applications in construction, furniture, and appliances. The automotive segment is further divided into primary coating techniques like Fluidized bed processes and sustainable practices like nanostructured powder coatings. Powder coatings offer advantages like durability, corrosion resistance, and chipping resistance. However, they contain solvents and volatile organic compounds, which contribute to carbon emissions and health hazards.

Additionally, the market is focusing on technology advancements like thin film coating, water-borne coating, and nano-coating to address these concerns. The use of resins like epoxy in thermosets is also gaining popularity due to their high performance and sustainability. Further, the market is influenced by several economic activities, including building construction revenue and dwelling building permits. As the GDP grows, sectors like automobiles and medical devices see increased demand for powder coatings. This trend extends to the consumer goods market and packaging industries, where architectural and industrial sectors drive the need for innovative coating solutions. Construction projects and economic recoveries further boost the market, reflecting its vital role in various economic recoveries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

153 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 610.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Aalberts Surface Treatment GmbH, Akzo Nobel NV, Arkema SA, Axalta Coating Systems Ltd., BASF SE, Covestro AG, CWS Powder Coatings GmbH, J Wagner GMBH, Kansai Paint Co. Ltd., Primatek Coatings OU, RIPOL Srl, Solvay SA, ST Powder Coatings S.p.A., The Sherwin Williams Co., Thermaset Ltd., and Wacker Chemie AG |

|

Market dynamics |

Parent market analysis, Market forecast, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the market forecast period. |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market report during the forecast period

- Detailed information of market growth analysis and report on factors that will drive the growth of the market between 2024 and 2028

- Precise estimation of the size of the market and its contribution in focus to the parent market

- Accurate predictions about upcoming trends and changes in consumer behaviour

- Growth of the market across Western Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.