Industrial Coatings Market Size 2025-2029

The industrial coatings market size is valued to increase USD 24.3 billion, at a CAGR of 4.5% from 2024 to 2029. Surging demand for waterborne coatings will drive the industrial coatings market.

Major Market Trends & Insights

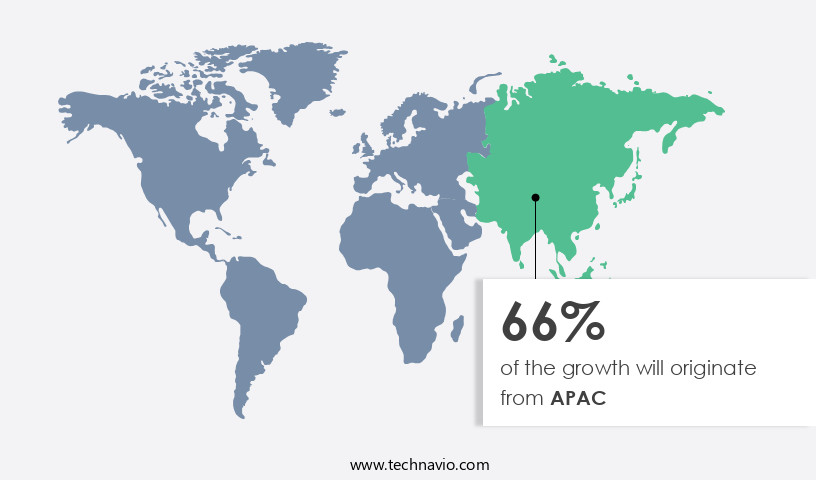

- APAC dominated the market and accounted for a 56% growth during the forecast period.

- By Technology - Waterborne segment was valued at USD 35.40 billion in 2023

- By Application - General industrial segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 39.91 billion

- Market Future Opportunities: USD 24.30 billion

- CAGR from 2024 to 2029 : 4.5%

Market Summary

- The market experiences continuous expansion, driven by the increasing demand for protective and decorative coatings across various industries. One notable trend is the shift towards waterborne coatings, which offer environmental benefits and superior performance compared to traditional solvent-based alternatives. Another emerging area of interest is the development of advanced coatings with self-cleaning and self-healing properties, responding to the evolving market requirements. However, the industry faces challenges, including the volatility of raw material prices, which can significantly impact production costs and profitability.

- According to market research, The market was valued at over USD150 billion in 2020 and is projected to reach a value of approximately USD200 billion by 2026, demonstrating the market's significant growth potential. This expansion is underpinned by advancements in technology, increasing demand for high-performance coatings, and the growing awareness of sustainability in manufacturing processes.

What will be the Size of the Industrial Coatings Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Industrial Coatings Market Segmented ?

The industrial coatings industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- Waterborne

- Solvent-borne

- Powdered coatings

- UV-cured

- Application

- General industrial

- Automotive OEMs

- Automotive refinishes

- Others

- Resin Type

- Acrylic

- Epoxy

- Polyurethane

- Alkyd and polyester

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Technology Insights

The waterborne segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with a growing emphasis on sustainable coating solutions. Aquatic coatings, comprising primarily aqueous solutions, are gaining popularity due to their low VOC content and compliance with US and European regulations. These coatings, which contain minimal solvents like glycol ethers, offer environmental benefits and ease of application. However, the curing process for aquatic coatings can be slower than solvent-based alternatives, taking into account factors such as temperature, humidity, and air circulation. In contrast, solvent-based coatings, including high-performance, epoxy resin systems and UV curable coatings, provide quicker curing times and excellent coating properties, such as high crosslinking density and impact resistance.

Coating application techniques, including electrostatic and airless spray, contribute to the versatility of industrial coating processes. To ensure the highest quality, various testing methods are employed. Coating durability standards are assessed through flexural strength testing, coating hardness testing, and corrosion resistance testing. Defect detection methods, such as film thickness measurement, wettability testing, and surface tension measurement, help maintain consistent coating quality. Pigment dispersion methods and color matching systems ensure accurate and uniform coatings. The industrial coating lifecycle analysis incorporates VOC emission regulations and considers the long-term performance of coatings, including chemical resistance, thermal spray, and powder coating technology. Overall, the market demonstrates a continuous drive towards innovation and sustainability.

For instance, powder coating technology, which offers excellent adhesion strength and abrasion resistance, has seen significant advancements. The market also encompasses a wide range of coating application techniques, such as electrostatic and crosslinking density control, which contribute to the overall quality and performance of industrial coatings.

The Waterborne segment was valued at USD 35.40 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 56% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Industrial Coatings Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing significant growth due to the expanding automotive sector, particularly in countries like India and China. Major players in the industrial coatings industry are capitalizing on these profitable opportunities by expanding their presence in APAC. Factors contributing to this growth include a burgeoning population, increasing disposable incomes, and a thriving automotive industry. Furthermore, the region's the market is poised for further expansion as stricter environmental regulations are implemented to reduce hazardous emissions and promote the use of advanced coatings with health benefits.

According to a recent study, the market in APAC is projected to grow substantially, underscoring its importance in the global industrial coatings landscape.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and innovative industry, driven by the constant demand for high-performance coatings in various sectors. One of the key trends in this market is the optimization of the electrostatic powder coating process to enhance efficiency and reduce production costs. In the automotive sector, UV curable coatings are gaining popularity due to their fast curing properties and ability to provide excellent color and gloss retention. Another significant development in the market is the epoxy resin system curing kinetics, which plays a crucial role in ensuring optimal curing and improving the overall performance of the coating. For automotive and industrial applications, polyurethane coatings are preferred for their superior chemical resistance, which is essential for withstanding extreme environments. To meet the evolving needs of the market, waterborne coating system formulation development is a priority for many coatings manufacturers. Solvent-based coatings are being phased out due to their environmental impact, and VOC reduction strategies are being implemented to meet regulatory requirements. Coating adhesion testing methods and standards are essential to ensure optimal adhesion and prevent defects. Surface preparation techniques, such as sandblasting and acid etching, are used to create a clean and porous surface for better adhesion. Industrial coating application techniques, such as thermal spray and airless spray, are used for large parts to ensure even coverage and improved quality. Impact and abrasion resistance testing standards are crucial for evaluating the performance of industrial coatings in harsh environments. Crosslinking density control in UV curable coatings is essential to ensure consistent coating properties and improve coating durability. Pigment dispersion methods, such as high shear mixing and ball milling, are used to improve coating quality and color stability. Coating rheology control for optimal application and thermal spray coating process parameters are critical to ensure consistent coating thickness and uniformity. Coating defect detection using image analysis and surface tension measurement for improved wettability are essential for ensuring coating quality and preventing defects. Coating gloss and color measurement instruments are used to ensure consistency and meet customer requirements.

What are the key market drivers leading to the rise in the adoption of Industrial Coatings Industry?

- The surging demand for waterborne coatings serves as the primary driver in the market's growth. Waterborne coatings, known for their eco-friendly composition and superior performance, have gained significant traction among industries due to increasing environmental regulations and consumer preferences for sustainable solutions. This trend is expected to continue, propelling the market forward.

- Aqueous coatings have gained significant traction across various industries, including automotive, construction, marine, oil and gas, metallurgical, aerospace, mining, and healthcare. These coatings serve multiple purposes, acting as primers and delivering superior heat and abrasion resistance, as well as excellent adhesion properties. Notably, waterborne coatings contribute to environmental sustainability by emitting lower levels of volatile organic compounds (VOC) and hazardous air pollutants (HAP) compared to solvent-based alternatives. This reduction in organic compound release translates to less severe environmental impact. Moreover, waterborne coatings are more cost-effective due to the absence of additives, thinners, or hardeners typically required for solvent-based coatings.

- The continuous evolution of aqueous coatings and their applications underscores their importance in addressing industry demands for eco-friendly, cost-effective, and high-performance solutions.

What are the market trends shaping the Industrial Coatings Industry?

- Self-cleaning and self-healing coatings are emerging as the latest market trend. These advanced coatings offer significant benefits in terms of maintenance and durability.

- Self-cleansing and self-restoration coatings represent a promising development in the business coatings market. These advanced coatings possess the ability to eliminate the need for multiple applications, significantly impacting the industry. Global producers are investing heavily in research and development to expand their offerings, integrating these properties into paints and coatings. However, the manufacturing costs associated with self-cleansing and self-restoration coatings are substantial, posing a challenge for some producers. Despite this, the potential benefits, such as increased durability and reduced maintenance requirements, make these coatings an attractive proposition.

- The market for self-cleansing and self-restoration coatings is evolving, with applications spanning various sectors, including automotive, construction, and industrial manufacturing. This ongoing research and development activity underscore the dynamic nature of the business coatings market.

What challenges does the Industrial Coatings Industry face during its growth?

- The volatile nature of raw material prices poses a significant challenge to the industry's growth trajectory.

- Industrial coatings' manufacturing costs are influenced by the volatile prices of raw materials, including binders, pigments, and solvents. These materials derive from petrochemical feedstocks, such as polyesters, alcohols, and epoxy resins, which are primarily based on crude oil and natural gas. Crude oil price fluctuations directly impact the cost of feedstock. Each petrochemical feedstock has a unique correlation with oil pricing, influenced by factors like feedstock supply and demand, manufacturing processes, and production locations.

- The coatings industry's continuous evolution and expansion into various sectors, including automotive, construction, and consumer goods, necessitate a deep understanding of raw material pricing dynamics. Adjusting to these changes and maintaining price stability for coatings products remains a significant challenge for manufacturers.

Exclusive Technavio Analysis on Customer Landscape

The industrial coatings market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the industrial coatings market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Industrial Coatings Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, industrial coatings market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Akzo Nobel NV - This company specializes in providing a range of industrial coatings, including Interpon, Sikkens, and Chemcraft, enhancing durability and protection for various industries. Through rigorous research and analysis, these high-performance coatings deliver superior coverage and resistance to wear and tear.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akzo Nobel NV

- Axalta Coating Systems Ltd.

- BASF SE

- Benjamin Moore and Co.

- Brillux GmbH and Co. KG

- Chugoku Marine Paints Ltd.

- Cloverdale Paint Inc.

- Endura Coatings

- Hempel AS

- Kansai Paint Co. Ltd.

- Nippon Paint Holdings Co. Ltd.

- NOROO Paint and Coatings Co. Ltd.

- Orkla ASA

- PPG Industries Inc.

- RPM International Inc.

- Teknos Group Oy

- The Sherwin Williams Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Industrial Coatings Market

- In January 2024, PPG Industries, a leading coatings manufacturer, announced the launch of its new line of high-performance industrial coatings, named "PPG TESLINX," designed for the renewable energy sector. These coatings offer enhanced durability and resistance to extreme weather conditions, making them ideal for wind turbines and solar panels (PPG Industries Press Release).

- In March 2024, AkzoNobel and BASF, two major players in the market, announced a strategic collaboration to develop and commercialize innovative, sustainable coating solutions. This partnership aimed to reduce their environmental footprint and meet the growing demand for eco-friendly industrial coatings (AkzoNobel Press Release).

- In May 2024, Axalta Coating Systems, a global leader in liquid and powder coatings, completed the acquisition of the industrial coatings business of Valspar Corporation for approximately USD4.3 billion. This acquisition significantly expanded Axalta's global reach and market share in the industrial coatings sector (Axalta Coating Systems Press Release).

- In January 2025, the European Union's REACH regulation introduced new restrictions on the use of certain industrial coatings containing heavy metals, such as lead and cadmium. This regulatory change forced manufacturers to invest in research and development of alternative, compliant coatings, creating opportunities for innovative companies in the market (European Chemicals Agency Press Release).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Industrial Coatings Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

238 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2025-2029 |

USD 24.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.3 |

|

Key countries |

China, US, India, Japan, Germany, South Korea, Brazil, Australia, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, with innovative technologies and applications shaping its dynamics. For instance, the adoption of UV curable coatings and waterborne coating systems has gained momentum due to their environmental benefits and faster curing processes. High-performance coatings, such as polyurethane, are increasingly utilized in sectors like automotive and construction for their superior durability and resistance to harsh conditions. Defect detection methods and color matching systems have become essential in ensuring consistent coating quality. Coating durability standards, including flexural strength testing, coating adhesion strength, and crosslinking density control, are rigorously enforced to maintain product excellence.

- Coating rheology control and film thickness measurement are also critical in optimizing application techniques and ensuring uniform coating distribution. Emerging technologies like electrostatic coating and powder coating application offer improved efficiency and reduced VOC emissions, aligning with the growing focus on environmental sustainability. The industrial coating processes landscape is further enriched by advancements in epoxy resin systems, surface preparation methods, and pigment dispersion techniques. Industry growth is expected to remain robust, with a projected increase of 5% annually. For example, the automotive sector has witnessed a significant sales increase of 10% in the past year due to the adoption of advanced coating technologies.

- This continuous unfolding of market activities and evolving patterns underscores the importance of staying informed and adaptive in the industrial coatings industry. In the realm of coating properties, polyurethane coatings exhibit impressive impact resistance and chemical resistance, making them a popular choice for various applications. Thermal spray coatings and corrosion resistance testing are also essential in ensuring coating longevity and reliability. Coating lifecycle analysis, wettability testing, and coating hardness testing are crucial in assessing the overall performance and effectiveness of industrial coatings. Airless spray coating and abrasion resistance testing are essential in optimizing application techniques and ensuring consistent coating quality.

- The market is a dynamic and ever-evolving landscape, shaped by continuous innovation and the ever-changing needs of various industries. Staying informed and adaptive to these trends and advancements is essential for businesses looking to thrive in this competitive market.

What are the Key Data Covered in this Industrial Coatings Market Research and Growth Report?

-

What is the expected growth of the Industrial Coatings Market between 2025 and 2029?

-

USD 24.3 billion, at a CAGR of 4.5%

-

-

What segmentation does the market report cover?

-

The report is segmented by Technology (Waterborne, Solvent-borne, Powdered coatings, and UV-cured), Application (General industrial, Automotive OEMs, Automotive refinishes, and Others), Resin Type (Acrylic, Epoxy, Polyurethane, and Alkyd and polyester), and Geography (APAC, Europe, North America, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Surging demand for waterborne coatings, Volatile raw material prices

-

-

Who are the major players in the Industrial Coatings Market?

-

Akzo Nobel NV, Axalta Coating Systems Ltd., BASF SE, Benjamin Moore and Co., Brillux GmbH and Co. KG, Chugoku Marine Paints Ltd., Cloverdale Paint Inc., Endura Coatings, Hempel AS, Kansai Paint Co. Ltd., Nippon Paint Holdings Co. Ltd., NOROO Paint and Coatings Co. Ltd., Orkla ASA, PPG Industries Inc., RPM International Inc., Teknos Group Oy, and The Sherwin Williams Co.

-

Market Research Insights

- The market is a dynamic and ever-evolving sector that encompasses various types of coatings, each with unique properties and applications. Two significant areas of focus are anti-graffiti coatings and UV degradation resistance. According to industry reports, the demand for anti-graffiti coatings is projected to grow by 5% annually, as more businesses seek to protect their assets from vandalism. Furthermore, the industry anticipates a 3% compound annual growth rate in the next decade, driven by advancements in technology and increasing demand for durable, high-performance coatings. An example of the market's continuous evolution can be seen in the development of hydrophilic coatings, which offer improved weathering resistance.

- A leading coating manufacturer reported a 10% increase in sales due to the introduction of a new hydrophilic coating line, which effectively extends the lifespan of infrastructure and building exteriors. This innovation underscores the industry's commitment to providing solutions that address the challenges of maintaining infrastructure and enhancing the longevity of structures.

We can help! Our analysts can customize this industrial coatings market research report to meet your requirements.