India Wine Market Size 2026-2030

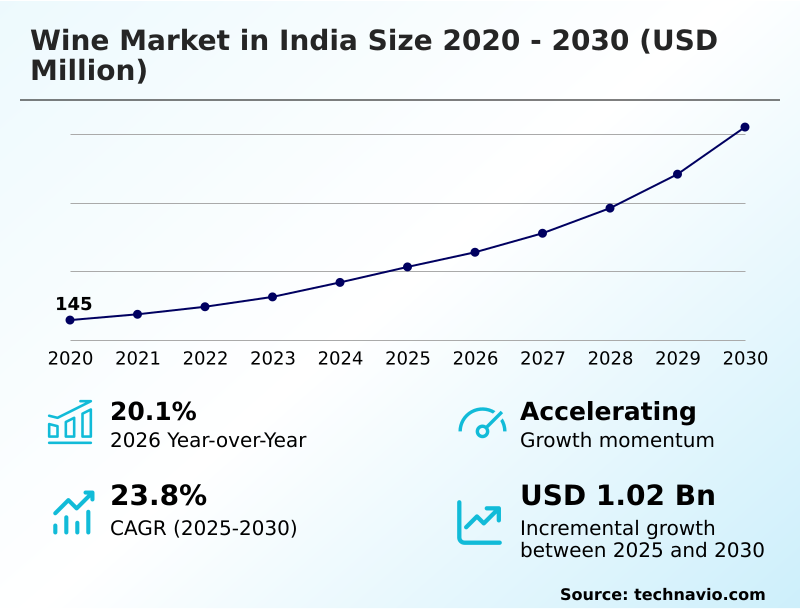

The india wine market size is valued to increase by USD 1.02 billion, at a CAGR of 23.8% from 2025 to 2030. Evolving demographics and shifting sociocultural norms will drive the india wine market.

Major Market Trends & Insights

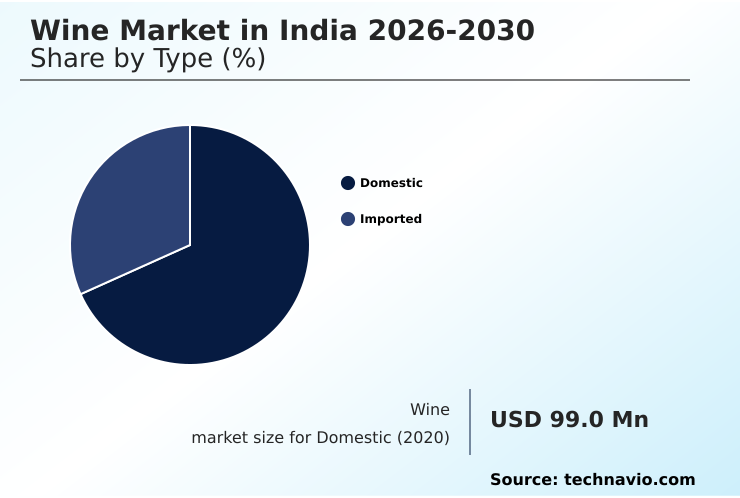

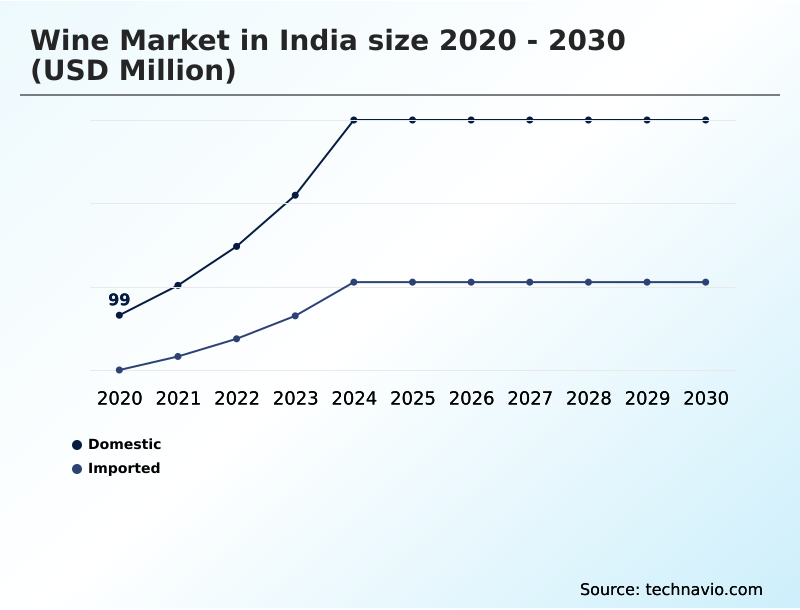

- By Type - Domestic segment was valued at USD 287.9 million in 2024

- By Product - Red segment accounted for the largest market revenue share in 2024

Market Size & Forecast

- Market Opportunities: USD 1.40 billion

- Market Future Opportunities: USD 1.02 billion

- CAGR from 2025 to 2030 : 23.8%

Market Summary

- The wine market in India is rapidly transitioning from a niche interest to a dynamic and mainstream sector. This evolution is propelled by evolving consumer spending patterns and a cultural shift, particularly among younger demographics who are more receptive to global lifestyle trends and products. Demand is expanding beyond major metropolitan hubs, signaling a broad-based adoption of wine culture.

- A key factor building consumer confidence is the integration of technology into the value chain. For instance, producers are leveraging blockchain for enhanced supply chain transparency, allowing consumers to verify a wine's provenance from vineyard to table. This addresses historical concerns about quality control, strengthens the D2C channel, and builds brand loyalty.

- This technological adoption, combined with a growing interest in wine tasting notes and gastronomic experiences, is redefining the market. While challenges related to regulatory fragmentation and a persistent consumer knowledge gap remain, the underlying momentum created by rising disposable incomes and an aspirational consumer base establishes a strong foundation for sustained expansion.

What will be the Size of the India Wine Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the India Wine Market Segmented?

The india wine industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2026-2030, as well as historical data from 2020-2024 for the following segments.

- Type

- Domestic

- Imported

- Product

- Red

- Fortified

- White

- Sparkling

- Packaging

- Bottles

- Cans

- Geography

- APAC

- India

- APAC

By Type Insights

The domestic segment is estimated to witness significant growth during the forecast period.

The domestic segment is the foundation of the wine market in India, holding a majority share by volume and driven by accessibility and an advancing quality proposition.

Indian wineries, through improved oenological techniques and vineyard management, now offer products that compete on both quality and price, resonating with a growing middle class.

Domestic producers leverage their understanding of local tastes, creating styles suitable for food and beverage pairing with Indian cuisine.

A key innovation boosting consumer trust is the implementation of blockchain for supply chain transparency, with new platforms improving traceability by over 95%.

This focus on quality, bolstered by brand storytelling and a vocal for local sentiment, solidifies the segment's market position, making it a critical component of the broader gastronomic culture.

The Domestic segment was valued at USD 287.9 million in 2024 and showed a gradual increase during the forecast period.

Market Dynamics

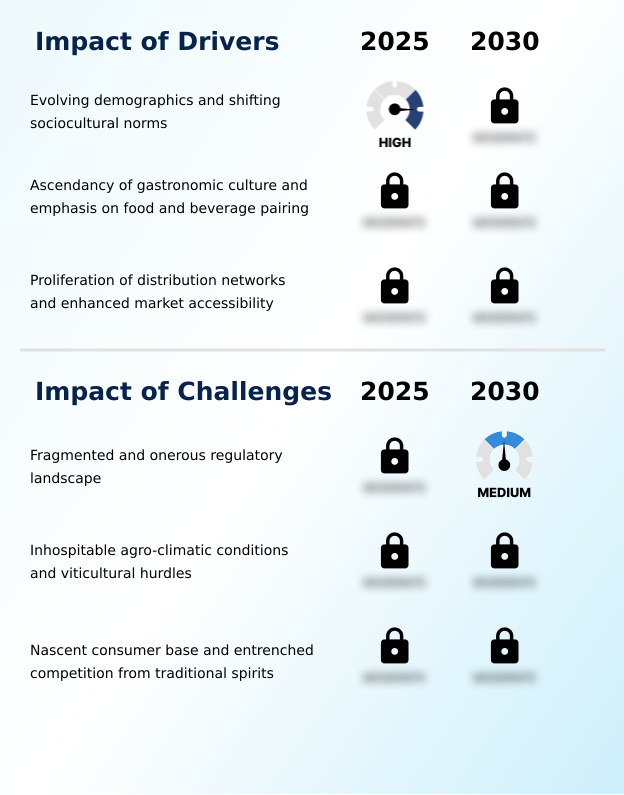

Our researchers analyzed the data with 2025 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

- The wine market in India is being reshaped by distinct premiumization trends in the Indian wine market, which are fundamentally altering domestic versus imported wine consumer preference. As palates evolve, the impact of terroir on Indian wine quality has become a central part of brand storytelling, with producers highlighting unique regional characteristics.

- Simultaneously, the industry is addressing operational hurdles, with a key focus on navigating state-level excise duties, which has historically been one of the major challenges in wine distribution in India. The introduction of blockchain for wine supply chain traceability is a direct response to these issues, promising a new level of transparency and efficiency.

- This technological shift coincides with evolving consumption habits, marked by the significant growth of sparkling wine consumption for celebratory and casual occasions, and the surprising rise of canned wine in casual settings.

- Culturally, the role of sommeliers in urban restaurants is becoming more influential in guiding consumer choice, particularly around the nuanced task of pairing wine with regional Indian food, further integrating it into the nation's gastronomic fabric.

What are the key market drivers leading to the rise in the adoption of India Wine Industry?

- Market growth is primarily driven by evolving demographics and a fundamental shift in sociocultural norms.

- Market growth is fueled by powerful demographic and sociocultural shifts, including evolving consumer spending patterns and a rising health and wellness consciousness. The expansion of the middle class has created a larger base of aspirational lifestyle products consumers.

- This is amplified by the influence of food blogging and a burgeoning class of culinary enthusiasts who view wine as integral to a gourmet meal. Consequently, the proliferation of distribution networks, including specialized wine education programs, has been critical.

- Modern retail formats have increased product visibility, contributing to a 25% year-over-year increase in trial among new consumers.

- This confluence of economic empowerment, culinary curiosity, and enhanced accessibility establishes a robust foundation for sustained market expansion, driven by both domestic producers and a curated influx of fortified wine.

What are the market trends shaping the India Wine Industry?

- The market is defined by a significant trend toward premiumization, reflecting a growing consumer palate sophistication and demand for higher-value products.

- Key trends are reshaping the wine market in India, driven by a pronounced premiumization trend and evolving palate sophistication. Consumers are increasingly seeking unique products, leading to a surge in demand for boutique winery offerings and wines made through biodynamic viticulture.

- The rise of digital commerce is a significant factor, with alcohol delivery platforms facilitating discovery and purchase, while the direct-to-consumer model allows for enhanced brand storytelling. This digital shift has improved access to a wider variety of wines, including old world wines, by over 40% in key urban markets.

- Furthermore, experiential marketing, such as events focused on wine pairing with Indian cuisine, has been shown to increase consumer engagement by 30%, fostering a deeper appreciation for the category.

What challenges does the India Wine Industry face during its growth?

- Industry expansion is significantly constrained by a fragmented and onerous regulatory landscape.

- The market faces significant structural challenges, primarily stemming from regulatory fragmentation and an entrenched consumer knowledge gap. The complex web of state-level taxes inflates final retail prices, acting as a major barrier. This complexity increases operational costs for producers by an average of 18% compared to a unified market.

- Concurrently, the industry must contend with competition from traditional spirits and a nascent consumer base that often finds wine's complexity intimidating. Agro-climatic hurdles, including the need for advanced canopy management to control tannins and achieve ripeness, add to production costs.

- Overcoming these challenges requires concerted efforts in consumer education to demystify single vineyard expression and highlight the value proposition of wine, alongside advocacy for a more streamlined regulatory environment to improve market accessibility.

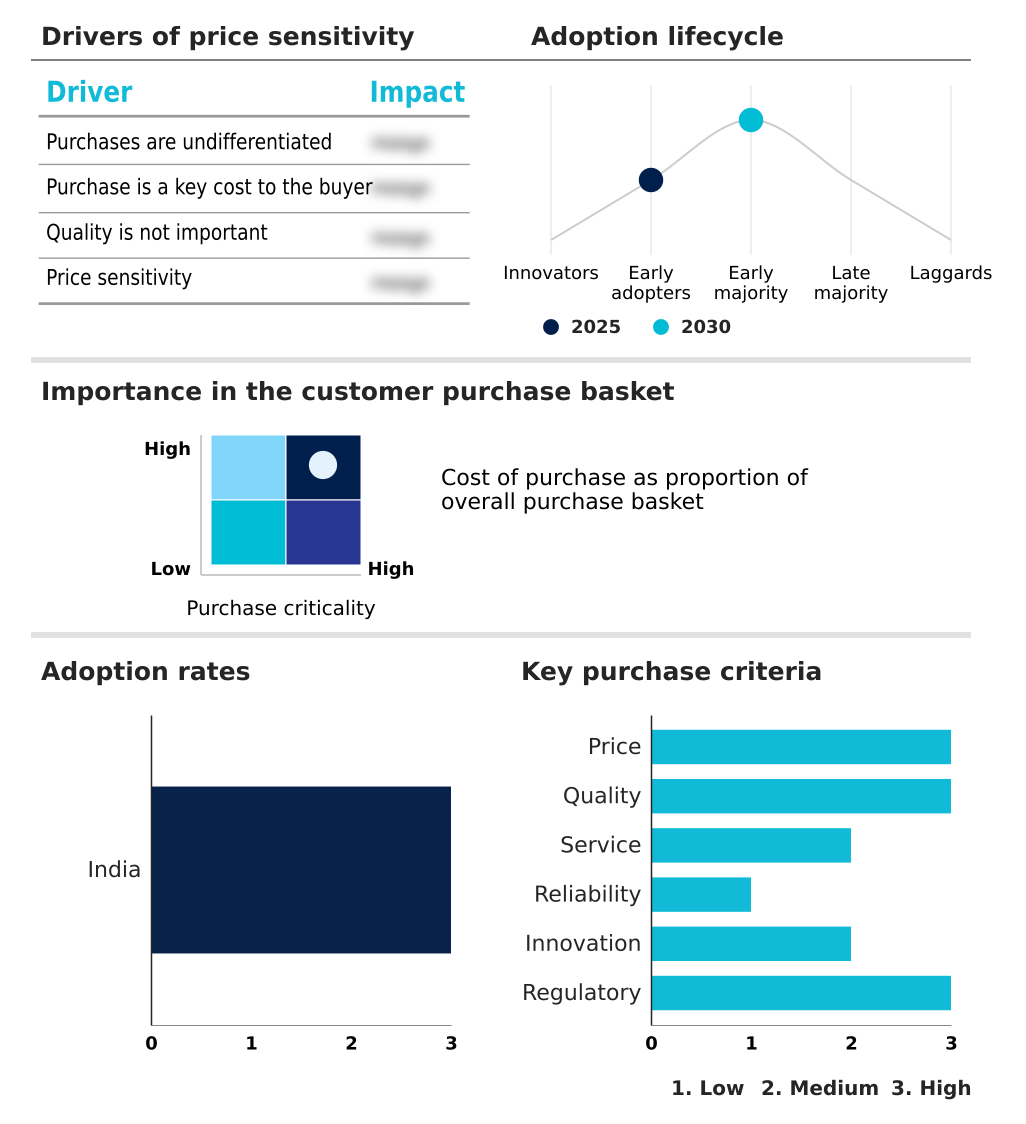

Exclusive Technavio Analysis on Customer Landscape

The india wine market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the india wine market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of India Wine Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, india wine market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Big Banyan Wines - Offers a distinguished portfolio of premium wines, including red, white, and rosé varieties, crafted with an emphasis on Italian winemaking finesse.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Big Banyan Wines

- Chandon Inc.

- Charosa Wineries Ltd.

- Chateau d Ori

- Fratelli Vineyards Ltd.

- Good Drop Wine Cellars

- Grover Zampa Vineyards Ltd.

- KRSMA Estates Pvt. Ltd.

- Nira Valley Grape Wines Ltd.

- Pernod Ricard SA

- RENAISSANCE Winery Pvt. Ltd.

- Reveilo

- Soma Vine Village

- Sula Vineyards Ltd.

- Vallonne Vineyards Pvt. Ltd.

- Vinusara Wines Pvt Ltd

- York Winery Pvt Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in India wine market

- In October 2024, the India Ministry of Commerce released an analysis indicating that foreign wine shipments grew by over 50% in volume during the first half of the year, highlighting a strong demand for international brands.

- In February 2025, Sula Vineyards reported that its annual SulaFest music and wine festival attracted a record number of attendees, demonstrating the success of experiential marketing in broadening the geographic reach of wine culture.

- In March 2025, a consortium led by Tata Consultancy Services announced the launch of Vino-Trace, a blockchain-based supply chain platform designed to bring unprecedented transparency and authenticity to the domestic wine market.

- In April 2025, the European Union successfully negotiated Green Channel customs clearance for Geographical Indication (GI) protected wines, streamlining the importation process and increasing the diversity of premium European wines available in India.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled India Wine Market insights. See full methodology.

| Market Scope | |

|---|---|

| Page number | 181 |

| Base year | 2025 |

| Historic period | 2020-2024 |

| Forecast period | 2026-2030 |

| Growth momentum & CAGR | Accelerate at a CAGR of 23.8% |

| Market growth 2026-2030 | USD 1017.1 million |

| Market structure | Fragmented |

| YoY growth 2025-2026(%) | 20.1% |

| Key countries | India |

| Competitive landscape | Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The wine market in India's evolution is a complex interplay of agricultural science and market strategy. At the core, advancements in viticulture and vineyard management are mitigating issues like fungal diseases and vintage variation, allowing for better control over phenolic ripeness in Vitis vinifera grapes.

- In the winery, investment in modern bottling lines and sophisticated oenological techniques, including controlled malolactic fermentation and specific barrel aging protocols, is crucial. Boardroom decisions increasingly weigh the economics of traditional method sparkling wine production against the scalability of the tank method.

- A primary strategic focus is on optimizing logistics, from ensuring cold chain management integrity to selecting between glass bottles, aseptic cartons, or bag-in-box packaging. This is critical for supporting both on-premise sales, where the sommelier-led experience is key, and the high-growth D2C channel.

- The adoption of sustainable farming practices and the pursuit of Geographical Indication (GI) status are becoming key differentiators, influencing everything from retail merchandising to cellar management and wine tourism.

What are the Key Data Covered in this India Wine Market Research and Growth Report?

-

What is the expected growth of the India Wine Market between 2026 and 2030?

-

USD 1.02 billion, at a CAGR of 23.8%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Domestic, and Imported), Product (Red, Fortified, White, and Sparkling), Packaging (Bottles, and Cans) and Geography (APAC)

-

-

Which regions are analyzed in the report?

-

APAC

-

-

What are the key growth drivers and market challenges?

-

Evolving demographics and shifting sociocultural norms, Fragmented and onerous regulatory landscape

-

-

Who are the major players in the India Wine Market?

-

Big Banyan Wines, Chandon Inc., Charosa Wineries Ltd., Chateau d Ori, Fratelli Vineyards Ltd., Good Drop Wine Cellars, Grover Zampa Vineyards Ltd., KRSMA Estates Pvt. Ltd., Nira Valley Grape Wines Ltd., Pernod Ricard SA, RENAISSANCE Winery Pvt. Ltd., Reveilo, Soma Vine Village, Sula Vineyards Ltd., Vallonne Vineyards Pvt. Ltd., Vinusara Wines Pvt Ltd and York Winery Pvt Ltd.

-

Market Research Insights

- Market dynamics are increasingly shaped by a vibrant gastronomic culture and the rise of experiential marketing. Consumers are moving beyond transactional purchases, seeking immersive engagements that connect them with a brand's narrative. This shift is evident in the growing popularity of wine tourism and curated tasting events.

- Wineries adopting a direct-to-consumer model have reported customer retention rates up to 25% higher than those relying solely on traditional retail. Furthermore, investment in experiential marketing initiatives, such as wine festival attendance, has been linked to a 40% increase in consumer brand loyalty among participants.

- This focus on creating memorable experiences is crucial for navigating a competitive landscape and fostering a more informed and engaged consumer base, turning nascent curiosity into long-term advocacy.

We can help! Our analysts can customize this india wine market research report to meet your requirements.