Sparkling Wine Market Size 2025-2029

The sparkling wine market size is forecast to increase by USD 8.99 billion at a CAGR of 4.8% between 2024 and 2029.

- The market is experiencing significant shifts, driven by the increasing popularity of low-alcohol beverages and the expansion of online distribution channels. Consumers' shifting preferences towards healthier lifestyle choices have led to the emergence of low-alcohol cocktails, which incorporate sparkling wine as a base. This shift is expected to continue, with an increasing number of producers introducing low-alcohol and no-alcohol sparkling wine options. Another key trend is the growth of online sales channels, which are providing greater convenience and accessibility for consumers. This trend is particularly pronounced in regions with stringent alcohol consumption regulations or remote locations, where traditional retail channels may be limited.

- However, campaigns against alcoholic beverage consumption pose a significant challenge to market growth. These campaigns, fueled by health and wellness concerns, are gaining traction and may lead to increased regulations and taxes on alcoholic beverages, potentially dampening demand. Companies in the market must navigate these challenges by offering innovative, health-conscious products and exploring alternative distribution channels to reach consumers effectively.

What will be the Size of the Sparkling Wine Market during the forecast period?

- The market exhibits dynamic trends, with consumer preferences increasingly favoring value for money and wine appreciation. Social media marketing plays a pivotal role in reaching and engaging consumers, while precision viticulture ensures a consistent flavor profile. New technologies, such as digital marketing and supply chain management, optimize operations and enhance brand loyalty. Wine branding, innovation in winemaking, and aging potential are key factors driving consumer interest. Sustainable practices and climate change awareness are shaping the industry, with wine auctions and competitions showcasing top-tier offerings. The global wine industry's evolution includes the use of glass bottles to showcase the wines' beauty and the health benefits associated with moderate alcohol consumption.

- Wine preservation and wine education are essential components of the consumer experience, as brand building and wine clubs offer exclusive access to collectors and enthusiasts. Vintage variation adds intrigue to the market, with price point and wine storage solutions catering to diverse consumer needs. Wine marketing strategies leverage aroma profile and wine awards to differentiate offerings and build brand recognition. Tariffs and protectionist measures impact the market, but organic wines and e-commerce sales channels provide opportunities for growth.

How is this Sparkling Wine Industry segmented?

The sparkling wine industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

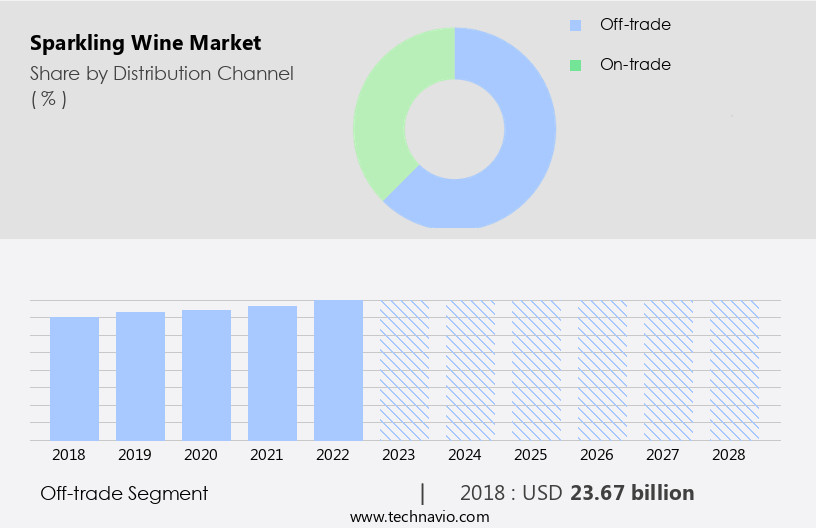

- Distribution Channel

- Off-trade

- On-trade

- Product

- Champagne

- Prosecco

- Cava

- Others

- Type

- Red sparkling wine

- White sparkling wine

- Rose sparkling wine

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The off-trade segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant shifts from 2025 to 2029, with the off-trade segment poised for transformation. Retail modernization is a key driver, as traditional retailers adapt to evolving consumer preferences. Omnichannel platforms are integrating physical and digital sales channels, making sparkling wine more accessible through online marketplaces and direct-to-consumer services. Technological advancements in inventory management systems enable retailers to optimize stock levels and respond to demand fluctuations. Consumer behavior is prioritizing convenience and premiumization. The demand for high-quality, lower-calorie, and organic sparkling wine variants is increasing, catering to health-conscious demographics. Denomination of origin, such as Champagne and Prosecco, continue to dominate the market, while grape varieties like Pinot Noir, Pinot Meunier, and Chardonnay drive innovation.

Wine pairing, wine events, and wine tourism contribute to the market's growth. Traditional methods like Methode Champenoise and Methode Traditionnelle, as well as modern techniques like Charmat and Transfer Method, cater to various consumer preferences. Fair trade wine, organic wine, and biodynamic wine are gaining traction, reflecting a growing focus on sustainability. Wine regulation and distribution channels continue to shape the market landscape, with premium wine and vintage sparkling wine maintaining their appeal. Wine tasting and wine investment remain popular activities, with blanc de noirs, blanc de blancs, and extra brut variants attracting collectors and enthusiasts. Off-premise consumption continues to dominate, but on-premise consumption is also growing as restaurants and bars adapt to changing consumer preferences.

Sparkling wine production is becoming more efficient and sustainable, ensuring a steady supply of high-quality products for consumers.

The Off-trade segment was valued at USD 28.93 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 79% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European market exhibits significant growth potential, with increasing consumer preference for premium and luxury wine options. Rosé sparkling wines and those with a traditional method of production, such as Champagne, continue to gain popularity. Wine pairing events and collectibles add value to the market, with denominations of origin, like Champagne and Prosecco, driving demand. Pinot Noir and other grape varieties, including Pinot Meunier and Chardonnay, are commonly used in sparkling wine production. Fair trade and organic wines are also gaining traction, aligning with consumer trends.

Wine regulation and distribution channels, including off-premise consumption and on-premise establishments, influence market dynamics. Wine tasting events and wine investment opportunities further fuel consumer interest. Vintage and non-vintage sparkling wines, as well as methode champenoise and extra brut options, cater to diverse consumer preferences. Wine tourism and wine retail contribute to market expansion, making the European the market an intriguing and dynamic sector.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Sparkling Wine market drivers leading to the rise in the adoption of Industry?

- The emergence of low-alcohol beverage cocktails is a significant trend driving growth in the market. These beverages cater to consumers seeking to enjoy the taste and experience of mixed drinks without the high alcohol content, expanding the market's reach and appeal. Sparkling wine, a luxury beverage known for its elegant and sophisticated character, is experiencing significant growth in the global alcohol market. Consumers are increasingly seeking lower-alcohol options, and sparkling wine provides a flavorful alternative to high ABV spirits or fruit juices. This trend is driving the growth of the market, as bartenders and home drinkers alike discover new ways to use this versatile beverage. Classic cocktails, such as the Mimosa and Bellini, have long featured sparkling wine as a base. However, the millennial demographic is rediscovering this beverage through the resurgence of Italian cocktails like the Negroni and the Americano.

- Wine pairing is another factor contributing to the market's growth, as consumers explore the various flavors and aromas that sparkling wine can bring to a meal. Denomination of origin and grape varieties, such as Pinot Noir for rose sparkling wine, also play a role in the market's dynamics. Wine events and collectibles further add to the allure of sparkling wine, making it a desirable addition to any social gathering or special occasion. Its ability to bring depth and flavor to cocktails, pair well with food, and serve as a collectible makes it an excellent choice for consumers seeking a sophisticated and health-conscious alcohol option.

What are the Sparkling Wine market trends shaping the Industry?

- The expansion of online distribution channels is an essential trend in today's market. Businesses are increasingly recognizing the importance of establishing a strong online presence to reach a wider customer base. The market is experiencing significant growth due to several factors. The expansion of distribution channels, driven by globalization and liberalization policies, has simplified cross-border trade and broadened the reach of businesses. Advanced technology and high Internet penetration have facilitated the online sales of sparkling wine, contributing to its increasing popularity. Moreover, consumers' evolving preferences towards fair trade wine and organic options have created new opportunities for market participants. Wine regulation and certification bodies have played a crucial role in ensuring the quality and authenticity of sparkling wine, instilling confidence in consumers. Wine tourism has emerged as a significant growth driver, with consumers seeking unique experiences.

- Dosage wine, a traditional method of producing sparkling wine, has gained popularity due to its taste and emphasis on terroir. These trends are expected to continue, offering lucrative opportunities for key players in the market. Companies in this market are focusing on innovation, quality, and sustainability to cater to the changing needs and demands of consumers.

How does Sparkling Wine market faces challenges during its growth?

- The reduction of alcoholic beverage consumption represents a significant challenge to the industry's growth trajectory. The market growth is influenced by several factors, including production methods such as methode champenoise, and wine categories like extra brut and non-vintage. Grape varieties used, including Chardonnay, Pinot Noir, and Pinot Meunier, significantly impact the market. However, the market faces challenges due to increasing campaigns against alcohol consumption by organizations in various countries. These campaigns, aimed at reducing alcohol abuse and related accidents, particularly among the younger population, have led to regulatory and social pressure on companies. Consequently, the demand for sparkling wine has been affected globally.

- Companies must respond to these challenges by engaging in social responsibility programs, including campaigns against drunken driving and underage drinking, and complying with stringent regulations. The governments of different countries are also implementing new campaigns to reduce overall alcohol consumption. Despite these challenges, the premium wine segment continues to be a significant contributor to the market.

Exclusive Customer Landscape

The sparkling wine market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the sparkling wine market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, sparkling wine market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accolade Wines Australia Ltd. - The company showcases a range of high-quality sparkling wines, meticulously crafted to deliver distinctive flavors and elegance.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accolade Wines Australia Ltd.

- Bacardi and Co. Ltd.

- BODEGAS MARTINEZ LACUESTA SA

- Breathless Wines

- Bronco Wine Co.

- Campari Group

- Champagne Louis Roederer

- Concha y Toro

- Constellation Brands Inc.

- Contratto srl

- E. and J. Gallo Winery

- Giulio Cocchi Spumanti Srl

- Gloria Ferrer

- Gruppo Caviro

- LVMH Moet Hennessy Louis Vuitton SE

- Pernod Ricard SA

- Quady Wines

- Schramberg Vineyards

- The Nude Wine Co.

- Treasury Wine Estates Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Sparkling Wine Market

- In March 2024, Moët Hennessy, a leading luxury goods company, introduced a new line of sustainable sparkling wines under the Dom Pérignon brand. The collection, named "P2," is produced using renewable energy and features eco-friendly packaging. This strategic move underscores the growing consumer demand for sustainable and eco-friendly products in the market (BusinessWire, 2024).

- In October 2024, Ferrari Trento, an Italian sparkling wine producer, completed the expansion of its production facility in Trento, Italy. The â¬30 million investment increased the company's annual production capacity by 30%, enabling it to meet the growing global demand for Italian sparkling wines (Ferrari Trento Press Release, 2024).

- In February 2025, the European Union introduced new regulations to protect the authenticity and quality of Champagne. The measures include stricter labeling requirements and increased oversight of production methods. These regulations aim to maintain the reputation of Champagne as a premium sparkling wine and differentiate it from other types of sparkling wines (European Commission, 2025).

Research Analyst Overview

The market continues to evolve, with dynamic shifts in consumer preferences, production methods, and regulatory frameworks. Luxury and rose sparkling wines have gained significant traction, with wine pairing becoming an essential consideration for consumers. Denomination of origin plays a crucial role in establishing authenticity and quality, as grape varieties such as Pinot Noir, Pinot Meunier, and Chardonnay are meticulously cultivated for various methods, including Traditional Method and Methode Champenoise. Fair trade and organic wines are increasingly popular, reflecting a growing emphasis on sustainability and ethical production. Sparkling wine quality is subject to rigorous regulation, ensuring consistency and adherence to standards.

Wine retailers and distributors adapt to these trends, offering diverse selections and innovative marketing strategies. Wine tourism contributes to the market's growth, with consumers seeking unique experiences and educational opportunities. Dosage wine, ranging from extra brut to sweeter options, caters to diverse palates. Mass market and premium wines coexist, appealing to various consumer segments. Non-vintage and vintage sparkling wines cater to different consumer preferences, with on-premise and off-premise consumption patterns continuing to evolve. Sparkling wine production innovations and wine tasting events showcase the latest trends and developments, while wine investment opportunities attract collectors and enthusiasts. Blanc de Noirs and Blanc de Blancs, produced from black and white grapes respectively, add diversity to the market.

Biodynamic wine production, focusing on holistic farming practices, reflects the industry's commitment to sustainability and quality. The market remains an intriguing and ever-changing landscape, with continuous unfolding of market activities and evolving patterns.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Sparkling Wine Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.8% |

|

Market growth 2025-2029 |

USD 8.99 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.5 |

|

Key countries |

Italy, France, Germany, Spain, US, UK, Canada, China, Brazil, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Sparkling Wine Market Research and Growth Report?

- CAGR of the Sparkling Wine industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the sparkling wine market growth of industry companies

We can help! Our analysts can customize this sparkling wine market research report to meet your requirements.