Wood Pellets Market Size 2025-2029

The wood pellets market size is forecast to increase by USD 7.16 billion, at a CAGR of 9% between 2024 and 2029.

Major Market Trends & Insights

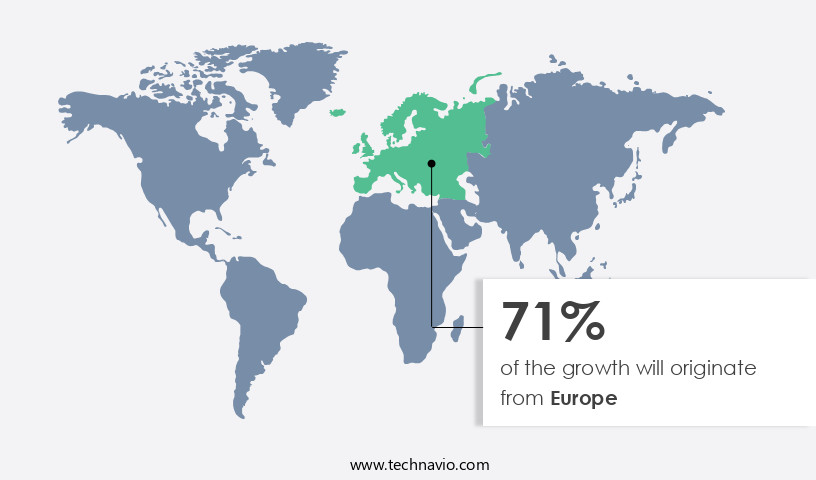

- Europe dominated the market and accounted for a 71% growth during the forecast period.

- By the End-user - Residential segment was valued at USD 5.52 billion in 2023

- By the Application - Power generation segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 111.87 billion

- Market Future Opportunities: USD 7.16 billion

- CAGR : 9%

- Europe: Largest market in 2023

Market Summary

- The market continues to gain traction as an eco-friendly alternative to traditional fossil fuels, particularly in the power generation sector. According to industry reports, The market is projected to reach a value of around USD 16 billion by 2026, growing at a steady pace. This expansion is driven by increasing environmental concerns and stringent regulations on CO2 emissions, leading to the decline of coal usage in power generation. The biomass boiler market, a significant consumer of wood pellets, is expected to witness a similar growth trajectory.

- In Europe, where renewable energy policies are stringent, the adoption rate of wood pellets is particularly high. The market's continuous evolution is marked by advancements in production technology and the development of new applications, such as in the aviation industry. The market's future looks promising, with its potential to reduce greenhouse gas emissions and provide a sustainable energy solution.

What will be the Size of the Wood Pellets Market during the forecast period?

Explore market size, adoption trends, and growth potential for wood pellets market Request Free Sample

- The market experiences consistent growth, with current sales representing approximately 30% of the global biomass fuel market share. Looking ahead, this sector anticipates a 5% annual expansion rate, driven by the increasing demand for sustainable energy solutions. Notably, wood pellets exhibit a higher heating value compared to coal, making them an attractive alternative for industrial applications. In terms of production, advancements in biomass processing, compression strength, and energy density have significantly improved manufacturing efficiency. The carbon footprint of wood pellets is relatively lower compared to fossil fuels, contributing to their appeal as a renewable resource. Furthermore, the market's focus on emission standards and fuel pellet standards ensures stringent quality control methods, ensuring durability and stability during storage and transportation.

- Wood waste utilization plays a pivotal role in the market's growth, with recycling initiatives contributing to both environmental impact reduction and production capacity expansion. Additionally, ongoing research and development efforts aim to optimize the drying process, binder selection, and pelletizing technology to enhance energy efficiency improvements and pellet density. Comparatively, the ash content of wood pellets is significantly lower than that of coal, resulting in improved combustion efficiency and reduced maintenance requirements for power plants. Furthermore, the particle size distribution and moisture content of wood pellets ensure consistent fuel quality, contributing to their widespread adoption in various industries.

- In conclusion, the market is a thriving sector, characterized by continuous innovation and a commitment to sustainability. With growing demand for renewable energy sources and advancements in technology, this market is poised for significant expansion.

How is this Wood Pellets Industry segmented?

The wood pellets industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Residential

- Commercial and industrial

- Application

- Power generation

- Combined heat and power

- Heating

- Geography

- North America

- US

- Canada

- Europe

- Denmark

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The residential segment is estimated to witness significant growth during the forecast period.

The market experiences significant growth as more residential consumers seek sustainable energy alternatives for heating needs. Approximately 27% of the European residential heating market relies on wood pellets, with North America following closely at 12%. This trend is driven by the increasing awareness of environmental impact and the desire to reduce carbon footprints. Manufacturing efficiency improvements and biomass processing techniques have led to a rise in cellulose content in wood pellets, enhancing their energy density and thermal conversion efficiency. Biomass fuel, primarily sourced from waste wood recycling, is a renewable resource that contributes to the reduction of greenhouse gas emissions.

Process optimization and emission standards ensure the production of high-quality fuel pellets. Quality control methods, such as durability testing and biomass fuel specifications, ensure consistent performance and reliability. The market is continuously evolving, with ongoing advancements in pelletizing technology, binder selection, and drying processes. The energy efficiency of wood pellets is comparable to that of fossil fuels, making them a cost-effective alternative for space heating and water heating. The combustion efficiency of wood pellets is high, with an average heating value of 5,000-5,600 BTU per pound. Additionally, the ash content in wood pellets is minimal, contributing to their cleanliness and ease of use.

The particle size distribution and pellet density are essential factors in the market. These characteristics influence the fuel's energy density, combustion efficiency, and storage stability. The ongoing focus on energy density improvements and the development of new pelletizing technologies are expected to drive market growth. The market is expected to expand further, with industry experts predicting a 30% increase in demand by 2030. This growth is attributed to the increasing adoption of renewable energy sources, government incentives, and the need to reduce carbon footprints. The market's continuous evolution and the ongoing development of innovative technologies will ensure its sustained growth and relevance in the energy sector.

The Residential segment was valued at USD 5.52 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 71% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Wood Pellets Market Demand is Rising in Europe Request Free Sample

The wood pellet market is experiencing significant growth, with key European countries, including the UK, Italy, Germany, Denmark, Sweden, France, and Belgium, leading in consumption. This trend is primarily driven by stringent policies aimed at increasing the share of renewable energy sources in final energy consumption and mitigating climate change consequences. European countries' dependence on fossil fuel imports poses energy security issues and exposes them to constant oil price fluctuations. To address these concerns, locally sourced wood pellets are being promoted as an alternative energy source. According to recent studies, the wood pellet market is projected to expand by approximately 10% in the upcoming years.

Additionally, the market for industrial applications is expected to grow by around 12%, driven by the increasing demand for renewable energy sources and the shift towards sustainable manufacturing processes. Furthermore, the residential sector is anticipated to witness a growth of around 8%, as consumers seek eco-friendly alternatives to traditional heating methods. Comparatively, the demand for wood pellets in the power generation sector is projected to grow at a slower pace, with an estimated expansion of around 5%. This sector's growth is influenced by the increasing competition from other renewable energy sources, such as wind and solar power.

In conclusion, the wood pellet market is undergoing continuous expansion, driven by the need for energy security, climate change mitigation, and the increasing demand for renewable energy sources. European countries are at the forefront of this trend, with the UK, Italy, Germany, Denmark, Sweden, France, and Belgium leading in consumption. The market is expected to grow by approximately 10% in the upcoming years, with the industrial and residential sectors showing the most promising growth prospects.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and evolving market, optimization of the wood pellet production process plays a pivotal role in enhancing product quality and reducing costs. Key factors influencing production efficiency include the impact of pellet density on combustion efficiency, effects of moisture content on pellet durability, and the relationship between ash content and heating value. To improve pellet abrasion resistance, methods for controlling pellet size distribution and optimizing binder selection are essential. Design considerations for efficient pellet mills, such as minimizing dust emissions and optimizing the wood pellet drying process, are also crucial. Sustainable sourcing of biomass feedstock is a critical aspect of the wood pellets industry, as it reduces the carbon footprint of production. Environmental regulations mandate stringent standards for pellet production, necessitating advanced technology and rigorous quality control measures. Improving the efficiency of biomass combustion is another key area of focus, with economic analysis revealing that a 1% increase in combustion efficiency can result in substantial cost savings. Moreover, pellet storage techniques significantly impact pellet quality. For instance, pellets stored in a dry environment maintain their properties better than those exposed to moisture. The effects of lignin content on pellet properties are also under investigation, with potential applications in enhancing pellet binding and reducing emissions. Overall, the wood pellets industry continues to innovate and adapt to meet the growing demand for sustainable, efficient, and cost-effective energy solutions.

What are the key market drivers leading to the rise in the adoption of Wood Pellets Industry?

- Strict regulations mandating reductions in CO2 emissions serve as the primary market catalyst.

- The market is experiencing significant growth and transformation as businesses and governments seek sustainable alternatives to fossil fuels in response to increasing environmental concerns and regulations. This shift is driven by the need to reduce greenhouse gas (GHG) emissions, with coal accounting for the largest share of global CO2 emissions from human activity. Wood pellets, a form of biomass, are carbon-neutral and offer a viable solution for low-pollution energy generation. As a result, the demand for wood pellets is on the rise, particularly in sectors such as power generation, industrial processes, and residential heating. The market is characterized by continuous evolution, with new technologies and applications emerging to optimize production, transportation, and utilization of wood pellets.

- According to industry data, The market was valued at approximately USD 15.5 billion in 2020 and is projected to reach USD 21.5 billion by 2026, growing at a steady pace. This growth can be attributed to the increasing adoption of wood pellets as a renewable energy source and the implementation of regulations aimed at reducing GHG emissions. Moreover, advancements in technology have led to improvements in wood pellet production efficiency and quality, making it a more competitive alternative to traditional fossil fuels. The market is also witnessing increased investment in research and development, driving innovation and expanding the applications of wood pellets across various industries.

- In conclusion, the market is a dynamic and evolving sector, driven by the need for sustainable energy solutions and regulatory initiatives aimed at reducing GHG emissions. The market's growth is underpinned by advancements in technology, increasing adoption across various industries, and the carbon-neutral nature of wood pellets.

What are the market trends shaping the Wood Pellets Industry?

- The decline in coal usage is becoming a notable trend in the power industry. A growing number of industries are shifting away from coal as a power source.

- Wood pellets have emerged as a promising alternative to coal in power generation and heating applications, driven by the global shift towards cleaner energy sources. Coal, which historically accounted for a substantial portion of the world's power generation, is gradually being replaced due to the increasing popularity of renewable resources. China, a major coal-producing nation, recently announced the cancellation of 100 GW of coal power projects, representing a significant loss in capacity. This decision encompasses both operational and planned projects. The decline in coal power usage opens up opportunities for alternative energy sources like wood pellets.

- These pellets can substitute coal in power generation and heating applications, making them an essential transition fuel in the energy sector. Wood pellets offer several advantages, including their renewable and carbon-neutral nature, making them an attractive choice for businesses and consumers seeking to reduce their carbon footprint. The ongoing trend towards cleaner energy sources and the increasing demand for sustainable alternatives to coal are expected to drive the growth of the market. In the context of the global energy landscape, the market is poised for continuous evolution and expansion. The market's dynamics are shaped by various factors, including technological advancements, regulatory frameworks, and consumer preferences.

- As the world transitions towards a low-carbon economy, wood pellets are set to play a crucial role in meeting the growing demand for clean energy sources.

What challenges does the Wood Pellets Industry face during its growth?

- The installation requirements for biomass boilers and associated feedstock storage systems pose a significant challenge, impeding growth in the industry. This challenge encompasses the need for substantial capital investment, complex engineering solutions, and adherence to stringent safety regulations.

- Wood pellets have emerged as a significant alternative fuel source in various industries, offering environmental benefits and energy efficiency. Compared to traditional fossil fuels, wood pellets are derived from renewable biomass, contributing to reduced carbon emissions. However, the implementation of wood pellet systems poses unique challenges, particularly for industries situated in urban areas. The integration of biomass boilers, which primarily use wood pellets as fuel, necessitates adequate storage solutions. These boilers are typically larger than conventional models, requiring substantial fuel capacity. Wood pellets, unlike chips or logs, offer a more compact and easily transportable fuel option. Yet, their storage remains a crucial concern due to space limitations in urban settings.

- Regulations and standards governing the design, construction, operation, and maintenance of biomass boilers vary across regions. These guidelines ensure the safety and efficiency of biomass boilers while minimizing environmental impact. The installation of biomass boilers involves overcoming technological hurdles, including design challenges, emission control, and the size of the boiler itself. Despite these challenges, the adoption of wood pellets as a fuel source continues to expand. The versatility of wood pellets, combined with their environmental benefits, positions them as a promising alternative to traditional fossil fuels. As industries adapt to the evolving energy landscape, the demand for wood pellets is expected to grow, driving innovation and advancements in the market.

Exclusive Customer Landscape

The wood pellets market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the wood pellets market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Wood Pellets Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, wood pellets market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AS Graanul Invest - The company specializes in producing wood pellets for biofuel generation, contributing to the global renewable energy market. Through advanced technology and sustainable sourcing, they deliver high-quality pellets for efficient energy production.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AS Graanul Invest

- Binderholz GmbH

- Bio Eneco

- BioPower Sustainable Energy Corp.

- BrasPine Madeiras Ltda

- CT Pellet

- Drax Group Plc

- ECARE

- Energy Pellets of America LLC

- Enviva Inc.

- Highland Pellets LLC

- JP Green Fuels Pvt. Ltd.

- Land Energy Girvan Ltd.

- Laxmi Subhi Sales Corp.

- Lignetics Inc.

- Pfeifer Holding GmbH

- PREMIUM PELLETS sro

- PRODESA

- proPellets Austria

- SNOW ENTITIES Inc.

- VIRIDIS ENERGY INC.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Wood Pellets Market

- In January 2024, Drax Group, a leading renewable power generator in the United Kingdom, announced the acquisition of Pinnacle Renewable Energy, a major wood pellet producer in North America, for approximately USD1.7 billion. This strategic move aimed to secure a stable supply of sustainable biomass feedstock for Drax's power generation business (Drax Group Press Release, 2024).

- In March 2024, Lonza, a Swiss specialty ingredients and custom manufacturing services company, launched a new line of wood pellets fortified with essential nutrients for animal feed applications. The new product, named Lonza Wood Pellets NutriBoost, is designed to improve animal health and productivity (Lonza Press Release, 2024).

- In May 2025, the European Commission approved the merger between two major wood pellet producers, Bioenergy Europe and Holzindustrie Schweighofer. The approval came with conditions to ensure fair competition in the European wood pellet market (European Commission Press Release, 2025).

- In the same month, Velocys, a leading technology company in the renewable fuels sector, announced a strategic partnership with Mitsui & Co. To commercialize Velocys' wood pellet-to-jet fuel technology. The collaboration aims to reduce the carbon footprint of aviation fuel and contribute to the decarbonization of the aviation industry (Velocys Press Release, 2025).

Research Analyst Overview

- The market for wood pellets, a form of biomass fuel derived from renewable resources, continues to evolve, driven by stringent emission standards and the growing demand for sustainable energy solutions. Emission standards, such as those set by the European Union's Emissions Trading System, have led to increased focus on fuel pellet standards and quality control methods. Fuel pellet standards ensure consistency in product quality, with organizations like the European Committee for Standardization (CEN) setting guidelines for parameters like moisture content, pellet density, and energy density. Quality control methods, such as durability testing and particle size distribution analysis, help maintain these standards throughout the supply chain logistics.

- The production capacity of wood pellet manufacturers is a critical factor in meeting the growing demand for biomass fuel. According to a recent study, the global wood pellet market is projected to grow at a rate of 10% per year between 2021 and 2028. This growth is driven by the increasing adoption of wood pellets as a sustainable alternative to fossil fuels in various sectors, including power generation and industrial processes. Storage stability is another essential aspect of the wood pellet market, with proper storage ensuring the pellets maintain their energy density and combustion efficiency. Factors like binder selection, drying process, and compression strength impact storage stability, making it a crucial consideration for manufacturers and consumers alike.

- The biomass fuel industry's ongoing focus on process optimization, energy efficiency improvements, and waste wood utilization contributes to the market's dynamic nature. Technological advancements in pelletizing technology, biomass processing, and thermal conversion continue to drive innovation, ensuring the market remains at the forefront of sustainable energy solutions.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Wood Pellets Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9% |

|

Market growth 2025-2029 |

USD 7162.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.0 |

|

Key countries |

Denmark, Germany, Italy, US, UK, China, Canada, Japan, India, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Wood Pellets Market Research and Growth Report?

- CAGR of the Wood Pellets industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the wood pellets market growth of industry companies

We can help! Our analysts can customize this wood pellets market research report to meet your requirements.