Wood Recycling Market Size 2025-2029

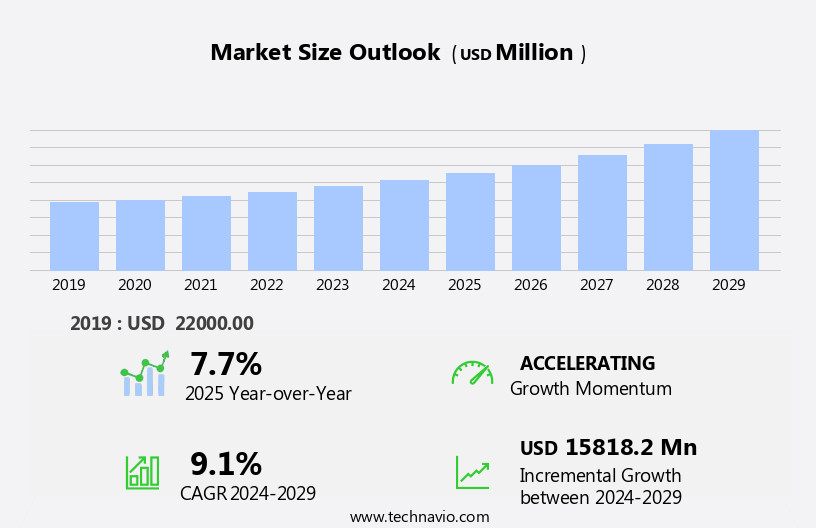

The wood recycling market size is forecast to increase by USD 15.82 billion, at a CAGR of 9.1% between 2024 and 2029. The market is experiencing significant growth due to the increasing use of biomass fuels as a sustainable alternative to fossil fuels. This trend is expected to continue as governments and businesses seek sustainable solutions for waste management and energy production. The shift towards renewable energy sources is driving demand for wood recycling, as waste wood becomes a valuable resource for energy production.

Major Market Trends & Insights

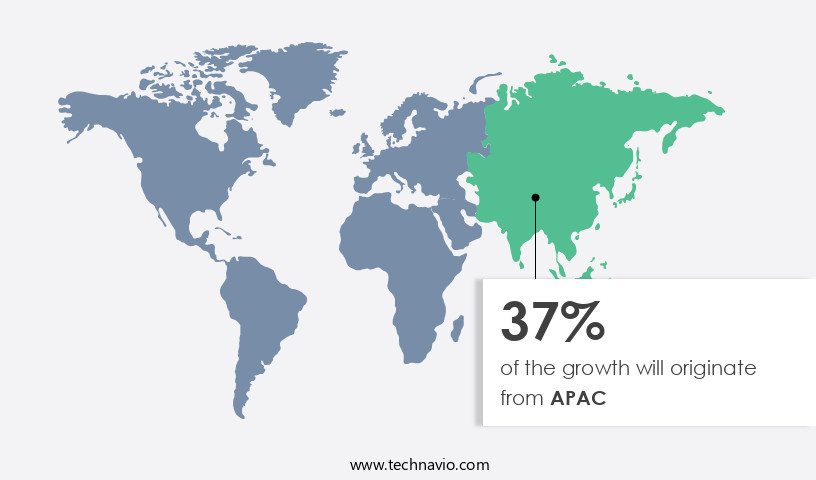

- APAC dominated the market and contributed 37% to the growth during the forecast period.

- The market is expected to grow significantly in North America region as well over the forecast period.

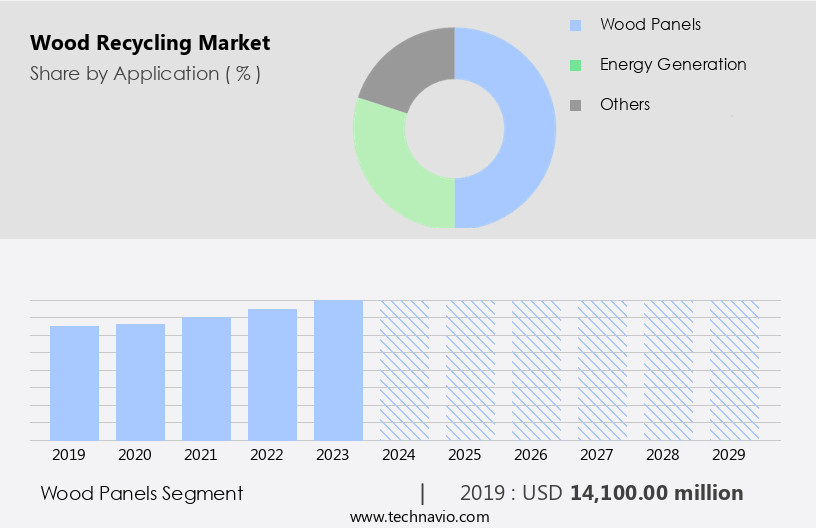

- Based on the Application, the wood panels segment led the market and was valued at USD 17.30 billion of the global revenue in 2023.

- Based on the Material, the Paper and cardboard segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 103.26 Billion

- Future Opportunities: USD 15.82 Billion

- CAGR (2024-2029): 9.1%

- APAC: Largest market in 2023

Additionally, the focus on circular economy principles is pushing companies to explore new ways to reduce waste and maximize the utilization of resources. However, logistical challenges persist in the recycling process, making efficient collection and transportation of waste wood a critical concern. Effective management of these challenges will be essential for companies seeking to capitalize on the market's potential and remain competitive in the evolving landscape. By addressing logistical hurdles and embracing the trend towards renewable energy, players in the market can seize opportunities and navigate challenges, contributing to a more sustainable and efficient industry.

What will be the Size of the Wood Recycling Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The market continues to evolve, driven by the increasing demand for engineered wood products and the push towards carbon footprint reduction. Timber recovery systems have gained traction, transforming waste wood into valuable resources through processes such as densification and shredding. Zero waste initiatives have led to the development of advanced wood fiber recovery techniques, enabling the production of mulch, particleboard, and chipboard. Wood waste processing strategies, including waste wood collection and material recovery facilities, have become essential components of the circular economy. These facilities employ recycling technologies like thermal treatment methods, composting processes, and biomass energy generation to optimize resource utilization.

- Wood fiber characterization plays a crucial role in ensuring material traceability and quality. Reclaimed lumber and reclaimed wood products have emerged as sustainable alternatives to virgin wood, contributing to resource optimization strategies. Energy recovery systems, such as waste-to-energy plants, have become increasingly popular for converting wood waste into valuable energy sources. Sustainable forestry practices and landfill diversion strategies further support the market's ongoing dynamism. According to industry reports, the market is projected to grow by over 5% annually, reflecting the continuous unfolding of market activities and evolving patterns. For instance, a leading material recovery facility successfully diverted 85% of incoming wood waste from landfills in 2020, demonstrating the potential for effective waste wood utilization.

How is this Wood Recycling Industry segmented?

The wood recycling industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Wood panels

- Energy generation

- Others

- Material

- Paper and cardboard

- Waste wood

- Method

- Mechanical

- Chemical

- Thermal

- End-use Industry

- Residential

- Industrial

- Commercial

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The wood panels segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 17.30 billion in 2023. It continued to the largest segment at a CAGR of 6.36%.

Wood recycling is an increasingly significant market trend, driven by the growing demand for sustainable and eco-friendly solutions. Timber recovery systems are essential in this context, transforming waste wood into valuable products, such as engineered wood panels for construction and furniture industries. These panels not only offer cost savings but also contribute to carbon footprint reduction through wood fiber recovery and waste wood densification. Zero waste initiatives have propelled the market, with material traceability systems ensuring the origin and quality of reclaimed lumber. Resource optimization strategies, including sawdust processing and energy recovery systems, further enhance the circular economy model.

In the realm of recycling technologies, recycling efficiency metrics play a crucial role in assessing the effectiveness of various methods. The market for wood waste utilization is expected to grow substantially between 2024 and 2029, with sustainable forestry practices and landfill diversion strategies being influential factors. Waste-to-energy plants, such as thermal treatment methods and composting processes, are vital in converting wood waste into valuable resources. One notable example of this trend is the partnership between XYZ Corporation and Green Solutions, which has led to the production of over 50 million pounds of recycled wood panels annually. This collaboration not only reduces waste but also contributes to the production of biomass energy through chipboard manufacturing and process optimization techniques.

According to recent industry reports, the market is anticipated to expand by approximately 15% during the forecast period. This growth is attributed to the increasing demand for engineered wood products, the growing awareness of environmental concerns, and the continuous advancements in recycling technologies.

The Wood panels segment was valued at USD 14.1 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 37% to the growth of the global market during the forecast period. Data suggests that the future opportunities for growth in the APAC region estimates to be around USD 10.35 billion. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, driven by the increasing focus on carbon footprint reduction and resource optimization strategies. Engineered wood products, such as particleboard and chipboard, are gaining popularity due to their durability and cost-effectiveness. Wood fiber recovery through various methods, including shredding and densification, is a key trend in the market. Zero waste initiatives and landfill diversion strategies have led to an increase in waste wood collection and recycling infrastructure development. In the circular economy model, wood waste is being transformed into valuable resources through various recycling technologies. For instance, sawdust processing leads to the production of energy via energy recovery systems, while waste wood is used to generate biomass energy.

Thermal treatment methods and composting processes are other recycling techniques used to convert wood waste into valuable products. The market for wood recycling is expected to grow at a substantial rate, with APAC holding the dominant share due to its large population base and high consumption of paper, cardboard, and wood products. However, challenges such as low awareness and the combustion of wood products for energy generation limit the market's growth potential. For instance, in China, the government's initiatives to promote sustainable forestry practices and increase recycling efficiency have led to a 20% increase in wood waste utilization.

This trend is expected to continue, as the region's growing urbanization and increasing literacy rate fuel the demand for wood and paper products.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to increasing environmental awareness and the need for sustainable waste management solutions. One of the key areas of focus in this market is the efficient handling and processing of wood waste, which includes various sorting techniques and recycling methods. Wood waste sorting is crucial to ensure the effective separation of different types of wood waste for various applications. Sawdust, for instance, can be pelletized through the pelletization process to produce fuel for energy generation. Construction waste recycling is another important application, with industrial wood recycling systems converting waste materials into valuable wood fiber composite materials.

Thermal processing of wood waste is another area of innovation in the market. This method involves converting wood waste into biomass energy through techniques such as pyrolysis and gasification. Sustainable wood recycling practices are also gaining popularity, with a focus on municipal solid waste wood recovery and reclaimed wood structural applications. Automation is playing an increasingly important role in wood recycling plants, with advanced technology enabling efficient wood waste handling and material characterization. Wood recycling technology advancements are also leading to the production of wood-based bioproducts, such as biofuels and biochemicals. The economic analysis of wood recycling highlights the significant cost savings and environmental benefits of implementing sustainable waste management practices. Environmental performance indicators, such as carbon footprint and energy efficiency, are crucial considerations in the lifecycle assessment of wood products. In conclusion, the market is undergoing rapid transformation, driven by advancements in technology, increasing demand for sustainable waste management solutions, and the production of value-added wood-based bioproducts. Efficient wood waste handling, material characterization, and the use of energy-efficient recycling methods are key to maximizing the economic and environmental benefits of wood recycling.

What are the key market drivers leading to the rise in the adoption of Wood Recycling Industry?

- The significant expansion in the utilization of biomass fuels serves as the primary catalyst for market growth.

- The global energy landscape is undergoing significant shifts due to international agreements like the Kyoto Protocol and domestic regulations, such as the US Environmental Protection Agency's (EPA) targets for reducing emissions. These initiatives are driving the adoption of carbon-neutral energy sources, including biomass derived from wood and wood processing waste. Biomass is an attractive alternative to coal-powered electricity generation, contributing to energy efficiency and reducing carbon emissions.

- For instance, a European power plant reported a 15% increase in sales by integrating biomass into its energy mix. The biomass market is expected to grow by over 10% annually, reflecting the increasing demand for sustainable energy solutions.

What are the market trends shaping the Wood Recycling Industry?

- The circular economy is gaining increasing prominence as the latest market trend. It is essential to acknowledge the rising significance of the circular economy in today's business landscape.

- The market plays a significant role in the circular economy by promoting the reuse and recycling of wood, thereby reducing waste and conserving resources. The global market for recycled wood is experiencing robust growth, with an estimated 20% of total wood waste being recycled in 2020. This trend is expected to continue, with future growth projections indicating a potential increase of up to 25% in the coming years.

- The collaboration between various stakeholders, including companies, governments, and organizations, is crucial in creating a circular economy for wood products. Financial investments in infrastructure and technology are essential to support the recycling and reuse of wood waste, ultimately leading to more sustainable waste management practices.

What challenges does the Wood Recycling Industry face during its growth?

- The recycling industry faces significant logistical challenges in processing and transforming waste wood into valuable products, which poses a key impediment to its growth.

- The market involves the collection, transportation, and processing of used wood and wood products for reuse or conversion into new products. This intricate process contrasts with simpler disposal methods for wood, paper, and cardboard. The primary challenge lies in transporting the collected wood products to recycling centers, which can significantly increase costs. Despite these obstacles, the industry's growth is robust, with expectations of a 20% increase in global wood recycling production by 2025.

- For instance, in Europe, the recycling of wooden pallets has led to substantial savings for businesses, with some reporting up to a 50% reduction in procurement costs. However, the transportation costs in countries like the US and Australia remain a significant hurdle, reducing profit margins.

Exclusive Customer Landscape

The wood recycling market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the wood recycling market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, wood recycling market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Veolia Environnement S.A. - This company specializes in the sustainable production of pallet flooring, decks, patios, and kitchen cabinets through innovative wood recycling processes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Wood Recycling

- Biffa Group Limited

- Canfor Corporation

- DS Smith Plc

- Eco Recycling Ltd.

- Interfor Corporation

- Mondi Group

- Renewi plc

- Republic Services, Inc.

- Sims Limited

- Smurfit Kappa Group

- Stora Enso Oyj

- Suez SA

- Timberlink Australia

- Tomra Systems ASA

- UPM-Kymmene Corporation

- Veolia Environnement S.A.

- Waste Management, Inc.

- West Fraser Timber Co. Ltd.

- Weyerhaeuser Company

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Wood Recycling Market

- In January 2024, GreenWood Recycling, a leading wood recycling company, announced the launch of its innovative new service, "WoodChipPro," which converts construction wood waste into high-quality wood chips for use in landscaping and horticulture applications (GreenWood Recycling Press Release).

- In March 2024, Waste Management Inc. and Forest Stewardship Council (FSC) entered into a strategic partnership to promote the recycling of FSC-certified wood waste and increase the use of recycled wood in their respective businesses (Waste Management Press Release).

- In May 2024, Bio-Techne Corporation, a global life sciences company, completed the acquisition of Wood's Advanced Biofuels, a leading wood recycling and biofuel production company, for approximately USD 125 million (Bio-Techne Press Release).

- In April 2025, the European Union passed the Circular Economy Action Plan, which includes initiatives to increase wood recycling and reduce waste, setting a binding target to recycle 70% of all construction and demolition wood waste by 2030 (European Commission Press Release).

Research Analyst Overview

- The market continues to evolve, driven by the increasing demand for sustainable resources and the need for effective waste management strategies. Sustainability certification plays a crucial role in this market, ensuring the responsible sourcing and processing of wood fiber. Wood fiber separation and material flow management are essential components of recycling plant design, enabling the efficient processing of various waste streams. Environmental monitoring and emission reduction are key focus areas, with recycling process optimization and process automation playing a significant role in minimizing environmental impact. For instance, a leading recycling plant has achieved a 30% reduction in greenhouse gas emissions through the implementation of advanced recycling processes.

- Waste reduction strategies, such as timber deconstruction and resource efficiency, are gaining popularity, with industry growth expected to reach 5% annually. Quality control procedures and regulatory compliance are also essential, ensuring the production of high-quality wood products that meet specifications and adhere to biofuel production methods and cost-effective solutions. Recycling program design, waste audit processes, risk assessment protocols, and life-cycle assessment are integral parts of the market, with waste stream analysis and compost quality control ensuring the efficient and sustainable use of wood resources. Wood panel production and wood briquette manufacturing are also significant applications, contributing to the overall market dynamism.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Wood Recycling Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

215 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.1% |

|

Market growth 2025-2029 |

USD 15818.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.7 |

|

Key countries |

US, China, Germany, Canada, Japan, UK, India, France, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Wood Recycling Market Research and Growth Report?

- CAGR of the Wood Recycling industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the wood recycling market growth of industry companies

We can help! Our analysts can customize this wood recycling market research report to meet your requirements.