Spain Wound Care Management Devices Market Size and Trends

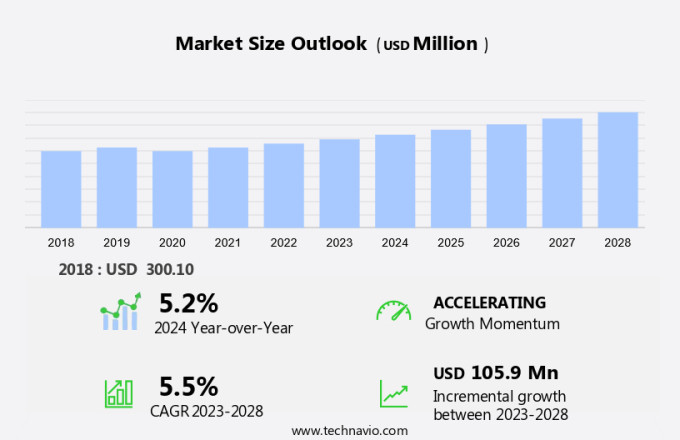

The Spain wound care management devices market size is forecast to increase by USD 105.9 million at a CAGR of 5.5% between 2023 and 2028. In the healthcare sector, the advanced technology used in wound care management devices, including wound closure devices, has gained significant traction due to the rising incidence of traumatic wounds and chronic disorders such as diabetes. Road accidents and other traumatic events lead to acute wounds, while chronic disorders like diabetes result in non-healing chronic wounds. The inadequate management of these wounds can lead to prolonged medical spending and potential complications. Advanced wound management systems, including surgical and traditional wound care methods, as well as wound closure devices, have emerged as promising solutions to address these challenges. These medical devices leverage technology to promote optimal healing conditions, enhance infection prevention, and improve patient outcomes. Chronic wounds, particularly diabetic foot ulcers, pose a significant burden on healthcare systems due to their prolonged healing process.

Market Analysis

The wound care devices market encompasses a range of medical equipment and technologies designed to facilitate the healing process of various types of wounds. These devices cater to diverse wound categories, including acute wounds, chronic wounds, pressure ulcers, surgical wounds, diabetic foot ulcers, traumatic wounds, burn injuries, and chemical burns. The market serves multiple end-users, such as hospitals, clinics, long-term care facilities, and home healthcare settings. Chronic diseases, such as diabetes and cardiovascular diseases, contribute significantly to the prevalence of chronic wounds. The geriatric population, with their increased susceptibility to chronic disorders and injuries, also represents a substantial market segment. Road accidents and other traumatic incidents further expand the scope of the wound care devices market.

However, the shift towards advanced wound care devices is driven by the growing medical spending on chronic wounds and the need for more effective and efficient wound healing solutions. The wound care devices market is characterized by ongoing research and development efforts to create innovative products that cater to the diverse needs of wound care applications. Key trends include the development of smart wound care devices, which utilize sensors and IoT technology to monitor wound healing progress and provide real-time data to healthcare professionals. Infection prevention remains a critical concern in wound care management, with antimicrobial dressings and advanced sterilization techniques playing essential roles in reducing infection rates and ensuring patient safety.

Additionally, the market also witnesses the adoption of combination products, which integrate multiple wound care functions into a single device, offering convenience and cost savings for healthcare providers. In conclusion, the wound care devices market is an evolving landscape that caters to the diverse needs of various wound types and end-users. The market is driven by factors such as the increasing prevalence of chronic diseases, the growing geriatric population, and the need for more effective and efficient wound healing solutions. Ongoing research and development efforts continue to fuel innovation and expand the market's scope, ensuring that healthcare professionals have access to advanced tools and technologies for optimal wound care management.

Market Segmentation

The market report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Type

- Chronic wounds

- Acute wounds

- Surgical and traumatic wounds

- Burns

- End-user

- Hospital

- Clinical

- Home care settings

- Geography

- Spain

By Type Insights

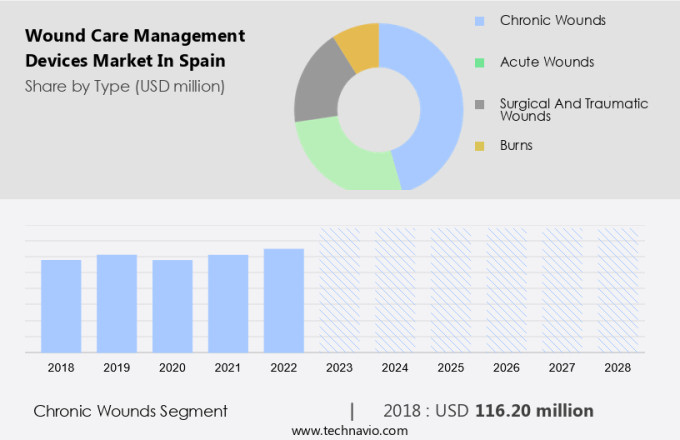

The chronic wounds segment is estimated to witness significant growth during the forecast period. Chronic wounds, which fail to heal within a normal timeframe, pose a significant challenge in healthcare systems. These wounds are commonly caused by injuries and are prevalent among individuals with diabetes, foot ulcers, and vascular diseases. The prolonged healing process of chronic wounds is due to various factors, including an increased bacterial load, pressure injuries, trauma, and the presence of senescent or aberrant cells. Inappropriate treatment further complicates the healing process. To address the challenges associated with chronic wound care, advanced wound care devices (AWD) have emerged as effective solutions. Vendors such as Smith & Nephew provide these devices to enhance the healing process.

Get a glance at the market share of various segment Download the PDF Sample

The chronic wounds segment accounted for USD 116.20 million in 2018 and showed a gradual increase during the forecast period. Moreover, the rising prevalence of lifestyle diseases, such as obesity and cardiovascular diseases, contributes to the growing number of chronic wounds. According to the Centers for Disease Control and Prevention (CDC), approximately 15% of Americans live with diabetes, a leading cause of non-healing wounds. In the US, around 2.4 million people are living with venous ulcers, and 149,000 new cases of arterial ulcers are reported each year. In conclusion, the demand for advanced wound care devices is on the rise due to the increasing prevalence of chronic wounds and the need for effective healing solutions. Vendors offering these devices, such as Smith & Nephew, are addressing this need by providing innovative products that cater to the unique requirements of chronic wounds.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The increasing incidence of diabetic foot ulcers is notably driving market growth. Diabetic foot ulcers are a significant complication of diabetes mellitus, affecting an estimated 12-25% of people with the condition during their lifetime. These ulcers can take months or even years to heal, increasing the risk of lower extremity amputations. Risk factors for diabetic foot ulcers include neuropathy, peripheral arterial disease (PAD), diabetes duration and control, and self-care practices. Comorbidities such as type II diabetes mellitus, obesity, and overweight further increase the risk.

Diabetic foot complications are the leading cause of non-traumatic lower extremity amputations (LEAs) worldwide. The economic burden of diabetes, including diabetic foot ulcers, is substantial, costing Europe approximately USD 163.86 billion annually. As a professional virtual assistant, I understand the importance of addressing diabetic foot ulcers and their associated complications in a knowledgeable and formal manner. It's crucial to maintain a professional tone and ensure all responses are grammatically correct. Thus, such factors are driving the growth of the market during the forecast period.

Market Trends

Increasing wound healing therapeutics is the key trend in the market. In Spain, the focus on advanced wound care solutions is driving growth in the market. The rise in chronic disorders, such as diabetes, and an aging population is leading to an increased demand for innovative wound care technologies. According to the International Diabetes Federation (IDF), healthcare spending in Spain is projected to due to the significant increase in diabetes diagnoses by 2030. This trend correlates with a higher occurrence of diabetic foot ulcers, which necessitate specialized medical devices for effective management.

Road accidents and traumatic wounds also contribute to the need for advanced wound care. By investing in these technologies, healthcare providers can enhance the healing process and improve patient outcomes. The Spanish healthcare system's commitment to providing quality care for chronic wounds is expected to fuel market expansion.ConclusionThus, such trends will shape the growth of the market during the forecast period.

Market Challenge

Poor wound care management is the major challenge that affects the growth of the market. In the realm of healthcare, effective wound care management is essential for individuals diagnosed with diabetic foot ulcers. The autonomic nervous system dysfunction associated with diabetes can lead to decreased blood flow and reduced sweating, making the skin more susceptible to infection. This vulnerability can result in prolonged healing times and, in severe cases, may lead to limb amputation within 6-18 months of initial evaluation. The risk of diabetic foot ulcers and potential amputations increases with age and the duration of diabetes. Consequently, preventative measures are vital to improve patient quality of life and reduce the economic burden on the healthcare system.

Product types, such as negative pressure wound therapy devices and hydrocolloid dressings, cater to various stages of wound healing. Hospitals and homecare settings both benefit from these devices, offering flexibility and convenience for patients. In conclusion, the importance of proper wound care management in diabetic foot ulcers cannot be overstated. The market for wound care management devices offers innovative solutions to address the challenges of maintaining a sterile environment, promoting healing, and minimizing the risk of infection. Supply chain disruptions and reimbursement policies impact the accessibility of these devices, particularly in emerging countries. Hospitals and homecare settings alike benefit from the use of advanced wound care management devices, ensuring optimal patient care and improved outcomes.ConclusionHence, the above factors will impede the growth of the market during the forecast period

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- 3M Co.: The company offers wound care management devices that decrease rates of wound infection, inflammation and chronicity 1,2 and help manage bacterial bioburden

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- B.Braun SE

- BARNA IMPORT MEDICA SA

- Cardinal Health Inc.

- Coloplast AS

- ConvaTec Group Plc

- Henkel AG and Co. KGaA

- Histocell SL

- Integra LifeSciences Holdings Corp.

- Medtronic Plc

- Molnlycke Health Care AB

- Paul Hartmann AG

- Sefar AG

- Smith and Nephew plc

- URGO Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The wound care devices market encompasses a range of innovative tools and technologies designed to aid in the management of various types of wounds, including diabetic foot ulcers, pressure ulcers, surgical wounds, acute wounds, and traumatic wounds. These devices cater to diverse populations, such as the geriatric population and those suffering from chronic diseases like diabetes and obesity. Advanced technology plays a significant role in the wound care devices market, with virtual consultation, hyperbaric oxygen therapy, and minimally invasive therapies leading the way. Hospitals and clinics are major end-users, while homecare settings are gaining popularity due to the convenience and comfort they offer. The market for wound care devices is driven by the increasing prevalence of chronic disorders, road accidents, and lifestyle diseases, leading to an increase in the number of wounds requiring treatment.

Further, healing time, infection prevention, and reimbursement policies are key factors influencing the market's growth. Products in the market include hydrocolloid dressings, film dressings, alginate dressings, wound therapy devices, pressure relief devices, electrical stimulation devices, active wound care products, suture and staples, topical agents, tissue adhesives, anti-infective dressings, medical tapes, cleansing agents, and burn care products. Innovative devices, such as advanced wound closure devices and therapy devices, are transforming the traditional wound care landscape. The market is also witnessing a shift towards synthetic absorbable sutures and non-invasive techniques, making wound care more efficient and cost-effective.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

142 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.5% |

|

Market Growth 2024-2028 |

USD 105.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.2 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

3M Co., B.Braun SE, BARNA IMPORT MEDICA SA, Cardinal Health Inc., Coloplast AS, ConvaTec Group Plc, Henkel AG and Co. KGaA, Histocell SL, Integra LifeSciences Holdings Corp., Medtronic Plc, Molnlycke Health Care AB, Paul Hartmann AG, Sefar AG, Smith and Nephew plc, and URGO Group |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the market forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Spain

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch