Home Healthcare Market Size 2025-2029

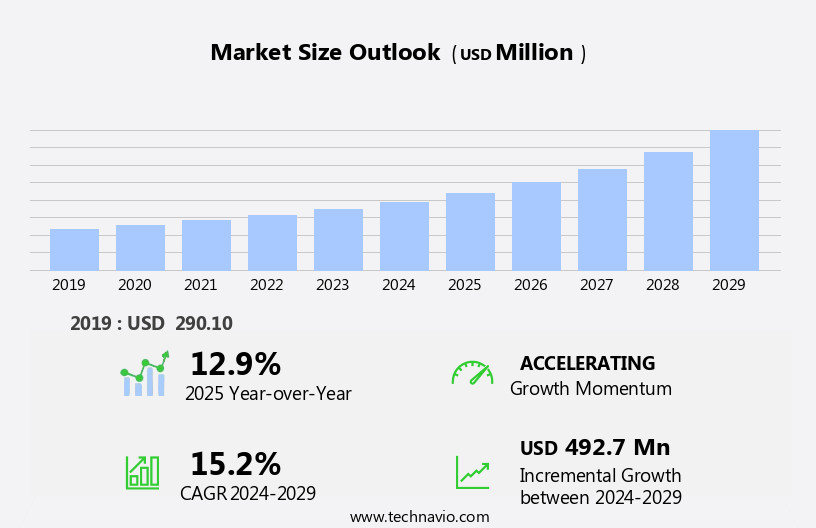

The home healthcare market size is forecast to increase by USD 492.7 million, at a CAGR of 15.2% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing preference for quality healthcare services care in the comfort of one's own home. Patient satisfaction is at an all-time high as home healthcare offers flexibility, convenience, and personalized care. However, this market faces a notable challenge that the rising incidence of life-threatening diseases necessitating home healthcare services puts immense pressure on the availability of home healthcare professionals (HCPs).

- This shortage poses a significant challenge for providers, requiring innovative solutions to ensure adequate staffing and maintain the high-quality care expected by patients. Companies that can effectively address this challenge and provide reliable, high-quality medical devices and home healthcare services will be well-positioned to capitalize on the market's potential for growth.

What will be the Size of the Home Healthcare Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, shaped by various sectors and dynamic market activities. Registered nurses (RNs) and other healthcare professionals, including pediatric care specialists, occupational therapists, and home healthcare agencies, deliver personalized care to patients in need. This care encompasses a range of services, from companion care and wound care to rehabilitation therapy and hospice care. Home healthcare software and patient portals facilitate efficient care coordination and medication management, ensuring HIPAA compliance. The aging population's increasing demand for in-home care necessitates continuous workforce development through employee training and quality improvement initiatives. Cost-effective solutions, such as homemaker services and telehealth services, address the chronic disease epidemic and hospital readmissions.

Value-based care and patient satisfaction are key drivers, with healthcare outcomes and diabetes management being crucial focus areas. Assistive devices, including mobility aids and oxygen therapy, enhance the quality of life for patients, while remote patient monitoring and in-home care provide essential support for those with complex conditions. Home infusion therapy and skilled nursing care ensure comprehensive care for patients with chronic diseases. The market's ethical considerations and regulatory landscape continue to unfold, with ongoing compliance regulations and Data Security measures ensuring the highest standards of care. Private insurance coverage and care coordination further strengthen the industry's foundation, enabling it to adapt and thrive in the ever-changing healthcare landscape.

How is this Home Healthcare Industry segmented?

The home healthcare industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Products

- Services

- Solutions

- Application

- Medical treatment

- Preventive healthcare

- Age Group

- Adults

- Geriatric

- Pediatric

- Disease Type

- Cardiovascular disorder and hypertension

- Diabetes and kidney disorders

- Cancer

- Wound care

- Others

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Russia

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW).

- North America

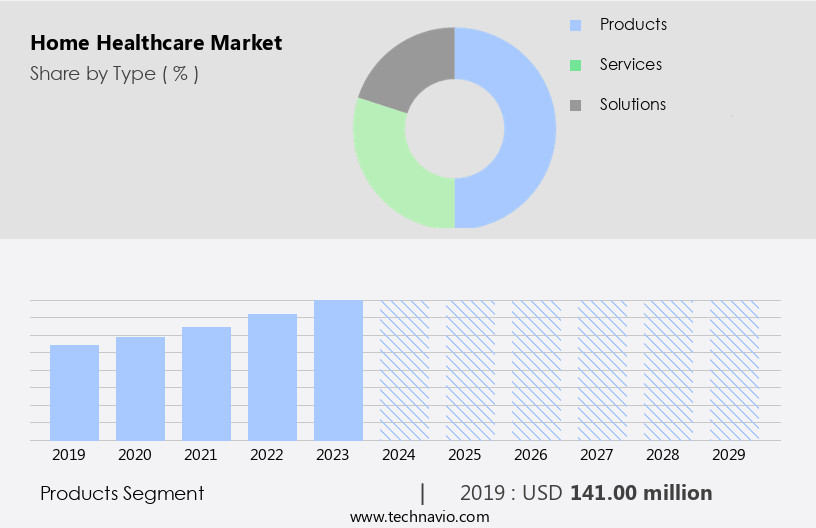

By Type Insights

The products segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of services and products, including Speech-Language Pathologists, Medical Supplies, Home Care Franchises, Mental Health Services, Medical Social Workers, and HIPAA Compliance. Post-Hospital Care, Personalized Care, and Home Healthcare Cost-Effectiveness are key drivers in the market. Ethical Considerations, Palliative Care, and Chronic Disease Epidemic require ongoing Quality Improvement to address Hospital Readmissions and Chronic Disease Management. Value-Based Care prioritizes Patient Satisfaction and Healthcare Outcomes, with Diabetes Management a significant focus. Home Healthcare Agencies employ various professionals such as Homemaker Services, Physical Therapists, Oxygen Therapy Providers, Home Health Aides, Personal Care Services, Telehealth Services, and Home Infusion Therapy specialists.

Compliance Regulations necessitate Patient Portals and Registered Nurses (RNs) for care coordination. Pediatric Care, Occupational Therapists, Companion Care, Wound Care, and Geriatric Care cater to diverse patient needs. The Home Healthcare Workforce relies on Home Healthcare Software for efficient care delivery. The Aging Population necessitates Hospice Care, Assistive Devices, remote patient monitoring, In-home Care, and Skilled Nursing Care. Private Insurance covers Medication Management and Mobility Aids. Data Security and Respiratory Therapy are essential for maintaining patient confidentiality and managing respiratory conditions, respectively. Products, including Medical Supplies and Assistive Devices, contribute significantly to the market's revenue due to their wide application and easy availability.

Patients use products like thermometers, BP monitors, pressure oximeters, and heart rate monitors regularly for health maintenance and observation. The convenience of purchasing and using these products without the assistance of Healthcare Professionals further increases their popularity.

The Products segment was valued at USD 141.00 million in 2019 and showed a gradual increase during the forecast period.

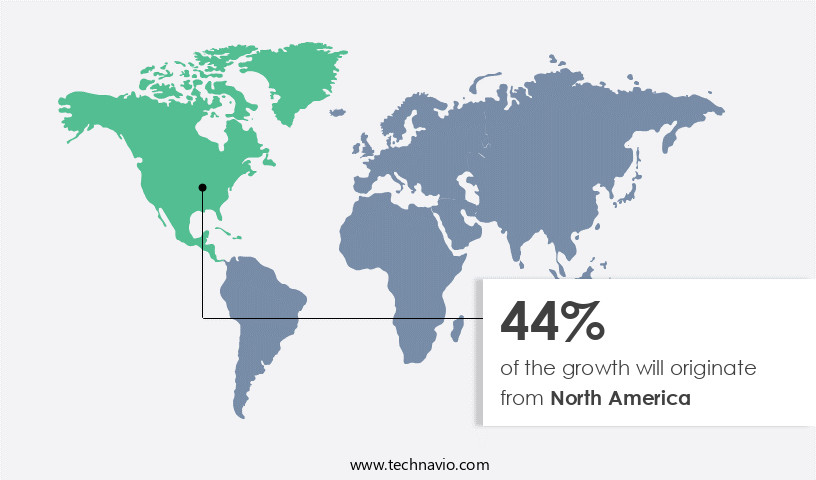

Regional Analysis

North America is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the expanding aging population and the increasing adoption of personalized care services. With approximately 16.8% of the North American population aged 65 and above, and this demographic growing at an annual rate of nearly 1%, the demand for long-term healthcare solutions is on the rise. This demographic shift is driving the market's growth, as older adults often require assistance with daily activities and chronic disease management. Home healthcare providers offer various services, including speech-language pathology, mental health services, medical social work, and post-hospital care. Medical supplies, such as oxygen therapy equipment and mobility aids, are essential for the effective delivery of care.

Compliance with HIPAA regulations is crucial to ensure patient data security and privacy. Value-based care, hospital readmissions reduction, and chronic disease management are key priorities for home healthcare agencies. Telehealth services, home infusion therapy, and remote patient monitoring enable care coordination and improve healthcare outcomes. Ethical considerations, such as patient satisfaction and quality improvement, are essential to maintain the integrity of the industry. Registered nurses, physical therapists, occupational therapists, and home health aides are essential members of the home healthcare workforce. Pediatric care, palliative care, hospice care, and wound care are specialized services offered by home healthcare agencies. Home healthcare software and patient portals facilitate efficient care coordination and medication management.

The market is further fueled by the adoption of assistive devices, skilled nursing care, and hospice care. Data security and employee training are essential to maintain regulatory compliance. Private insurance and geriatric care are also significant contributors to the market's growth. The market in North America is evolving to meet the needs of an aging population and the increasing demand for personalized care services. The market's growth is driven by factors such as the aging population, increasing awareness about healthcare, and the adoption of technology to improve care coordination and patient outcomes.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Home Healthcare Industry?

- The enhancement of home healthcare quality significantly contributes to elevated patient satisfaction, serving as the primary market growth driver.

- Home healthcare services have gained significant importance in the US market due to their ability to address patients' physical, psychological, and healthcare needs in the comfort of their homes. The focus on value-based care and reducing hospital readmissions has led to an increased demand for chronic disease management services, including diabetes management, oxygen therapy, and home infusion therapy. Home health aides, homemaker services, physical therapists, and telehealth services are also crucial components of home healthcare, ensuring patient safety, privacy, and dignity. To enhance patient satisfaction, companies prioritize quality control and analyze their offerings based on various parameters. These include consideration of patient preference during service selection, assessment of patient and caregiver needs, design and plan of service delivery, patient safety, inclusion of preventive measures, medication management, wound management, continuous patient monitoring, risk assessment, complaint management, and effective service feedback systems.

- By focusing on these aspects, home healthcare providers aim to deliver high-quality, personalized care that meets patients' unique requirements.

What are the market trends shaping the Home Healthcare Industry?

- The rising prevalence of life-threatening diseases represents a significant market trend. This trend underscores the increasing demand for advanced healthcare solutions and innovative treatments.

- According to the Centers for Disease Control and Prevention (CDC), chronic diseases such as stroke, heart disease, diabetes, and chronic respiratory diseases were the leading causes of death in 2024. Approximately 129 million Americans have at least one chronic condition, and around 77 million have multiple chronic diseases. Compliance with regulations, including those related to patient portals, is crucial for home healthcare agencies to ensure quality care. Registered Nurses (RNs), Occupational Therapists, and other healthcare professionals play a vital role in home healthcare, providing services such as pediatric care, wound care, and hospice care.

- The home healthcare workforce also utilizes assistive devices to enhance patient care and improve outcomes. Home healthcare software is essential for managing patient records, scheduling appointments, and ensuring regulatory compliance. The aging population is another significant factor driving the growth of the market. According to the US Census Bureau, the population aged 65 and above is projected to reach 95 million by 2060. Home healthcare offers an alternative to institutionalized care, enabling seniors to receive care in the comfort of their own homes. The market is experiencing growth due to the increasing number of individuals with chronic diseases, the need for regulatory compliance, and the aging population.

- Home healthcare agencies rely on healthcare professionals, assistive devices, and software to provide quality care to patients in their homes.

What challenges does the Home Healthcare Industry face during its growth?

- The scarcity of home healthcare professionals represents a significant obstacle to the expansion and growth of the industry.

- The market experiences a critical challenge due to the insufficient supply of skilled home healthcare professionals (HCPs). This shortage is attributed to various factors, including high turnover rates, inadequate training, and the demanding nature of home healthcare work. According to the U.S. Bureau of Labor Statistics, the demand for new personal care aides and home health aides is projected to reach 924,000 by 2031. This shortage negatively impacts the quality and accessibility of home healthcare services, as the growing elderly population and the increasing prevalence of chronic conditions require more care. Furthermore, the scarcity of skilled HCPs can lead to increased workloads for existing staff, resulting in burnout and worsening turnover rates.

- Remote Patient Monitoring (RPM), In-home Care, Medication Management, Geriatric Care, Care Coordination, Employee Training, Mobility Aids, Respiratory Therapy, and Skilled Nursing Care are essential components of home healthcare services. Data Security is another crucial aspect, ensuring the confidentiality and integrity of sensitive patient information. Despite these challenges, the market continues to evolve, integrating advanced technologies and innovative solutions to address the shortage of skilled professionals and improve patient care.

Exclusive Customer Landscape

The home healthcare market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the home healthcare market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, home healthcare market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

A and D Holon Holdings Co Ltd. - This company specializes in providing advanced home healthcare solutions. Our product range includes the UA-1200BLE blood pressure monitor and UT-201BLE-A thermometer. These devices offer accurate and reliable readings for individuals managing their health at home. The UA-1200BLE blood pressure monitor ensures precise measurement of systolic and diastolic blood pressure levels, while the UT-201BLE-A thermometer delivers fast and accurate temperature readings. Both devices are equipped with Bluetooth connectivity, enabling seamless data transfer to smartphones and other compatible devices for easy tracking and trend analysis. By incorporating technology into home healthcare, we aim to enhance the overall well-being of individuals and support them in managing their health effectively.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A and D Holon Holdings Co Ltd.

- Abbott Laboratories

- Apollo Hospitals Enterprise Ltd.

- ARKRAY Inc.

- B.Braun SE

- Baxter International Inc.

- Becton Dickinson and Co.

- Cardinal Health Inc.

- Exergen Corp.

- F. Hoffmann La Roche Ltd.

- Fresenius SE and Co. KGaA

- Home Medical Products Inc.

- Invacare Corp.

- Johnson and Johnson Services Inc.

- Medline Industries LP

- OMRON Corp.

- Pulsenmore Ltd.

- ResMed Inc.

- Rotech Healthcare Inc.

- Stryker Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Home Healthcare Market

- In February 2023, Philips unveiled its new integrated care platform, Philips CareOrchestrator, designed to streamline home healthcare services and improve patient outcomes (Philips, 2023). This solution aims to connect various health devices, data analytics, and care teams, addressing the growing demand for remote patient monitoring and personalized care.

- In May 2024, Amazon Care, Amazon's healthcare service, expanded its offerings to include in-home healthcare services, partnering with various healthcare providers to offer medical assessments, care coordination, and follow-up appointments (Amazon, 2024). This strategic move positions Amazon Care as a more comprehensive healthcare solution, targeting the growing the market.

- In July 2024, Medtronic announced the acquisition of Patriot Therapeutics, a clinical-stage biotech company, to expand its home healthcare offerings with remote patient monitoring and digital therapeutics (Medtronic, 2024). This strategic acquisition is expected to bolster Medtronic's home healthcare portfolio and strengthen its position in the Digital Health market.

Research Analyst Overview

- In the evolving home healthcare landscape, various trends and market dynamics shape the industry's future. Home healthcare advocacy groups push for policy changes, fostering increased access to home-based care for those with Alzheimer's, dementia, and other care needs. Assisted living facilities and hospices expand their offerings through direct contracting, integrating home modifications, predictive analytics, and machine learning to enhance patient care. Social media marketing and content marketing strategies engage adult day care attendees and caregivers, providing essential resources for cognitive decline management, pain management, and nutrition counseling. Home safety assessments, wearable health technology, and remote monitoring devices ensure fall prevention and end-of-life care, while home healthcare policy and caregiver support facilitate medication reconciliation and disease-based segmentation.

- Rehabilitation services, hospice at home, and bereavement support cater to post-acute care and patient education, addressing the needs of an aging population through age-based segmentation and digital marketing. The marketing and community outreach initiatives prioritize patient-centered care, fostering a collaborative approach to care needs segmentation and palliative care.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Home Healthcare Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

249 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.2% |

|

Market growth 2025-2029 |

USD 492.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.9 |

|

Key countries |

US, Germany, UK, Canada, China, Japan, France, India, Russia, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Home Healthcare Market Research and Growth Report?

- CAGR of the Home Healthcare industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the home healthcare market growth of industry companies

We can help! Our analysts can customize this home healthcare market research report to meet your requirements.