Wound Closure Devices Market Size 2025-2029

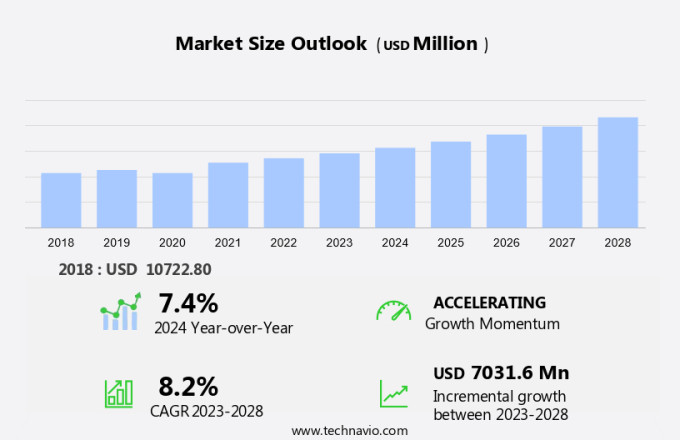

The wound closure devices market size is forecast to increase by USD 7.91 billion, at a CAGR of 8.5% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing demand for cosmetic and plastic surgeries. This trend is fueled by the rising preference for minimally invasive procedures and the desire for quicker recovery times. Furthermore, advancements in wound care technologies, such as the use of biocompatible materials and advanced closure techniques, are enhancing patient outcomes and boosting market growth. However, intense competition in the market poses a significant challenge. With numerous players vying for market share, pricing pressure is a major concern.

- Additionally, regulatory requirements and the need for clinical trials to gain approval for new products can also hinder market growth and require substantial investments. To capitalize on opportunities and navigate challenges effectively, companies must stay abreast of market trends and consumer preferences, and focus on delivering high-quality, cost-effective solutions. Companies must differentiate themselves through innovative product offerings, strategic partnerships, and effective marketing strategies to maintain a competitive edge. Dermal substitutes and skin grafts offer alternatives to traditional incision closure methods, while absorbable sutures and staples provide strength and durability.

What will be the Size of the Wound Closure Devices Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in regenerative medicine and the intricacies of the wound healing process. Biomaterial properties, infection prevention, and wound contraction are key factors shaping market dynamics. Hemostatic agents, tissue adhesives, and wound dressing materials play crucial roles in ensuring optimal surgical site conditions. Cost-effectiveness analysis, patient outcomes, and scar tissue formation are critical considerations. Biocompatibility testing is essential to ensure safety and efficacy, while bioengineered skin, wound debridement, angiogenesis stimulation, collagen synthesis, and cellular adhesion are integral to the healing process.

Clinical trial data and surgical sealant research are ongoing, aiming to improve device efficacy and reduce complication rates. Adhesive strength and fibroblast proliferation are essential factors in the development of advanced wound closure solutions. The market's continuous unfolding reflects the complex interplay of various elements, requiring a nuanced understanding of the wound healing process and the evolving needs of healthcare providers and patients. Wound closure devices refer to medical devices used to close various types of wounds, including chronic wounds such as diabetic foot ulcers and pressure ulcers, as well as those resulting from surgical procedures and minimally invasive surgeries.

How is this Wound Closure Devices Industry segmented?

The wound closure devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Sutures

- Hemostats

- Surgical staples

- Wound sealants

- Wound strips

- Application

- General surgery

- Orthopedics

- Gynecology and obstetrics

- Cardiology

- Others

- End-user

- Hospitals

- Ambulatory surgical centers

- Specialty wound clinics

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

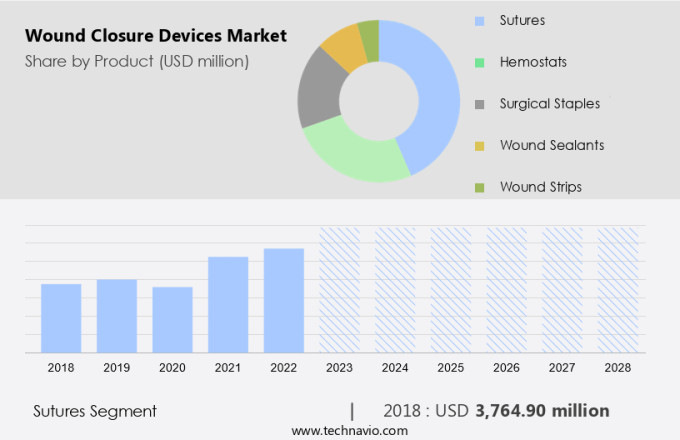

By Product Insights

The sutures segment is estimated to witness significant growth during the forecast period. Sutures play a crucial role in wound closure by binding injured or operated tissue together, using needles made from stainless or carbon steel. The design and thread material selection depend on the medical condition, with abdominal surgery sutures differing significantly from those used in cataract surgery. Thread materials for wound closure include silk, nylon, polypropylene, polyester, and synthetic polymers, which are strong, non-toxic, flexible, hypoallergenic, and restrict fluid entry for infection prevention. Biomaterial properties, such as hemostatic agents, tissue adhesives, and wound dressing materials, enhance the wound healing process. Infection prevention is a significant concern, with surgical site infection a potential complication.

Wound contraction is facilitated by absorbable and non-absorbable sutures, while tissue regeneration is encouraged by dermal substitutes and skin grafts. Patient outcomes are crucial, with factors like scar tissue formation and wound closure time influencing recovery. Complication rates and adhesive strength are essential considerations for surgical wound closure. Clinical trial data and biocompatibility testing ensure the safety and efficacy of surgical sealants, bioengineered skin, and wound debridement. Angiogenesis stimulation and collagen synthesis promote tissue regeneration, while fibroblast proliferation and cellular adhesion contribute to the overall success of the wound closure process. Sutures, staples, hemostatic agents, stapling devices, sealants, adhesives, and hemostats are some of the essential wound closure devices used in various surgical interventions.

The Sutures segment was valued at USD 4.01 billion in 2019 and showed a gradual increase during the forecast period.

The Wound Closure Devices Market is rapidly advancing with innovations tailored for both chronic wound care and acute wound management. Devices now integrate biological sealants, promoting faster healing and reducing infection risks. The use of autologous skin grafts enhances compatibility and accelerates recovery. Emerging regenerative techniques stimulate tissue repair, improving reepithelialization rate and minimizing complications. A strong focus on scarring reduction is driving demand for solutions that enhance cosmetic outcomes. Furthermore, minimally invasive surgery has revolutionized wound closure, offering patients faster recovery and less trauma.

Regional Analysis

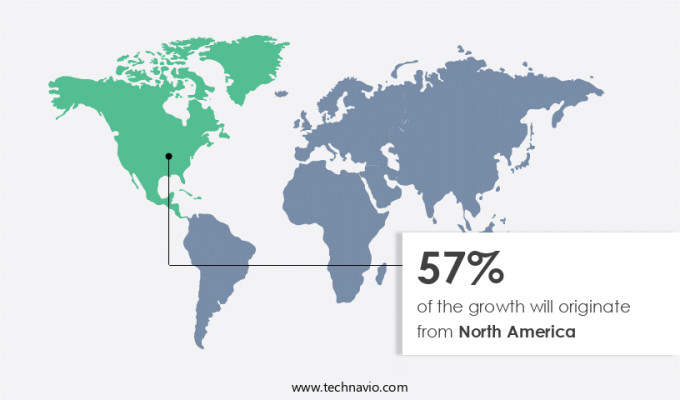

North America is estimated to contribute 59% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market experienced significant growth in 2024, with North America leading the revenue contribution. Advanced wound closure devices have become increasingly popular in healthcare facilities, contributing to a slower growth rate during the forecast period. The market's expansion is driven by heightened awareness among healthcare professionals and individuals regarding the importance of infection prevention and improved patient outcomes. Wound closure devices play a crucial role in minimizing infection risks during the healing process by maintaining stringent safety measures. In North America, the market is maturing, but the potential for growth remains due to ongoing research and development in the field of regenerative medicine and tissue engineering. These devices facilitate the binding of injured or operated body tissue together, repairing lacerations using needles made from stainless steel or carbon steel.

Biomaterial properties, such as hemostatic agents and tissue adhesives, are essential components of wound closure devices, promoting wound contraction and tissue regeneration. Clinical trial data and biocompatibility testing ensure the safety and efficacy of these devices. Wound dressing materials and surgical sealants further enhance the healing process by promoting angiogenesis stimulation, collagen synthesis, and cellular adhesion. Despite the potential complications, including scar tissue formation and adhesive strength, the benefits of wound closure devices far outweigh the risks. Absorbable and non-absorbable sutures, staples, and skin grafts are also integral to the market. Overall, the market's growth is underpinned by a relentless pursuit of innovation to improve patient outcomes and reduce wound closure time.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Wound Closure Devices Industry?

- The rise in popularity for cosmetic and plastic surgeries serves as the primary catalyst for market growth in this sector. The market for surgical wound closure solutions, which includes wound dressing materials and dermal substitutes, has gained significant traction due to the increasing demand for cosmetic and reconstructive surgical procedures. In 2024, cosmetic surgeries experienced a 1% growth, while minimally invasive procedures saw a 3% rise, with over 837,000 patients utilizing GLP-1 medications like Ozempic for post-weight-loss aesthetic treatments. The pandemic has led to a rise in virtual consultations, further fueling this trend.

- The market's growth is driven by these factors, ensuring a continued emphasis on advanced wound closure technologies. Reconstructive surgeries, crucial for treating congenital deformities, injuries, and severe burns, witnessed a 2% increase, underlining their importance in both physical healing and psychological well-being. Medical tourism also plays a role in driving market growth, as individuals seek superior surgical interventions.

What are the market trends shaping the Wound Closure Devices Industry?

- Wound care technology is currently experiencing significant advancements, making it a noteworthy market trend. This sector's ongoing innovations aim to improve patient outcomes and accelerate healing processes. The wound care market is experiencing significant growth due to the increasing prevalence of chronic injuries and surgeries. Advanced wound closure devices, such as staples and absorbable sutures, are in high demand as they offer efficient and effective solutions for wound care and healing. Patient outcomes are a top priority, and these devices contribute to improved scar tissue formation and reduced wound closure time. Fibroblast proliferation, a critical factor in wound healing, is enhanced by these advanced technologies.

- The aging population's growing need for sophisticated wound care technologies is another significant factor driving market growth. With a better understanding of the pathophysiology of wounds, there have been numerous advancements in wound care treatment and management, including negative pressure wound therapy (NPWT). This method employs controlled sub-atmospheric pressure to enhance wound healing by promoting drainage and reducing edema. The wound care market is expected to continue growing due to the increasing demand for advanced wound closure devices and the aging population's need for sophisticated wound care solutions.

What challenges does the Wound Closure Devices Industry face during its growth?

- The intense competition prevalent in the industry puts significant pressure on pricing, posing a major challenge to sustainable growth. The market is characterized by intense competition among major international and local manufacturers. Key players dominate certain product segments, but the market remains accessible for smaller companies producing sutures, hemostats, surgical staples, and tissue sealants. Local manufacturers offer these products at significantly lower costs than larger, branded companies like Ethicon (a Johnson & Johnson subsidiary) and Covidien (Medtronic). This pricing strategy puts pressure on leading players to reconsider their pricing strategies in the current market climate.

- Wound debridement and cellular adhesion are essential functions of these devices. Complication rates are a significant concern, and ongoing research focuses on improving device efficacy and reducing complications. Manufacturers invest in research and development to create advanced wound closure devices, such as negative pressure wound therapy and bioengineered skin substitutes. These innovations offer benefits like faster healing, reduced scarring, and improved patient outcomes.

Exclusive Customer Landscape

The wound closure devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the wound closure devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, wound closure devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - This company specializes in advanced wound closure devices, enhancing wound support and boosting tensile strength beyond traditional sutures. Their innovative solutions promote effective healing processes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Abbott Laboratories

- Arthrex Inc.

- Artivion Inc.

- B.Braun SE

- Baxter International Inc.

- Connexicon Medical Ltd.

- ConvaTec Group Plc

- DeRoyal Industries Inc.

- Essity AB

- Futura Surgicare Pvt. Ltd.

- Integra LifeSciences Holdings Corp.

- IVT Medical Ltd.

- Johnson and Johnson Services Inc.

- Medtronic Plc

- Smith and Nephew plc

- Stryker Corp.

- Teleflex Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Wound Closure Devices Market

- In January 2024, Ethicon, a Johnson & Johnson company, announced the FDA approval of its new absorbable negative pressure wound closure system, EXPANCEL Dermal Closure System. This innovative product is designed to promote wound healing and reduce the need for secondary dressings (Johnson & Johnson press release, 2024).

- In March 2024, Medtronic and 3M collaborated to expand their partnership in advanced wound care, combining Medtronic's wound care expertise with 3M's adhesive technologies. This collaboration aims to develop next-generation wound closure and care solutions (Medtronic press release, 2024).

- In May 2024, Smith & Nephew completed the acquisition of Osiris Therapeutics, a leading regenerative medicine company. This strategic move enhances Smith & Nephew's portfolio with Osiris' advanced tissue repair and regeneration technologies (Smith & Nephew press release, 2024).

- In February 2025, Stryker received FDA approval for its new VELHOX Wound Closure System, which utilizes a unique vacuum-assisted closure technology to improve wound healing. This approval marks a significant milestone in Stryker's continued investment in wound care innovation (Stryker press release, 2025).

Research Analyst Overview

The market encompasses a range of innovative technologies, including absorbable mesh, laser surgery, wound closure strips, advanced wound dressings, and surgical sealants. These solutions cater to both acute and chronic wound management, with a focus on minimally invasive techniques and pain management. Robotic surgery and tissue engineering are emerging trends, integrating platelet-rich plasma, cellular therapies, and skin substitutes to enhance re-epithelialization rates and reduce scarring. Surgical techniques continue to evolve, with the adoption of synthetic sealants and biological alternatives, such as fibrin sealant, to minimize wound infection rates and optimize healing processes.

Despite the competition, the market's potential for growth remains strong due to the increasing prevalence of chronic wounds and the growing aging population. Biocompatibility testing is crucial to ensure the safety and efficacy of wound closure devices. These devices also promote bioengineered skin growth through processes like angiogenesis stimulation and collagen synthesis. Pressure ulcer treatment and surgical staplers are also key areas of investment, as healthcare providers seek to improve patient outcomes and reduce healthcare costs.

Overall, the market for wound closure devices is dynamic, driven by advancements in technology and a growing demand for effective and efficient wound care solutions. These devices contribute to improved patient outcomes, faster healing, and reduced scar tissue formation. Clinical trial data supports their efficacy, making them a preferred choice for healthcare professionals. Clinical trial data supports the efficacy of these wound closure devices, making them a preferred choice for healthcare professionals. Surgical sealants are another innovative development in wound care, providing an additional layer of protection against infection and promoting faster healing.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Wound Closure Devices Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

238 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.5% |

|

Market growth 2025-2029 |

USD 7.91 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.7 |

|

Key countries |

US, Germany, China, Canada, Japan, UK, France, Italy, Mexico, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Wound Closure Devices Market Research and Growth Report?

- CAGR of the Wound Closure Devices industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the wound closure devices market growth of industry companies

We can help! Our analysts can customize this wound closure devices market research report to meet your requirements.