APAC Healthcare Analytics Market Size 2024-2028

The APAC healthcare analytics market size is forecast to increase by USD 20.84 billion, at a CAGR of 27.94% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends and drivers. The integration of big data with healthcare analytics is a major catalyst for market expansion, enabling more accurate and efficient diagnosis and treatment plans. Additionally, the increasing use of digital health technologies, such as telemedicine and remote patient monitoring, is driving demand for advanced analytics solutions. However, data security and privacy concerns remain a challenge, as sensitive healthcare information is increasingly being stored and transmitted digitally.

- IT services providers are addressing these concerns through cloud analytics and software solutions. The rise of 5G technology is also expected to boost market growth, enabling real-time data processing and analysis for public safety and predictive analytics applications. Insurers and healthcare services providers are also leveraging data analytics to improve operations, reduce costs, and enhance customer experience. Overall, the market is poised for strong growth, driven by these trends and the increasing adoption of digital technologies in healthcare.

What will be the size of the APAC Healthcare Analytics Market during the forecast period?

- The market is experiencing significant growth In the adoption of healthcare analytics. This trend is driven by the increasing focus on patient care, treatment costs, and patient retention. Big data analytics and digital solutions are transforming the industry, enabling healthcare providers to extract valuable insights from clinical data. The aging population in APAC is a major factor fueling this growth, as analytics tools help improve performance, efficiency, and accuracy in service delivery. Future trends include the use of predictive analytics for clinical outcomes, cost savings, and hospital readmission reduction. Security issues and cultural barriers are challenges that must be addressed as the market expands.

- Healthcare costs remain a critical concern, with analytics playing a key role in addressing this challenge. Qpharma and BC platforms are leading the way in analytics adoption, with life sciences companies and healthcare providers also investing heavily in this area. The market is segmented into on-premises and cloud-based solutions, with both offering unique advantages depending on the specific needs of organizations. Overall, the market is poised for continued growth, offering significant opportunities for innovation and improvement in service delivery and clinical outcomes.

How is this market segmented and which is the largest segment?

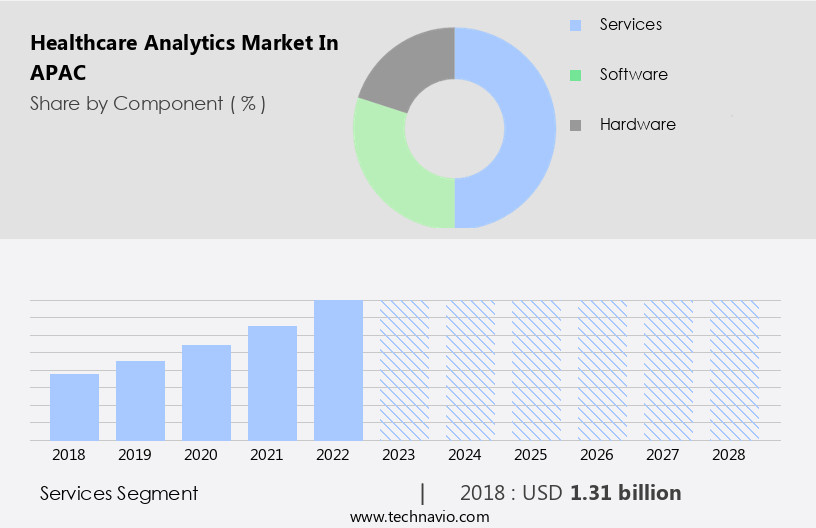

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Component

- Services

- Software

- Hardware

- Deployment

- On-premises

- Cloud-based

- Geography

- APAC

- China

- India

- Japan

- South Korea

- APAC

By Component Insights

- The services segment is estimated to witness significant growth during the forecast period.

In the APAC region, the healthcare analytics market is primarily driven by the services segment, which accounted for the largest market share in 2023. This segment encompasses consulting, implementation, training, and support services offered by healthcare analytics companies. With the growing emphasis on patient-centric care and the need to adhere to stringent regulatory requirements such as FDA regulations and HIPAA legislation, healthcare providers are increasingly relying on IT services and solutions. The healthcare sector is heavily regulated due to the importance of public safety standards. Big data analytics, digital solutions, and analytics tools are transforming patient care, treatment costs, patient retention, and clinical outcomes In the APAC region.

Key trends include the use of cloud analytics for healthcare fraud analytics, infectious diseases, and medical insurance fraud. Future trends include the integration of 5G technology, telemedicine platforms, electronic health records, and personal health records. Performance, efficiency, accuracy, service delivery, clinical outcomes, and healthcare costs are critical factors influencing market growth. Security issues, cultural barriers, confidentiality, a skilled workforce, analytics network, international political relations, economic relations, federal regulations, and quality care are also significant considerations.

Get a glance at the market share of various segments Request Free Sample

The services segment was valued at USD 1.31 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the APAC Healthcare Analytics Market?

The growing integration of big data with healthcare analytics is the key driver of the market.

- In the IT healthcare sector, big data analytics plays a pivotal role in enhancing patient care and managing treatment costs. The vast amount of clinical data generated from electronic health records, personal health records, and wearable devices necessitates advanced analytics tools. Healthcare analytics encompasses descriptive and predictive analytics, enabling healthcare providers to gain insights into patient trends, clinical outcomes, and hospital readmission rates. Factors driving the adoption of healthcare analytics include the aging population and the rise of chronic diseases. Cloud analytics and 5G technology facilitate the sharing and processing of large datasets, while telemedicine platforms and digital solutions improve service delivery.

- However, challenges such as security issues, cultural barriers, and confidentiality concerns necessitate a skilled workforce and strong analytics networks. Life sciences companies, healthcare providers, and the financial segment are major consumers of healthcare analytics. Big Data analytics helps in healthcare fraud analytics, infectious diseases management, and medical insurance fraud detection. Future trends include the integration of 5G technology, AI, and machine learning for improved performance, efficiency, accuracy, and quality care. Federal regulations and international political and economic relations also impact the market dynamics.

What are the market trends shaping the APAC Healthcare Analytics Market?

Increasing use of Internet-enabled mobile devices in healthcare is the upcoming trend In the market.

- The IT healthcare sector in APAC is witnessing significant advancements with the integration of healthcare analytics. This technology is revolutionizing patient care by enabling data-driven insights, leading to improved treatment costs, patient retention, and clinical outcomes. Big data analytics and digital solutions are at the forefront of this transformation, with analytics tools processing clinical data from aging populations and those suffering from chronic diseases. Cloud analytics, a key component of digital healthcare, offers benefits such as scalability, accessibility, and cost savings. Moreover, healthcare fraud analytics is gaining importance to combat medical insurance fraud and infectious diseases surveillance. The advent of 5G technology and telemedicine platforms is further enhancing service delivery, while electronic health records and personal health records ensure data accuracy and accessibility.

- Future trends include performance and efficiency gains, hospital readmission reduction, security issues, cultural barriers, and confidentiality concerns. The skilled workforce, analytics network, international political relations, and economic relations are crucial factors shaping the market dynamics. The financial segment, life sciences companies, and healthcare providers are major consumers of healthcare analytics. The on-premises and cloud-based segments cater to varying requirements based on data security, cost, and flexibility considerations.

What challenges does APAC Healthcare Analytics Market face during the growth?

Increasing data security and privacy concerns is a key challenge affecting the market growth.

- In the IT healthcare sector, healthcare analytics plays a crucial role in enhancing patient care, reducing treatment costs, and improving patient retention. Big data analytics and digital solutions are transforming the industry, with analytics tools enabling the processing of clinical data for predictive and descriptive insights. The aging population and the rise of chronic diseases necessitate advanced analytics capabilities to manage and prevent health issues. Cloud analytics is a preferred choice for organizations due to its cost-effectiveness and ease of accessibility. This technology allows for centralized data storage, high-speed networks, and easy software maintenance, leading to increased productivity and enhanced data sharing and collaboration.

- Furthermore, cloud analytics enables the integration of functional gaps in existing systems and processes. In the APAC region, healthcare providers, life sciences companies, and the financial segment are adopting cloud-based analytics solutions for performance, efficiency, accuracy, and service delivery. The future trends include the integration of 5G technology, telemedicine platforms, electronic health records, and personal health records. However, challenges such as security issues, cultural barriers, and confidentiality concerns must be addressed to ensure the successful implementation of these solutions. Additionally, regulatory compliance and the availability of a skilled workforce are essential factors to consider. International political and economic relations may also impact the adoption of healthcare analytics In the region.

Exclusive APAC Healthcare Analytics Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture Plc

- Capgemini Service SAS

- Cognizant Technology Solutions Corp.

- HCL Technologies Ltd.

- Health Catalyst Inc.

- Infosys Ltd.

- Inovalon

- IQVIA Holdings Inc.

- McKesson Corp.

- Merative L.P.

- Microsoft Corp.

- Optum Inc.

- Oracle Corp.

- SAP SE

- SAS Institute Inc.

- Veradigm LLC

- Wipro Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing adoption of healthcare analytics. This trend is driven by the need to improve patient care, reduce treatment costs, and enhance patient retention. Big data analytics is playing a crucial role in this transformation, enabling healthcare providers to derive valuable insights from clinical data. The aging population and the prevalence of chronic diseases In the APAC region are major factors fueling the demand for healthcare analytics. The region is home to some of the world's largest aging populations, and the incidence of chronic diseases such as diabetes, cancer, and cardiovascular diseases is on the rise.

Further, healthcare providers are leveraging analytics tools to gain a better understanding of patient health patterns and deliver personalized treatment plans. Cloud analytics is gaining popularity In the APAC healthcare sector due to its scalability and cost-effectiveness. This technology enables healthcare providers to store and analyze large volumes of data in real-time, leading to improved performance, efficiency, and accuracy in service delivery. Furthermore, cloud analytics offers the flexibility to access data from anywhere, making it an ideal solution for telemedicine platforms. The increasing prevalence of infectious diseases In the APAC region is also driving the adoption of healthcare analytics for fraud detection.

In addition, medical insurance fraud and healthcare fraud analytics are becoming essential tools for healthcare providers to mitigate financial losses and maintain the integrity of their operations. The APAC healthcare sector is also witnessing the adoption of digital solutions to enhance patient care and clinical outcomes. Electronic health records and personal health records are becoming standard tools for healthcare providers to manage patient data and deliver quality care. The region is also witnessing the emergence of 5G technology, which is expected to revolutionize telemedicine platforms and enable real-time data transfer and analysis. Future trends In the APAC healthcare analytics market include the increasing adoption of descriptive and predictive analytics.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

156 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 27.94% |

|

Market Growth 2024-2028 |

USD 20.84 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

24.1 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch