Cloud Analytics Market Size 2024-2028

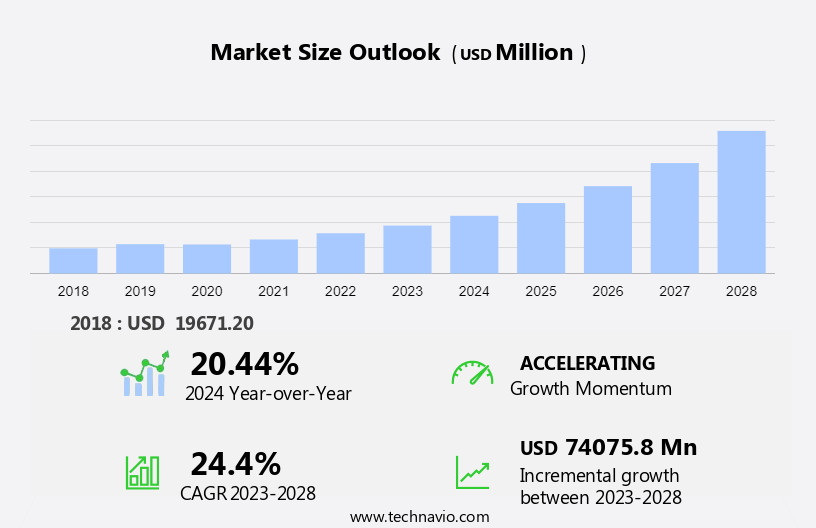

The cloud analytics market size is forecast to increase by USD 74.08 billion at a CAGR of 24.4% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. The adoption of hybrid and multi-cloud setups is on the rise, as these configurations enhance data connectivity and flexibility. Another trend driving market growth is the increasing use of cloud security applications to safeguard sensitive data.

- However, concerns regarding confidential data security and privacy remain a challenge for market growth. Organizations must ensure robust security measures are in place to mitigate risks and maintain trust with their customers. Overall, the market is poised for continued expansion as businesses seek to leverage the benefits of cloud technologies for data processing and data analytics.

What will be the Size of the Cloud Analytics Market During the Forecast Period?

- The market is experiencing significant growth due to the increasing volume of data generated by businesses and the demand for advanced analytics solutions. Cloud-based analytics enables organizations to process and analyze large datasets from various data sources, including unstructured data, in real-time. This is crucial for businesses looking to make data-driven decisions and gain valuable insights to optimize their operations and meet customer requirements. Key industries such as sales and marketing, customer service, and finance are adopting cloud analytics to improve key performance indicators and gain a competitive edge. Both Small and Medium-sized Enterprises (SMEs) and large enterprises are embracing cloud analytics, with solutions available on private, public, and multi-cloud platforms.

- Big data technology, such as machine learning and artificial intelligence, are integral to cloud analytics, enabling advanced data analytics and business intelligence. Cloud analytics provides businesses with the flexibility to store and process data In the cloud, reducing the need for expensive on-premises data storage and computation. Hybrid environments are also gaining popularity, allowing businesses to leverage the benefits of both private and public clouds. Overall, the market is poised for continued growth as businesses increasingly rely on data-driven insights to inform their decision-making processes.

How is this Cloud Analytics Industry segmented and which is the largest segment?

The cloud analytics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2017-2022 for the following segments.

- Solution

- Hosted data warehouse solutions

- Cloud BI tools

- Complex event processing

- Others

- Deployment

- Public cloud

- Hybrid cloud

- Private cloud

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Middle East and Africa

- South America

- North America

By Solution Insights

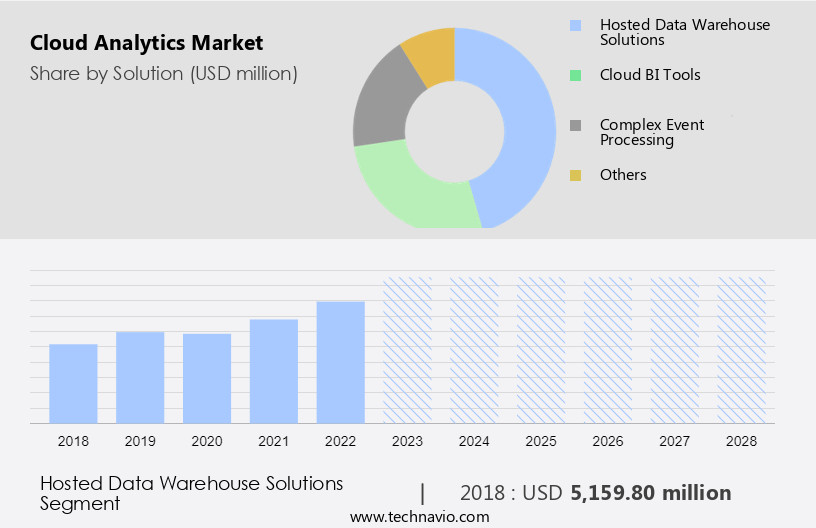

- The hosted data warehouse solutions segment is estimated to witness significant growth during the forecast period.

Hosted data warehouses enable organizations to centralize and analyze large datasets from multiple sources, facilitating advanced analytics solutions and real-time insights. By utilizing cloud-based infrastructure, businesses can reduce operational costs through eliminating licensing expenses, hardware investments, and maintenance fees. Additionally, cloud solutions offer network security measures, such as Software Defined Networking and Network integration, ensuring data protection. Cloud analytics caters to diverse industries, including SMEs and large enterprises, addressing requirements for sales and marketing, customer service, and key performance indicators. Advanced analytics capabilities, including predictive analytics, automated decision making, and fraud prevention, are essential for data-driven decision making and business optimization.

Furthermore, cloud platforms provide access to specialized talent, big data technology, and AI, enhancing customer experiences and digital business opportunities. Data connectivity and data processing in real-time are crucial for network agility and application performance. Hosted data warehouses offer computational power and storage capabilities, ensuring efficient data utilization and enterprise information management. Cloud service providers offer various cloud environments, including private, public, multi-cloud, and hybrid, catering to diverse business needs. Compliance and security concerns are addressed through cybersecurity frameworks and data security measures, ensuring data breaches and thefts are minimized.

Get a glance at the Cloud Analytics Industry report of share of various segments Request Free Sample

The Hosted data warehouse solutions segment was valued at USD 5.15 billion in 2017 and showed a gradual increase during the forecast period.

Regional Analysis

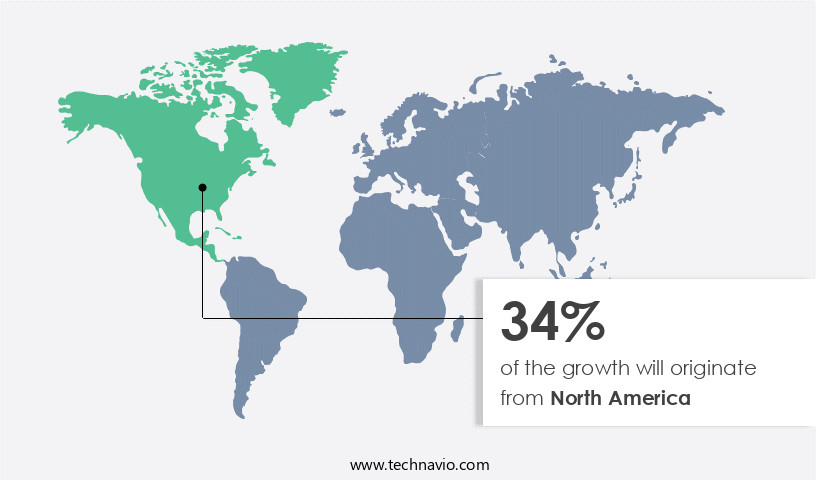

- North America is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America experienced significant growth in 2023, driven by the early adoption of cloud-based services and increased investment in data centers. Cloud analytics solutions facilitate seamless IT and service delivery, both internally and externally, in organizations. In the US, the surge in cloud computing adoption is a primary factor fueling the demand for cloud analytics. Advanced analytics solutions enable businesses to process and gain insights from large datasets, including unstructured data, from various data sources. These insights inform business operations, decision-making, and customer requirements in real time. Cloud-based analytics offers network security measures, such as Software Defined Networking and network integration, ensuring data protection.

Training and upskilling are essential for organizations to effectively utilize cloud analytics, offering opportunities for specialized talent. Cloud service providers offer batch analytics, data processing, and real-time insights, requiring substantial computational power and storage capabilities. Predictive analytics, fraud prevention, and automated decision-making are key applications, while data connectivity and compliance with big data technology, AI, and cybersecurity frameworks are critical considerations. SMEs and large enterprises in sales, marketing, customer service, and key performance indicators benefit from cloud analytics. Cloud platforms, business intelligence, data analytics, and data visualization tools offer opportunities for digital business growth in various industries, including IT and telecommunications.

Market Dynamics

Our cloud analytics market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Cloud Analytics Industry?

Hybrid and multi-cloud setups can improve data connectivity is the key driver of the market.

- Cloud analytics refers to the use of advanced analytics solutions in cloud-based environments to process and derive insights from large datasets from various data sources. These datasets can include unstructured data, which requires specialized talent and computational power for analysis. Businesses utilize cloud analytics for decision making, fraud prevention, predictive analytics, and automated decision making, among other applications. The flexibility of cloud analytics enables network integration, real-time insights, and data connectivity, making it an attractive option for both SMEs and large enterprises. Cloud analytics addresses the challenges of handling big data by providing scalable storage capabilities and access to specialized talent.

- Service providers offer various cloud platforms, including private, public, and multi-cloud environments, catering to diverse business needs. Cloud technology also enables network agility, application performance, and data security measures such as Software Defined Networking and cybersecurity frameworks. Cloud analytics is transforming business operations across sectors like sales and marketing, customer service, and key performance indicators. It provides businesses with data-driven insights, enabling them to make informed decisions and improve customer experiences. Additionally, the integration of cloud analytics with technologies like IoT, AI, and business intelligence tools offers new opportunities for businesses to gain a competitive edge. Despite the benefits, cloud analytics also presents challenges, including data security concerns and data breaches.

- Companies must ensure they have robust data security measures in place to protect sensitive information. Moreover, businesses need to consider network integration, training and upskilling their workforce, and ensuring data connectivity to maximize the benefits of cloud analytics.

What are the market trends shaping the Cloud Analytics Industry?

Rise in cloud security applications is the upcoming market trend.

- Cloud analytics has become a priority for businesses of all sizes, as the volume of data continues to grow. Advanced analytics solutions In the cloud enable organizations to process and gain insights from both structured and unstructured datasets from various data sources. Business operations rely heavily on data-driven insights for decision making, and cloud-based analytics provides real-time capabilities and computational power. However, security remains a significant concern, especially in hybrid environments. Cloud technology offers network security measures such as Software Defined Networking (SDN) and network integration, but data breaches and cybersecurity frameworks are essential for mitigating risks. Cloud platforms offer various services, including fraud prevention, predictive analytics, and automated decision making, making it easier for businesses to utilize their data effectively.

- Big data technology, including AI, is transforming industries such as sales and marketing, customer service, and IoT(Internet Of Things). SMEs and large enterprises alike are adopting cloud computing for its network agility and scalability. Data connectivity and data storage platforms are essential components of cloud-based business intelligence and data analytics. Cloud service providers offer various solutions, from private and public clouds to multi-cloud and hybrid environments. Key performance indicators are crucial for measuring the success of these implementations. Data visualization and customer experience are essential for digital business success, and communication networks and application performance are critical for ensuring business continuity.

- Data security problems, such as data thefts and breaches, are significant concerns for corporate organizations, and cloud technology offers solutions for addressing these challenges. In conclusion, cloud analytics is a dynamic and evolving market, with a focus on developing software that simplifies policy compliance, data protection, and visibility. The market is expected to grow significantly, driven by the increasing need for data utilization and enterprise information management in various industries. Cloud technology offers numerous benefits, including increased efficiency, scalability, and security, making it an essential component of modern business operations.

What challenges does the Cloud Analytics Industry face during its growth?

Concerns about confidential data security and privacy is a key challenge affecting the industry growth.

- In today's digital business landscape, the adoption of cloud analytics is on the rise as businesses seek to harness the power of advanced analytics solutions to derive data-driven insights from their vast and complex datasets. Cloud-based analytics enables business operations to become more agile and responsive to customer requirements by providing real-time insights and automated decision making. However, the increasing use of cloud technology also brings about new challenges, particularly In the realm of data security. As data volume continues to grow, so too do the risks associated with network security measures and data breaches. Cloud service providers offer various security frameworks to mitigate these risks, but the shared infrastructure and multi-tenancy nature of cloud environments can create vulnerabilities.

- Unstructured data, such as text and video analytics, pose additional challenges for data security and require specialized talent and computational power. Moreover, the integration of Software Defined Networking (SDN) and Network Function Virtualization (NFV) into cloud-based analytics adds another layer of complexity to data connectivity and network agility. To address these challenges, businesses must invest in training and upskilling their workforce, as well as implementing robust data security measures. The market is segmented by data sources, including batch analytics, real-time insights, and data processing. Large enterprises and SMEs alike are adopting cloud analytics for various applications, including sales and marketing, customer service, and key performance indicators.

- Cloud platforms offer various deployment models, such as private cloud, public cloud, and hybrid environments, each with its unique advantages and challenges. The use of cloud technology in industries such as healthcare, finance, and retail is driving the growth of the market. Big data technology, including AI and IoT, is also fueling innovation and creating new opportunities for businesses to gain competitive advantages. However, the increasing adoption of cloud technology also raises concerns about data security and compliance, particularly in highly regulated industries. However, the challenges associated with data security and compliance require a strategic approach and a commitment to investing In the right tools, talent, and training. By addressing these challenges, businesses can unlock the full potential of cloud analytics and gain a competitive edge In their respective industries.

Exclusive Customer Landscape

The cloud analytics market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cloud analytics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cloud analytics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Actian Corp. - The company specializes in cloud analytics solutions, delivering advanced data processing and insights through offerings such as BigQuery, Dataproc, and Cloud Data Fusion. By leveraging these technologies, businesses can efficiently analyze vast amounts of data in the cloud, enabling informed decision-making and strategic growth.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Actian Corp.

- Alphabet Inc.

- Amazon.com Inc.

- Cloud Software Group Inc.

- Hewlett Packard Enterprise Co.

- Infor Inc.

- International Business Machines Corp.

- Microsoft Corp.

- MicroStrategy Inc.

- Open Text Corporation

- Oracle Corp.

- Panorama Software Inc.

- QlikTech international AB

- Rackspace Technology Inc.

- Salesforce Inc.

- SAP SE

- Sisense Ltd.

- Teradata Corp.

- VMware Inc.

- Zendesk Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Latest Market Developments and News

-

In December 2024, Google Cloud launched an enhanced analytics platform that integrates AI-driven insights with real-time data processing capabilities. The platform aims to help businesses across industries like retail and finance make data-driven decisions quickly, leveraging cloud technology to scale analytics operations seamlessly.

-

In November 2024, a strategic partnership between Amazon Web Services (AWS) and a leading e-commerce company was announced to integrate advanced cloud analytics tools into their supply chain operations. The collaboration focuses on using predictive analytics to optimize inventory management, forecast demand, and improve logistics efficiency.

-

In October 2024, Microsoft introduced a new cloud-based analytics service designed for the healthcare sector, enabling hospitals and clinics to aggregate and analyze patient data in real time. This service uses machine learning to detect patterns in patient outcomes, providing actionable insights to improve care and operational efficiency.

-

In September 2024, SAP acquired a cloud analytics startup focused on improving data integration and visualization. The acquisition allows SAP to expand its cloud analytics offerings, targeting industries such as manufacturing and automotive, where companies need to aggregate large datasets and generate insights for operational optimization and predictive maintenance.

Research Analyst Overview

Cloud analytics refers to the process of analyzing data in a cloud computing environment. With the increasing volume of data being generated daily, the demand for advanced analytics solutions that can handle large datasets has grown significantly. Cloud-based analytics offers several benefits, including access to unlimited computational power and storage capabilities, real-time insights, and network integration. Businesses of all sizes, from Small and Medium Enterprises (SMEs) to large corporations, are increasingly relying on cloud analytics to gain data-driven insights for better decision making. The use of cloud analytics is not limited to specific industries or departments; it is being adopted across various business operations, including sales and marketing, customer service, and finance.

The data sources for cloud analytics are diverse and include both structured and unstructured data. Structured data, such as relational databases and spreadsheets, can be easily processed using traditional data processing techniques. However, unstructured data, such as social media feeds, emails, and audio and video recordings, require specialized talent and advanced analytics tools to extract meaningful insights. Cloud analytics solutions offer several advantages over traditional on-premises analytics. They provide greater network agility, enabling businesses to scale up or down as per their requirements. They also offer real-time insights, allowing businesses to make informed decisions quickly. Moreover, cloud analytics solutions offer advanced features such as predictive analytics, automated decision making, and fraud prevention.

The adoption of cloud analytics is driven by several factors, including the need for data connectivity, the increasing volume of big data, and the growing demand for data-driven insights. The cloud platform offers several advantages over traditional data storage platforms, including lower costs, greater scalability, and improved data security. The market is expected to grow significantly In the coming years, driven by the increasing adoption of cloud technology by corporate organizations. The market is segmented into public cloud and private cloud, with public cloud being the largest segment due to its flexibility and cost-effectiveness. The market also includes multi-cloud and hybrid environments, which offer businesses greater flexibility and improved disaster recovery capabilities.

The use of cloud analytics is not without challenges, however. Data security concerns, including data breaches and cyber-attacks, are a major concern for businesses adopting cloud analytics. Network security measures, such as software-defined networking and cybersecurity frameworks, are essential to mitigate these risks. In conclusion, cloud analytics is an essential tool for businesses looking to gain data-driven insights and make informed decisions. The use of cloud analytics offers several advantages over traditional analytics, including access to unlimited computational power and storage capabilities, real-time insights, and network integration. The market for cloud analytics is expected to grow significantly In the coming years, driven by the increasing adoption of cloud technology and the growing demand for data-driven insights. However, businesses must address data security concerns to fully leverage the benefits of cloud analytics.

|

Cloud Analytics Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

187 |

|

Base year |

2023 |

|

Historic period |

2017-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 24.4% |

|

Market growth 2024-2028 |

USD 74.08 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

20.44 |

|

Key countries |

US, China, UK, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cloud Analytics Market Research and Growth Report?

- CAGR of the Cloud Analytics industry during the forecast period

- Detailed information on factors that will drive the Cloud Analytics growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cloud analytics market growth of industry companies

We can help! Our analysts can customize this cloud analytics market research report to meet your requirements.