Acrolein Market Size 2025-2029

The acrolein market size is forecast to increase by USD 208 million at a CAGR of 3.3% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the expanding plastic and polymer industries. These industries rely heavily on acrolein as a raw material for the production of various chemicals, including methionine and acrylic acid. The demand for these chemicals is on the rise due to increasing consumer preferences for synthetic materials and the growing adoption of Biodegradable Plastics. However, the market faces a notable challenge in the form of the adverse health impact of acrolein. This compound is known to have toxic effects on the respiratory system and can cause irritation to the eyes, skin, and mucous membranes.

- As a result, stringent regulations regarding the handling and disposal of acrolein are being implemented in various regions, which may hinder market growth. Companies operating in the market must comply with these regulations to mitigate potential risks and maintain a strong market presence. To capitalize on the growth opportunities and navigate the regulatory challenges, market participants need to focus on developing safer production methods and alternative raw materials. This strategic approach will enable them to cater to the evolving market demands while ensuring compliance with health and safety regulations.

What will be the Size of the Acrolein Market during the forecast period?

- The market exhibits continuous evolution, driven by its diverse applications across various sectors. In the oil industries, acrolein serves as a crucial intermediate in the production of petrochemical feedstocks through propylene oxidation. Simultaneously, in water treatment, acrolein functions as a biocide, inhibiting the growth of microorganisms in water treatment plants. Moreover, acrolein finds extensive use in the polymer industry, particularly in the synthesis of polyurethane foams and polymer additives. Its electrophilic nature makes it an essential component in the production of coatings and paints. The petrochemical industry relies on acrolein for the manufacture of acrylic acid and other specialty chemicals.

- In the agrochemical sector, it is used in the synthesis of pesticides and herbicides. Furthermore, acrolein's role extends to the engineering plastic industry, where it is employed as a monomer in the production of synthetic fibers. The ongoing exploration of natural resources, such as oil wells and drilling water wells, fuels the demand for acrolein in the hydrocarbon-fuels sector. Additionally, its application in the production of triglyceride processes for biodiesel and bio-based glycerol further underscores its significance in the Renewable Energy sector. Acrolein's carcinogenic property necessitates stringent regulations and the development of alternative production methods, such as catalytic reduction processes and the glycerol dehydration method.

- These advancements reflect the dynamic nature of the market and its commitment to addressing environmental concerns. Acrolein's versatility extends to various industries, including algae growth and irrigation canals, where it functions as a growth regulator and a disinfectant, respectively. Its role in glutaraldehyde production further underscores its importance in the biocide market. In conclusion, the market is characterized by continuous evolution and diversification, driven by its applications in various industries, including the oil industries, water treatment, polymer industries, agrochemicals, and specialty chemicals. The ongoing development of alternative production methods and the exploration of new applications further underscore the market's dynamism.

How is this Acrolein Industry segmented?

The acrolein industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Acrylic acid

- Methionine

- Biocides

- Type

- Propylene oxidation method

- Glycerol dehydration method

- End-user

- Water treatment

- Agrochemicals

- Plastics and polymers

- Pharmaceuticals

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

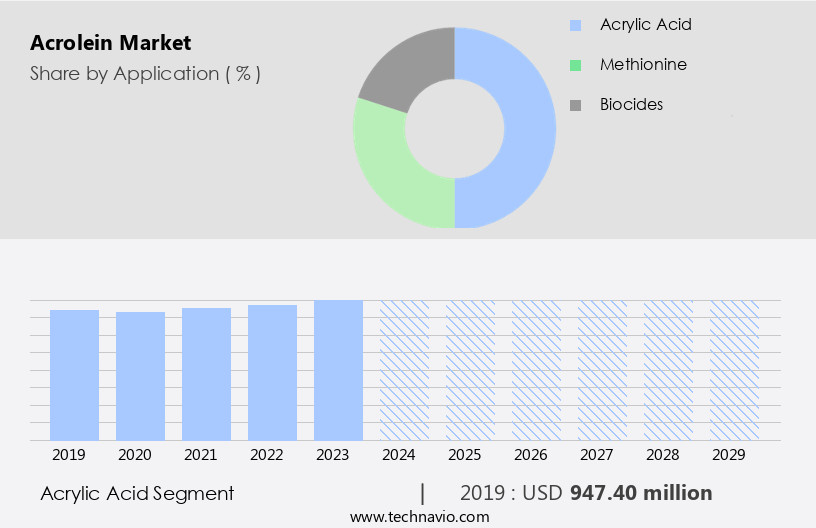

The acrylic acid segment is estimated to witness significant growth during the forecast period.

Acrolein, an organic compound with a pungent odor, is derived from various sources including the Propylene Oxidation Method using petrochemical feedstocks and the Glycerol Dehydration Method using natural resources. Acrolein is a carcinogenic aldehyde compound, widely used as a biocide in water treatment plants and pesticide manufacturing. In the petrochemical industry, it serves as a crucial building block for the synthesis of industrial chemicals, specialty chemicals, and engineering plastics. Acrolein is employed in polymer industries for the production of polyurethane foams, polymer additives, and synthetic fibers. It is also used in the production of coatings, including paints and coatings, and acts as a catalyst in the catalytic reduction process.

In water treatment, acrolein is used to control algae growth in irrigation canals and water treatment ponds. The carcinogenic property of acrolein has raised concerns in various industries, leading to the exploration of alternative, bio-based sources, such as microorganisms and bio-based glycerol. Oil industries, including drilling water wells and oil wells, also use acrolein as a hydrocarbon fuel additive. Acrolein is also used in the production of agrochemicals, such as glutaraldehyde, and in the triglyceride processes for the production of fatty acids. In summary, acrolein is a versatile organic compound with a wide range of applications in various industries, including the petrochemical industry, water treatment, polymer industries, and agrochemicals.

The demand for acrolein is driven by its use in these industries, with growing consumer demand and emerging technologies leading to new applications and opportunities for growth.

The Acrylic acid segment was valued at USD 947.40 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

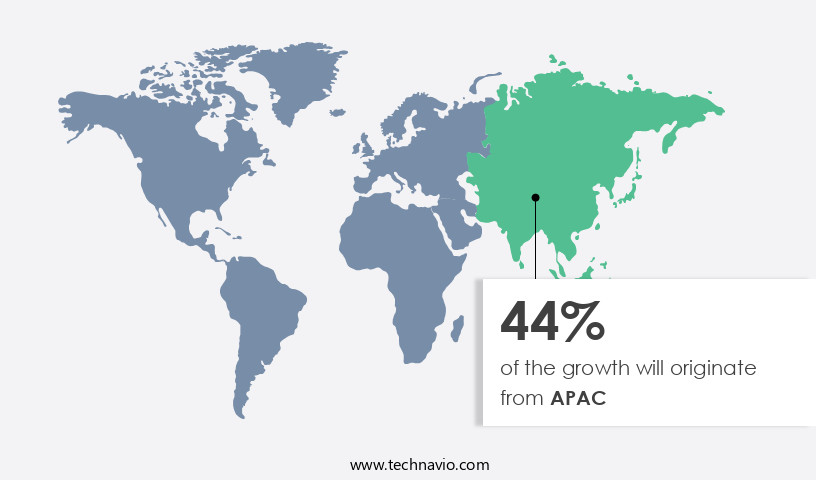

APAC is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is driven by its extensive applications in various industries, particularly in the APAC region. Acrolein, an organic compound produced through the Propylene Oxidation Method or Glycerol Dehydration Method, is a crucial ingredient in the production of acrylic acid and its copolymers. These copolymers are widely used in industries such as packaging, automotive, construction, industrial equipment, paper, and textile due to their superior adhesive properties. In water treatment, acrolein serves as a biocide and helps prevent the growth of microorganisms in water treatment plants and irrigation canals. The petrochemical industry relies on acrolein as a feedstock for the production of various chemicals, including sodium sulfite and polymer additives.

The carcinogenic property of acrolein has raised concerns, leading to stringent regulations in its production and usage. However, the engineering plastic industry, coatings production, and pesticide manufacturing continue to use acrolein due to its unique properties. The hydrocarbon-fuels industry also utilizes acrolein in drilling water wells and oil wells as a biocide. In the agrochemical industry, acrolein is used in the production of glutaraldehyde and aldehyde compounds for use as herbicides and fungicides. The expansion of the chemical industry, particularly in the APAC region, is expected to significantly contribute to the growth of the market.

The region is the largest consumer of acrolein due to its extensive usage in various industries. The growth of industries such as automotive, construction, and packaging is expected to further boost the demand for acrolein in the region. Additionally, the use of bio-based glycerol in the production of acrolein through the Glycerol Dehydration Method is gaining popularity due to its eco-friendly nature, further driving the market growth. In conclusion, The market is expected to witness significant growth due to its extensive applications in various industries, particularly in the APAC region. The market's growth is driven by the expansion of the chemical industry, the superior adhesive properties of acrylic acid, and the increasing demand for eco-friendly production methods.

Despite the concerns regarding its carcinogenic properties, the market is expected to retain its growth trajectory due to its unique properties and extensive applications.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Acrolein Industry?

- The expansion of plastic and polymer industries serves as the primary catalyst for market growth.

- Acrolein, a colorless, pungent, and volatile organic compound, is primarily used as a chemical intermediate in the production of acrylic acid. Acrolein is derived from the Propylene Oxidation Method using a petrochemical feedstock. In the plastics and polymer industry, acrolein finds extensive applications in various sectors. Acrolein is utilized in biocide applications for water treatment plants, preserving water quality by inhibiting the growth of bacteria and algae. Additionally, it is employed in polymer industries for the production of protein groups, enhancing the performance and properties of polymers.

- Acrolein is also a crucial component in the manufacturing of Polyurethane foams, contributing to their excellent insulation properties. Despite its significant uses, acrolein is known for its carcinogenic property and requires careful handling and disposal. Natural resources, such as wood and corn, can also be used as alternatives to petrochemical feedstocks for acrolein production, promoting sustainability in the industry.

What are the market trends shaping the Acrolein Industry?

- The market trend indicates a rising demand for methionine and acrylic acid. These essential chemicals are increasingly sought after in various industries, including agriculture, pharmaceuticals, and manufacturing.

- Acrolein, an organic compound used extensively in various industries, is primarily produced through the partial oxidation of hydrocarbon-fuels such as propylene. However, to increase the production of acrolein in a sustainable manner, researchers are exploring the catalytic dehydration of glycerol. This process involves altering the physicochemical properties and optimizing reaction conditions to enhance selectivity and catalyst stability. The intramolecular dehydration of glycerol is the preferred route to produce acrolein, as intermolecular dehydration may lead to heavy by-products. The catalytic dehydration of glycerol is a burgeoning field of research due to its potential to reduce the carbon footprint in the petrochemical industry.

- The primary challenge lies in improving selectivity while maintaining catalyst performance. This innovative approach can significantly impact the production of polymer additives, pesticides, engineering plastics, paints and coatings, and other applications within the chemical industry.

What challenges does the Acrolein Industry face during its growth?

- The growth of the industry is confronted with a significant challenge due to the adverse health impacts associated with acrolein.

- Acrolein is a toxic organic compound primarily used as an intermediate in the production of acrylic acid and as a biocide. It can be generated through the degradation of certain pollutants in outdoor air or from the combustion of organic matter, including fuels like oil and gas. Acrolein poses health risks, particularly through inhalation, oral, and dermal exposure. Acute exposure may cause respiratory tract irritation and congestion. Long-term exposure can lead to chronic respiratory congestion, eye, nose, and throat irritation. Industries that manufacture other chemicals using acrolein, such as acrylic acid, may expose workers to this hazardous compound.

- Acrolein is also utilized in the agrochemical industry for the production of coatings and as a component in the synthesis of fatty acids, biobased glycerol, and agrochemicals like glutaraldehyde. It is also used in algae growth inhibition in irrigation canals. Despite its applications, acrolein's toxic properties necessitate stringent safety measures during handling and disposal.

Exclusive Customer Landscape

The acrolein market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the acrolein market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, acrolein market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adisseo - The company specializes in providing innovative acrolein-based solutions, encompassing acrylic acid and acrylic monomers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adisseo

- Akzo Nobel N.V.

- Arkema Group

- BASF SE

- Cargill Incorporated

- Cayman Chemical

- Chempoint

- Daicel Corp.

- Dow Chemical Company

- Evonik Industries AG

- Hubei Jinghong Chemical Co. Ltd.

- Hubei Shengling Technology Co. Ltd.

- Hubei Xinjing New Material Co. Ltd.

- Merck KGaA

- NHU (Zhejiang NHU Co. Ltd.)

- Puyang Shenghuade Chemical Co. Ltd.

- Shanghai Huachen Energy Company, Ltd.

- The Shell Oil Company

- Wuhan Ruiji Chemical Co. Ltd.

- Wuhan Youji Industries Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Acrolein Market

- In January 2024, INEOS Oxide, a leading global manufacturer of acrolein, announced the successful commissioning of its new world-scale acrolein plant in Marchem, Germany. This expansion increased the company's global acrolein production capacity by 25%, making INEOS the largest acrolein producer worldwide (INEOS Oxide Press Release, 2024).

- In March 2025, BASF SE, another major acrolein producer, entered into a strategic collaboration with BioAmber Inc. To develop and commercialize bio-based acrolein. This partnership aimed to reduce the carbon footprint of acrolein production by utilizing renewable feedstocks (BASF Press Release, 2025).

- In July 2024, SABIC, a leading chemical manufacturer, completed the acquisition of GE's Plastics business, which included the latter's acrolein production assets. This acquisition expanded SABIC's portfolio in the market and strengthened its position as a global chemical supplier (SABIC Press Release, 2024).

- In October 2025, the European Chemicals Agency (ECHA) approved the renewal of the authorization for the use of acrolein as a biocide in biocidal products. This approval ensured the continuity of acrolein's use in various applications, particularly in water treatment and wood preservation (ECHA Press Release, 2025).

Research Analyst Overview

The market is a significant segment of the specialty chemical industry, primarily used in the production of coatings, adhesives, and polymer industries. This organic compound, also known as 2-propenal, is derived from petrochemical feedstocks such as propylene and acrylic acid. Its carcinogenic property necessitates careful handling and application in various industries. In the oil industries, acrolein is used as a catalyst in the catalytic reduction process for producing hydrogen. Additionally, it plays a role in water treatment plants as a disinfectant and coagulant. In the coatings production sector, acrolein is used as a monomer for producing resins and emulsifiers.

The biobased glycerol derived from glycerine and glycerin is gaining popularity as a potential feedstock for acrolein production, offering a more sustainable alternative to petrochemical sources. The polyurethane foam industry utilizes acrolein in the polymerization process, while synthetic fibers and methionine production also rely on this versatile compound. Acrolein's applications extend to the production of glutaraldehyde, a disinfectant and preservative, and catalytic oxidation processes in the chemical industry. Overall, the market is dynamic, driven by the diverse applications in various industries and the ongoing research for more sustainable production methods.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Acrolein Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

212 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2025-2029 |

USD 208 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

3.1 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Egypt, Oman, Argentina, KSA, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Acrolein Market Research and Growth Report?

- CAGR of the Acrolein industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the acrolein market growth of industry companies

We can help! Our analysts can customize this acrolein market research report to meet your requirements.