Advanced Carbon Dioxide Sensors Market Size 2025-2029

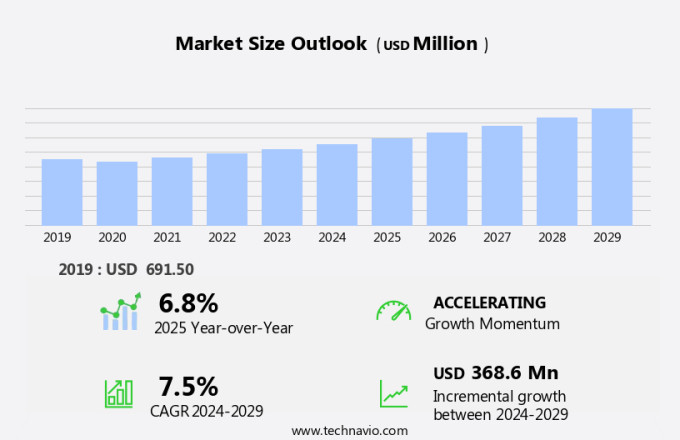

The advanced carbon dioxide sensors market size is forecast to increase by USD 368.6 million at a CAGR of 7.5% between 2024 and 2029.

- The carbon dioxide sensors market is witnessing significant growth due to several key trends and challenges. One of the primary growth factors is the increasing adoption of advanced submersible carbon dioxide sensors in emerging countries. These sensors are essential for various applications, including water treatment, oil and gas production, and power generation, which are witnessing considerable expansion in developing economies. Another trend driving the market is the rise in institutional use of advanced carbon dioxide sensors. Institutions such as research laboratories, educational institutions, and healthcare facilities are increasingly investing in advanced sensors to ensure the safety and well-being of their personnel and the environment.

- In the industrial sector, automation and smart buildings require precise CO2 monitoring for optimal energy efficiency and air quality. However, the market also faces challenges, such as the complex operations of advanced carbon dioxide sensors. These sensors require sophisticated calibration techniques and regular maintenance to ensure accurate readings. Moreover, the high cost of these sensors and the lack of standardization in the market are other significant challenges that need to be addressed to promote widespread adoption.

What will be the Size of the Advanced Carbon Dioxide Sensors Market During the Forecast Period?

- Advanced carbon dioxide sensors have gained significant importance in today's business landscape due to the increasing awareness of air pollution and the need to mitigate the effects of greenhouse gases. The market for carbon dioxide sensors is driven by several factors, including stringent regulations aimed at reducing emissions of hazardous gases, such as carbon dioxide, methane, nitrous oxide, and fluorinated gases. Basket analysis and profit ratio analysis are essential tools for businesses seeking to evaluate the financial attractiveness of investing in advanced carbon dioxide sensors. Cash flow analysis is another critical aspect, as these sensors can help companies reduce operational costs by optimizing energy usage and improving overall efficiency.

- The market for advanced carbon dioxide sensors is also influenced by the rising trend of holistic evaluation, which considers the impact of these sensors on the environment and social responsibility. With the growing concern over the effects of heat and higher temperatures on the environment, the demand for carbon dioxide sensors is expected to increase further. The market dynamics of advanced carbon dioxide sensors are complex, with various factors at play. These include the increasing awareness of air pollution, the need to comply with stringent regulations, and the potential for modifications to land and combustion processes to reduce emissions.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- NDIR

- Chemical

- Fitting

- Wall-mount

- Retrofit

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- South Korea

- Middle East and Africa

- South America

- North America

By Product Insights

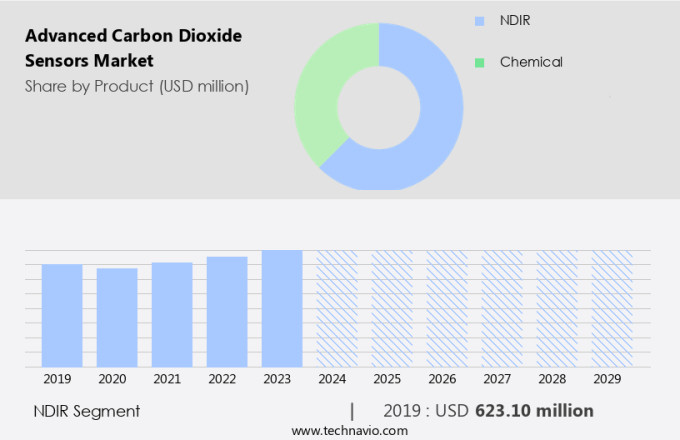

- The NDIR segment is estimated to witness significant growth during the forecast period.

Advanced carbon dioxide sensors, particularly those based on Non-Dispersive Infrared (NDIR) technology, are experiencing steady growth in various sectors such as healthcare, automotive, and petrochemical. These sensors consist of an IR lamp, an optical filter, and a detector, which measure CO2 concentrations by analyzing the amount of infrared radiation absorbed by CO2 molecules. Import duties and lack of awareness are among the challenges hindering market expansion.

However, the increasing prevalence of wireless sensors, connected things, 3D printed sensors, smart constructions, miniaturization, building management systems, and environmental changes are driving demand. The petrochemical and automotive segments are significant contributors to the market due to increasing emissions and the need to monitor hazardous gases and air pollution.

Get a glance at the market report of share of various segments Request Free Sample

The NDIR segment was valued at USD 623.10 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

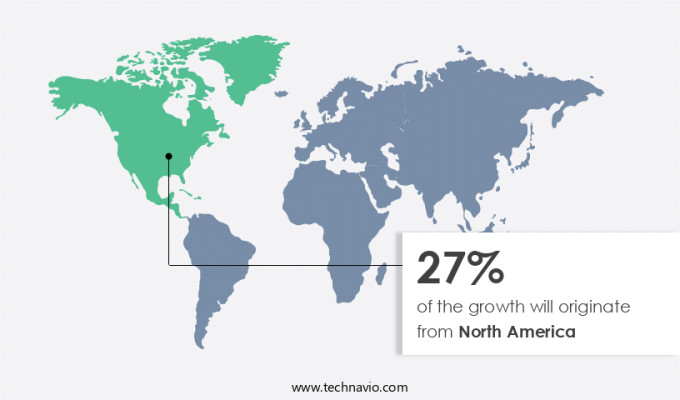

- North America is estimated to contribute 27% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is projected to expand at a moderate growth rate due to the increasing applications of these sensors in energy-efficient solutions, particularly in the US. With sophisticated infrastructure and a high demand for cost-effective energy savings, CO2-based Demand Control Ventilation (DCV) systems are gaining popularity in various sectors, including office buildings, government facilities, retail stores, and educational institutions. Advanced carbon dioxide sensors play a crucial role in these systems by monitoring atmospheric CO2 concentrations and adjusting ventilation rates accordingly, leading to significant energy savings. Additionally, the increasing focus on reducing greenhouse gas emissions, such as carbon dioxide, methane, nitrous oxide, and fluorinated gases, is driving the demand for advanced carbon dioxide sensors in various industries, including agriculture and manufacturing. IoT applications of these sensors further enhance their utility by providing real-time data on CO2 levels, enabling timely modifications to optimize crop yields and production quality and reduce energy consumption.

Market Dynamics

Our advanced carbon dioxide sensors market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Advanced Carbon Dioxide Sensors Market?

The proliferation of advanced submersible carbon dioxide sensors in emerging countries is the key driver of the market.

- Carbon dioxide sensors play a crucial role in monitoring air quality, particularly in industrial settings and building interiors. Advanced CO2 sensors, which can measure carbon dioxide levels at altitude, temperature, and humidity, are increasingly being adopted due to their accuracy and efficiency. The attractiveness analysis of the market reveals significant growth potential in various sectors, including factories, the healthcare sector, automotive, and petrochemical industries. Industrialization and increasing emissions have led to stringent regulations regarding carbon emissions and air pollution levels. The petrochemical and automotive sectors, in particular, are under scrutiny due to their high carbon footprint. The profit ratio analysis indicates that energy efficiency and connectivity are key drivers for the market, with wireless CO2 sensors and building automation systems gaining popularity.

- However, factors such as import duties, lack of awareness, and cross-sensitivity to other gases pose challenges to the market's growth. Technological advancements, such as 3D printed sensors, miniaturization, and IoT applications, offer opportunities for innovation. The selectivity of gases and the precision of sensors are essential considerations for product segmentation. The healthcare sector, particularly indoor public places like theatres, schools, nightclubs, retail outlets, pubs, and restaurants, is a significant market for CO2 sensors due to the need for maintaining proper indoor ventilation levels. Corrective action, such as opening windows, using fans, or introducing fresh air, is necessary when CO2 levels exceed the recommended limit.

What are the market trends shaping the Advanced Carbon Dioxide Sensors Market?

An increase in institutional use of advanced carbon dioxide sensors is the upcoming trend in the market.

- Advanced carbon dioxide sensors have gained significant attention in various industries due to their ability to measure and monitor CO2 levels accurately. Cash flow analysis and profit ratio analysis indicate a positive outlook for the advanced CO2 sensors market, driven by factors such as increasing emissions from industrialization, air pollution levels, and the need for energy efficiency in buildings. Advanced CO2 sensors are used in factories to ensure optimal working conditions and maintain safe levels of CO2, volatile organic compounds (VOCs), and other hazardous gases. In the building sector, these sensors play a crucial role in maintaining indoor air quality in public places like theaters, schools, retail outlets, restaurants, and nightclubs.

- The use of advanced carbon dioxide sensors is also expanding in the healthcare sector for patient safety and in the automotive sector for improving vehicle emissions. Altitude, temperature, and humidity are essential factors affecting CO2 sensor performance. Technological advancements in wireless CO2 sensors and building automation systems have made it possible to monitor CO2 levels in real-time, enabling corrective action when necessary. The petrochemical and automotive sectors are significant contributors to the market due to stringent regulations and increasing awareness of carbon emissions. However, import duties and a lack of awareness among consumers pose challenges to market growth. Advanced carbon dioxide sensors are used to measure atmospheric concentration of CO2, parts per million of greenhouse gases like methane, nitrous oxide, and fluorinated gases.

What challenges does the advanced Carbon Dioxide Sensors Market face during its growth?

Complex operations of advanced carbon dioxide sensors is a key challenge affecting the market growth.

- Advanced carbon dioxide sensors play a crucial role in measuring and managing carbon dioxide levels in various industries and applications. However, the complexity of these sensors can pose challenges for end-users in evaluating their performance. Cash flow analysis and profit ratio analysis are essential tools for understanding the financial attractiveness of investing in advanced carbon dioxide sensors. Advanced carbon dioxide sensors are designed to function optimally in specific environments, such as factories, buildings, and public places, where air pollution levels are a concern. These sensors are particularly important in industries with high carbon emissions, such as chemical, automotive, and petrochemical sectors.

- However, the high cost of these sensors and the lack of awareness about their benefits can hinder their adoption. The functionality of advanced carbon dioxide sensors is influenced by several factors, including altitude, temperature, humidity, and the presence of other gases like volatile organic compounds. The sensors' selectivity for carbon dioxide is essential to ensure accurate measurements. Product segmentation based on technology, application, and end-use industries can help identify the most attractive markets. Advanced carbon dioxide sensors are used in various applications, including industrialization, building interiors, energy efficiency, and building automation. The increasing emissions of hazardous gases and the need for air pollution control have led to stringent regulations and a growing demand for carbon dioxide sensors.

Exclusive Customer Landscape

The advanced carbon dioxide sensors market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Amphenol Corp. - The company offers advanced carbon dioxide sensors such as Telaire T6700 Series, and Telaire T6743.

The advanced carbon dioxide sensors market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aeroqual Ltd.

- Airtest Technologies Inc.

- AMETEK Inc.

- Amphenol Corp.

- Asahi Kasei Corp.

- Cubic Sensor and Instrument Co. Ltd.

- Digital Control Systems Inc.

- E E Elektronik Ges.m.b.H

- Gas Sensing Solutions Ltd.

- Honeywell International Inc.

- Infineon Technologies AG

- Johnson Controls

- NEW COSMOS ELECTRIC Co. Ltd.

- RKI Instruments Inc.

- Schneider Electric SE

- Sensirion AG

- Siemens AG

- Trane Technologies plc

- Trolex Ltd.

- Vaisala Oyj

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Carbon dioxide (CO2) sensors have gained significant attention in various industries due to the growing concerns over air quality and environmental changes. These sensors play a crucial role in measuring CO2 levels in different environments, including factories, building interiors, and public places. The advanced CO2 sensors market is driven by several factors. Industrialization and increasing emissions from factories have led to higher atmospheric concentration levels of CO2. This has resulted in stringent regulations being imposed to monitor and control CO2 emissions. Furthermore, the need for energy efficiency and indoor air quality has increased the demand for CO2 sensors in building automation systems.

Furthermore, carbon dioxide sensors are used in various applications, such as measuring CO2 levels in industrial processes, monitoring indoor ventilation levels in buildings, and detecting hazardous air quality in public places. The healthcare sector, automotive sector, and petrochemical sector are some of the major industries that use CO2 sensors for specific applications. The market for advanced CO2 sensors is also influenced by technological advancements. Nondispersive infrared sensors and photoacoustic spectroscopy are some of the cutting-edge technologies used in CO2 gas sensing. These technologies offer high precision, long-term stability, and low power consumption, making them ideal for various applications. The petrochemical segment and automotive segment are expected to dominate the advanced CO2 sensors market due to their high demand for CO2 measurement in industrial processes and vehicle emissions.

However, the increasing awareness of indoor air quality and the need for energy efficiency in buildings are also driving the growth of the CO2 sensors market in the building automation sector. The use of wireless CO2 sensors and connected things is another trend in the advanced CO2 sensors market. These sensors offer the advantage of easy installation, real-time monitoring, and remote access, making them popular in various applications. The integration of CO2 sensors with building management systems and IoT applications is also expected to drive the growth of the market. The market for advanced CO2 sensors is also influenced by environmental changes and contamination.

|

Advanced Carbon Dioxide Sensors Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

201 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.5% |

|

Market Growth 2025-2029 |

USD 368.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.8 |

|

Key countries |

US, Canada, China, Germany, Japan, UK, South Korea, France, India, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch