Air Pollution Control Market Size 2025-2029

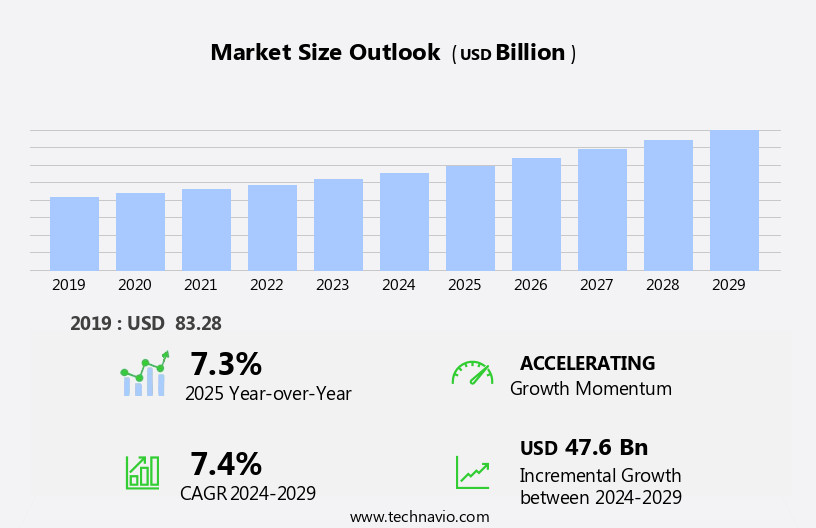

The air pollution control market size is forecast to increase by USD 47.6 billion, at a CAGR of 7.4% between 2024 and 2029. The market is experiencing significant growth, driven by the expanding industrial sector and the increasing demand for Flue Gas Desulfurization (FGD) systems due to the flourishing FGD gypsum market. This trend is expected to continue as industries seek to meet stricter emissions regulations.

Major Market Trends & Insights

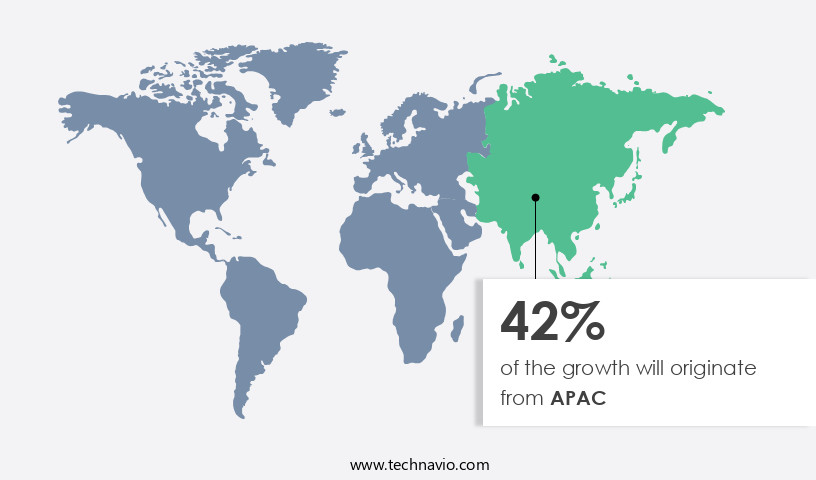

- APAC dominated the market and accounted for a 42% share in 2023.

- The market is expected to grow significantly in Europe region as well over the forecast period.

- Based on the End-user, the power segment led the market and was valued at USD 44.90 billion of the global revenue in 2023.

- Based on the Product, the scrubbers segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 89.37 Billion

- Future Opportunities: USD 47.6 Billion

- CAGR (2024-2029): 7.4%

- APAC: Largest market in 2023

The market faces challenges as the cessation of funding by the World Bank for Emissions and Efficiency (E and P) activities may impact the financial viability of new projects. Companies in the market must navigate these challenges by exploring alternative funding sources and collaborating with governments and industry associations to secure financing for necessary infrastructure investments.

Additionally, the development of advanced technologies, such as Selective Catalytic Reduction (SCR) and Selective Non-Catalytic Reduction (SNCR), offers opportunities for market growth and improved emissions control. Overall, the market presents a dynamic landscape, requiring strategic planning and innovation to capitalize on opportunities and overcome challenges. Companies must remain agile and responsive to changing regulations and market conditions to maintain a competitive edge.

What will be the Size of the Air Pollution Control Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the ever-growing need to mitigate emissions from various industries. Industrial gas cleaning technologies, such as scrubber water treatment and thermal oxidizers, play a significant role in reducing sulfur dioxide and volatile organic compound (VOC) emissions. For instance, the implementation of flue gas desulfurization in power plants has led to a 90% reduction in sulfur dioxide emissions since the 1970s. Moreover, fabric filter performance and electrostatic precipitators are essential in controlling particulate matter emissions from industrial processes. Gas turbine emissions are also under scrutiny, leading to the development of combustion optimization and stack emission control technologies.

The market for emission monitoring systems, including gas chromatography analysis and ambient air monitoring, is expanding as regulatory bodies impose stricter emission control regulations. Hazardous air pollutants, such as nitrogen oxides and hazardous organic compounds, are targeted through selective catalytic reduction and catalytic converter efficiency improvements. Industrial ventilation and dust suppression systems, like baghouse dust collectors and dry scrubbers technology, are crucial in maintaining a clean production environment and minimizing fugitive emissions. Regenerative thermal oxidizers and wet scrubbers efficiency enhancements contribute to the ongoing advancements in emission control technologies. According to industry reports, the market is expected to grow by over 5% annually, driven by increasing environmental awareness and regulatory compliance requirements.

This growth is fueled by the continuous development of innovative technologies, such as smog chamber testing and emission control regulations, to address the complexities of air pollution challenges.

How is this Air Pollution Control Industry segmented?

The air pollution control industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Power

- Chemical Industry

- Iron & Steel Industry

- Cement Industry

- Mining

- Transportation/Automotive

- Others

- Product

- Scrubbers

- Catalyst converters

- Electrostatic Precipitators (ESPs)

- Thermal Oxidizers

- Fabric Filters (Baghouse Filters)

- Flue Gas Desulfurization (FGD) Systems

- Application

- Industrial Emissions Control

- Vehicular Emissions Control

- Power Generation

- Indoor Air Quality Management

- Waste Management

- Technology

- Scrubbers

- Electrostatic Precipitators

- Catalytic Converters

- Thermal Oxidizers

- Fabric Filters

- Pollutant Type

- Particulate Matter (PM)

- Nitrogen Oxides (NOx)

- Sulfur Oxides (SOx)

- Volatile Organic Compounds (VOCs)

- Carbon Oxides (COx)

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The power segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 45.32 billion in 2023. It continued to the largest segment at a CAGR of 5.76%.

The power market segment encompasses air pollution control equipment utilized in managing emissions from thermal power plants and gas turbines. Coal, a substantial contributor to global power generation, particularly in countries like China and India, drives this segment's significance. Coal combustion results in various chemical reactions, producing harmful air pollutants and heavy metals, including mercury, sulfur dioxide, carbon dioxide, nitrogen oxides, and particulate matter. Additionally, ash is generated as a byproduct from burning solid fuels. To mitigate these emissions, various technologies are employed. Sulfur dioxide scrubbers, a type of scrubber water treatment, are used to remove sulfur dioxide from flue gases.

Thermal oxidizers, including catalytic and regenerative thermal oxidizers, eliminate volatile organic compounds (VOCs) and other harmful gases. Industrial gas cleaning techniques, such as fabric filter performance and electrostatic precipitators, remove particulate matter. Flue gas desulfurization systems employ a wet or dry process to remove sulfur dioxide. Combustion optimization and stack emission control technologies enhance overall efficiency and reduce emissions. Filtration media selection and dust suppression systems, like baghouse dust collectors and dry scrubbers, ensure effective particulate matter filtration. Gas chromatography analysis and emission monitoring systems enable continuous monitoring of emissions. Regulatory bodies mandate stringent emission control regulations, driving the market's growth.

According to estimates, the market is projected to expand by over 5% annually. For instance, the implementation of the Mercury and Air Toxics Standards (MATS) in the US resulted in a 90% reduction in mercury emissions from coal-fired power plants.

The Power segment was valued at USD 36.99 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 42% to the growth of the global market during the forecast period. Data suggests that the future opportunities for growth in the APAC region estimates to be around USD 48.25 billion. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth due to increasing industrialization and urbanization, leading to high energy consumption and subsequent air pollution. Governments in countries like China and India have recognized the severity of the issue and implemented initiatives and policies to address it. For instance, China's "War on Pollution" campaign and India's "Make in India" program have boosted demand for air pollution control equipment in the manufacturing sector. Air pollution control technologies, such as scrubber water treatment, thermal oxidizers, sulfur dioxide scrubbers, industrial gas cleaning, fabric filter performance, and electrostatic precipitators, are essential in mitigating emissions from industries.

In addition, advanced technologies like flue gas desulfurization, particulate matter filters, and selective catalytic reduction systems for nitrogen oxide reduction are gaining popularity. Gas turbine emissions and volatile organic compound (VOC) abatement technologies are also crucial in reducing industrial emissions. Air pollution modeling and hazardous air pollutant monitoring are essential for identifying and mitigating potential health risks. Emission monitoring systems, industrial ventilation, and combustion optimization are other critical aspects of effective air pollution control. The market for air pollution control equipment is expected to grow at a substantial rate, with a recent study estimating a 15% increase in demand for such technologies by 2026.

This growth can be attributed to stringent emission control regulations, advancements in filtration media selection, and the increasing efficiency of technologies like catalytic thermal oxidizers and regenerative thermal oxidizers. For example, a leading industrial conglomerate in China reported a 30% reduction in particulate matter emissions after implementing a comprehensive air pollution control system, which included the installation of fabric filters and electrostatic precipitators. This not only improved the company's environmental footprint but also enhanced its reputation and contributed to increased consumer trust.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to increasing regulations and public awareness regarding the need for emission reduction and air quality improvement. Key components of this market include electrostatic precipitator maintenance schedules, catalytic converter performance optimization, and fabric filter bag replacement frequency in various industries. Industries must also consider upgrades to flue gas desulfurization systems to meet stricter emission control regulations. When selecting air pollution control equipment, cost effectiveness of volatile organic compound (VOC) abatement technologies is a critical consideration. Real-time air quality monitoring data analysis and emission control system regulatory compliance are essential for maintaining industrial gas cleaning systems and ensuring stack emission monitoring data interpretation is accurate.

Industrial gas cleaning system design considerations include hazardous air pollutant control strategies, selective catalytic reduction system troubleshooting, and scrubber water treatment plant optimization. Particle size distribution measurement techniques and air pollution modeling software validation are crucial for optimizing emission control technology lifecycle cost analysis and Clean Air Act compliance strategies for industries. Smog chamber testing protocols and procedures, such as gas chromatography analysis of air pollutants, play a vital role in ensuring effective emission control technology implementation. Ambient air quality monitoring network design is another essential aspect of the market, providing valuable data for regulatory compliance and public health protection. Overall, the market continues to evolve, driven by the need for innovative technologies and regulatory requirements.

What are the key market drivers leading to the rise in the adoption of Air Pollution Control Industry?

- The significant expansion of industrial sectors serves as the primary catalyst for market growth.

- Air pollution control is a critical issue in the industrial sector, with greenhouse gases (GHGs) and sulfur dioxide (SO2) being the most common pollutants released from factories. GHGs, primarily carbon dioxide (CO2) from the burning of fossil fuels, contribute significantly to global warming and acidification risk due to the formation of acid rain, which involves SO2, NOx, and ammonia (NH3). The industrial sector's growth, particularly in energy-intensive industries, has led to a significant increase in GHG emissions. For instance, CO2 emissions from the US industrial sector increased by 11% between 2012 and 2018. Furthermore, SO2 emissions from industrial processes account for approximately 60% of the total SO2 emissions in the US.

- The industrial sector's growth trajectory and reliance on fossil fuels for energy production indicate that GHG emissions will continue to rise, necessitating stringent air pollution control measures. According to the US Environmental Protection Agency, the industrial sector is expected to grow by 1.7% annually, leading to a 25% increase in industrial emissions by 2030.

What are the market trends shaping the Air Pollution Control Industry?

- The flourishing market for Flue Gas Desulfurization (FGD) gypsum is projected to stimulate growth in the FGD market. This emerging trend underscores the significance of the FGD gypsum market's contribution to the overall FGD industry.

- FGD gypsum, derived from Flue Gas Desulfurization (FGD) systems, is a synthetic gypsum obtained through the oxidation process using lime reagents or limestone. This gypsum is gaining significant traction in various industries, including agriculture, construction, mining, and water treatment. In the agricultural sector, FGD gypsum is applied to the soil, providing essential nutrients like sulfur and calcium to plants. Additionally, it enhances clay flocculation and soil aggregation, thereby reducing surface crusting and improving water infiltration. In the construction industry, FGD gypsum is utilized in the production of plaster and card gypsum for interior work and partitioning walls.

- The demand for FGD gypsum is expected to surge due to its environmental benefits, as it effectively reduces sulfur dioxide emissions from power plants. The market for FGD gypsum is projected to grow robustly, with an estimated 15% increase in demand over the next five years.

What challenges does the Air Pollution Control Industry face during its growth?

- The cessation of World Bank funding for Exploration and Production (E&P) activities poses a significant challenge to the industry's growth trajectory.

- The market faces a significant challenge following the World Bank's decision to cease funding for exploration and production activities. This financial support is crucial for the development and implementation of advanced pollution control technologies in the energy sector, which is a substantial contributor to greenhouse gas emissions. Without adequate funding, research and development in areas such as bioreactors, carbon capture, and storage technologies may stagnate, impeding progress in reducing industrial emissions. This lack of investment can also result in delays in the adoption of new technologies and infrastructure upgrades necessary for regulatory compliance. For instance, the European Union's Industrial Emissions Directive, which sets emission limit values for over 40 industrial sectors, has led to substantial investments in pollution control technologies.

- However, the absence of financial backing may hinder the ability of industries to meet these stringent regulations, potentially leading to increased pollution levels and negative environmental consequences. According to a recent report, the market is projected to grow by over 6% annually, driven by increasing environmental awareness and stringent regulations.

Exclusive Customer Landscape

The air pollution control market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the air pollution control market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, air pollution control market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ahlstrom - This company specializes in providing air pollution control systems, including bin vent, shaker, and cartridge models, to various industries for effective emission mitigation.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ahlstrom

- Airex Industries Inc.

- American Air Filter Co. Inc.

- Andritz AG

- Babcock and Wilcox Enterprises Inc.

- Camfil AB

- Donaldson Co. Inc.

- Doosan Lentjes GmbH

- Ducon

- DuPont de Nemours Inc.

- FLSmidth and Co. AS

- Freudenberg and Co. KG

- Fujian Longking Co. Ltd.

- GEA Group AG

- General Electric Co.

- Hamon S.A.

- John Wood Group PLC

- KernelSphere Technologies Pvt. Ltd.

- Mitsubishi Heavy Industries Ltd.

- MITTAL BLOWERS India PVT. LTD.

- Parker Hannifin Corp.

- PAS Solutions BV

- PBG SA

- Thermax Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Air Pollution Control Market

- In January 2024, in a strategic move to expand its product portfolio, Honeywell International Inc. announced the acquisition of UltraSource, a leading provider of selective catalytic reduction (SCR) technology for reducing nitrogen oxide emissions (Reuters). This acquisition aimed to strengthen Honeywell's position in the market.

- In March 2024, Siemens Energy AG and Linde plc entered into a partnership to jointly develop and commercialize advanced gas filtration technologies for power generation and industrial applications (Bloomberg). This collaboration aimed to address the growing demand for cleaner air solutions in power generation and industrial sectors.

- In May 2024, the European Union passed the revised Industrial Emissions Directive (IED), which tightened emission limits for various industrial sectors, including cement, lime, glass, and metallurgical industries (European Commission). This regulatory change is expected to drive the demand for advanced air pollution control technologies in Europe.

- In April 2025, 3M Company launched its new line of advanced air filtration media, the Filtrex DX Series, which offers improved efficiency and longer service life (3M Press Release). This product launch is expected to help 3M capture a larger share of the growing air filtration market.

Research Analyst Overview

- The market for air pollution control solutions continues to evolve, driven by stringent pollution control standards and the need for effective filtration system designs to remove particle matter and control odors from various sectors. For instance, mobile source emissions have seen significant reduction through the adoption of advanced emission control technologies, leading to a 15% decrease in nitrogen oxide emissions from heavy-duty vehicles between 2015 and 2019. Moreover, gas absorption techniques and adsorption technology have gained traction in industrial processes for waste gas treatment, contributing to energy efficiency measures and environmental compliance. The industry anticipates a 5% annual growth rate in the adoption of clean technology for air pollution remediation, including biofiltration systems, membrane separation, and exhaust gas cleaning.

- Risk assessment methodologies and source emission control strategies are essential components of industrial hygiene practices, ensuring process emission control and air quality improvement. Incinerator emissions are addressed through innovative solutions, such as membrane filtration and advanced combustion technologies, enabling efficient energy usage and minimizing harmful emissions. Overall, the market for air pollution control solutions remains dynamic, with ongoing research and development in emission reduction strategies and clean technology adoption.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Air Pollution Control Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.4% |

|

Market growth 2025-2029 |

USD 47.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.3 |

|

Key countries |

China, US, Japan, Canada, Germany, South Korea, UK, Australia, India, Mexico, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Air Pollution Control Market Research and Growth Report?

- CAGR of the Air Pollution Control industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the air pollution control market growth of industry companies

We can help! Our analysts can customize this air pollution control market research report to meet your requirements.