Aeroponics Market Size 2025-2029

The aeroponics market size is forecast to increase by USD 5.35 billion at a CAGR of 26.5% between 2024 and 2029.

- The market is experiencing significant growth due to the limited arable land available for agricultural usage and the increasing trend toward vertical farming technologies. Aeroponics, a soilless cultivation method that uses mist or fine spray to provide nutrients directly to plant roots, offers a promising solution to address land scarcity concerns. However, the market faces challenges, primarily from regulatory hurdles and supply chain inconsistencies. Patented aeroponics systems, which ensure optimal growing conditions and higher yields, are gaining traction among farmers and investors. This farming technique, which integrates aquaponics, aeroponics, and hydroponics, is characterized by the use of artificial intelligence, automation, LED lighting, and sensing devices for optimal crop growth.

- Despite these challenges, the potential for aeroponics to revolutionize agriculture by reducing water usage and increasing crop productivity is immense. Companies seeking to capitalize on this market opportunity should focus on addressing regulatory approvals and supply chain stabilization to ensure long-term success. Energy consumption is minimized through the use of artificial intelligence and automation.

What will be the Size of the Aeroponics Market during the forecast period?

- In the market, advanced technologies are revolutionizing vertical farm design and production. Machine learning algorithms enhance yield prediction models, optimizing crop rotation and variety selection. Hydroponic nutrients are augmented with microbial inoculants for improved plant health and growth. Agricultural robotics and AI integrate with aerosol spray systems for precise pest identification and integrated pest management. Food traceability is ensured through data visualization and remote monitoring, while environmental control units and climate control systems maintain optimal conditions. Nutrient solutions are automated with watering systems, and plant growth regulators fine-tune crop development. The farming systems, including hydroponics, aeroponics, and aquaponics, reduce the reliance on chemicals and pesticides, while maintaining optimal growing conditions through advanced technologies like LED lighting systems, sensors, and robots.

- Image recognition technology assists in plant disease detection, ensuring food safety. Root zone aeration and crop monitoring software further boost productivity, making the market a dynamic and innovative sector for US businesses.

How is this Aeroponics Industry segmented?

The aeroponics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Low pressure aeroponics

- High pressure aeroponics

- Ultrasonic fogger aeroponics

- Type

- Indoor farming

- Outdoor farming

- Crop Type

- Vegetables

- Fruits

- Herbs

- Flowers

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

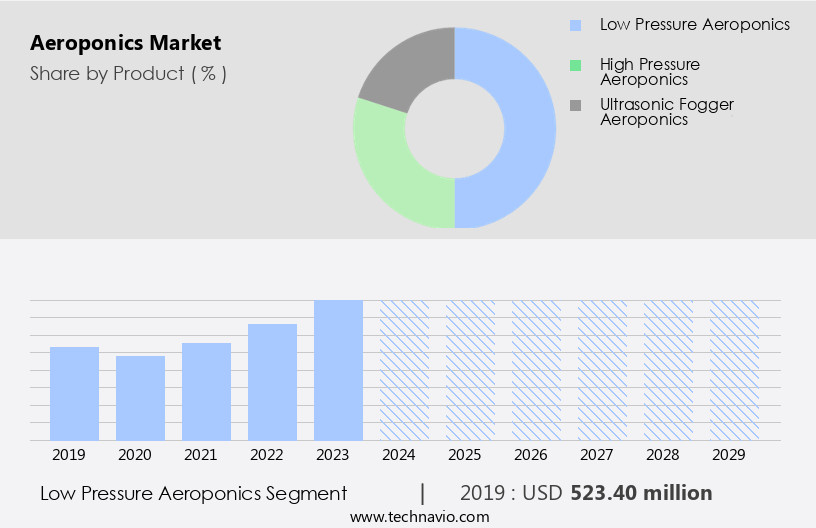

By Product Insights

The low pressure aeroponics segment is estimated to witness significant growth during the forecast period. Aeroponics, a method of growing plants without soil using mist or nutrient solution, is gaining traction in various sectors due to its advantages in resource efficiency, crop production, and plant health optimization. Low pressure aeroponics, a type of aeroponic system, delivers nutrients to plant roots via a fine mist at low pressure. This method is popular for its ease of setup and maintenance, as well as its ability to run continuously, keeping plant roots consistently wet. Organic farming practices can be integrated into aeroponics, making it an attractive option for sustainable agriculture and urban farming. Lighting systems, such as LED grow lights, are essential for indoor farming and controlled environment agriculture, ensuring optimal plant growth. The tomato segment is estimated to witness significant growth during the forecast period. Farming is an innovative agriculture solution that utilizes Indoor farming technology, including hydroponics systems and aeroponics farming, to grow crops in controlled environments.

Overall, the market is evolving, driven by the integration of various technologies and the potential for sustainable, efficient, and high-yielding crop production.

The Low pressure aeroponics segment was valued at USD 523.40 billion in 2019 and showed a gradual increase during the forecast period. Advanced building modeling tools, such as 3D modeling software and architectural design tools, are essential for designing and constructing the farming infrastructure. Crop diversification and seedling production are enhanced through aeroponics, as it allows for precise irrigation control and pest management. Academic institutions and commercial farming operations are exploring aeroponics for its potential in increasing crop yields and improving plant health monitoring. Venture capital and investment opportunities are emerging in this field, fueled by the demand for fresh produce, food security, and water conservation. Agricultural automation, monitoring systems, and data analytics are integral to optimizing aeroponic systems, contributing to smart agriculture and resource efficiency. Root development and clonal propagation are also facilitated by aeroponics, making it an attractive choice for plant tissue culture and hydroponic growing. Urban agriculture solutions, such as urban greenhouse farming and building-based vertical farms, are key applications of vertical farming.

Regional Analysis

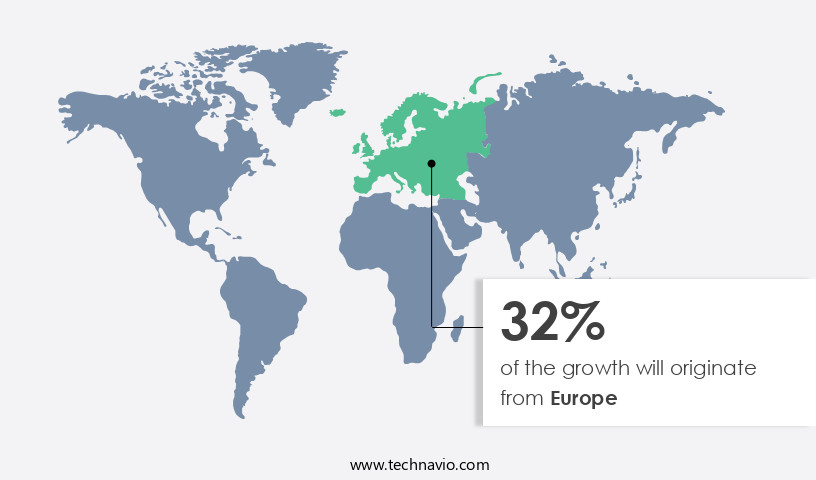

Europe is estimated to contribute 32% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European market is experiencing significant growth, driven by a focus on sustainable agriculture, food security, and technological innovation. Advanced agricultural infrastructure and research capabilities in countries like the Netherlands, Germany, and France are propelling the adoption of aeroponic systems. These countries prioritize water conservation, reduced pesticide usage, and efficient space utilization, all of which are key benefits of aeroponics. The European Union's supportive regulatory environment and funding for Agri-tech startups are also accelerating the deployment of aeroponic farms, particularly in urban and peri-urban areas where traditional farming is less feasible. Lighting systems, nutrient delivery, and irrigation control play crucial roles in optimizing plant growth, while precision agriculture and monitoring systems ensure crop health and yield. By utilizing advanced building modeling software, architectural design tools, and construction project management, vertical farming infrastructure can be designed and managed efficiently.

Academic institutions and venture capital investments contribute to research and development in plant tissue culture, clonal propagation, and disease control. Aeroponic systems, vertical farming, and hydroponic growing are transforming commercial farming, with fresh produce and resource efficiency at their core. Urban agriculture and smart agriculture further enhance the market's potential, as air pumps, data analytics, and misting systems address the unique challenges of controlled environment agriculture. The market's evolution underscores its potential to revolutionize crop production and food distribution, ensuring a sustainable and secure food supply.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Aeroponics market drivers leading to the rise in the adoption of Industry?

- The scarcity of arable land serves as the primary factor driving the agricultural market. Aeroponics, a cutting-edge nutrient delivery system in agriculture, is gaining traction due to its water conservation and space-saving benefits. Compared to traditional farming methods, aeroponics consumes 85%-90% less water, making it an attractive solution for farming in water-scarce regions. This cultivation technique enables high-quality crop production in minimal space, allowing for crop diversification and increased plant growth optimization. Organic farming practices are seamlessly integrated into aeroponics, eliminating the need for pesticides and resulting in null harmful waste. The global population's increasing demand for food and the limited habitable land pose significant challenges to food security. Aeroponic farming addresses these concerns by maximizing land utilization efficiency and reducing water consumption.

- Advancements in lighting systems, such as LED grow lights, and agricultural automation have further enhanced the potential of aeroponics. Sustainable agriculture and precision agriculture are key areas of focus, with greenhouse technology playing a crucial role in optimizing crop yields. These factors create significant investment opportunities in the market, making it an exciting space for businesses and entrepreneurs.

What are the Aeroponics market trends shaping the Industry?

- The increasing preference for vertical aeroponics farming technologies, which feature patented systems, represents a significant market trend. This advanced farming method is gaining popularity due to its efficiency and innovation. Aeroponics, a root development technique in controlled environment agriculture, is gaining traction in the global market due to its advantages in crop production. This method, which involves suspending plant roots in mist or nutrient solution, enables faster root growth and improved nutrient absorption. Aeroponics is particularly useful in clonal propagation, allowing for the mass production of genetically identical plants. Manufacturers in the market can differentiate themselves by offering patented systems and monitoring technologies. These advanced features ensure plant health monitoring and optimize crop production. Academic institutions and venture capital firms have shown interest in this technology due to its potential to increase yield and reduce water usage.

- AeroFarms, a leading player in the market, offers patented aeroponics technology with faster harvest cycles, food safety, and less environmental impact. Their smart aeroponics system consumes 95% less water than field farming and 40% less than hydroponics. This innovative technology not only helps manufacturers stay competitive but also attracts end-users seeking enhanced performance and sustainability.

How does Aeroponics market faces challenges face during its growth?

- Aeroponics, a specialized hydroponic method with limited applications, poses a significant challenge to the industry's growth. This technique, which involves growing plants in air without soil, offers numerous benefits such as water conservation and increased nutrient absorption. However, its high implementation cost and limited scalability have hindered its widespread adoption, thereby impeding the industry's expansion. Aeroponics is an innovative farming technology that involves growing plants in air without the use of soil or traditional irrigation methods. This method allows for increased crop yields and efficient use of resources, making it an attractive option for seedling production and urban agriculture. Aeroponic systems provide precise irrigation control, enabling farmers to manage water and nutrient levels more effectively. Additionally, these systems offer improved pest management and disease control, ensuring healthier crops. The market for aeroponics is driven by the need for resource efficiency, smart agriculture, and research and development in the agricultural sector.

- While this technology is not suitable for all types of fruits and vegetables, it is ideal for growing select crops such as cucumbers, tomatoes, lettuce, strawberries, herbs, and some varieties of fruits. This technology's adoption is expected to increase as farmers seek to optimize their operations and increase profitability. However, for crops such as wheat, barley, corn, and rice, traditional farming methods remain the preferred choice. Overall, aeroponics represents an exciting development in agriculture, offering the potential for increased yields, resource efficiency, and improved crop health.

Exclusive Customer Landscape

The aeroponics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the aeroponics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, aeroponics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AeroFarms LLC - The company specializes in advanced agricultural technology, providing aeroponic solutions for the cultivation of kale and arugula through its proprietary FlavorSpectrum system.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AeroFarms LLC

- Aessense Corp.

- AgriHouse Brands Ltd.

- Barton Breeze Pvt. Ltd.

- Bifarm Tech Inc.

- CleanGreens Solutions SA

- Eden Grow Systems

- Evergreen Farm Oy

- Freight Farms Inc.

- Good Life Growing

- Hexagro Urban Farming Srl

- LettUs Grow Ltd.

- Living Greens Farm Inc.

- Neofarms GmbH

- The Scotts Miracle Gro Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Aeroponics Market

- In February 2024, Bright Agrotech, a leading aeroponics technology company, unveiled their new commercial-scale aeroponics system, the Raft system, designed to increase crop yields by up to 30% compared to traditional hydroponic systems (Bright Agrotech Press Release). This technological advancement signifies a significant shift towards more efficient and productive cultivation methods in the market.

- In October 2024, AeroFarms, a global aeroponics leader, secured a USD200 million investment from a consortium of leading investors, including Siemens AG and Mitsui & Co., to expand their production capacity and enter new markets (AeroFarms Press Release). This substantial funding round represents a major boost for the market, signaling increased investor confidence and market potential.

- In March 2025, the European Union approved the use of aeroponics technology for large-scale commercial agriculture, marking a significant regulatory milestone for the industry (European Commission Press Release). This approval opens up new opportunities for aeroponics companies to expand their operations in Europe and tap into the vast potential of the European market.

Research Analyst Overview

The market continues to evolve, with dynamic market activities shaping the industry's landscape. Nutrient delivery systems, an integral part of aeroponic technology, facilitate optimal plant growth by delivering essential nutrients directly to plant roots in a mist or fine spray. Organic farming applications are on the rise, as aeroponics offers a controlled environment for organic crop production. Lighting systems, including LED grow lights, play a crucial role in optimizing plant growth, ensuring consistent crop yields and uniform vegetative development. Crop diversification is a growing trend, with aeroponics enabling the cultivation of various plant species, from leafy greens to fruits and flowers.

Agricultural automation, including irrigation control and pest management, enhances resource efficiency and reduces labor costs. Sustainable agriculture and precision agriculture are key focus areas, with aeroponics offering water conservation and controlled environment agriculture solutions. Venture capital investment and research and development are driving innovation in the market, with academic institutions and plant tissue culture facilities contributing to advancements in plant growth optimization and seedling production. Plant health monitoring systems and disease control measures ensure high-quality produce, while smart agriculture and data analytics enable real-time crop management. Urban agriculture and vertical farming are gaining popularity, offering solutions for food security and fresh produce distribution in densely populated areas.

Aeroponics offers a sustainable and resource-efficient alternative to traditional farming methods, making it an attractive investment opportunity for commercial farming operations. The ongoing integration of aeroponic systems into various sectors, from hydroponic growing to post-harvest handling and supply chain management, continues to shape the market's future. The evolving patterns in the market reflect its continuous growth and adaptability to meet the changing needs of agriculture and food production.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Aeroponics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 26.5% |

|

Market growth 2025-2029 |

USD 5.35 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

25.8 |

|

Key countries |

US, The Netherlands, Japan, China, Canada, UK, India, Germany, France, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Aeroponics Market Research and Growth Report?

- CAGR of the Aeroponics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the aeroponics market growth of industry companies

We can help! Our analysts can customize this aeroponics market research report to meet your requirements.