Indoor Farming Technologies Market Size 2024-2028

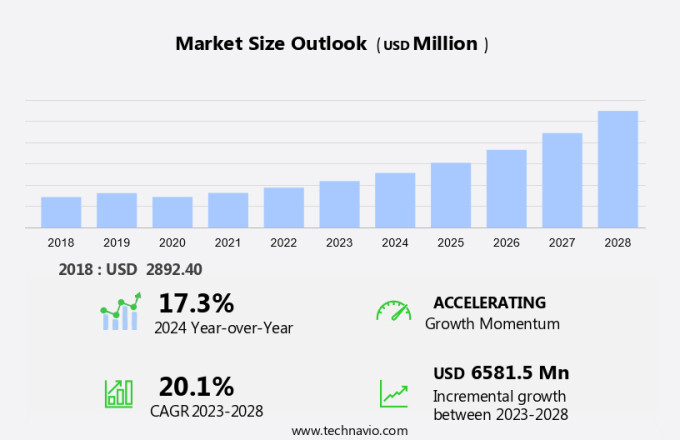

The indoor farming technologies market size is forecast to increase by USD 6.58 billion, at a CAGR of 20.1% between 2023 and 2028.

- Indoor farming technologies, including aquaponics and aeroponics, have gained significant traction due to the pressing need to improve crop yield and reduce wastage, particularly in the context of increasing food security concerns. This trend is driven by the potential for year-round production and controlled environmental conditions, which can lead to higher crop yields and improved product quality. However, the adoption of indoor farming technologies faces challenges, most notably the high energy consumption required for artificial lighting. This issue, which can significantly increase operational costs, necessitates the development of more energy-efficient lighting solutions.

- Effective management of these challenges will be crucial for companies seeking to capitalize on the opportunities presented by the indoor farming market. By focusing on innovations in energy-efficient lighting and optimizing operational processes, businesses can navigate these challenges and drive growth in this dynamic and evolving market.

What will be the Size of the Indoor Farming Technologies Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

Indoor farming technologies continue to evolve, shaping the agricultural landscape with innovative solutions that address food security, investment opportunities, and sustainable practices. Modular farming units and vertical farming systems, such as stackable growing structures, are gaining traction in urban areas due to their efficiency and reduced water usage. Precision agriculture techniques, including automated irrigation and climate monitoring, optimize crop yields and reduce environmental impact. Plant growth regulators and nutrient solutions enhance crop health and productivity, while pest control methods employ artificial intelligence and machine learning for disease management. Food safety is ensured through controlled environments, and LED grow lights provide energy-efficient light sources.

Vertical farming startups are revolutionizing the industry with advanced designs and data analytics, focusing on yield optimization and labor efficiency. Sustainable farming practices, such as crop rotation and water conservation, are integrated into these systems. Organic farming methods are also being explored, expanding the market's reach. Indoor farming technologies offer significant investment opportunities, with potential for high returns on investment and continuous market penetration. The integration of environmental controls and energy efficiency further solidifies their role in the future of agriculture. Microgreen production and plant phenotyping are additional applications that contribute to the sector's growth and diversity.

How is this Indoor Farming Technologies Industry segmented?

The indoor farming technologies industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Greenhouse farming

- Vertical farming

- Hydroponics

- Aeroponics

- Aquaponics

- Component

- Hardware (LED Grow Lights, HVAC Systems, Irrigation Systems, Sensors)

- Software (Farm Management Software, AI and Automation)

- Crop Type

- Fruits & Vegetables

- Herbs & Microgreens

- Flowers & Ornamentals

- Cannabis

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

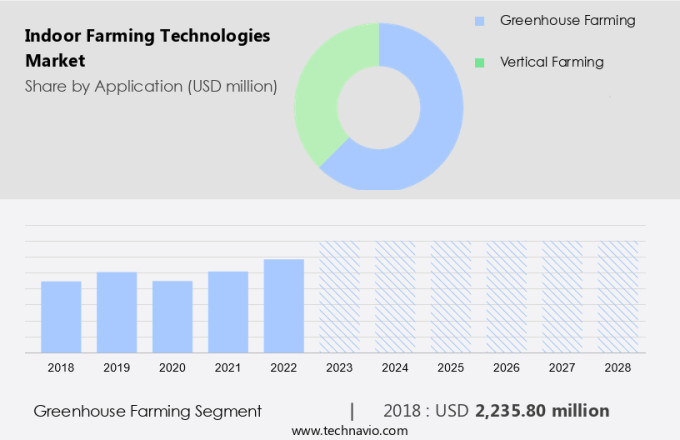

The greenhouse farming segment is estimated to witness significant growth during the forecast period.

Indoor farming technologies have gained significant traction in the agriculture industry, driven by the increasing need for sustainable, efficient, and secure food production. Precision agriculture, a key component of this market, leverages data analytics and automation to optimize crop growth and yield. Consumer demand for fresh, locally grown produce, particularly leafy greens, fuels the adoption of indoor farming systems, including modular farming units and vertical farming. Cost analysis and energy efficiency are critical considerations for indoor farming, with LED grow lights and environmental controls playing essential roles. Water conservation is another significant benefit, especially in urban agriculture and arid regions.

Indoor farming also offers advantages in pest control, automated irrigation, and disease management through climate monitoring and artificial intelligence. Investment opportunities abound in this sector, with vertical farming startups and organic farming gaining popularity. Sustainable farming practices, such as crop rotation and nutrient solutions, further enhance the market's appeal. Machine learning and data analytics facilitate yield optimization and plant phenotyping, while plant growth regulators ensure consistent, high-quality produce. Market penetration for indoor farming technologies continues to expand, with market leaders focusing on energy efficiency, return on investment, and microgreen production. The integration of these technologies in greenhouse farming enhances food security and offers a harmonious balance between labor efficiency and climate control.

The Greenhouse farming segment was valued at USD 2.24 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

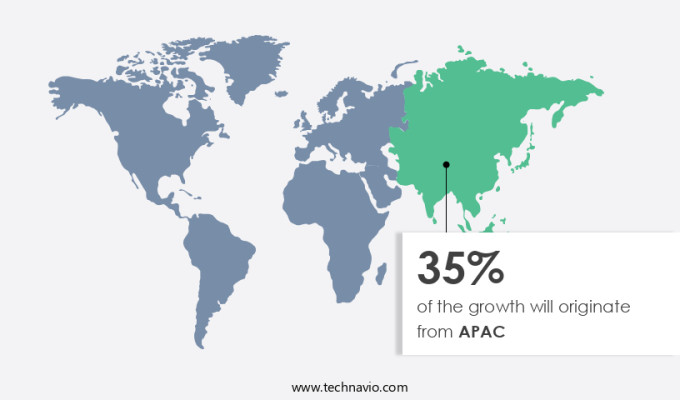

APAC is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Indoor farming technologies have gained significant traction in the European Union (EU) as farmers seek sustainable alternatives to traditional outdoor farming methods. With increasing concerns over surface pollution, groundwater issues, loss of biodiversity, soil erosion, and health risks associated with insecticides, indoor farming is becoming an attractive solution. Moreover, the need for food security due to population growth is another driving factor. The Netherlands, France, Germany, Spain, and the UK are key countries in the EU the market. Precision agriculture and modular farming units are integral to this trend, allowing for cost analysis, crop rotation, and water conservation.

Urban agriculture is also gaining popularity, with indoor growing systems providing food security in densely populated areas. Pest control, automated irrigation, and climate monitoring are essential components of these systems, ensuring food safety and disease management. Sustainable farming practices, such as LED grow lights, environmental controls, and labor efficiency, are increasingly adopted in indoor farming. Vertical farming startups and plant phenotyping have revolutionized yield optimization, while organic farming and machine learning enable data analytics and energy efficiency. Nutrient solutions and controlled environment agriculture further enhance crop production. Investment opportunities abound in this sector, with plant growth regulators, yield optimization, and market penetration being key areas of focus.

Artificial intelligence and vertical farm design play a crucial role in optimizing operations and reducing costs. As the indoor farming market continues to evolve, it offers significant potential for return on investment, particularly in microgreen production.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Indoor farming technologies have revolutionized agriculture, enabling the production of fresh, locally grown produce year-round. These advanced systems utilize hydroponics, aeroponics, and vertical farming techniques to optimize resource usage and maximize crop yield. LED lighting, temperature and humidity control, and automated irrigation systems ensure ideal growing conditions. Sensors monitor plant health and nutrient levels, while precision farming software allows for real-time data analysis. Indoor farming also reduces water usage and eliminates the need for harmful pesticides, making it an eco-friendly alternative. With urbanization and population growth, this market is poised for significant expansion, offering opportunities for tech innovations and sustainable agriculture solutions. The future of indoor farming is bright, with continued advancements in automation, energy efficiency, and crop diversity.

What are the key market drivers leading to the rise in the adoption of Indoor Farming Technologies Industry?

- The market growth is driven by the need to enhance crop yields in urban settings, which is achievable through various indoor farming technologies.

- To enhance agricultural productivity and minimize crop losses, there is a pressing need in the market to improve crop yields and reduce wastage. Indoor farming, also known as controlled environment agriculture, has gained significant traction in both small and large-scale commercial production. This farming method is particularly popular in urban areas where land availability is limited. In such environments, indoor farming plays a crucial role in augmenting local food supplies and ensuring access to fresh produce for communities. Compared to traditional outdoor farming, indoor farming enables the production of greater crop yields in a smaller area.

- For instance, Sky Greens' patented vertical farming system can intensify land use and yield up to ten times more produce per unit area compared to monolayer farms. This technology, along with others, contributes to the growth of the global indoor farming market. The use of advanced technologies such as hydroponics, aeroponics, and LED lighting systems allows for optimal crop growth conditions, resulting in higher yields and improved product quality. Overall, the indoor farming market is poised for growth due to its ability to address the challenges of land scarcity and the demand for locally grown, fresh produce in urban areas.

What are the market trends shaping the Indoor Farming Technologies Industry?

- The requirement for food security is becoming increasingly more significant in today's market. A trend that is both noteworthy and essential for professionals to acknowledge.

- Indoor farming technologies have gained significant traction in response to increasing consumer demand for locally grown, fresh produce and the need for food security, particularly in urban areas. Precision agriculture techniques, such as modular farming units and automated irrigation systems, enable efficient use of resources, including water conservation and effective pest control. Indoor farming offers several advantages, including the ability to practice crop rotation year-round, reducing the environmental impact of transportation, and minimizing the use of synthetic fertilizers and pesticides.

- The cost analysis of indoor farming is favorable due to controlled growing conditions and reduced reliance on external factors. Urban agriculture initiatives have further fueled the growth of indoor farming, providing opportunities for local food production and community engagement. Overall, indoor farming technologies offer a harmonious solution to address food security challenges, while also promoting sustainable agricultural practices.

What challenges does the Indoor Farming Technologies Industry face during its growth?

- The growth of the industry is significantly impacted by the complexities and intricacies of implementing artificial lighting as an alternative to natural light.

- Indoor farming technologies, which utilize controlled environments for plant growth, present significant opportunities for food security and sustainable farming. These systems employ advanced technologies such as plant growth regulators, artificial intelligence, climate monitoring, and disease management to optimize plant growth and ensure food safety. However, one challenge is the use of indoor growing systems with LED lighting, which may not efficiently deliver the necessary light for plant growth and can result in high electricity bills. While indoor LED lights have advanced to mimic sunlight, they cannot fully replicate the emission wavelength of natural sunlight.

- Despite this limitation, the indoor farming market continues to grow, driven by the need for year-round production, reduced water usage, and increased crop yields. Investors are taking notice of this trend, recognizing the potential for profitable returns in this dynamic industry.

Exclusive Customer Landscape

The indoor farming technologies market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the indoor farming technologies market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, indoor farming technologies market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AeroFarms - The company specializes in advanced indoor farming technologies, including the innovative Raging Kale 2.0 system. This cutting-edge solution optimizes plant growth through precise environmental control and efficient resource utilization.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AeroFarms

- Agri-Sense

- Bowery Farming

- BrightFarms

- Freight Farms

- Gotham Greens

- Green Sense Farms LLC

- Infarm

- Lettuce Grow

- Local Bounti Corporation

- Netafim (Orbia)

- Plenty Unlimited Inc.

- Priva

- Sananbio

- Signify Holding

- Superior Fresh

- Vertical Harvest

- Village Farms International, Inc.

- Voelker Equipment

- ZipGrow Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Indoor Farming Technologies Market

- In January 2024, Plenty, a leading indoor farming company, announced the launch of its new hydroponic farming system, the 'Harvest Cube,' designed to increase yield by 30% and reduce water usage by 90% compared to traditional farming methods (Plenty Press Release).

- In March 2024, BrightFarms, a leading vertical farming company, entered into a strategic partnership with Walmart, the world's largest retailer, to expand its supply chain and increase the availability of locally grown produce in Walmart stores (Walmart Press Release).

- In May 2024, Infarm, a German urban farming startup, raised a USD200 million Series D funding round, bringing its total funding to over USD370 million, to expand its operations and further develop its vertical farming technology (Infarm Press Release).

- In February 2025, the European Union approved the use of hydroponic and aeroponic farming methods under its Organic Farming Regulation, paving the way for the adoption of indoor farming technologies in the European organic farming sector (European Commission Press Release).

Research Analyst Overview

- Indoor farming technologies have gained significant traction in the global market, with yield forecasting and precision farming tools playing crucial roles in optimizing crop production. Indoor climate control, achieved through advanced HVAC systems and LED lighting technology, ensures consistent growing conditions. Vertical farming economics are shaped by factors such as energy management, water recycling, and urban farming regulations. Growth monitoring through plant sensors and genetic modification enable farmers to optimize nutrient intake and improve crop health. Smart agriculture, including automated harvesting and hydroponic nutrient systems, streamlines operations and enhances sustainability assessments. Urban farming projects utilizing aeroponic towers, nutrient film technique, and cultivation chambers are transforming food distribution in densely populated areas.

- Vertical farm development relies on seed selection, plant breeding, and vertical farming infrastructure to maximize space utilization and consumer acceptance. Local sourcing and sustainable practices further boost the market's appeal. Indoor farming research continues to advance, driving innovation in areas like air filtration and urban farming projects.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Indoor Farming Technologies Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

136 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.1% |

|

Market growth 2024-2028 |

USD 6581.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

17.3 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Indoor Farming Technologies Market Research and Growth Report?

- CAGR of the Indoor Farming Technologies industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the indoor farming technologies market growth of industry companies

We can help! Our analysts can customize this indoor farming technologies market research report to meet your requirements.