Africa HIV Treatment Drugs Market Size 2024-2028

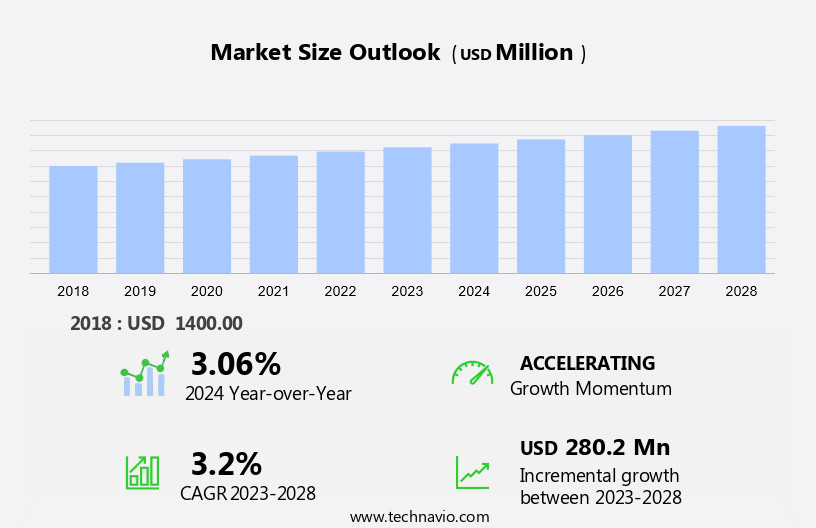

The Africa HIV treatment drugs market size is forecast to increase by USD 280.2 million at a CAGR of 3.2% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. The rising prevalence of sexually transmitted diseases (STDs) and the increasing awareness efforts by various organizations are major drivers of market expansion. The market is experiencing significant growth, with the increasing availability of generic drugs making treatment more accessible, while travel and global mobility further drive demand for portable and affordable treatment options. However, challenges persist, including the lack of HIV diagnosis and limited access to modern medication. These issues, while daunting, present opportunities for innovation and collaboration among stakeholders to improve HIV treatment and care in Africa. The market is expected to continue growing as efforts to address these challenges intensify and access to treatment becomes more widespread.

What will be the size of the Africa HIV Treatment Drugs Market during the forecast period?

- The market represents a significant and growing sector within the global healthcare industry. Factors contributing to the HIV infection rates include biological, social, behavioral, cultural, economic, and structural factors. Despite these challenges, there is a rising investment in HIV treatment in Africa, driven by both public and private sectors. Pricing remains a critical factor In the market, with affordability being a key consideration for companies and patients alike. Competition among companies is intense, with companies offering various promotional strategies to gain market share.

- Research reports suggest that the use of telemedicine and mobile health technologies, including mobile phones, is becoming increasingly prevalent in HIV diagnosis and treatment in Africa. Qualitative and quantitative research conducted by report analysts indicates that HIV transmission can be mitigated through a combination of prevention efforts, early diagnosis, and effective treatment. company selection is a crucial aspect of the market, with buyers prioritizing factors such as drug efficacy, safety, and affordability. Overall, the market is expected to continue growing, driven by the increasing number of HIV cases and the ongoing efforts and healthcare services to improve access to treatment and care.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Drug Class

- Reverse transcriptase inhibitors

- Protease inhibitors

- Integrase inhibitors

- Fusion inhibitors

- Coreceptor antagonists

- Route Of Administration

- Oral drugs

- Injectable drugs

- Geography

- Africa

- South Africa

- Nigeria

- Kenya

- Africa

By Drug Class Insights

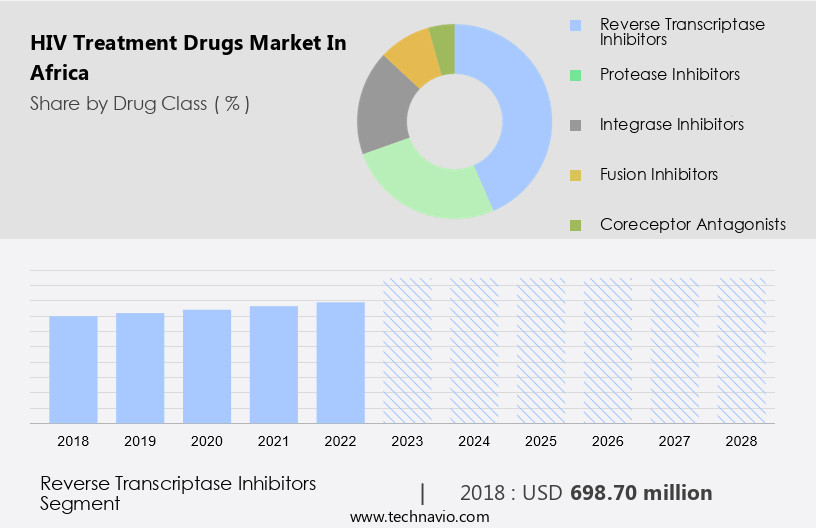

- The reverse transcriptase inhibitors segment is estimated to witness significant growth during the forecast period.

Reverse transcriptase inhibitors (RTIs), a crucial class of antiretroviral drugs, are used for managing HIV infection. Classified into nucleoside reverse transcriptase inhibitors (NRTIs) and non-nucleoside reverse transcriptase inhibitors (NNRTIs), these drugs inhibit the reverse transcriptase enzyme, preventing HIV replication. NRTIs, such as tenofovir and zidovudine, and NNRTIs, including efavirenz and nevirapine, dominate the market due to their widespread availability and use in antiretroviral therapy. Factors like a growing number of HIV cases, increasing R&D activities, and high consumption of NNRTIs among children and adults contribute to the market's growth. However, challenges like drug resistance, toxicity, and daily administration hinder market expansion.

Some other antiviral drugs used in combination therapy include abacavir, lamivudine, and cabotegravir. The HIV medications market in Africa is expected to experience significant growth due to the high prevalence of HIV and STDs, rising awareness, investments in healthcare, and emerging opportunities in remote and underserved areas. The market's success relies on factors like healthcare infrastructure, treatment coverage, and innovative treatment strategies. Telemedicine, mobile health, and internet connectivity play a vital role in addressing geographical distance, transportation costs, and healthcare workforce shortages.

Get a glance at the market share of various segments Request Free Sample

The reverse transcriptase inhibitors segment was valued at USD 698.70 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Africa HIV Treatment Drugs Market?

The increasing prevalence of STDs is the key driver of the market.

- HIV/AIDS, a type of Sexually Transmitted Disease (STDs), is a significant health concern, particularly in Sub-Saharan Africa, where it holds the highest yearly incidence compared to other regions. The prevalence of STDs, including HIV, is increasing the demand for early screening, diagnosis, and treatment. companies In the HIV drug market are responding by offering a diverse range of medications to combat this disease. The market dynamics are influenced by various factors, including biological, social, behavioral, cultural, economic, and structural factors that contribute to HIV infection rates and transmission. HIV medications are essential for managing the disease and improving health outcomes.

- Companies are investing in research and development to introduce innovative treatment strategies and long-acting HIV drugs like cabotegravir. Investments in healthcare infrastructure, including clinics and pharmacies, are crucial in addressing the HIV epidemic, especially in remote and underserved areas. Telemedicine services, mobile health, and mobile phones have emerged as potential solutions to bridge geographical distance and transportation costs, ensuring medication adherence and providing counseling services. However, challenges such as healthcare workforce shortages, rising awareness, and increasing investments in healthcare infrastructure present both opportunities and risks for companies. The private sector's role in research and development and treatment coverage is vital in addressing the HIV epidemic.

What are the market trends shaping the Africa HIV Treatment Drugs Market?

An increase in awareness by various organizations is the upcoming trend In the market.

- The market is witnessing significant growth due to the rising prevalence of HIV cases and increasing investments in healthcare infrastructure. According to research reports, biological, social, behavioral, cultural, and economic factors contribute to the spread of HIV infection in Africa. Governments and international organizations are taking initiatives to address this issue through research and development of new HIV medications, promotion of prevention methods, and expansion of treatment coverage in underserved areas. Companies are investing in the production of HIV medications, including long-acting HIV drugs such as cabotegravir. The market dynamics include competition among companies, pricing strategies, and supply chain management in remote and rural areas.

- Telemedicine services, mobile health, and internet connectivity are emerging opportunities for improving medication adherence, counseling services, and remote consultations. However, geographical distance, transportation costs, healthcare workforce availability, and healthcare infrastructure are potential challenges. Investments in healthcare and rising awareness of HIV transmission have led to an increase in treatment coverage in clinics and pharmacies. Innovation in HIV treatment strategies and the private sector's role in research and development are also contributing to market growth. Despite these opportunities, risks such as economic and structural factors, HIV infection rates, and HIV transmission continue to pose challenges. Overall, the HIV drug market in Africa is an essential area for businesses looking to make a positive impact on public health.

What challenges does Africa HIV Treatment Drugs Market face during the growth?

Lack of diagnosis of HIV and access to modern medication is a key challenge affecting the market growth.

- In Africa, the market is characterized by several market dynamics. One of the significant challenges is the low HIV diagnosis rates due to social and economic barriers. Many individuals are diagnosed with HIV for the first time after experiencing seizures, which can be attributed to the fear of testing positive and the reliance on older antiepileptic drugs for seizure management, hindering the effectiveness of HIV treatments. The prevalence of sexually transmitted diseases (STDs) and the high HIV infection rates necessitate substantial investments in healthcare infrastructure, including clinics and supply chains, to ensure adequate treatment coverage, particularly in remote and underserved areas.

- company selection for HIV medications is a critical consideration, with factors such as pricing, competition, promotions, and research reports influencing decisions. Research reports indicate that biological, social, behavioral, cultural, economic, and structural factors contribute to HIV transmission. Innovations in HIV medications, such as long-acting HIV drugs like cabotegravir, are promising solutions to improve medication adherence and health outcomes. Rising awareness and investments in healthcare have led to the emergence of telemedicine services, mobile health, and mobile phones as essential tools for remote consultations, counseling services, and medication adherence. However, challenges remain, including geographical distance, transportation costs, healthcare workforce availability, and healthcare infrastructure limitations in rural areas.

Exclusive Africa HIV Treatment Drugs Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- AbbVie Inc.

- Alpha Pharma

- Aspen Pharmacare Holdings Ltd.

- AstraZeneca Plc

- Aurobindo Pharma Ltd.

- Avacare Health

- Boehringer Ingelheim International GmbH

- Cipla Inc.

- F. Hoffmann La Roche Ltd.

- Gilead Sciences Inc.

- GlaxoSmithKline Plc

- Hetero Labs Ltd.

- Johnson and Johnson Services Inc.

- Merck and Co. Inc.

- SSI Diagnostica AS

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Theratechnologies Inc.

- Viatris Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market in Africa is a significant and growing sector within the continent's healthcare industry. This market is driven by various factors, including the high prevalence of HIV infections and the increasing investments in healthcare infrastructure. The HIV drug market in Africa is characterized by a diverse range of players, including multinational pharmaceutical companies and local manufacturers. These entities offer a mix of branded and generic HIV medications, catering to the varying needs and budgets of healthcare providers and patients. The profitability of the HIV drug market in Africa is influenced by several factors. Pricing plays a crucial role, with competition among companies leading to price reductions for both branded and generic HIV drugs.

However, the cost of HIV medications remains a challenge for many healthcare systems and individuals in Africa, particularly in underserved areas. Research and development efforts are ongoing to address the unique challenges of treating HIV in Africa. For instance, there is a growing interest in long-acting HIV drugs, such as Cabotegravir, which offer the potential for improved medication adherence and reduced healthcare costs. The HIV drug market in Africa is also influenced by various market dynamics. The prevalence of sexually transmitted diseases (STDs) and other biological, social, behavioral, cultural, economic, and structural factors contribute to the high HIV infection rates In the region.

Furthermore, rising awareness and education campaigns, as well as increasing investments in healthcare, are helping to mitigate these factors and improve health outcomes. Telemedicine and mobile health technologies are emerging opportunities for improving HIV treatment and care in Africa. Telemedicine services, such as remote consultations and medication adherence counseling, can help overcome geographical distance and transportation costs. Mobile phones and internet connectivity are becoming increasingly accessible, making it easier for patients to access telemedicine services and receive timely care. The HIV drug market in Africa is not without its challenges, however. Healthcare infrastructure, including hospitals and pharmacies, remains inadequate in many areas, particularly in rural and remote regions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.2% |

|

Market Growth 2024-2028 |

USD 280.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.06 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch