Agricultural Pesticides Market Size 2025-2029

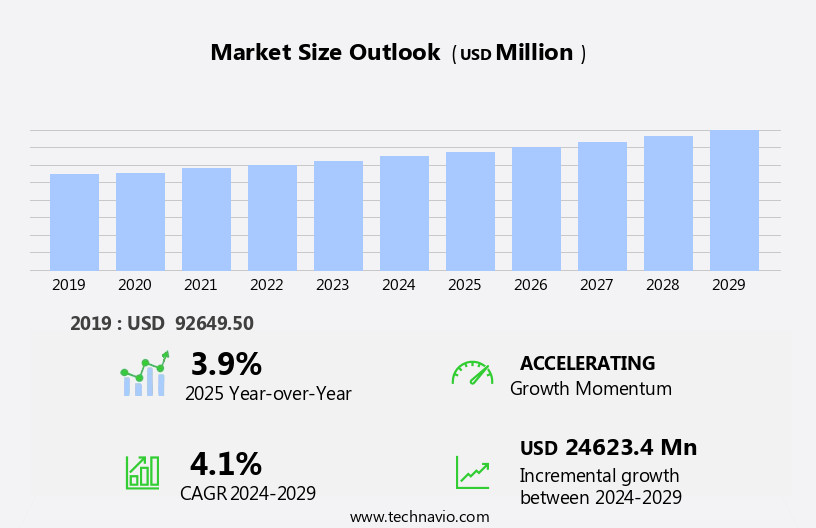

The agricultural pesticides market size is forecast to increase by USD 24.62 billion at a CAGR of 4.1% between 2024 and 2029.

- The market is experiencing significant growth due to several key trends. The increased use of herbicides is a major factor driving market expansion, as farmers seek to enhance crop yields and protect their crops from pests and weeds. Additionally, the continuous launch of new pesticide products is contributing to market growth. These pesticides include herbicides, insecticides, fungicides, acaricides, bactericides, and other pest control agents.

- However, the regulatory environment poses a challenge for market participants. Farmers continue to seek effective and sustainable pesticide solutions to maintain yields and ensure the production of fresh fruits and vegetables and other agricultural products. Strict regulations regarding the use of agricultural pesticides, particularly those with potential health and environmental risks, are increasing. Producers must comply with these regulations to maintain market access and mitigate potential legal and reputational risks. Overall, the market is expected to continue its growth trajectory, with a focus on innovation and regulatory compliance.

What will be the Size of the Agricultural Pesticides Market During the Forecast Period?

- The market encompasses a range of products used by farmers to manage pests, weeds, fungi, insects, and other organisms that threaten the health and productivity of plants. The market is driven by the need to protect cash crops and export products from damage caused by local pest species.

- However, the rise of organic food production and increasing concerns over pesticide resistance have led to growing demand for non-insecticidal and alternative pest management solutions. Farmers continue to seek effective and sustainable pesticide solutions to maintain yields and ensure the production of fresh fruits and vegetables and other agricultural products. Despite these challenges, the market is expected to grow due to the ongoing demand for food production and the need to mitigate losses from pests and diseases.

How is this Agricultural Pesticides Industry segmented and which is the largest segment?

The agricultural pesticides industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Herbicides

- Insecticides

- Fungicides and bactericides

- Others

- Product

- Synthetic pesticides

- Biopesticides

- Geography

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Argentina

- Europe

- Germany

- UK

- France

- North America

- US

- Middle East and Africa

- APAC

By Type Insights

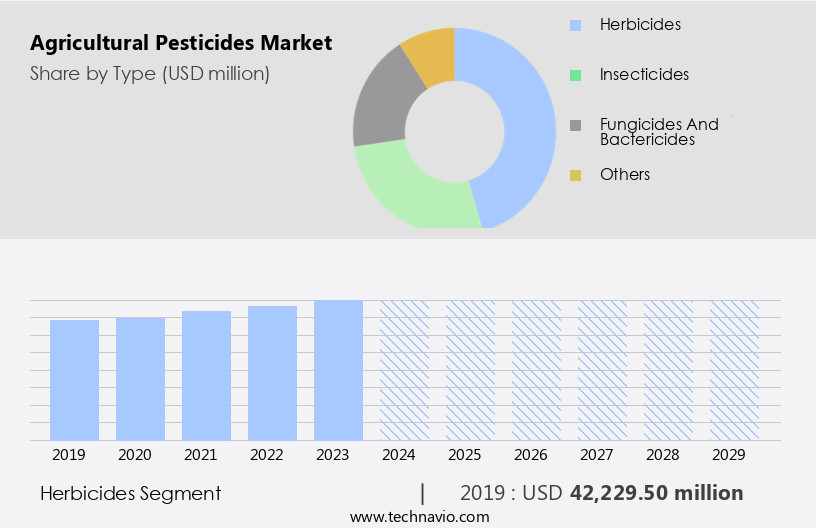

The herbicides segment is estimated to witness significant growth during the forecast period. The market encompasses a range of products used for managing pests, weeds, fungi, and insects in plants and crops. Herbicides, a significant segment, are employed to eradicate unwanted weeds and herbs, preserving crop yield. Notable herbicides include glyphosate, bio-herbicides, 2,4-D, paraquat, acetochlor, and atrazine. Glyphosate, a widely used herbicide, is available in gel and powder forms. However, herbicide resistance among pests and crops poses a significant challenge to market growth. This resistance is observed in various pests, including weeds, fungi, insects, and even nematodes. Other pesticide categories include insecticides, fungicides, nematicides, and rodenticides. Organic food production and modern farming techniques, including intensive farming and precision agriculture, also influence market dynamics. Climatic conditions, fluctuations, and irregular rainfall impact crop production and pest management strategies. Pesticide resistance, local pest species, and regulations governing the use of agrochemicals are key factors shaping the market landscape.

Get a glance at the share of various segments. Request Free Sample

The herbicides segment was valued at USD 42.23 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

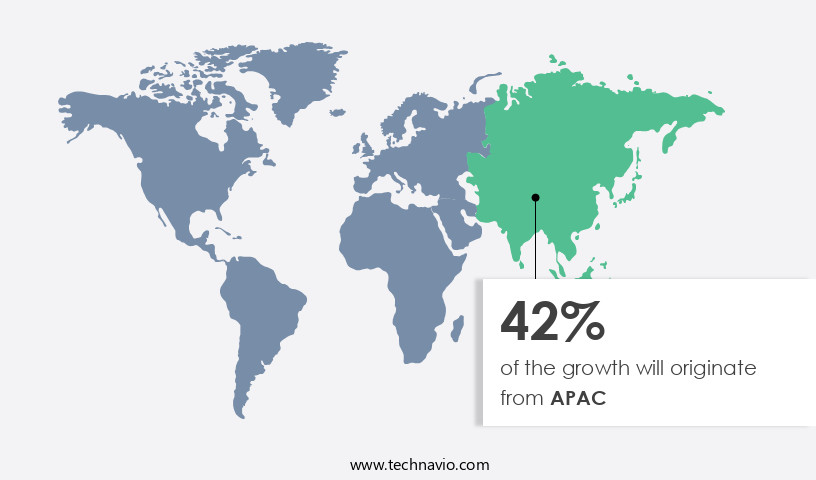

APAC is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC experiences significant growth due to the expanding agricultural sector and increasing population. With approximately 30% of the world's arable land and nearly 60% of the global human population, APAC is the leading consumer of pesticides. The market expansion is fueled by the adoption of modern farming techniques and intensive farming practices, which require the use of agrochemicals such as insecticides, herbicides, and fungicides and fertilizers for effective pest management and crop management. Despite the farming community's slow adoption of new technologies, the integration of modern farming methods will boost the demand for agricultural pesticides In the region. Key pests, weeds, plants, fungi, insects, and other organisms pose significant challenges to crop production, necessitating the use of pesticides.

Market Dynamics

Our agricultural pesticides market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Agricultural Pesticides Industry?

Increased use of herbicides is the key driver of the market.

- The market encompasses a range of products used to manage pests, weeds, fungi, and insects in plants. These include insecticides, herbicides, fungicides, nematicides, acaricides, bactericides, defoliants and desiccants, fumigants, larvicides, molluscicides, nematicides, ovicides, rodenticides, silvicides, slimicides, repellants, and pest control agents. Farmers and horticulturists rely on these pesticides to ensure optimal crop production, particularly in intensive farming techniques and modern farming practices. However, the use of synthetic pesticides, such as chlorinated hydrocarbons and organic phosphates, has raised concerns regarding human health and environmental impact. As a result, there is a growing demand for organic food products and bio-pesticides. Toxicologists and other experts are exploring alternative solutions, such as nanotechnology, to develop more effective and eco-friendly pesticides.

- Moreover, climatic conditions, including climatic fluctuations and irregular rainfall, also impact crop management and the need for pesticide applications. Despite these challenges, the market continues to grow, driven by the demand for cash crops and export products. companies are investing in research and development to create new categories of pesticides, such as FMC's tetflupyrolimet herbicide launched in 2023. Overall, the market is a dynamic and complex industry that requires ongoing research, innovation, and regulation to ensure sustainable and effective crop management.

What are the market trends shaping the Agricultural Pesticides Industry?

Increasing product launches is the upcoming market trend.

- The market is experiencing significant growth due to the increasing threat of pests, weeds, fungi, and insects that pose a risk to plants and crops. These organisms can cause substantial damage to fresh vegetables, fruits, and cash crops, leading to decreased production and potential financial losses for farmers. To mitigate these issues, farmers are turning to a range of pesticides, including insecticides, herbicides, fungicides, and other crop solutions. Modern and intensive farming techniques have increased the demand for effective pesticides, as climatic conditions, such as irregular rainfall and climatic fluctuations, can exacerbate pest infestations. Pesticide resistance is another concern, leading farmers to seek out new and innovative pest management strategies.

- Furthermore, local pest species and the need to protect export products further drive the demand for effective pesticides. companies In the market are responding to these challenges by expanding their product portfolios. For instance, in March 2024, Adama Ltd. Launched Isocycloseram, a new insecticide that offers innovative control of pests. Other companies are developing non-insecticides, such as nematicides, molluscicides, and repellants, to address the growing demand for alternative pest control agents. The use of agricultural pesticides, however, raises concerns regarding human health and the environment. Toxicologists and horticulturists are working to develop safer alternatives, such as nanotechnology-based pesticides and organic pesticides.

What challenges does the Agricultural Pesticides Industry face during its growth?

Challenging regulatory environment is a key challenge affecting the industry growth.

- The market encompasses a range of products designed to manage Pests, Weeds, Fungi, and Insects that threaten the growth of Plants in various Farming areas. The market is influenced by modern and intensive farming techniques, climatic conditions, and crop management. Pesticide resistance and the emergence of Local pest species impact crop production, especially in Cash crops and Export products. The use of non-insecticides and Organic food products is on the rise among Farmers and Horticulturists due to concerns over Human health and Environmental impact.

- In addition, toxicologists and other experts are exploring alternatives, including Nanotechnology, to develop less harmful Pesticide solutions. Regulations, including the International Code of Conduct on the Distribution and Use of Pesticides, govern the agrochemical industry, limiting the use of certain products and driving the development of Bio-pesticides and other alternative solutions.

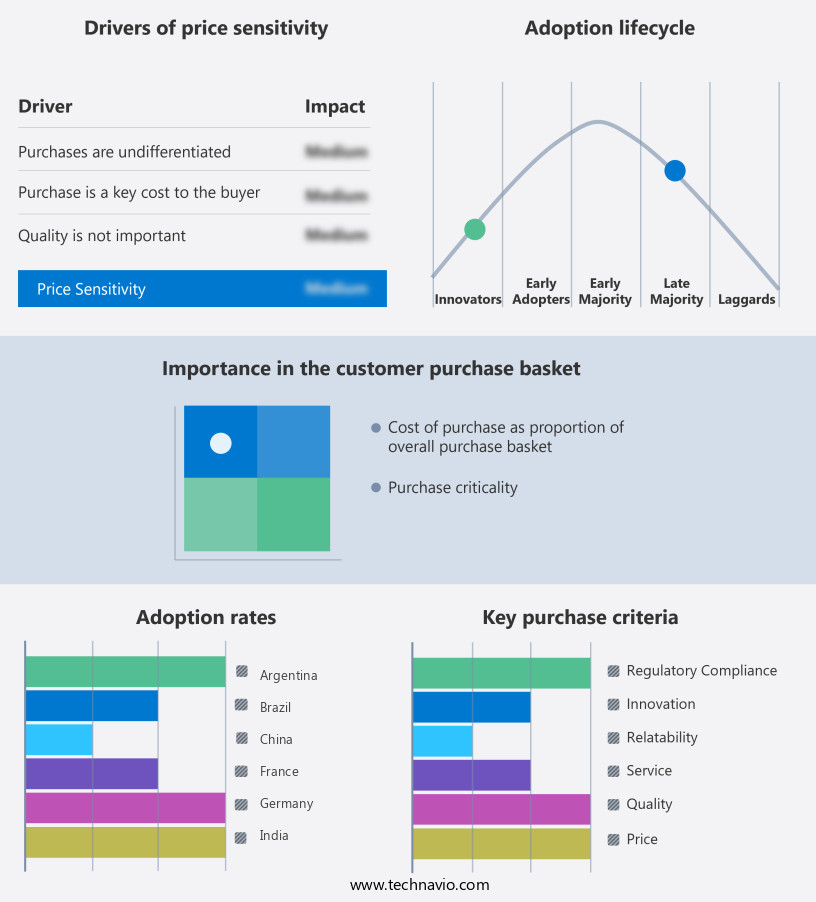

Exclusive Customer Landscape

The agricultural pesticides market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the agricultural pesticides market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, agricultural pesticides market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ADAMA Ltd. - The company offers agricultural pesticides such as Acemain.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BASF SE

- Bayer AG

- Corteva Inc.

- Cropnosys India Pvt. Ltd.

- FMC Corp.

- Isagro Spa

- NACL Industries Ltd.

- Nantong Jiangshan Agrochemical and Chemicals Ltd. Liability Co.

- Novozymes AS

- Nufarm Ltd.

- Shandong Weifang Rainbow Chemical Co. Ltd.

- Sichuan Fuhua Agricultural Investment Group

- Sinochem Group Co. Ltd.

- Sumitomo Chemical Co. Ltd.

- Syngenta Crop Protection AG

- UPL Ltd.

- Wynca Group

- Zuari Agro Chemicals Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a broad range of products utilized in managing various pests, weeds, fungi, and other organisms that threaten the productivity and quality of crops. These pesticides play a crucial role in modern farming techniques, enabling farmers to optimize crop production and mitigate the impact of climatic fluctuations and irregular rainfall. Pests, including insects, nematodes, and rodents, pose significant challenges to farmers, damaging crops and reducing yields. Fungi, too, can devastate crops, leading to substantial losses. Horticulturists and toxicologists have developed a diverse array of pesticides to address these issues. Insecticides, nematicides, molluscicides, and rodenticides are among the most commonly used pesticide types.

Moreover, insecticides target a wide range of insect pests, while nematicides combat nematodes, and molluscicides are used against mollusks. Rodenticides are designed to control rodent populations. Fungicides, on the other hand, are employed to protect crops from fungal diseases. Modern farming techniques, including intensive farming, have led to increased reliance on pesticides. However, the emergence of pesticide resistance among local pest species necessitates the development of new pest management strategies. The market is vast and diverse, with applications spanning various cash crops and export products. Fruits, vegetables, cereal, and plantation crops are among the primary beneficiaries of pesticide use.

Furthermore, pesticides are also employed In the production of organic food products, albeit in a more limited capacity due to stringent regulations. The use of pesticides extends beyond agriculture, with applications in various industries, including factories, homes, roadways, and infrastructure constructions. Arable land and crop land are the primary areas of application, with pesticides used during harvest and throughout the cropland's lifecycle. Despite their benefits, pesticides can pose risks to human health and the environment. Exposure to synthetic pesticides, such as chlorinated hydrocarbons and organic phosphates, can lead to health effects. Concerns regarding the impact of pesticides on the environment have led to the development of bio-pesticides and other alternative pest control agents.

In addition, regulations governing the use of pesticides are stringent, with laws in place to ensure their safe and responsible use. Organic farming and the production of organic foods have gained popularity as alternatives to conventional farming practices that rely heavily on synthetic pesticides. Therefore, the market plays a vital role in modern farming, enabling farmers to mitigate the impact of pests, weeds, and fungi on crop production. However, the potential risks to human health and the environment necessitate the continued development of alternative pest management strategies and the responsible use of pesticides.

|

Agricultural Pesticides Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

201 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.1% |

|

Market growth 2025-2029 |

USD 24.62 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.9 |

|

Key countries |

Brazil, US, China, Japan, Germany, India, South Korea, France, UK, and Argentina |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Agricultural Pesticides Market Research and Growth Report?

- CAGR of the Agricultural Pesticides industry during the forecast period

- Detailed information on factors that will drive the Agricultural Pesticides growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, South America, Europe, North America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the agricultural pesticides market growth of industry companies

We can help! Our analysts can customize this agricultural pesticides market research report to meet your requirements.