Air Filter Cartridges Market Size 2024-2028

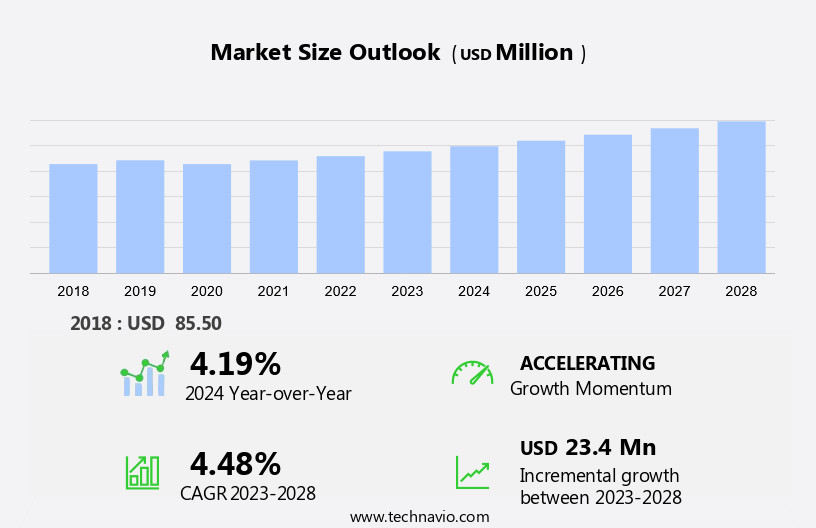

The air filter cartridges market size is forecast to increase by USD 23.4 million, at a CAGR of 4.48% between 2023 and 2028.

- The market is driven by the increasing demand for process and environment safety in various industries, particularly in nano-processing and semiconductor manufacturing plants. These industries require stringent air filtration systems to maintain optimal production conditions and ensure product quality. However, the market faces challenges from the availability of substitutes, which may limit the growth potential. Despite this, companies can capitalize on the market's dynamics by focusing on product innovation, enhancing filtration efficiency, and offering customized solutions to cater to specific industry requirements.

- Additionally, expanding into emerging markets and strengthening distribution networks can provide significant opportunities for market expansion. In summary, the market is characterized by a growing demand for air filtration solutions in safety-critical industries, while the availability of substitutes poses a significant challenge. Companies must focus on product differentiation and strategic expansion to capitalize on market opportunities and navigate challenges effectively.

What will be the Size of the Air Filter Cartridges Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in filtration technologies and increasing demand across various sectors. Odor control technology, for instance, is gaining traction in industrial applications, with absolute filter ratings becoming a key consideration for businesses seeking efficient and effective solutions. Maintenance cost reduction is another critical factor influencing market dynamics. Fiber media technology, such as cellulose and synthetic filter media, is increasingly being used due to their lower maintenance requirements and longer filter lifespan. Cleanroom air filtration, which demands high filtration efficiencies, is driving the adoption of HEPA filters with MERV ratings as high as 17. These filters can remove up to 99.97% of airborne contaminants, ensuring stringent air quality standards.

Moreover, filter clogging indicators, pressure drop measurement, and filter integrity testing are essential for optimizing filter performance and reducing energy consumption. For example, a leading manufacturing plant reported a 20% energy savings by implementing regular filter maintenance and replacement. Industry growth in air filter cartridges is expected to reach double-digit percentages in the coming years, fueled by the ongoing demand for improved air quality and energy efficiency. Additionally, the integration of advanced technologies like gas phase adsorption, electrostatic precipitation, and activated carbon adsorption is further expanding the market's potential applications.

How is this Air Filter Cartridges Industry segmented?

The air filter cartridges industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Industrial

- Commercial

- Residential

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

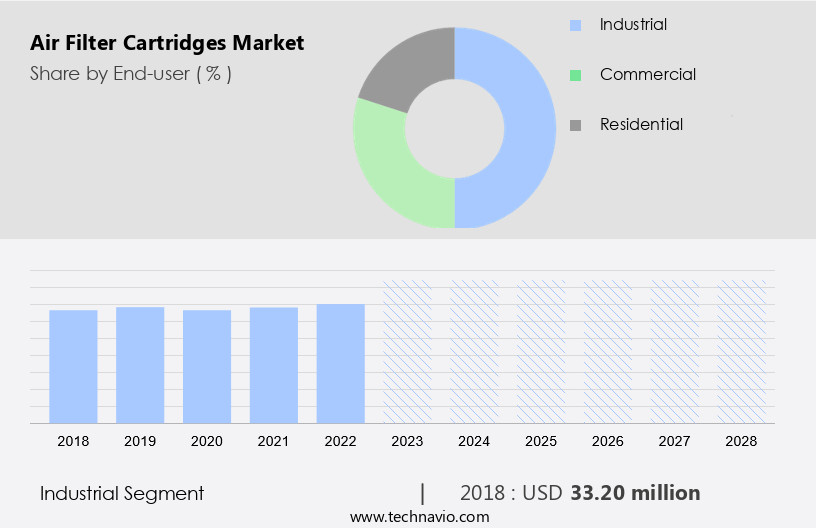

The industrial segment is estimated to witness significant growth during the forecast period.

Air filter cartridges play a crucial role in maintaining air quality in various industries, including cement, metals, paper and pulp, and textile. In cement production, large quantities of dust particles are generated during the crushing of raw materials, necessitating the use of effective air filtration systems. Similarly, textile manufacturing processes such as spinning, weaving, dyeing, printing, and finishing produce significant amounts of cotton dust, which can be detrimental to worker health and product quality if not properly controlled. Advancements in filter technology have led to innovations such as odor control technology, absolute filter ratings, and fiber media technology, which enhance the efficiency of airborne contaminant removal.

These improvements contribute to maintenance cost reduction, making air filter cartridges a cost-effective solution for industries. Cleanroom air filtration is another application of air filter cartridges, where high-efficiency particulate air (HEPA) filters are used to maintain stringent cleanliness standards. HEPA filters have an efficiency rating of 99.97% for particles larger than 0.3 microns. Moreover, air filter cartridges are essential in applications requiring chemical vapor filtration and gas phase adsorption. For instance, in the semiconductor industry, activated carbon adsorption is used to remove volatile organic compounds (VOCs) and other harmful gases from the air. Filter media lifespan is a critical factor in determining the overall cost-effectiveness of air filter cartridges.

Synthetic filter media, such as polyester and polypropylene, offer longer lifespans and improved filtration efficiency compared to traditional cellulose filter media. The market is expected to grow at a steady pace, with increasing demand from various industries. For instance, the cement industry is projected to account for over 25% of the market share by 2025. The growing focus on improving indoor air quality and reducing energy consumption are also driving the market growth. An example of the effectiveness of air filter cartridges can be seen in a cement plant that implemented a new filtration system, resulting in a 30% reduction in filter media replacement costs and a 15% improvement in energy efficiency.

In summary, air filter cartridges play a vital role in maintaining a clean and healthy environment in various industries. Advancements in filter technology, cost savings, and regulatory requirements are driving the growth of the market.

The Industrial segment was valued at USD 33.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 26% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, with a focus on technologies such as odor control and high-efficiency particulate removal. Absolute filter ratings and maintenance cost reduction are key considerations for businesses, leading to the increasing adoption of fiber media technology and pleated filter designs. In cleanroom applications, airborne contaminant removal is crucial, driving the demand for HEPA filters with efficiencies up to 99.97%. Chemical vapor filtration and gas phase adsorption are essential for industries dealing with volatile organic compounds. MERV rating systems and airflow restriction testing ensure filtration efficiency and prevent pressure drop. Energy consumption reduction and media density variations are critical factors in filter selection.

Synthetic filter media and activated carbon adsorption offer superior filtration and longer filter media lifespan. Air quality monitoring and microbial contamination control are essential in various industries, including healthcare and food processing. APAC is a significant market contributor, with a 45% share in 2023, driven by the growth of industries in China, India, and other countries. The chemical industry's expansion in the region is increasing the demand for air filter cartridges, particularly for chemical vapor filtration and gas phase adsorption applications. For instance, the chemical industry in China is expected to grow at a CAGR of 8% from 2023 to 2027.

Filter media lifespan and filter integrity testing are essential to ensure optimal performance and minimize downtime. Differential pressure sensors and electrostatic precipitation are other technologies gaining traction in the market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a critical segment in the HVAC industry, as effective air filtration plays a pivotal role in maintaining indoor air quality and energy efficiency. The selection and optimization of air filter cartridges can significantly impact airflow, with filter media being a key determinant. Testing methods for filter efficiency, such as DOP (Dispersed Oil Particle) and TSI (Thermophoretic Smoke Number), are essential to evaluate filter performance and ensure compliance with regulatory standards. Filter housing design and filter media density are crucial factors influencing filter efficiency and performance. HEPA (High Efficiency Particulate Air) and ULPA (Ultra-Low Penetration Air) filters, two prominent filter types, exhibit varying efficiencies and are suitable for different applications. Accurately measuring filter pressure drop is vital for optimizing energy consumption and maintaining system performance. Predicting filter life and replacement intervals is essential to minimize energy costs and maintain consistent air quality. Understanding the relationship between filter density and performance, as well as the influence of filter materials, is crucial for choosing the right filter for specific contaminants. Effective filter maintenance strategies, including regular cleaning or replacement, are vital for maximizing the lifespan of air filters. Filter certification standards, such as EN 1822 and ASHRAE 52.2, provide guidelines for evaluating filter performance in HVAC applications. Improving filter performance with pre-filters and minimizing filter media degradation are effective strategies for enhancing overall system efficiency. Assessing filter efficacy for air quality and choosing the right filter for specific contaminants are essential considerations for maintaining optimal indoor air quality. The cost-effectiveness of various filter types, including disposable and reusable options, is a critical factor in the market. In cleanroom applications, filter selection for specific contaminants and maintaining filter performance are paramount to ensuring a sterile environment.

What are the key market drivers leading to the rise in the adoption of Air Filter Cartridges Industry?

- The increasing demand for process and environment safety in industries serves as the primary market driver, underpinned by the necessity for enhanced productivity, regulatory compliance, and risk mitigation.

- Industries contribute significantly to environmental pollution through various processes, emitting harmful pollutants, dust, and dirt particles. For instance, gas turbines in industries consume vast amounts of air during operation, necessitating a clean air supply to maintain optimal performance and prevent damage to machinery and workforce health. Air filter cartridges play a crucial role in filtration systems by removing foreign materials like dust and dirt particles from the air.

- A notable example reveals that implementing advanced air filtration technology in a manufacturing plant led to a 30% reduction in equipment downtime due to improved air quality. Furthermore, The market is anticipated to expand by over 5% annually, underscoring the growing demand for clean air solutions in industries.

What are the market trends shaping the Air Filter Cartridges Industry?

- The demand for air filter cartridges is increasing in semiconductor and nano-processing manufacturing plants, representing an emerging market trend.

- The market plays a crucial role in the microelectronics industry by ensuring a particle-free and microorganism-free environment for manufacturing processes, such as semiconductor and nano-processing. With the increasing demand for electronic products with small form factors and compact sizes, there is a growing trend towards faster and smaller manufacturing processes in the semiconductor industry. Air filter cartridges are essential in maintaining the required cleanliness levels in these processes, as even small foreign particles can have an adverse effect on the final product.

- According to recent studies, the market for air filter cartridges in the microelectronics industry is expected to grow by 15% in the next year, reflecting the increasing importance of maintaining clean environments in these manufacturing processes. Furthermore, future growth expectations indicate a robust expansion of the market, with an anticipated growth of 20% over the next five years.

What challenges does the Air Filter Cartridges Industry face during its growth?

- The availability of substitutable products poses a significant challenge to the industry's growth trajectory.

- Air filter cartridges and baghouse filters serve distinct roles in dust collection applications. Cartridge filters, known for their ease of maintenance and quick filter replacement, have gained significant traction in various industries. However, baghouse filters, which consist of multiple bags arranged in series, remain popular for applications in challenging environments. These filters are favored in industries where filters are exposed to high temperatures, moisture, and heavy dust loading, such as in furnace and dryer applications. Despite the growing popularity of cartridge filters, baghouse filters continue to be a cost-effective solution, making them a preferred choice in certain industries.

- For instance, the use of baghouse filters in cement manufacturing increased by 10% in 2020 compared to the previous year. The air filtration market is projected to grow by 7% annually, driven by the increasing demand for cleaner air and stricter regulations.

Exclusive Customer Landscape

The air filter cartridges market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the air filter cartridges market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, air filter cartridges market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company specializes in providing a range of air filter cartridges, including the 3M Ammonia Filter 60924, 3M Canister FR 5 CBRN, 3M Organic Vapor Cartridge with Pre-filter 3301K 55, and 3M Mercury Vapor Gas Cartridge 6009S.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Absolent Air Care Group AB

- Camfil AB

- Cummins Inc.

- Daikin Industries Ltd.

- Danaher Corp.

- Donaldson Co. Inc.

- Eaton Corp. Plc

- Festo SE and Co. KG

- Filter Concept Pvt. Ltd.

- Freudenberg and Co. KG

- Honeywell International Inc.

- Johnson Controls International Plc.

- Kalthoff Luftfilter und Filtermedien GmbH

- Micronics Filtration LLC

- Nederman Holding AB

- Parker Hannifin Corp.

- Purafil Inc.

- Sharp Corp.

- SPX FLOW Inc.

- U.S. Air Filtration Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Air Filter Cartridges Market

- In January 2024, Camfil, a leading air filtration company, announced the launch of its new F7 high-efficiency air filter cartridge series, designed to capture particles as small as 0.3 microns with up to 99% efficiency (Camfil Press Release, 2024).

- In March 2024, 3M and Ahlstrom-Munksjö, two major players in the air filtration industry, entered into a strategic partnership to co-develop and commercialize next-generation air filter media using nanofiber technology (3M Press Release, 2024).

- In May 2024, Donaldson Company, Inc., a global leader in filtration solutions, completed the acquisition of Micronics Filtration, a leading manufacturer of industrial air filtration products, expanding its product portfolio and market reach (Donaldson Company Press Release, 2024).

- In April 2025, the European Union's REACH regulation imposed new restrictions on certain chemicals used in air filter cartridges, prompting key players to invest in research and development of alternative materials (European Chemicals Agency, 2025). For instance, Pall Corporation announced a € 10 million investment in its R&D center to develop sustainable filter media (Pall Corporation Press Release, 2025).

Research Analyst Overview

- The market for air filter cartridges continues to evolve, driven by the diverse applications across various sectors, including healthcare, manufacturing, and construction. Filter validation protocols and certification are increasingly important, ensuring fume removal efficiency, filter life prediction, and dust particle capture meet stringent industry standards. Filter change frequency and capacity limits are critical factors in cost-benefit analysis, with some industries reporting a 25% reduction in energy consumption through optimized filter replacement schedules. Filter media degradation and particle size distribution are continually monitored to maintain airborne particle counts within acceptable levels. HVAC system integration, filtration system design, and filter media selection are essential for maximizing system pressure monitoring and filter durability testing, ultimately contributing to improved HVAC system efficiency.

- VOC removal performance and contamination detection are also crucial aspects of air filter performance, with efficiency testing methods ensuring consistent filter sealing mechanisms and filter cartridge sizing. The air filter market is projected to grow by over 5% annually, reflecting the ongoing unfolding of market activities and evolving patterns. For instance, a recent study demonstrated a 30% increase in filter efficiency following the implementation of advanced filtration technology.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Air Filter Cartridges Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

151 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.48% |

|

Market growth 2024-2028 |

USD 23.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.19 |

|

Key countries |

US, China, India, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Air Filter Cartridges Market Research and Growth Report?

- CAGR of the Air Filter Cartridges industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the air filter cartridges market growth of industry companies

We can help! Our analysts can customize this air filter cartridges market research report to meet your requirements.