Air Filter Market Size 2024-2028

The air filter market size is forecast to increase by USD 7.48 billion at a CAGR of 6.21% between 2023 and 2028. The market is witnessing significant growth due to the increasing concerns over respiratory illnesses and premature deaths caused by harmful particles in indoor air. The need for maintaining good indoor air quality (IAQ) is driving the demand for advanced air filtration systems. Regulatory initiatives and stricter regulations are being implemented to ensure the health and safety of building occupants. HVAC systems are being upgraded with energy-efficient filters to reduce energy consumption and operating costs. Activated carbon filters are gaining popularity for their ability to remove odors and volatile organic compounds (VOCs). However, technical limitations such as filter replacement frequency and the ability to filter viruses and other small particles remain challenges for the market. Despite these challenges, the market is expected to grow steadily due to the increasing awareness of the importance of IAQ for human health and productivity.

Market Analysis

The market is experiencing significant growth due to the increasing demand for improved indoor air quality in various applications. HVAC systems, including fan coils, air handlers, and terminal units, utilize air filters to remove tiny particles and improve air quality. Air-moving devices in industrial settings, such as dust collectors type, also require effective air filtration systems to maintain optimal operating conditions and ensure worker safety. In the residential sector, the growing health consciousness and rising standard of living have led to an increased focus on air quality. Passenger cars are also incorporating advanced air filtration systems to protect against airborne infections and improve passenger comfort.

Furthermore, urban areas, with their high levels of air pollution and associated health problems like respiratory illnesses and premature deaths, are driving the demand for air filtration systems. Stricter regulations on air quality are further boosting market growth. Air filtration systems play a crucial role in removing harmful particles and maintaining indoor air quality, contributing to better overall health and well-being.

Market Segmentation

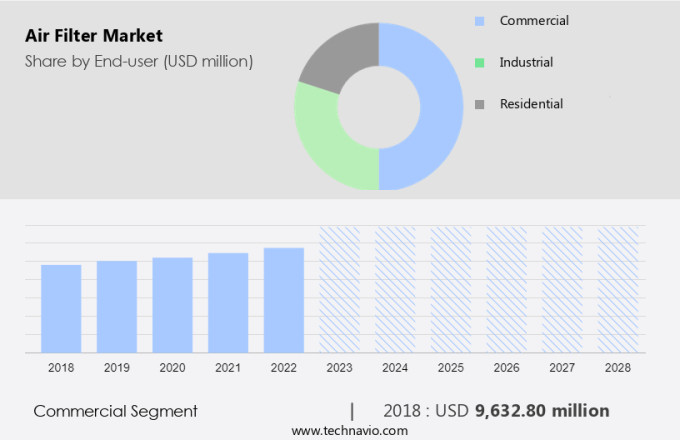

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Commercial

- Industrial

- Residential

- Type

- Dust collectors

- HEPA filters

- Cartridge filters

- Others

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By End-user Insights

The commercial segment is estimated to witness significant growth during the forecast period. The market caters to various end-users, with the commercial sector being a significant segment. In this sector, establishments prioritize air filtration systems to ensure a healthy indoor environment for employees, customers, and visitors. Key sub-segments within the commercial end-user category include offices and hospitality. Air filters in offices eliminate dust, pollen, and particulate matter, ensuring a clean and comfortable work setting. In the hospitality industry, air filters are employed to improve indoor air quality and create a pleasant atmosphere for guests. Advanced filtration technologies, such as bio-filtration, MERV, HEPA filters, and dust collectors, are utilized to capture air contaminants, including bacterial particles.

Furthermore, these systems not only enhance air quality but also contribute to energy savings. In residential applications, air purifiers are increasingly popular for maintaining fresh indoor air and improving overall air quality. The market offers a range of filtering performances and dust-holding capacities to cater to diverse needs.

Get a glance at the market share of various segments Request Free Sample

The commercial segment was valued at USD 9.63 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 53% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in the Asia Pacific (APAC) region is projected to experience significant growth during the forecast period, primarily driven by the expansion of the automotive, HVAC, and industrial sectors. With countries such as India and China having high levels of air pollution, there is a substantial demand for green buildings and improved indoor air quality. This demand is met through various air filter technologies, including bio-filtration and high-efficiency filters such as MERV and HEPA. In the automotive industry, which has a substantial presence in countries like China, India, and Japan, the sales of vehicles continue to rise due to population growth and increasing disposable incomes.

Furthermore, new model launches by manufacturers further fuel this growth. In response to these trends, there is a growing need for advanced air filtration systems in vehicles to ensure fresh indoor air and reduce air contaminants. Moreover, in residential applications, air purifiers are becoming increasingly popular as consumers prioritize health and well-being. These devices, which often incorporate filters with high dust-holding capacity and filtering performance, help remove bacterial particles and other pollutants from indoor air. In industrial settings, dust collectors and air quality systems are essential for maintaining optimal working conditions and ensuring energy savings. Overall, the market in APAC is poised for strong expansion, driven by the automotive, HVAC, and industrial sectors, as well as the growing emphasis on air quality and energy efficiency.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing number of data centers is the key driver of the market. The market is witnessing significant growth due to the increasing usage of air filter solutions in HVAC systems and air moving devices. Tiny particles, such as dust and pollen, can adversely affect indoor climate and energy performance in buildings. To mitigate this issue, air filters are increasingly being used in fan coils, air handlers, terminal units, and other air handling equipment.

Furthermore, dirt accumulation on coils and fan wheels can reduce the efficiency of these systems, leading to higher energy consumption and increased maintenance costs. Air filters help prevent this by trapping particles before they enter the system, ensuring optimal indoor air quality and improved energy efficiency. The importance of maintaining a clean ventilation system is crucial for both occupant comfort and building energy performance.

Market Trends

A rise in spending on green construction is the upcoming trend in the market. In the global construction sector, there is a growing trend towards energy-efficient solutions as a response to increasing energy costs and a heightened focus on reducing the environmental impact of buildings. Commercial establishments are leading the charge in adopting green systems, which not only improve indoor climate conditions but also enhance energy performance. Air handling equipment, including fan coils, air handlers, and terminal units, are being upgraded with advanced air filtration systems to ensure optimal indoor air quality (IAQ) and minimize carbon emissions. These filtration systems effectively trap tiny particles, ensuring that the HVAC system and its components, such as coils and fan wheels, remain free from dirt buildup.

Furthermore, the investment in these energy-efficient and eco-friendly systems not only leads to LEED certification and Energy Star designation but also results in significant cost savings through reduced energy consumption. Companies are further collaborating with green building associations and councils to research and develop more efficient filtration technologies, ensuring a sustainable future for the construction industry.

Market Challenge

Lack of awareness about the need to replace air filters is a key challenge affecting the market growth. Air filters are essential components of HVAC systems, including fan coils, air handlers, terminal units, and ventilation systems. These filters help in trapping tiny particles, ensuring the indoor climate remains clean and healthy. However, the importance of regularly cleaning or replacing air filters is often overlooked by end-users.

Furthermore, the lifespan of air filters varies based on their type and application. For instance, cabin air filters typically need replacement annually or after 15,000 to 30,000 miles, while engine air filters are usually replaced after a year or 30,000 miles. Neglecting the replacement of air filters can lead to several health issues and reduced energy performance of air handling equipment. It is crucial for building owners and occupants to prioritize the maintenance of their air filters to ensure optimal indoor climate and energy efficiency.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Camfil AB: The company offers air filters such as cleanroom panels and compact filters.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Air Filter Co. Inc.

- Camfil AB

- Carrier Global Corp.

- Cummins Inc.

- Daikin Industries Ltd.

- Donaldson Co. Inc.

- Dyson Group Co.

- Filtration Group Corp.

- Honeywell International Inc.

- IQAir AG

- Koninklijke Philips N.V.

- LG Electronics Inc.

- MANN HUMMEL International GmbH and Co. KG

- Panasonic Holdings Corp.

- Parker Hannifin Corp.

- Samsung Electronics Co. Ltd.

- Sharp Corp.

- Unilever PLC

- United Filter Industries Pvt. Ltd.

- Whirlpool Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for maintaining indoor climate with fresh and clean air in buildings. Air filters play a crucial role in HVAC systems, including fan coils, air handlers, terminal units, and ventilation systems, by trapping tiny particles such as dust, dirt, and coil debris, improving energy performance and indoor air quality. The market is driven by the growing awareness of health problems caused by airborne incontaminants, including bacteria, viruses, and harmful emissions. The market is segmented into industrial end-user, including HVAC systems, and residential applications, such as air purifiers. The industrial sector's growth is driven by stricter regulations and regulatory initiatives, while residential applications are driven by health consciousness and standard of living.

Furthermore, air filter technology has evolved over the last decade, with advancements in MERV, HEPA filters, and dust collectors, as well as new technologies like nanofiber filters, ultrafine particles, smart air filters, and self-cleaning filters. The market is also witnessing trends towards sustainability, with eco-friendly and biodegradable materials, recycled filters, and activated carbon filters for odor control. The market's growth is influenced by factors such as energy savings, green building standards, and the increasing number of vehicle miles driven and vehicle parks, leading to higher demand for air filtration systems in industrial and transportation applications. However, technical limitations and low awareness remain challenges for market growth. The market is expected to grow significantly due to increasing health consciousness, regulatory initiatives, and advancements in air filtration technology. The market's growth is driven by applications in HVAC systems, industrial end-users, and residential applications, with a focus on sustainability and energy savings.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

188 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.21% |

|

Market Growth 2024-2028 |

USD 7.47 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.75 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 53% |

|

Key countries |

China, US, Japan, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

American Air Filter Co. Inc., Camfil AB, Carrier Global Corp., Cummins Inc., Daikin Industries Ltd., Donaldson Co. Inc., Dyson Group Co., Filtration Group Corp., Honeywell International Inc., IQAir AG, Koninklijke Philips N.V., LG Electronics Inc., MANN HUMMEL International GmbH and Co. KG, Panasonic Holdings Corp., Parker Hannifin Corp., Samsung Electronics Co. Ltd., Sharp Corp., Unilever PLC, United Filter Industries Pvt. Ltd., and Whirlpool Corp. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch