India Air Freshener Market Size 2025-2029

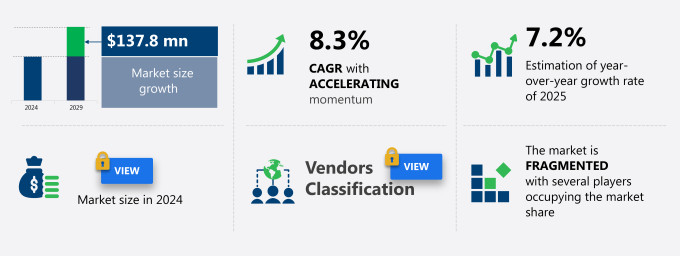

The India air freshener market size is forecast to increase by USD 137.8 million at a CAGR of 8.3% between 2024 and 2029.

- The market is witnessing significant growth, driven by the increasing popularity of new product launches. These innovations cater to diverse consumer preferences, ranging from eco-friendly solutions to smart air fresheners integrated with digital media platforms. Consumers are increasingly turning to technology-enabled air fresheners, including smart and voice-activated devices, to enhance their indoor air quality and create a more pleasant living environment. Additionally, health concerns associated with traditional air fresheners have led to a rise in demand for natural and eco-friendly alternatives. However, this market expansion faces challenges, including growing health concerns associated with air fresheners. The potential health risks linked to certain chemicals used in air fresheners are raising awareness among consumers, leading to a demand for natural and organic alternatives.

- Companies seeking to capitalize on the market's opportunities must stay abreast of consumer preferences and address health concerns through product innovation and transparency. Adapting to the digital shift and offering eco-friendly solutions will also be essential for market success.

What will be the size of the India Air Freshener Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The Indian air freshener market is witnessing significant shifts, driven by consumer research and industry trends. Social media marketing plays a pivotal role in reaching consumers, with sales forecasting indicating a promising future. Value proposition and retail strategies are key focus areas, as consumer insights reveal preferences for eco-friendly packaging materials and sustainable practices. Product innovation and brand differentiation are essential, with influencer marketing and online marketing channels utilized for reach. Technology advancements, such as scent masking technologies and premium pricing, are shaping the market. Environmental responsibility and ethical sourcing are becoming essential for customer experience and brand reputation. Distribution networks and marketing strategies are optimized for product lifecycle management.

- Content marketing and trends analysis help companies stay competitive, with social impact and sustainability initiatives gaining importance. Digital marketing and public relations are crucial for customer loyalty programs. Supply chain optimization and quality certifications are essential for maintaining consumer trust.

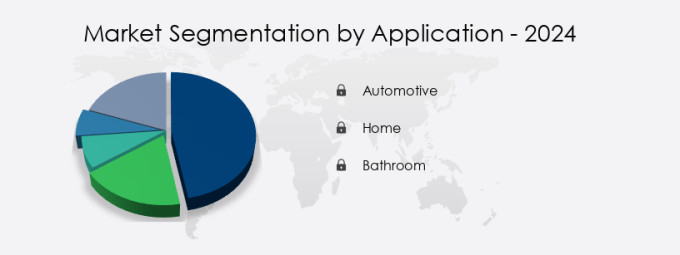

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Automotive

- Home

- Bathroom

- End-user

- Individual users

- Enterprise users

- Type

- Spray

- Liquid

- Gel

- Electric

- Others

- Geography

- APAC

- India

- APAC

By Application Insights

The automotive segment is estimated to witness significant growth during the forecast period.

The Indian air freshener market encompasses various segments, including aluminum cans for aerosol sprays and plastic bottles for non-aerosol products. Customer satisfaction is paramount, with scent profiles tailored to cater to diverse consumer preferences, ranging from floral to fruity and spicy. Indoor air quality is a significant concern, driving demand for air purification and scent masking solutions. Base notes and top notes in fragrance oils contribute to the overall scent experience, while brand loyalty is fostered through effective marketing campaigns and brand building. Inventory management is crucial for retail stores to maintain stock levels and ensure quality control.

Safety regulations govern the manufacturing processes, with safety valve systems and controlled release mechanisms ensuring product safety. Scent technology offers mood enhancement and stress reduction benefits, making air fresheners a popular choice for both home and commercial use. E-commerce platforms and online retailers have expanded distribution channels, while pricing strategies cater to various consumer segments. Natural fragrances, including essential oils and plant-based extracts, are gaining popularity due to their health benefits and environmental impact. Product development incorporates synthetic fragrances and botanical extracts, with usage occasions varying from automotive to therapeutic applications. The automotive segment is experiencing growth, with air fresheners used to combat odors caused by fuel emissions and smelly footwear.

Air purification is a key feature, as the confined space in vehicles can lead to poor indoor air quality. The trend towards sustainable air care products is driving demand for organic and eco-friendly car air fresheners.

The Automotive segment was valued at USD 102.60 million in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market continues to thrive, driven by increasing consumer awareness and preference for improved indoor air quality. With a growing population and urbanization, the demand for air fresheners in Indian homes and commercial spaces is on the rise. Key players in this market offer a diverse range of products, including room sprays, car air fresheners, plug-ins, and gels. These air fresheners come in various fragrances, catering to different preferences and sensitivities. Sustainability is a significant trend, with eco-friendly and biodegradable options gaining popularity. Additionally, the market witnesses continuous innovation, with smart air fresheners and subscription services emerging. Consumers in India seek air fresheners that provide long-lasting fragrance, are affordable, and cater to their unique cultural preferences. Overall, the market presents lucrative opportunities for businesses and continues to evolve with consumer needs and trends.

What are the India Air Freshener Market market drivers leading to the rise in adoption of the Industry?

- The new product launches serve as the primary catalyst for market growth.

- The Indian air freshener market is experiencing significant growth due to the introduction of innovative products. companies are capitalizing on this trend by launching new offerings to expand their customer base and increase revenue. For instance, in early 2024, Perfetti Van Melle BV, known for its Mentos brand, collaborated with Bharat Aluminium Company Ltd to launch aluminum can air fresheners. This strategic move is expected to boost sales and enhance the company's market presence. Scent profiles and indoor air quality are key factors influencing consumer behavior in the air freshener market. Brands are focusing on providing a wide range of fragrance options and emphasizing the importance of maintaining good indoor air quality for stress reduction and overall well-being.

- Quality control and inventory management are crucial elements in the production and distribution of aerosol sprays and aluminum can air fresheners. Scent technology plays a significant role in the market, with companies investing in research and development to create harmonious and immersive fragrance experiences. Consumer preferences for eco-friendly and environmentally-conscious products are also driving the market, with fragrance oils being a popular alternative to synthetic fragrances. The market is expected to continue its growth trajectory, driven by these market dynamics.

What are the India Air Freshener Market market trends shaping the Industry?

- The increasing significance of digital media platforms represents a notable market trend. This shift towards digital communication is mandatory for professionals seeking to stay current in today's dynamic business landscape.

- The Indian air freshener market is witnessing significant growth, driven by the increasing use of digital media for brand building and marketing campaigns. With the widespread adoption of internet-enabled smartphones, social media platforms have emerged as a primary communication channel for companies. Air freshener manufacturers are capitalizing on this trend by investing in social media marketing to expand their reach and promote their products. The influence of social media personalities has led major brands to form strategic partnerships with these influencers, particularly for household product lines. Synthetic fragrances are commonly used in air fresheners due to their long-lasting and consistent scent.

- Raw material sourcing and safety regulations are crucial factors in the production of air fresheners. companies are focusing on controlled release technologies to optimize scent dispersion and enhance mood. Air purification and scent masking are other key applications of air fresheners, particularly in commercial settings. Pump mechanisms are commonly used for dispensing air fresheners, ensuring consistent and efficient delivery. Marketing efforts are also directed towards mood enhancement and air purification, as consumers seek to improve indoor air quality and create pleasant environments. Safety regulations and controlled release technologies are essential considerations for manufacturers to ensure the safety and effectiveness of their products.

- The distribution channels for air fresheners include modern trade, traditional trade, and e-commerce platforms. Overall, the Indian air freshener market presents significant opportunities for companies, driven by increasing consumer awareness, digital media usage, and the growing demand for air quality solutions.

How does India Air Freshener Market market faces challenges face during its growth?

- The growth of the air freshener industry is confronted by significant health concerns, which represent a key challenge that necessitates addressing the potential risks associated with the use of these products.

- Air fresheners, available primarily in plastic bottles, are widely used in India for home and automotive applications to impart pleasant scents and mask unpleasant odors. The e-commerce platforms have made these products easily accessible to consumers. However, concerns regarding the health effects of air fresheners, particularly those containing volatile organic compounds (VOC), are a significant challenge. Studies suggest that prolonged exposure to these chemicals can lead to respiratory issues, including asthma and allergies. Manufacturing processes for air fresheners must adhere to testing standards to ensure the safety and efficacy of the products. Supply chain management plays a crucial role in ensuring the timely delivery of high-quality products.

- Scent diffusion and valve systems are essential components of air fresheners, determining their performance and user experience. Pricing strategies vary depending on the brand, size, and fragrance of the air freshener. Scent profiles, including heart notes and therapeutic effects, are essential considerations for consumers. Spray mechanisms and odor elimination capabilities are other essential features. Valve systems and scent diffusion technology have evolved significantly, providing consumers with more efficient and long-lasting air freshening solutions. Automotive use of air fresheners is also growing, with an increasing focus on scent diffusion and long-lasting fragrance. Overall, the market offers significant opportunities for innovation and growth, driven by changing consumer preferences and increasing awareness of health concerns.

Exclusive India Air Freshener Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABC Compounding Co. Inc.

- Air Delights Inc.

- Airpro

- Aromate Industries Co. Ltd.

- Beaumont Products Inc.

- BODYONE

- CAR-FRESHNER Corp.

- Church and Dwight Co. Inc.

- Dabur India Ltd.

- Enviroscent Inc.

- Fleur De Fragrances

- Godrej and Boyce Manufacturing Co. Ltd.

- House of Mangalam

- JCK GLOBAL SPRAY TECH Pvt. Ltd.

- Kobayashi Pharmaceutical Co. Ltd.

- MidasCare Pharmaceuticals Pvt. Ltd.

- MINISO Group Holding Ltd.

- Newell Brands Inc.

- Pure Source India

- Ra Lifecare Pvt. Ltd.

- Reckitt Benckiser Group Plc

- S.C. Johnson and Son Inc.

- The Procter and Gamble Co.

- Vanesa Care Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Air Freshener Market In India

- In January 2024, Godrej Consumer Products Ltd., a leading Indian FMCG company, introduced 'Aer' - a new range of air fresheners in India. The product line includes gel, spray, and roll-on variants, expanding the company's offerings in the air care segment (Godrej Press Release, 2024).

- In March 2024, Dabur India Ltd., another major FMCG player, announced a strategic partnership with the US-based company, ScentAir, to introduce scent marketing solutions in India. This collaboration aimed to offer customized fragrance solutions to various industries, including retail, hospitality, and healthcare (Dabur India Press Release, 2024).

- In May 2024, ITC Limited, India's leading agro-business and consumer goods company, secured a significant investment of INR 300 crores (approximately USD 40 million) from the PE major, KKR, to expand its consumer goods business, including its air care segment (ETMarkets, 2024).

- In February 2025, the Indian government announced the 'Swachh Air' initiative, which includes the promotion and incentivization of air purification and freshening technologies. The move aims to improve the overall air quality in India, presenting a significant growth opportunity for the air freshener market (PIB India, 2025).

Research Analyst Overview

The market continues to evolve, driven by shifting consumer preferences and advancements in technology. Brands strive to build loyalty through unique scent profiles and marketing campaigns, utilizing synthetic fragrances and raw material sourcing for air purification and scent masking. Safety regulations guide manufacturing processes, ensuring controlled release and mood enhancement through pump mechanisms and valve systems. Commercial use expands beyond retail stores to automotive applications, offices, and public spaces, while distribution channels broaden to e-commerce platforms and wholesale distributors. Consumer behavior influences pricing strategies and product positioning, with a growing emphasis on natural fragrances, essential oils, and plant-based extracts. Indoor air quality remains a top concern, leading to innovation in scent technology and scent diffusion methods.

Base notes and heart notes contribute to therapeutic effects and stress reduction, while odor elimination and automotive use cater to specific consumer needs. Quality control and testing standards ensure product consistency and safety, as manufacturing processes adapt to meet evolving market demands. Brand building and inventory management are crucial aspects of the industry, with a focus on sustainability and environmental impact. Product development continues to explore new fragrance trends and usage occasions, as the market unfolds with continuous dynamism.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Air Freshener Market in India insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

179 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.3% |

|

Market growth 2025-2029 |

USD 137.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.2 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across India

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch