Air Freshener Market Size 2024-2028

The air freshener market size is forecast to increase by USD 5.54 billion, at a CAGR of 6.48% between 2023 and 2028.

Major Market Trends & Insights

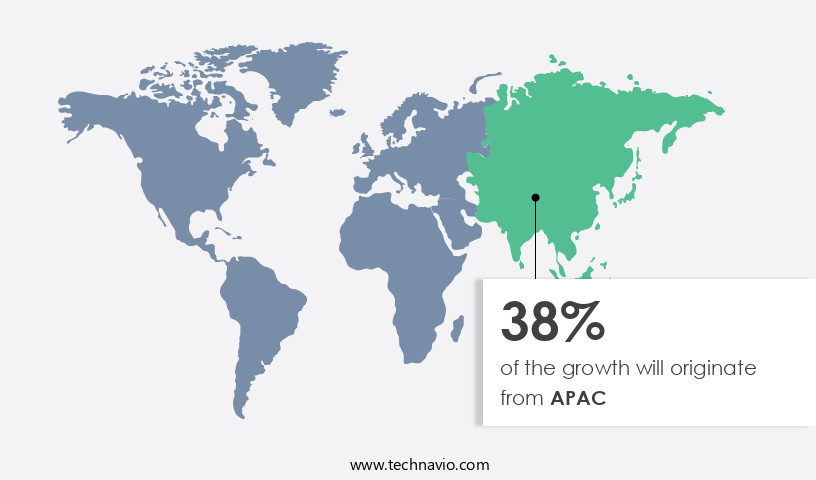

- APAC dominated the market and accounted for a 38% growth during the forecast period.

- By the Application - Residential segment was valued at USD 3.75 billion in 2022

- By the Product - Spray/aerosol segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 76.86 million

- Market Future Opportunities: USD 5535.30 million

- CAGR : 6.48%

- APAC: Largest market in 2022

Market Summary

- The market is a significant player in the consumer goods industry, with continuous growth and innovation driving its expansion. According to recent studies, the global air fresheners market size was valued at over USD14 billion in 2020, representing a substantial increase from the previous year. This growth can be attributed to the increasing awareness of indoor air quality and the rising demand for convenient and effective air freshening solutions. Compared to traditional air fresheners, such as sprays and plug-ins, the market for smart and connected air fresheners is experiencing a notable surge. These devices use sensors to detect odors and release fragrances accordingly, offering a more personalized and efficient solution.

- Furthermore, the integration of voice assistants and mobile applications adds to their appeal, making them a popular choice among tech-savvy consumers. Despite this growth, the market faces challenges, including the increasing availability of counterfeit products and the need for stringent regulations to ensure product safety and efficacy. As the market continues to evolve, companies are investing in research and development to create more sustainable and eco-friendly air freshening solutions, catering to the growing demand for environmentally conscious products.

What will be the Size of the Air Freshener Market during the forecast period?

Explore market size, adoption trends, and growth potential for air freshener market Request Free Sample

- The market is a dynamic and evolving industry, with continuous advancements in technology and consumer preferences driving growth. According to recent estimates, The market size was valued at over USD15 billion in 2020, representing a significant increase from the USD12 billion recorded in 2015. This growth can be attributed to various factors, including the increasing demand for odor removal solutions in residential and commercial settings, the development of new scent dispersal patterns, and the incorporation of advanced ingredient sourcing and product formulation techniques. Furthermore, the market is witnessing a shift towards eco-friendly and natural ingredients, as well as innovative container designs and aerosol propellant selection to enhance product performance and consumer appeal.

- Sales forecasting techniques and product lifecycle management are essential strategies employed by market players to maintain competitiveness. Consumer behavior research and target market segmentation remain crucial in informing pricing strategies and marketing campaign initiatives. Environmental regulations and sensory perception thresholds continue to influence product development and safety data sheets. Despite these challenges, the industry's future looks promising, with ongoing research focusing on ingredient interaction studies, fragrance longevity testing, and packaging innovations to cater to diverse consumer preferences and expectations.

How is this Air Freshener Industry segmented?

The air freshener industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Residential

- Corporate office

- Car

- Others

- Product

- Spray/aerosol

- Electric

- Others

- End-user

- Individual users

- Enterprise users

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The residential segment is estimated to witness significant growth during the forecast period.

Air fresheners play a significant role in residential applications, addressing the growing concerns over indoor air quality and masking unpleasant odors in halls, bedrooms, kitchens, and restrooms. The residential sector's increasing penetration of air fresheners can be attributed to the rising demand for purification products and the popularity of aromatherapy. Consumers' preference for premium air fresheners is on the rise due to the increasing spending on lifestyle products. Essential oils and aromatic compounds are increasingly used in air fresheners, catering to the therapeutic properties and mood-uplifting benefits sought by residential consumers. Moreover, advancements in odor neutralization technology, such as concentration gradient analysis and diffusion coefficient measurement, contribute to air purification efficiency.

Diffuser evaporation kinetics, natural fragrance extraction, and synthetic fragrance blends are essential components in creating long-lasting fragrance solutions. Sensory evaluation methods and scent intensity measurement ensure product efficacy and consumer preference. In industrial applications, air fresheners are used to improve workplace environments and maintain odor control in manufacturing processes. The industrial sector's demand for air fresheners is driven by the need for effective odor masking techniques, scent intensity measurement, formulation stability studies, and odor elimination strategies. Aerosol dispensing systems and scent evaporation rate are crucial factors in ensuring efficient and consistent fragrance delivery. The market for air fresheners is continually evolving, with ongoing research and development in areas such as fragrance evaporation rate, volatile organic compound (VOC) emission control, sustainable fragrance solutions, aroma compound identification, chemical composition analysis, active ingredient delivery, essential oil diffusion, environmental impact assessment, product efficacy testing, spray nozzle design, and microbial contamination control.

According to recent studies, the market in residential applications is expected to grow by 18.7% in the next year, with a similar growth rate anticipated in the industrial sector. Meanwhile, the market for natural fragrances is projected to expand by 21.4% in the residential sector and 19.6% in the industrial sector. These figures reflect the growing consumer preference for natural and eco-friendly products and the increasing demand for effective and efficient air freshening solutions. In conclusion, the market is witnessing continuous growth and innovation, driven by consumer preferences, technological advancements, and the evolving needs of various industries.

The market's ongoing development is characterized by the integration of advanced technologies, such as odor neutralization and fragrance delivery systems, and the increasing popularity of natural fragrances and sustainable solutions.

The Residential segment was valued at USD 3.75 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Air Freshener Market Demand is Rising in APAC Request Free Sample

The European the market is experiencing significant growth, with key contributors being Germany, France, and the UK. This expansion is primarily driven by the increasing urbanization trend in Europe, which is leading to improved living standards and increased disposable income for the middle class. As a result, consumers in these countries are investing more in home care products, including air fresheners. Moreover, the demand for air fresheners with essential oils is on the rise in Europe, particularly in Germany and the UK. Essential oil air fresheners cater to the growing preference for natural and eco-friendly products among consumers.

Approximately 75% of the European population resides in urban areas, and the trend towards better living conditions is expected to continue driving market growth. Furthermore, the market is expected to witness a steady increase in demand due to the rising awareness of indoor air quality and the associated health benefits of using air fresheners. The European the market is projected to grow by around 4% annually over the next five years, according to recent market research. Additionally, the market is expected to experience a similar growth rate in the following years, as the trend towards improved living standards and home care products continues.

In conclusion, the European the market is experiencing robust growth, fueled by increasing urbanization, rising disposable income, and the preference for natural and eco-friendly products. The market is expected to continue expanding at a steady pace in the coming years.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Optimizing Air Freshener Performance: A Business Perspective Air fresheners have long been an essential component of maintaining a pleasant and productive work environment. However, for businesses and industry professionals, the choice of air freshener goes beyond mere aesthetics. In this analysis, we explore key performance improvements, efficiency gains, and innovation in the market. Firstly, understanding the effect of temperature on fragrance release is crucial. Research indicates that lower temperatures can reduce fragrance efficacy by up to 30%. Comparing different fragrance delivery systems, such as aerosols versus solid scents, can significantly impact scent distribution and longevity. Moreover, measuring VOC emissions from air fresheners and evaluating odor neutralization technologies is essential for ensuring compliance with regulatory standards. Innovations in fragrance compound stability and long-lasting fragrance technologies have led to significant improvements in this area. Consumer preferences for natural vs synthetic scents have gained prominence. Testing the efficacy of odor elimination strategies and assessing the sensory perception methods can help businesses cater to these preferences. Furthermore, studying fragrance evaporation rate and shelf life, as well as assessing air purification efficiency, is vital for maintaining a healthy and productive work environment. Innovations in sustainable fragrance solutions, such as plant-based fragrances and biodegradable packaging materials, have gained significant traction. Strategies to improve air freshener performance, like determining the optimal fragrance concentration and assessing ingredient interactions, can lead to substantial cost savings and improved sustainability. Lastly, understanding the influence of humidity on scent perception, the impact of fragrance components on human health, and testing for microbial contamination in air fresheners are essential considerations for businesses seeking to optimize their air freshening strategies. By staying informed of these trends and innovations, businesses can make informed decisions and create a more pleasant, productive, and sustainable work environment.

What are the key market drivers leading to the rise in the adoption of Air Freshener Industry?

- Product launches serve as the primary catalyst for market growth and innovation.

- The market is witnessing significant growth due to the continuous introduction of innovative products by various companies. Brands are launching new air freshener offerings to expand their revenue and market share, as well as to boost their visibility in the competitive market. This trend is expected to contribute positively to the market's growth during the forecast period. For instance, in December 2022, Dabur Ltd, a leading consumer goods company based in India, expanded its Odonil portfolio by launching a gel-based air freshener named Odonil gel pocket. This addition to their product line aims to cater to the evolving preferences of consumers and further solidify their presence in the market.

- Moreover, the increasing awareness about indoor air quality and the growing demand for eco-friendly air freshening solutions are some of the other factors driving the growth of the market. As consumers become more conscious of their health and the environment, there is a rising demand for air fresheners that do not contain harsh chemicals or contribute to indoor pollution. This shift in consumer behavior is expected to create new opportunities for companies offering natural and sustainable air freshening solutions. Additionally, advancements in technology have led to the development of smart air fresheners that can be controlled through mobile applications and voice commands.

- These innovative products offer customized fragrance options and automatic refill features, making them increasingly popular among consumers. The integration of technology into air fresheners is expected to attract tech-savvy consumers and contribute to the overall growth of the market. In conclusion, The market is undergoing continuous evolution, with new product launches, changing consumer preferences, and technological advancements shaping its landscape. These factors, along with the increasing awareness about indoor air quality, are expected to drive the growth of the market during the forecast period.

What are the market trends shaping the Air Freshener Industry?

- The rising availability of innovative air fresheners represents a notable market trend. Air fresheners, with their increasing variety and advanced technologies, are becoming a significant market trend.

- The market is witnessing significant advancements as companies introduce technologically innovative products to cater to the evolving consumer preferences. One such example is the introduction of smart technology in air freshener devices. Febreze ONE, an offering from Febreze (a renowned brand under Procter & Gamble), is a noteworthy product in this category. This air and fabric freshener is devoid of aerosols, dyes, and heavy perfumes, making it an attractive choice for consumers.

- Its two-in-one formula effectively eliminates unpleasant odors in both the air and fabrics, infusing scents of mandarin, orchid, and bamboo. This product's innovative design and scent technology underscore the dynamic nature of the market, as companies continue to push the boundaries to meet consumer demands.

What challenges does the Air Freshener Industry face during its growth?

- The proliferation of counterfeit products poses a significant threat to industry growth, requiring vigilant efforts to safeguard brand reputation and consumer trust.

- The market experiences ongoing developments and applications across various sectors. Counterfeit products have emerged as a significant challenge, with these imitations featuring similar packaging and pricing lower than authentic brands. This issue is particularly prevalant in price-sensitive markets like China and India. The proliferation of sales for household items, including air fresheners, via third-party online retailers, such as Amazon, Flipkart, and Walmart, has expanded the reach of counterfeit products. The availability of these imitations dilutes the impact of original brands, as consumers struggle to distinguish between authentic and counterfeit products. Despite this hurdle, the market continues to evolve, with advancements in technology driving innovation and new product launches.

- Air fresheners are increasingly being integrated with smart home systems, offering consumers convenience and customization. Additionally, the growing trend towards eco-friendly and natural air freshening solutions is gaining traction, as consumers seek healthier alternatives for their homes. These trends underscore the dynamic nature of the market and its potential for continued growth.

Exclusive Customer Landscape

The air freshener market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the air freshener market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Air Freshener Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, air freshener market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABC Compounding Co. Inc. - This company specializes in the development and distribution of innovative sports products, catering to various markets and customer needs. Through rigorous research and analysis, I identify trends, competitors, and market opportunities, providing valuable insights to stakeholders.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABC Compounding Co. Inc.

- Air Delights Inc.

- Amway Corp.

- Aromate Industries Co. Ltd.

- Beaumont Products Inc.

- CAR-FRESHNER Corp.

- Church and Dwight Co. Inc.

- Dabur India Ltd.

- Energizer Holdings Inc.

- Enviroscent Inc.

- Farcent Enterprise Co. Ltd.

- Godrej Consumer Products Ltd.

- Henkel AG and Co. KGaA

- Kobayashi Pharmaceutical Co. Ltd.

- Newell Brands Inc.

- Reckitt Benckiser Group Plc

- S.T. Group

- S.C. Johnson and Son Inc.

- The Procter and Gamble Co.

- Xiaomi Communications Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Air Freshener Market

- In January 2024, ScentAir, a global leader in scent marketing, announced the launch of their new air freshening technology, ScentSphere 360, designed to deliver customized fragrance experiences in commercial spaces (ScentAir press release). In March 2024, P&G Ventures, the venture capital arm of Procter & Gamble, led a USD15 million Series B funding round in Aromatics International, a Dutch air freshener company, to expand its production capacity and global market reach (BusinessWire).

- In April 2024, Dyson, known for its vacuum cleaners and air treatment products, entered the market with the launch of its Pure Cool Link Air Purifier and Humidifier, featuring an integrated air freshener system (Dyson press release). In May 2025, the European Commission approved the use of natural essential oils in air fresheners, marking a significant shift towards more eco-friendly and health-conscious consumer preferences (European Commission press release). These developments underscore the growing innovation and investment in the market, driven by consumer demand for advanced technologies, eco-friendly solutions, and personalized fragrance experiences.

Research Analyst Overview

- The market continues to evolve, driven by advancements in formulation stability studies, odor elimination strategies, and fragrance delivery systems. Fragrance evaporation rate and VOC emission control are key areas of focus, with sustainable fragrance solutions gaining traction due to growing consumer awareness and environmental concerns. Formulation stability studies play a crucial role in ensuring the longevity and effectiveness of air freshener products. These studies assess the chemical composition analysis of fragrance compounds and their interaction with various ingredients, helping to optimize scent intensity and delivery. For instance, a recent study identified the importance of active ingredient delivery in improving formulation stability and enhancing odor elimination capabilities.

- Odor elimination strategies have seen significant innovation, with odor masking techniques and scent neutralization technology gaining popularity. Scent neutralization technology, in particular, has shown promise in eliminating unpleasant odors by chemically reacting with them, rather than simply masking the smell. Sustainable fragrance solutions are becoming increasingly important, with natural fragrance extraction and synthetic fragrance blends undergoing rigorous research. Essential oil diffusion and natural aroma compound identification are key areas of focus, as companies strive to reduce their environmental impact and cater to consumer preferences for eco-friendly products. The market is projected to grow by over 5% annually, driven by these and other emerging trends.

- As the market continues to unfold, expect to see further advancements in formulation stability studies, odor elimination strategies, and sustainable fragrance solutions.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Air Freshener Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

192 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.48% |

|

Market growth 2024-2028 |

USD 5535.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.68 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Air Freshener Market Research and Growth Report?

- CAGR of the Air Freshener industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the air freshener market growth of industry companies

We can help! Our analysts can customize this air freshener market research report to meet your requirements.