Aircraft Engine Market Size 2024-2028

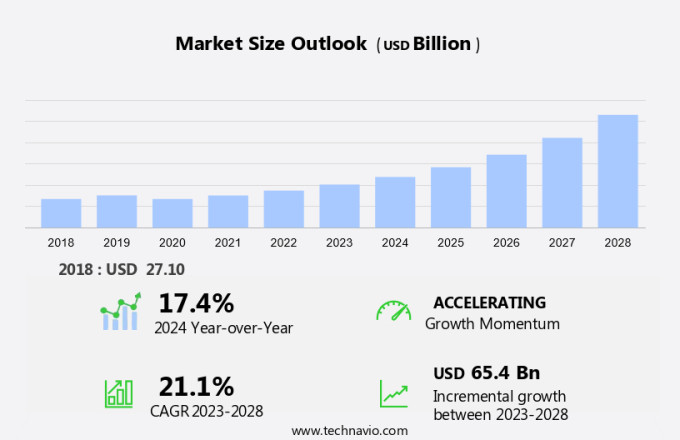

The aircraft engine market size is forecast to increase by USD 65.4 billion, at a CAGR of 21.1% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the increasing number of aircraft deliveries. This trend is expected to continue as the aviation industry recovers from the pandemic-induced downturn. However, the market faces challenges in the form of the rapid adoption of new technologies, which necessitates a skilled workforce for implementation and maintenance. The scarcity of skilled resources, particularly in areas such as advanced materials and engine design, poses a significant challenge for market participants. New technologies, including electric and hybrid engines, are gaining ground, offering opportunities for innovation and competitive differentiation. Also, airlines are focusing on enhancing the flying experience for passengers by investing in advanced engine technologies, such as jet engines and turboprop engines, to improve fuel efficiency and performance.

- Companies must invest in workforce development and collaborate with educational institutions to address the skills gap. Embracing these technologies and adapting to the evolving market landscape will be essential for success in the market.

What will be the Size of the Aircraft Engine Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the relentless pursuit of improved engine materials, high-bypass ratio, and engine life extension. Fuel efficiency remains a key focus, with engine leasing and data analysis playing crucial roles in optimizing fleet performance. Manufacturers innovate through advanced engine technologies, such as hybrid-electric propulsion and engine design, pushing the boundaries of aircraft range and aircraft safety. Military aviation, short-haul flights, business aviation, and commercial aviation all benefit from these advancements. Engine monitoring systems and emissions reduction are essential for aircraft regulations compliance. Noise abatement and aircraft payload optimization are also critical considerations.

General aviation, engine repair, and the engine aftermarket cater to diverse needs. Advanced engine technologies, including fan blades, turboprop engines, sustainable aviation fuels, and Electric Aircraft, are shaping the future of aviation. Long-haul flights, engine performance, and engine innovation are at the forefront of this transformation. Thrust-to-weight ratio, engine certification, testing, and engine diagnostics are essential components of engine manufacturing. Aircraft maintenance, engine financing, and engine financing ensure optimal engine performance and airworthiness standards. Aircraft operating costs and engine upgrades are ongoing concerns for Fleet Management. Electric propulsion systems, engine replacement, engine components, and engine overhaul are integral parts of the engine life cycle.

In the ever-changing landscape of the market, engine design, aircraft range, engine life cycle, and aircraft safety are interconnected and continuously unfolding. The market's dynamism is reflected in its applications across various sectors, from military aviation to commercial aviation, short-haul flights to long-haul flights, and from engine leasing to engine financing. The ongoing evolution of engine materials, high-bypass ratio, fuel efficiency, engine life extension, and engine manufacturing will continue to shape the future of aviation.

How is this Aircraft Engine Industry segmented?

The aircraft engine industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Commercial aviation

- Military aviation

- Geography

- North America

- US

- Europe

- France

- Germany

- UK

- APAC

- China

- Rest of World (ROW)

- North America

.

By Application Insights

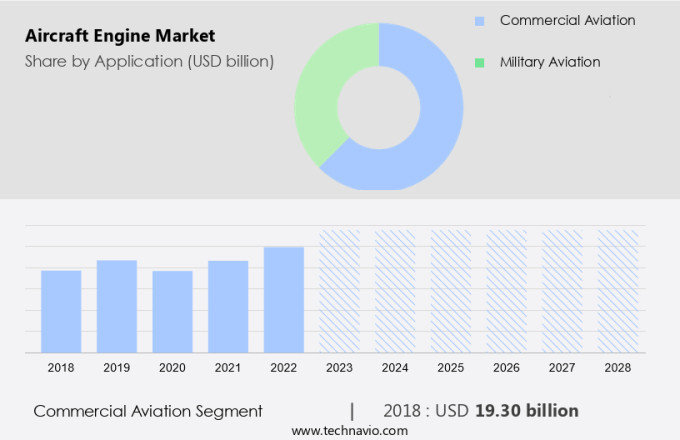

The commercial aviation segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth, particularly in the commercial aviation sector. This segment is driving market expansion due to the increasing number of aircraft deliveries and the rising demand for air travel worldwide. Airlines are prioritizing fuel efficiency and environmental compliance, leading to a preference for advanced turbofan engines. Manufacturers are investing heavily in research and development to create lightweight materials and innovative turbine designs, enhancing engine performance. Engine life extension and data analysis are critical trends in the market, enabling predictive maintenance and optimizing engine performance. Fuel efficiency remains a key focus, with the adoption of sustainable aviation fuels and hybrid-electric propulsion systems gaining momentum.

Military aviation and business aviation segments also contribute to the market's growth, with a demand for high-performance engines and engine leasing solutions. Regulations and safety are essential considerations, with stringent airworthiness standards and emissions reduction initiatives shaping the market. Engine monitoring systems and diagnostics are essential for maintaining aircraft safety and optimizing engine life cycle. Advanced engine technologies, such as fan blades, turboprop engines, and turbine blades, are improving engine efficiency and reducing noise levels. General aviation and regional aviation segments are also growing, with a focus on engine repair, engine financing, and engine upgrades. Engine replacement and engine components are essential for maintaining aircraft performance and ensuring aircraft speed.

Electric propulsion systems and thrust-to-weight ratio are emerging trends, with electric aircraft and turbojet engines leading the innovation. In conclusion, The market is experiencing dynamic growth, driven by the commercial aviation sector's increasing demand for fuel-efficient and advanced engines. Technological innovation, engine life extension, and data analysis are key trends shaping the market, with a focus on safety, emissions reduction, and noise abatement. The market is diverse, encompassing military aviation, business aviation, short-haul flights, long-haul flights, and general aviation, each with unique requirements and challenges.

The Commercial aviation segment was valued at USD 19.30 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The Russian the market experiences a fluctuating trend, with local airlines adjusting their fleets due to economic challenges and political tensions. Despite the decline, engine manufacturers continue to innovate, focusing on advanced technologies like hybrid-electric propulsion, fan blades, and turbofan engines. The military aviation sector remains significant, with ongoing projects such as turbine blades for turbojet engines and engine certification for military aircraft. In commercial aviation, engine monitoring systems and emissions reduction are key priorities, driving the demand for engine diagnostics and engine upgrades. Business aviation and general aviation sectors seek engine repair and engine financing solutions.

Engine leasing and engine components are essential for aircraft maintenance, while engine life extension and engine life cycle management are critical for both commercial and military applications. Aircraft safety remains a top concern, with regulations mandating airworthiness standards and engine testing. Engine innovation, such as electric propulsion systems and thrust-to-weight ratio improvements, is shaping the future of engine design and aircraft performance. Sustainable aviation fuels and engine data analysis are also gaining traction, contributing to fuel efficiency and noise abatement. Engine replacement and engine overhaul are ongoing processes in the engine aftermarket. Regional aviation and long-haul flights require engines that offer optimal aircraft speed and range.

Overall, the Russian the market is undergoing significant changes, driven by technological advancements and market dynamics.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Aircraft Engine Industry?

- The significant rise in aircraft deliveries serves as the primary market driver.

- Aircraft engines continue to play a pivotal role in the aviation industry, driving the growth of commercial aviation despite economic challenges and high jet fuel prices. Reciprocating engines remain essential for smaller aircraft, while turbofan engines power the majority of commercial aircraft due to their superior fuel efficiency and high thrust-to-weight ratio. The engine aftermarket, including engine financing, upgrades, and overhaul, is a significant contributor to the overall market growth. Turbine blades are a critical component of turbine engines, requiring continuous maintenance and replacement to ensure airworthiness standards are met. Emerging technologies, such as electric propulsion systems, are poised to disrupt the market, offering potential fuel savings and reduced emissions.

- Commercial aviation's operating costs remain a critical concern, making engine upgrades a priority for airlines to improve efficiency and reduce expenses. The market dynamics are influenced by factors such as airworthiness standards, aircraft maintenance practices, and the demand for fuel-efficient engines. In conclusion, the market is expected to experience steady growth, driven by the increasing demand for air travel, particularly in emerging markets, and the continuous advancements in engine technology.

What are the market trends shaping the Aircraft Engine Industry?

- The current market landscape is characterized by the increasing prevalence of new technologies. This trend signifies a significant shift towards innovation and advancement in various industries.

- The market is experiencing significant advancements due to the integration of manufacturing technology with data and connectivity. This transformation is particularly evident in the aftermarket sector, where next-generation tools and processes are being adopted. Two technologies leading this evolution are augmented and virtual reality (AR/VR) and advanced predictive maintenance. AR/VR technology extends human visualization capabilities through hardware such as glasses or smartphones. It offers various applications, including operations, maintenance, and training, enabling more immersive and harmonious experiences. On the other hand, advanced predictive maintenance uses engine parameter monitoring to detect potential failures and react proactively, thereby reducing maintenance costs and downtime.

- These technologies contribute to a more efficient and cost-effective the market, enhancing performance and safety. As the industry continues to evolve, the integration of these advanced technologies will become increasingly essential to remain competitive.

What challenges does the Aircraft Engine Industry face during its growth?

- The scarcity of skilled resources poses a significant challenge to the industry's growth trajectory, necessitating the continuous development and acquisition of a proficient workforce to maintain competitiveness.

- The market is experiencing significant growth due to the increasing demand for fuel efficiency and extended engine life. High-bypass ratio engines and engine life extension programs are key trends driving market expansion. Fuel efficiency is a critical factor as airlines aim to reduce operating costs and improve aircraft performance. Engine leasing companies also play a significant role in market growth, providing flexible financing options for airlines. Engine data analysis is another crucial aspect of the market, enabling predictive maintenance and engine design improvements. Engine manufacturing companies invest heavily in research and development to create more efficient and reliable engines.

- Hybrid-electric propulsion is an emerging technology that could disrupt the market in the future. Engine design and aircraft range are essential factors in engine selection, with safety being a top priority. Engine life cycle management is also crucial to ensure optimal performance and reduce maintenance costs. The market dynamics are complex, with technology advancements, regulatory requirements, and economic factors influencing market trends. Predictive maintenance, while offering numerous benefits, presents challenges related to technology and manpower resources. Despite these challenges, the market is expected to continue growing as the aviation industry seeks to improve aircraft efficiency and reduce operating costs.

Exclusive Customer Landscape

The aircraft engine market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the aircraft engine market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, aircraft engine market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Airbus SE - The company provides two distinct engines to support the three variants of the A350 aircraft model. These engines, engineered for optimal performance, enhance the aircraft's efficiency and versatility. By offering this engine diversity, the company caters to the unique requirements of various airline clients, ensuring a customized flying experience. This strategic approach not only elevates the aircraft's market appeal but also strengthens its competitive position within the aviation industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airbus SE

- BMW AG

- EuroJet Turbo GmbH

- General Electric Co.

- Honeywell International Inc.

- IHI Corp.

- JSC Klimov

- Liebherr International AG

- Mitsubishi Heavy Industries Ltd

- MTU Aero Engines AG

- Northstar Aerospace

- PowerJet Pressure Cleaning Systems

- Pratt and Whitney

- Safran SA

- Shenyang Aircraft Corp.

- UEC Aviadvigatel JSC

- Williams International Co. LLC

- Xi an Aero-Engine Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Aircraft Engine Market

- In March 2023, Rolls-Royce, a leading aircraft engine manufacturer, unveiled its latest UltraFan engine, which promises a 10% fuel efficiency improvement and a 75% reduction in nitrogen oxide emissions compared to its current engines (Rolls-Royce Press Release, 2023). This technological advancement is a significant development in the market, as fuel efficiency and emissions reduction are critical factors in the aviation industry's drive towards sustainability.

- In August 2024, GE Aviation and Safran Aircraft Engines announced a strategic partnership to develop a new line of advanced turbofan engines, combining their expertise in materials science, aerodynamics, and digital technologies (GE Aviation Press Release, 2024). This collaboration is expected to result in more fuel-efficient engines and reduced maintenance costs, making it a significant strategic move in the competitive the market.

- In January 2025, CFM International, a joint venture between GE Aviation and Safran Aircraft Engines, secured a USD25 billion contract from Boeing to supply LEAP-1B engines for 737 MAX aircraft (CFM International Press Release, 2025). This large-scale order underscores the market's confidence in CFM's engine technology and its ability to meet the growing demand for fuel-efficient engines in the aviation sector.

- In May 2025, Pratt & Whitney, another major aircraft engine manufacturer, received certification from the Federal Aviation Administration (FAA) for its Geared Turbofan (GTF) engine, enabling it to power Airbus A220 aircraft (Pratt & Whitney Press Release, 2025). This certification marks a significant milestone for Pratt & Whitney, as it expands its customer base and strengthens its position in the competitive the market.

Research Analyst Overview

- The market is experiencing significant advancements in technology, driven by the need for increased engine efficiency, reduced emissions, and the emergence of autonomous and electric aircraft. Engine weight and size are being optimized through innovative materials and design, leading to improved fuel economy and reduced environmental impact. Engine durability is a key focus, with manufacturers investing in advanced simulation tools and vibration control systems to extend engine life expectancy. Engine financing options are evolving to accommodate the high capital costs of new engine technology, with leasing agreements and aftermarket services becoming increasingly popular. Engine innovation trends include electric aircraft development, hybrid-electric propulsion, and engine optimization techniques.

- Engine noise reduction is also a priority, with noise level regulations becoming more stringent and engine manufacturers investing in new materials and design solutions. Engine maintenance costs are a significant concern for operators, with maintenance scheduling and reliability becoming critical factors in fleet management. Engine testing procedures are becoming more sophisticated, with digital design software and performance metrics used to optimize engine efficiency and reduce emissions. Engine certification standards are also evolving to reflect these advancements, with new regulations focusing on engine emissions and safety. Engine technology advancements are driving the development of next-generation aircraft, with engine power and thrust being key performance metrics.

- Engine efficiency and emissions are also major considerations, with manufacturers investing in new materials and design solutions to meet regulatory requirements. Engine vibration control and maintenance scheduling are also crucial for ensuring engine reliability and minimizing downtime. Engine innovation continues to be a major driver in the aviation industry, with engine technology advancements leading to improved performance, reduced emissions, and increased efficiency. Engine design software and certification standards are evolving to reflect these advancements, with a focus on reducing weight, improving durability, and increasing engine power and efficiency. Engine leasing agreements and aftermarket services are also becoming increasingly important in managing the high capital costs of new engine technology.

- Overall, the market is undergoing significant change, with a focus on innovation, efficiency, and sustainability.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Aircraft Engine Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 21.1% |

|

Market growth 2024-2028 |

USD 65.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

17.4 |

|

Key countries |

US, France, Germany, UK, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Aircraft Engine Market Research and Growth Report?

- CAGR of the Aircraft Engine industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the aircraft engine market growth of industry companies

We can help! Our analysts can customize this aircraft engine market research report to meet your requirements.