Aircraft Fairings Market Size 2024-2028

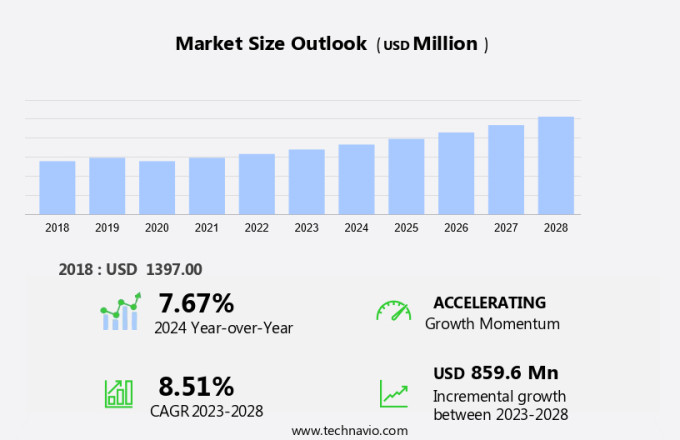

The aircraft fairings market size is forecast to increase by USD 859.6 million and is estimated to grow at a CAGR of 8.51% between 2023 and 2028. The global Aircraft Fairings industry is experiencing significant growth due to the increasing procurement of new-generation aircraft and the rising demand for composite aerostructures. The aviation sector continues to expand, with a growing number of air passengers driving the need for more efficient and technologically advanced aircraft. Composite aerostructures, made primarily of carbon fiber reinforced polymers, offer lighter weight, improved fuel efficiency, and enhanced durability compared to traditional metallic structures. This trend is expected to continue, with composite aerostructures projected to account for over 70% of the global aerospace composites market by 2026. Additionally, advancements in 3D printing technology are further revolutionizing the production of composite aerostructures, leading to cost savings and increased production efficiency. Overall, the aerospace industry's focus on innovation and sustainability is driving the demand for composite aerostructures and fueling its growth.

What will be the Size of the Market During the Forecast Period?

For More Highlights About this Report, Request Free Sample

Market Dynamic and Customer Landscape

The Aircraft Fairings Market refers to the demand for components that cover and protect various parts of an aircraft, including flight control surfaces, fuselage, nose, cockpit, wings, landing gear, and engines. These fairings are essential for reducing drag and improving the overall aerodynamic performance of the aircraft. Aircraft fairings are available in two main categories: OEM (Original Equipment Manufacturer) and aftermarket. OEM fairings are installed during the initial assembly of the aircraft, while aftermarket fairings are used for maintenance, repair, or upgrades. The market for aircraft fairings is driven by the increasing demand for commercial aircraft, particularly in the urban air mobility segment. The use of lightweight materials such as composites, alloys, and metallic alloys in the production of aircraft fairings is a major trend in the market. Key players in the Aircraft Fairings Market include McDonnell Douglas, Aerostructures, and Materialize, among others. The market is expected to grow significantly due to the increasing demand for fuel-efficient and lightweight aerostructures in the aviation industry. Aircraft fairings come in various shapes and sizes, including nose fairings, wing fairings, engine fairings, and cockpit fairings. The weight and payload capacity of these components are critical factors in the design and manufacturing process. Energy consumption is also a significant consideration, as lightweight aerostructures can help reduce the overall energy consumption of the aircraft. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

Rising procurement of new generation aircraft is notably driving market growth. The market is witnessing significant growth due to the increasing number of commercial aircraft deliveries, driven primarily by the burgeoning air travel industry in the Asia Pacific region. To cater to this rising demand, aircraft Original Equipment Manufacturers (OEMs) are expanding their production capabilities.

For instance, Airbus inaugurated a new manufacturing facility in Mobile, Alabama, US, in May 2020, to produce the A220-100 and A220-300 aircraft versions. This expansion is essential to ensure timely deliveries and meet the growing demand for commercial aircraft. Aircraft fairings, as structural components, play a crucial role in the aircraft's aerodynamic performance. These components are typically made of lightweight materials like aluminum and its alloys to minimize the overall weight of the aircraft. Thus, such factors are driving the growth of the market during the forecast period.

Significant Market Trends

Diversification of OEMs into aftermarket is the key trend in the market. The aircraft fairings market has undergone significant transformations in the last decade, with 777 Partners and other key players investing in new commercial aircraft deliveries and MRO facilities to meet evolving customer expectations. Structural components, such as fairings, play a crucial role in aircraft design and performance, with materials like aluminum alloys being widely used due to their strength and lightweight properties.

However, the aviation industry's dynamic landscape presents challenges, including consolidation in mature markets and the need for continuous innovation to stay competitive. These factors are driving the demand for advanced materials and technologies in aircraft fairings production. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

Delays in aircraft deliveries and order cancellations is the major challenge that affects the growth of the market. The market is experiencing significant pressure due to the increasing demand for commercial aircraft deliveries and the need for structural components that meet advanced technological requirements. Manufacturers are under pressure to produce high-quality parts and components while adhering to tight deadlines and budget constraints.

Moreover, this can result in potential compromises in the manufacturing process, which may impact the quality of aircraft fairings. The production of aircraft involves an intricate process, from design to final production, which can be time-consuming. Delays in this process can lead to extended delivery dates and potential cancellations of orders. For instance, Boeing canceled the delivery of 51 aircraft in February 2021 due to such delays. Hence, the above factors will impede the growth of the market during the forecast period.

Exculsive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AAR Corp: The company offers aircraft fairings such as composite flap track fairings.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airbus SE

- Arnprior Aerospace Inc.

- Barnes Group Inc.

- DAHER

- FACC AG

- Fdc Composites Inc.

- Fiber Dynamics Inc.

- Kaman Corp.

- Latecoere

- Malibu Aerospace LLC.

- McFarlane Aviation Inc.

- nV Aerospace LLC

- Royal Engineered Composites Inc.

- ShinMaywa Industries Ltd.

- Strata Manufacturing PJSC

- The Nordam Group LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

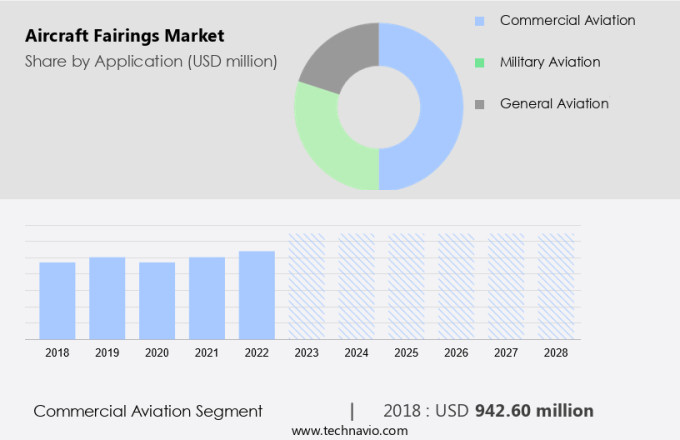

By Application

The commercial aviation segment is estimated to witness significant growth during the forecast period. Aircraft fairings are essential components that enhance the aerodynamic efficiency of various aircraft types, including Commercial aviation, Business Jets, Military Fighter Aircraft, Military Transport, General Aviation, UAVs, Agriculture, Real Estate, Mining, Photography, Oil & Gas, Product Delivery, Greenhouse Emission Monitoring, Wildlife Research & Preservation, Precision Farming, and Urban Air Mobility.

Get a glance at the market share of various regions Download the PDF Sample

The commercial aviation segment was the largest segment and valued at USD 942.60 million in 2018. These components are used on OEM (Original Equipment Manufacturer) and Aftermarket aircraft and are integrated into various parts such as Flight Control Surfaces, Fuselage, Engine, Nose, Cockpit, Wings, and Landing Gear. Aircraft fairings are available in various materials like Composite, Metallic, and Alloy, with lightweight aerostructures and high-performance materials being preferred for their weight, payload capabilities, and energy consumption efficiency. Hence, such factors are fuelling the growth of this segment during the forecast period.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

Europe is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. Aircraft fairings are essential components used in both OEM and aftermarket applications for various types of aircraft, including commercial aviation, business jets, military aircraft, and UAVs. These fairings are designed to cover and streamline different parts of an aircraft, such as Flight Control Surfaces, Fuselage, Engine, Nose, Cockpit, Wings, Landing Gear, and other structural elements. Manufacturers use materials like composite, metallic alloys, and lightweight aerostructures to create these fairings, ensuring optimal weight, payload, and energy consumption. Hence, such afctors are driving the market in Europe during the forecast period.

Segment Overview

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million " for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application Outlook

- Commercial aviation

- Military aviation

- General aviation

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

You may also interested in below market reports:

Commercial Aircraft Airframe Materials Market Analysis North America, Europe, APAC, Middle East and Africa, South America - US, China, Japan, Germany, UK - Size and Forecast

Commercial Aircraft Avionic Systems Market Analysis North America, Europe, APAC, Middle East and Africa, South America - US, France, China, Germany, UK - Size and Forecast

Fiberglass Market for Aerospace Industry Analysis APAC, North America, Europe, South America, Middle East and Africa - US, Canada, China, Japan, Germany - Size and Forecast

Market Analyst Overview

In the aviation industry, Flight Control Surface technology is critical for the performance of various aircraft types, including Narrow Body Aircraft (NBA), Wide Body Aircraft (WBA), and Very Large Aircraft (VLA). Regional Transport Aircraft (RTA) also rely on advanced control surfaces for efficiency and safety. The International Air Transport Association provides guidelines that impact these technologies. Platforms and materials used in the design of these surfaces are continually evolving, with innovations such as the Delta wing design enhancing aerodynamic performance. These advancements support the industry's growth and adaptability in an ever-changing environment.

Aircraft fairings are essential components that enhance the aerodynamic performance and structural integrity of aircraft. These structures cover various parts of an aircraft, including wings, engines, nose, cockpit, and landing gear. Aircraft fairings are manufactured using different materials such as composites, metallics, and alloys. The global aircraft fairing market caters to various sectors, including OEM and aftermarket. OEMs like McDonnell Douglas use aircraft fairings in commercial aviation, business jets, military aircraft, and urban air mobility. Aftermarket players focus on serving the needs of the maintenance, repair, and overhaul industry. The market for aircraft fairings is driven by the increasing demand for lightweight aerostructures in commercial aviation. Composites are a preferred choice due to their high strength-to-weight ratio and low energy consumption. The use of aircraft fairings in UAVs, agriculture, real estate, mining, oil & gas, product delivery, greenhouse emission monitoring, wildlife research & preservation, precision farming, 3D printing, and other applications is also growing. Weight and payload are critical factors in the design and production of aircraft fairings. Manufacturers focus on developing innovative solutions to reduce weight while maintaining structural integrity and enhancing performance. Some of the key players in the aircraft fairing market include Aerostructures, Materialize, Proponent, and others.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

139 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.51% |

|

Market growth 2024-2028 |

USD 859.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.67 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

Europe at 40% |

|

Key countries |

US, Germany, China, France, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AAR Corp., Airbus SE, Arnprior Aerospace Inc., Barnes Group Inc., DAHER, FACC AG, Fdc Composites Inc., Fiber Dynamics Inc., Kaman Corp., Latecoere, Malibu Aerospace LLC., McFarlane Aviation Inc., nV Aerospace LLC, Royal Engineered Composites Inc., ShinMaywa Industries Ltd., Strata Manufacturing PJSC, and The Nordam Group LLC |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies