Aircraft Seating Market Size 2024-2028

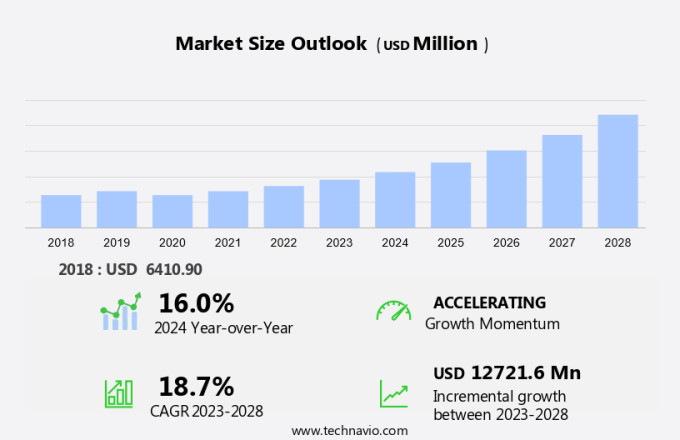

The aircraft seating market size is forecast to increase by USD 12.72 billion at a CAGR of 18.7% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for commercial aircraft. This trend is driven by the expanding air travel industry and the subsequent rise in passenger traffic. Another key factor fueling market growth is the adoption of advanced materials, such as composites, in seat design and construction. Narrowbody aircraft, such as Economy class seats in commercial jets, are popular choices for cost-conscious travelers. On the other hand, Premium economy seats and business jets cater to the growing preference for comfort and convenience among travelers. However, the high costs associated with the development and manufacturing of aircraft seats pose a challenge to market growth. Despite this, innovations in materials science and manufacturing processes are expected to drive down costs and make aircraft seats more affordable. Additionally, the focus on enhancing passenger comfort and safety is leading to the development of new seat designs and technologies.

What will be the Size of the Aircraft Seating Market During the Forecast Period?

- The market is a dynamic and innovative industry that caters to the evolving needs of passengers and crew In the aviation sector. With a focus on passenger safety, comfort, and travel experience, this market encompasses the design, manufacturing, and installation of seating systems for various aircraft types, including narrowbody and widebody models. Actuators and electrical fittings are integral components of modern aircraft seating, providing advanced functionality and customization.

- Fleet expansion and passenger comfort are key drivers in the market, leading to the development of ergonomically designed seats with increased legroom, adjustable headrests, and improved amenities. Premium seating options, such as premium economy seats, are gaining popularity for their enhanced comfort and features. Lightweight metals and eco-friendly seating materials are also becoming increasingly important, offering fuel savings and reduced carbon emissions. The market is continually evolving to meet the demands of airlines and passengers, with a focus on creating a more enjoyable and sustainable travel experience.

How is this Aircraft Seating Industry segmented and which is the largest segment?

The aircraft seating industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Aircraft Type

- Commercial aircraft

- Military aircraft

- Geography

- Europe

- Germany

- UK

- France

- Italy

- North America

- Canada

- US

- APAC

- China

- India

- Japan

- South Korea

- Middle East and Africa

- South America

- Europe

By Aircraft Type Insights

- The commercial aircraft segment is estimated to witness significant growth during the forecast period.

The market is experiencing substantial growth due to increasing air travel demand and evolving passenger preferences. Factors driving this growth include the rise of global tourism, corporate travel, and a growing middle class in emerging economies. Airlines are focusing on improving the passenger experience by offering modern, comfortable seating solutions with features such as in-seat power, connectivity options, and ergonomic designs. The emergence of low-cost carriers (LCCs) in regions like APAC and Europe has also influenced the market, prioritizing efficient seating arrangements that maximize capacity while minimizing costs. Seating solutions In the market incorporate advanced materials like lightweight metals, eco-friendly seating materials, and recyclable components to reduce fuel costs and carbon emissions.

Furthermore, seating options range from economy class to premium business and first class, with ergonomically designed seats offering increased legroom, adjustable headrests, and personal entertainment systems. Modern amenities include improved cabin layouts, smart features like embedded screens, USB charging ports, Wi-Fi connectivity, and convenience items like lavatories. Safety standards remain a priority, with passenger protection a key consideration.

Get a glance at the Aircraft Seating Industry report of share of various segments Request Free Sample

The commercial aircraft segment was valued at USD 4.5 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

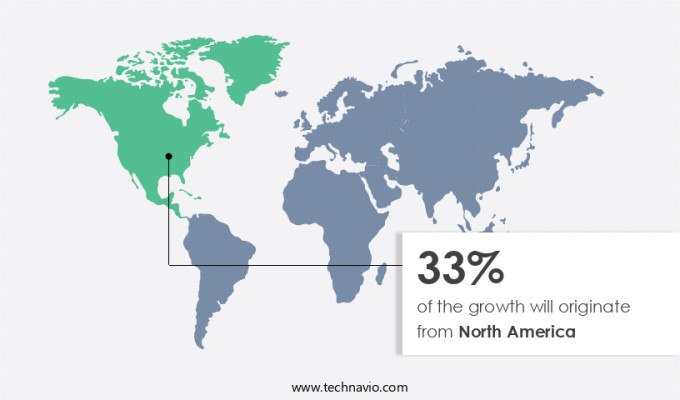

- North America is estimated to contribute 33% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The European market is driven by the region's mature aerospace industry and significant research and development investments. EU member countries lead the market due to their advanced technological capabilities, enabling them to supply aircraft and related components globally. Airline operators in Europe are focusing on cabin retrofitting to provide modern amenities and designs, enhancing the travel experience for passengers while keeping costs minimal. This trend is essential for airlines to remain competitive In the market. Advanced seating options, such as ergonomically designed seats with increased legroom, adjustable headrests, and personal entertainment systems, are increasingly popular. Lightweight designs using materials like nylon, synthetic leathers, silicon, polyethylene, and fireproof fabric contribute to fuel savings and reduced carbon emissions.

Market Dynamics

Our aircraft seating market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Aircraft Seating Industry?

Growing demand for commercial aircraft is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for commercial aircraft. Factors such as globalization, rising disposable incomes, and the expansion of low-cost carriers are driving the need for more aircraft, leading to an increased requirement for seating solutions that cater to various passenger needs. Airlines prioritize enhancing passenger comfort and experience, resulting in a heightened demand for modern seating configurations. Advanced features, including in-seat power, connectivity options, and ergonomic designs, are becoming increasingly popular. Lightweight designs made from materials like nylon, synthetic leathers, silicon, polyethylene, and fireproof fabric contribute to fuel savings and reduced carbon emissions, making them eco-friendly and cost-effective.

- Seating options range from Economy Class to Business Class and First Class, as well as Suite Class, Military Aircraft, and Helicopters. Actuators, electrical fittings, and smart features, such as embedded screens, USB charging ports, and WiFi connectivity, are also essential components of contemporary aircraft interiors. Passenger safety remains a top priority, with safety standards ensuring passenger protection. Airline operators of commercial jets, business jets, and regional aircraft are continually seeking innovative seating solutions to meet the evolving needs of Travelers. Cabin layouts are also a significant consideration, with increased legroom, adjustable headrests, and improved amenities contributing to overall passenger satisfaction.

What are the market trends shaping the Aircraft Seating Industry?

The use of composites and other advanced materials for seat design and construction is the upcoming market trend.

- The market is experiencing significant growth due to the increasing demand for passenger comfort and travel experience in both commercial and business aviation. Airline operators are focusing on fleet expansion and advanced seating options to enhance passenger comfort, including ergonomically designed seats with increased legroom, adjustable headrests, and personal entertainment systems. Lightweight designs using materials such as magnesium alloys, nylon, synthetic leathers, silicon, polyethylene, and fireproof fabrics are gaining popularity for their fuel savings and reduced carbon emissions.

- Seats are also being equipped with smart features like embedded screens, USB charging ports, and WiFi connectivity to improve convenience. Cabin layouts are being redesigned to accommodate premium seating options. Manufacturers are investing in lightweight metals and eco-friendly seating materials to meet these demands while maintaining safety standards and passenger protection. The aviation industry's focus on fuel efficiency and cost savings is driving the market forward, with budget airlines also adopting these advanced seating solutions.

What challenges does the Aircraft Seating Industry face during its growth?

High costs associated with the development and manufacturing of aircraft seats is a key challenge affecting the industry growth.

- The market faces significant challenges due to the high costs involved In the design, development, and manufacturing of aircraft seats. These expenses, driven by stringent safety and regulatory standards, can hinder market growth. Premium seating options, such as business and first-class configurations, can cost between USD 60,000 and USD 150,000 per seat. This can deter airlines from upgrading their fleets or investing in advanced seating solutions. In a price-sensitive industry, these high expenses often lead airlines to prioritize cost-effectiveness over passenger comfort and experience. Aircraft seating manufacturers must balance safety, comfort, and affordability to cater to the diverse needs of airline operators, including commercial jets, business jets, regional aircraft, and military aircraft.

- Innovations in lightweight designs, ergonomically designed seats, increased legroom, adjustable headrests, personal entertainment systems, improved amenities, and eco-friendly seating materials offer potential solutions to these challenges. Additionally, the integration of smart features, such as embedded screens, USB charging ports, Wi-Fi connectivity, and convenience items like lavatories, can enhance the travel experience for all passengers while adhering to safety standards.

Exclusive Customer Landscape

The aircraft seating market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the aircraft seating market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, aircraft seating market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACRO Aircraft Seating Ltd.

- Adient Plc

- Airbus SE

- Aviointeriors Spa

- Causeway Aero

- Collins Aerospace

- EnCore Corporate Inc.

- Expliseat SAS

- Geven Spa

- JAMCO Corp.

- John Swire and Sons Ltd.

- Martin-Baker Aircraft Co. Ltd.

- Mirus Aircraft Seating Ltd.

- RECARO Holding GmbH

- Safran SA

- Singapore Technologies Engineering Ltd.

- Thales Group

- Thompson Aero Seating Ltd.

- TSI Seats Inc.

- ZIM AIRCRAFT SEATING GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the design, manufacturing, and installation of seats for various types of aircraft, including commercial jets, business jets, regional aircraft, military aircraft, and helicopters. This market caters to the needs of both passengers and crew, prioritizing safety, comfort, and travel experience. Passenger safety is a primary concern In the aircraft seating industry. Seats are engineered to withstand the rigors of flight while ensuring occupant protection in various scenarios. Actuators and electrical fittings are integral components of modern aircraft seating, enabling adjustability and functionality. Comfort is another essential factor In the market. Travelers seek increased legroom, adjustable headrests, and ergonomically designed seats to enhance their overall travel experience.

Moreover, premium seating options, such as business class, first class, and suite class seats, offer additional comfort features and amenities. Aircraft interiors, including seating, are subject to fuel costs and weight considerations. Lightweight designs utilizing materials like silicon, polyethene, nylon, synthetic leathers, and fireproof fabrics are increasingly popular in reducing fuel consumption and carbon emissions. Advanced seating options continue to emerge, incorporating smart features like embedded screens, USB charging ports, and wifi connectivity. These innovations aim to enhance the travel experience and provide greater convenience for passengers. Cabin layouts are continually evolving to accommodate various aircraft sizes and passenger preferences.

Furthermore, narrowbody aircraft typically feature economy class seats, while widebody aircraft offer more expansive seating configurations for premium travelers. Fleet expansion and passenger comfort are significant drivers In the market. Airline operators invest in new seating solutions to meet growing demand and improve the overall travel experience for their customers. Military aircraft and helicopter seating also prioritize safety and functionality, with designs tailored to the unique requirements of these applications. The market is subject to stringent safety standards, ensuring passenger protection during all phases of flight. These regulations drive continuous innovation and improvement in seating technology and materials.

|

Aircraft Seating Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.7% |

|

Market Growth 2024-2028 |

USD 12.72 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

16.0 |

|

Key countries |

US, France, China, Germany, UK, Japan, Canada, India, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Aircraft Seating Market Research and Growth Report?

- CAGR of the Aircraft Seating industry during the forecast period

- Detailed information on factors that will drive the Aircraft Seating market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution to the industry in focus on the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the aircraft seating market growth of industry companies

We can help! Our analysts can customize this aircraft seating market research report to meet your requirements.