Helicopter Market Size 2025-2029

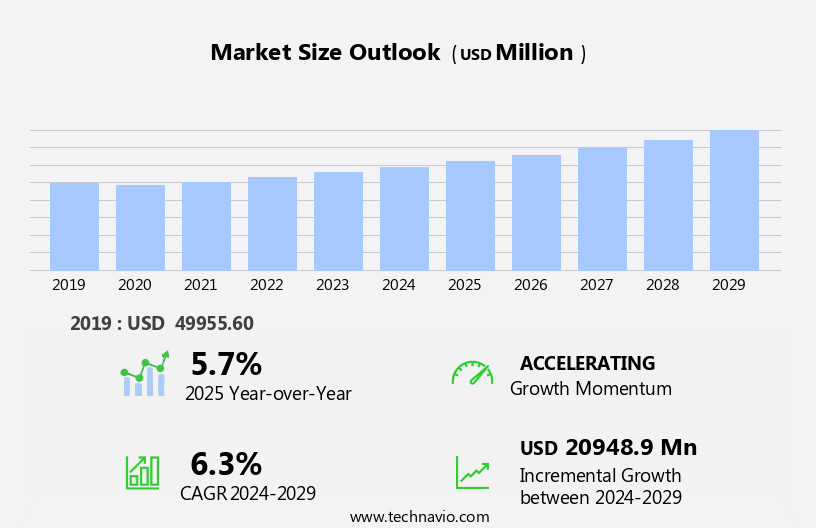

The helicopter market size is forecast to increase by USD 20.95 billion at a CAGR of 6.3% between 2024 and 2029.

- The market experiences significant growth, driven by the increasing demand for technologically advanced combat helicopters. These modern helicopters offer enhanced capabilities, such as improved speed, range, and payload capacity, making them indispensable for military applications. Furthermore, the emergence of electric vertical takeoff and landing (eVTOL) aircraft adds an exciting new dimension to the market. EVTOL helicopters promise reduced emissions, increased efficiency, and the potential for urban air mobility, opening up new opportunities for commercial applications. However, the market faces challenges that require careful consideration. High operational and maintenance costs remain a significant obstacle for helicopter adoption, particularly in the commercial sector. Delivery backlogs for military helicopters are a challenge, as the demand for these aircraft outpaces supply. Complex product certification and stringent regulatory norms also pose barriers to market growth. New technologies, such as electric vertical takeoff and landing (eVTOL) engines, are gaining traction, but their adoption is hindered by the high cost of development and certification.

- These costs can be attributed to factors such as fuel consumption, spare parts, and labor. Additionally, regulatory hurdles impact adoption, with strict safety regulations and certification processes adding complexity to market entry. Supply chain inconsistencies also temper growth potential, as delays in component delivery can disrupt production schedules and impact customer satisfaction. Companies seeking to capitalize on market opportunities must address these challenges effectively through innovations in cost reduction, regulatory compliance, and supply chain optimization.

What will be the Size of the Helicopter Market during the forecast period?

- The market encompasses various stakeholders, including helicopter service providers, manufacturers, and leasing companies. Flight safety is a paramount concern, with helicopter operations relying heavily on advanced technology for flight planning, weather forecasting, and certification standards. Helicopter manufacturing involves intricate processes, from assembly lines to flight testing and certification. Customer needs drive sales, with leasing gaining popularity due to its flexibility. Helicopter maintenance technicians ensure optimal performance through rigorous maintenance schedules and the use of flight data recording. Industry trends include the integration of stabilization systems, competitive advantages in anti-torque systems, and the role of emergency procedures in enhancing safety.

- Ground handling and air traffic control also play crucial roles in helicopter operations. Rotor blade design and parts and components continue to evolve, while certification standards remain stringent to ensure the highest levels of safety. The future outlook for the helicopter industry remains promising, with continued innovation in technology and a focus on enhancing operational efficiency.

How is this Helicopter Industry segmented?

The helicopter industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Light

- Medium

- Heavy

- Application

- Civil and commercial

- Military

- Component

- Airframe

- Main and tail rotor systems

- Engines

- Avionics and navigation systems

- Landing gear

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Type Insights

The light segment is estimated to witness significant growth during the forecast period. The light market is experiencing notable growth due to its wide application across various industries. These helicopters, designed for transporting small numbers of passengers or cargo, have a maximum takeoff weight of under 6,000 pounds. Their use is prevalent in sectors such as tourism, emergency medical services, law enforcement, offshore activities, and corporate transportation. In areas with limited infrastructure or challenging terrain, light helicopters offer a flexible and efficient transportation solution. Flight control systems and composite materials are essential components of these helicopters, ensuring safety and durability. Search and rescue missions, air ambulance services, and law enforcement operations rely heavily on helicopters for their swift response and maneuverability.

Noise pollution is a concern, prompting advancements in fuel efficiency and quieter engines. Private ownership and charter flights are increasing, necessitating the development of landing zones in urban areas. Navigation systems and communication systems are crucial for safe and efficient flight operations. Autonomous flight and data analytics are emerging trends, offering potential for reduced operational costs and increased payload capacity. Environmental impact is a growing concern, leading to the exploration of renewable energy sources and lightweight design. Emergency landing systems and oil and gas industry applications further expand the market's scope.

The Light segment was valued at USD 30.43 billion in 2019 and showed a gradual increase during the forecast period.

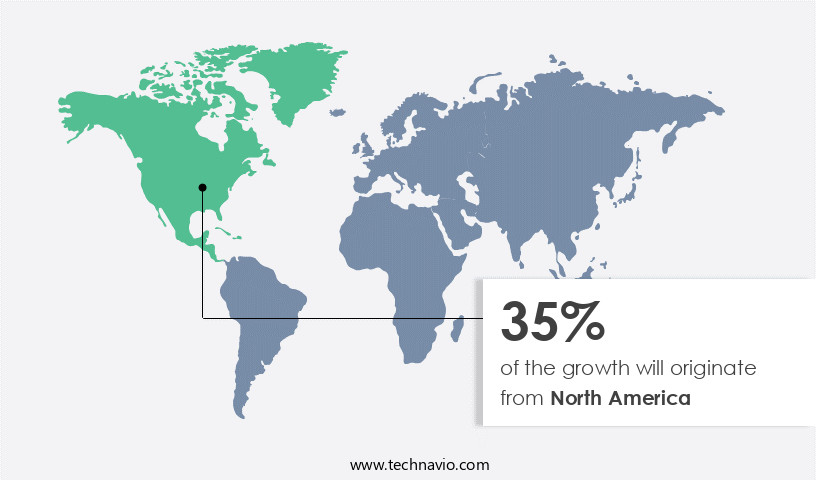

Regional Analysis

North America is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing notable growth, driven by the increasing demand for helicopters in various applications. The region's helicopter supply chain is primarily fueled by procurement from government entities, air charter companies, and private or corporate clients. The adoption of helicopters for passenger transport, search and rescue, law enforcement, oil and gas industries, and other sectors has led to a in demand. Advancements in technology have significantly impacted the market, with the integration of fuel efficiency systems, composite materials, navigation systems, communication systems, artificial intelligence, and data analytics. These advancements have not only made helicopters more efficient but also more environmentally friendly, addressing concerns related to noise pollution and emissions reduction.

The US and Canada are the major contributors to the North American market. The US, in particular, leads the market due to its extensive distribution network, large and skilled workforce, and robust support for policy promotion at regional and national levels. Additionally, the increasing demand for executive transport, charter flights, and cargo transport has further boosted the market's growth. Helicopter manufacturers are focusing on designing lightweight, fuel-efficient helicopters with advanced safety features, such as emergency landing systems, to cater to the evolving market trends. The integration of autonomous flight technology and renewable energy sources is also expected to shape the future of the market.

Maintenance costs and operational expenses remain critical factors influencing the market's dynamics. However, the development of advanced maintenance systems and the increasing focus on reducing maintenance costs are expected to mitigate these challenges. In summary, the North American the market is witnessing significant growth, driven by the increasing demand for helicopters in various applications, advancements in technology, and supportive government policies. The market is expected to continue evolving, with a focus on fuel efficiency, safety, and cost reduction.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Helicopter market drivers leading to the rise in the adoption of Industry?

- The increasing demand for technologically advanced combat helicopters serves as the primary market driver. The market is experiencing significant growth due to the increasing demand for advanced passenger transport helicopters and the integration of innovative technologies. Flight control systems are being enhanced with the use of composite materials, leading to lighter, faster, and more fuel-efficient helicopters. These advancements are particularly crucial for operations in the areas of search and rescue and private ownership, where quieter and more agile aircraft are essential. Moreover, the development of augmented reality (AR) software and the digitalization of cockpits have revolutionized helicopter design. Modern helicopters now offer improved navigation and guidance, allowing for increased satellite performance and easier information gathering during reconnaissance and combat operations.

- The compact equipment and user-friendly interfaces have made these aircraft more intuitive and efficient. Over the past three decades, the helicopter industry has witnessed remarkable progress, with engineers focusing on creating helicopters that fly faster, quieter, and lower while maintaining agility. The integration of AR software into cockpits has enabled helicopters to carry more technology, enhancing their capabilities and streamlining operations. The market is poised for continued growth, driven by the demand for advanced technologies and the evolving needs of various industries.

What are the Helicopter market trends shaping the Industry?

- The increasing popularity for electric Vertical Takeoff and Landing (eVTOL) aircraft represents a significant market trend in the aviation industry. This emerging technology offers numerous advantages, including reduced emissions, quieter operations, and increased efficiency compared to traditional aircraft. The market is experiencing significant growth, driven in part by the increasing demand for electric vertical takeoff and landing (eVTOL) aircraft. EVTOL helicopters, which can take off and land vertically using electric propulsion systems, offer numerous advantages, including quiet and emission-free operations and the ability to maneuver in urban environments. This makes them ideal for use in transportation, emergency services, and cargo transport in densely populated areas. Navigation systems are another crucial factor driving market growth, as advanced technologies such as artificial intelligence and data analytics enhance helicopter safety and efficiency. Air ambulance services also represent a substantial market segment, with the need for rapid response and transport of patients to hospitals driving demand.

- Payload capacity is another essential factor, with the ability to carry heavier loads increasing the versatility of helicopters in various industries. The future of the market is likely to be shaped by advancements in autonomous flight technology, which could further enhance safety and efficiency while reducing operational costs. Overall, the market is poised for continued growth, driven by technological innovation and the expanding range of applications for these versatile aircraft.

How does Helicopter market faces challenges during its growth?

- The escalating operational and maintenance costs represent a significant challenge to the growth of the helicopter industry. The market faces significant challenges due to the high operational and maintenance costs. These expenses can be substantial, with older models requiring frequent oil changes, inspections, and major repairs, such as engine replacements, costing tens of thousands of dollars. The cost of storing and maintaining a helicopter is also considerable, with hangar space and storage fees adding up quickly for frequent flyers. Communication systems are essential for safe and efficient flight operations, but they can also increase costs. Moreover, the environmental impact of helicopter emissions is a growing concern for many businesses, leading to a push for emissions reduction technologies.

- In the charter flight sector, executive transport remains a popular application, with cruise speed being a crucial factor for time-conscious clients. Despite these challenges, the market continues to grow, driven by the need for versatile and efficient transportation solutions.

Exclusive Customer Landscape

The helicopter market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the helicopter market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, helicopter market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Airbus SE - The company specializes in providing helicopter solutions, encompassing models such as the H125, military training H135, and ACH145.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airbus SE

- Bristow Group Inc.

- CHC Group LLC

- Enstrom Helicopter Crop.

- EHang Holdings Ltd.

- Helicopteres Guimbal S.A.S

- Hill Helicopters Ltd.

- Hindustan Aeronautics Ltd.

- Joby Aviation Inc.

- Kaman Corp.

- Kawasaki Heavy Industries Ltd.

- Leonardo Spa

- Lockheed Martin Corp.

- MD Helicopters Inc.

- Northrop Grumman Corp.

- Robinson Helicopter Co. Inc.

- Rostec

- Textron Inc.

- The Boeing Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Helicopter Market

- In February 2024, Bell Helicopter, a Textron Inc. Company, unveiled the Bell Nexus, an innovative electric vertical takeoff and landing (eVTOL) aircraft, marking a significant technological advancement in the market (Bell Helicopter Press Release, 2024).

- In November 2024, Sikorsky, a Lockheed Martin company, secured a contract worth over USD1 billion from the U.S. Army for the production of H-60M Black Hawk helicopters. This major acquisition marks a significant boost for Sikorsky's market presence and strengthens its relationship with the U.S. Military (Lockheed Martin Press Release, 2024).

- In March 2025, the European Union Aviation Safety Agency (EASA) granted certification to AgustaWestland's AW169 helicopter, enabling its commercial operation in Europe. This key regulatory approval signifies a significant market entry for the AW169 and further solidifies AgustaWestland's position in the European market (AgustaWestland Press Release, 2025).

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and shifting market dynamics. Composite materials are increasingly utilized in helicopter manufacturing for their lightweight design and durability, reducing operational costs and fuel consumption. Flight control systems have seen significant improvements, enabling greater precision and efficiency in flight operations. Navigation systems have become essential, ensuring safe and efficient flight paths for various sectors, including air ambulance services and law enforcement. Noise pollution remains a concern, leading to the development of quieter helicopter models. Private ownership and charter flights have gained popularity, necessitating the provision of executive transport with high cruising speeds and comfort. Unmanned attack helicopters and military helicopters continue to dominate the market.

Cargo transport is another growing application, with the need for larger payload capacities and autonomous flight capabilities. Artificial intelligence and data analytics are being integrated into helicopter systems to optimize flight performance and reduce maintenance costs. Autonomous flight is a promising development, aiming to increase safety and efficiency. Environmental impact is a significant consideration, with renewable energy solutions and emissions reduction technologies being explored. Emergency landing systems and communication systems are crucial for ensuring safety and an effective response in various sectors. The market's continuous dynamism is reflected in the ongoing development of landing zones, flight operations, and maintenance practices. However, the civil sector is also showing a rising trend towards electric vertical takeoff and landing (eVTOL) aircraft and hybrid-electric propulsion systems.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Helicopter Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

226 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.3% |

|

Market growth 2025-2029 |

USD 20.95 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.7 |

|

Key countries |

US, Germany, China, Canada, UK, Japan, France, Italy, Saudi Arabia, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Helicopter Market Research and Growth Report?

- CAGR of the Helicopter industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the helicopter market growth of industry companies

We can help! Our analysts can customize this helicopter market research report to meet your requirements.