Aluminum Smelting Market Size 2024-2028

The aluminum smelting market size is forecast to increase by USD 28.3 billion, at a CAGR of 4.1% between 2023 and 2028.

- The market experiences significant growth due to the increasing demand for lightweight materials in various industries. Aluminum's versatility makes it an ideal choice for sectors such as packaging, construction, and transportation. In particular, the packaging industry's expansion, driven by the rise in consumer demand for beverages, food, and pharmaceuticals, fuels the market's growth. Additionally, the increasing usage of aluminum in smartphones, batteries, and renewable energy applications further boosts market growth. However, high energy consumption and costs associated with aluminum smelting remain challenges for market participants. Other trends include the adoption of automation and insulation technologies to reduce energy usage and enhance efficiency. Furthermore, the growing usage of aluminum in construction, flooring, roofing, and real estate, as well as in cable and greenhouse applications, presents new opportunities for market expansion. The increasing demand for magnesium, zinc, copper, and other metals as alloys also impacts the market dynamics.

What will be the Size of the Aluminum Smelting Market During the Forecast Period?

- The market encompasses the production of primary and secondary aluminum through various processes, including the Hall-Heroult process and aluminothermic reduction. This market is driven by the increasing demand for aluminum in diverse sectors such as construction, aerospace, automotive, and consumer goods, including lightweight mobile phones, consumer electronics, and packaging. Aluminum's unique properties, like lightweight, strength, and corrosion resistance, make it an essential component in various industries. Alumina, the primary raw material for aluminum production, is sourced from bauxite ore. The smelting process requires substantial energy inputs, primarily from power plants, which contributes to the market's significant energy consumption. Transportation costs associated with the movement of alumina and aluminum products also impact market dynamics.

- The market is expanding due to the growing demand for energy-efficient buildings, renewable energy infrastructure, and the increasing use of aluminum in industries like agriculture, construction equipment, mining equipment, machinery, and transportation. However, concerns over greenhouse gas emissions and the need for more sustainable production methods are driving the adoption of smelting technologies that minimize carbon emissions, such as automation and the integration of renewable energy sources. Both primary and secondary aluminum production contribute to the market's growth. Primary aluminum is produced through electrolytic reduction, while secondary aluminum is recycled from scrap. The market's size and direction are influenced by various factors, including technological advancements, market trends, and regulatory policies.

How is this Aluminum Smelting Industry segmented and which is the largest segment?

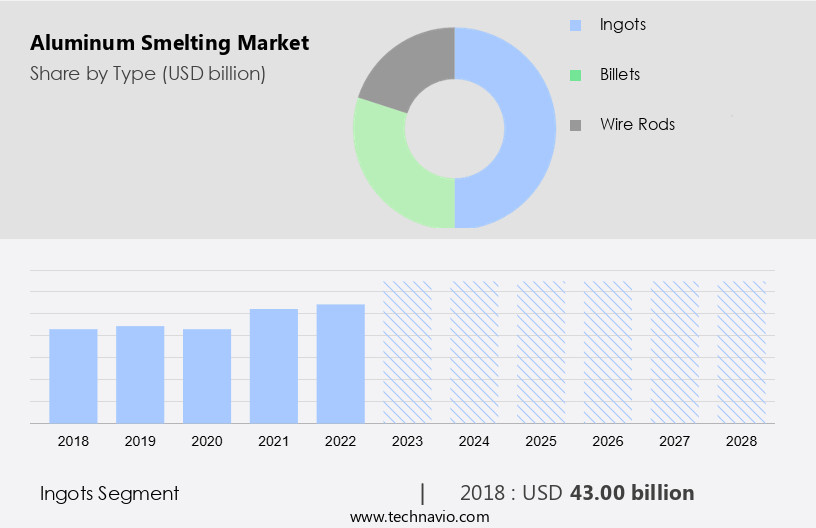

The aluminum smelting industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Ingots

- Billets

- Wire rods

- End-user

- Transportation

- Heavy machinery and industrial

- Construction

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- India

- Japan

- Middle East and Africa

- South America

- Brazil

- North America

By Type Insights

- The ingots segment is estimated to witness significant growth during the forecast period.

Aluminum smelting involves the production of aluminum ingots through the Hall-Heroult process, which uses a reduction pot, electrode conductor, and an electrolyte solution to extract aluminum from alumina. This process is energy-intensive and requires significant power from power plants, leading to high transportation costs. The market is driven by the demand for aluminum in various industries, including consumer goods such as lightweight mobile phones and beverage cans, as well as in construction equipment, agricultural equipment, mining equipment, machinery, and automotive components. Aluminum's corrosion resistance, lightweight properties, and energy efficiency make it a popular choice for various applications. The construction industry, in particular, uses aluminum extensively for windows, doors, and other building components.

With the increasing focus on reducing greenhouse gas emissions, there is a growing interest in smelting technologies that utilize renewable energy sources. Automation and the use of secondary aluminum and alloy aluminum are also key trends In the market. The aluminum market is expected to grow significantly due to the increasing demand from various end-use industries, including construction activities, food and packaging, pharmaceuticals, electrical, electric vehicles, OEM, real estate, and healthcare facilities.

Get a glance at the market report of the share of various segments Request Free Sample

The ingots segment was valued at USD 43.00 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

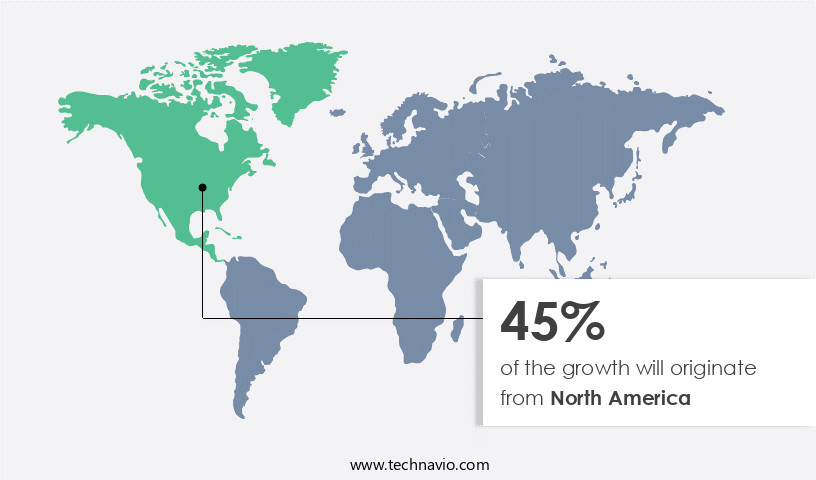

- North America is estimated to contribute 45% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is experiencing growth due to the increasing demand for aluminum wire rods, particularly in the US and Canada. This trend is driven by the automotive industry, which is a significant end user of aluminum and the second-largest market for automobile sales and production globally. The presence of strong automotive manufacturing bases in the region has significantly contributed to the growth of the automotive industry, thereby increasing the demand for aluminum smelting. The Hall-Heroult process, the primary method used in aluminum smelting, involves the use of alumina, reduction pot, electrode conductor, electrolyte solution, carbon lined bed, and smelting technologies.

Aluminum is widely used in various industries such as consumer goods, construction equipment, mining equipment, machinery, and aerospace due to its lightweight, corrosion resistance, and energy efficiency. However, the aluminum industry faces challenges such as high transportation costs and greenhouse gas emissions. To address these challenges, there is a growing focus on renewable energy and automation in aluminum smelting processes. The market for primary, secondary, and alloy aluminum is expected to continue growing, driven by demand from various sectors including construction activities, food and packaging, pharmaceutical, electrical, electric vehicles, OEM, FDI inflow, real estate, and healthcare facilities.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Aluminum Smelting Industry?

High demand for aluminum wire rods is the key driver of the market.

- Aluminum smelting is a significant process in the production of primary aluminum, which is extensively utilized in various industries due to its unique properties, including lightweight, strength, and corrosion resistance. The Hall-Heroult process is the most common method used in aluminum smelting, involving the electrolytic reduction of alumina in a reduction pot using an electrode conductor and an electrolyte solution. This process produces molten aluminum, which is then solidified into various forms, such as ingots, billets, or wire rods. Aluminum smelting is essential In the manufacturing of numerous consumer goods, including lightweight mobile phones, beverage cans, and consumer electronics.

- Moreover, it is a critical component in the production of agricultural, construction, and mining equipment, machinery, and automotive components. Aluminum smelting also plays a significant role in the aerospace and defense industries due to the metal's high strength-to-weight ratio and excellent formability. Despite its numerous benefits, aluminum smelting is an energy-intensive process, with power plants being a significant contributor to the aluminum industry's carbon emissions. However, advancements in smelting technologies, such as automation and the integration of renewable energy sources, are helping to reduce carbon emissions and improve energy efficiency. The market is expected to grow due to the increasing demand for lightweight materials in various industries, including construction activities, food and packaging, pharmaceuticals, electrical, electric vehicles, OEM, and real estate.

What are the market trends shaping the Aluminum Smelting Industry?

High demand for lightweight materials is the upcoming market trend.

- The market is experiencing significant growth due to the increasing demand for aluminum in various industries. Aluminum's unique properties, including its lightweight nature and high strength, make it an ideal choice for manufacturing consumer goods, transportation equipment, and industrial machinery. The Hall-Heroult process, the primary method for aluminum smelting, uses alumina, reduction pot, electrode conductor, and electrolyte solution to extract aluminum from its ore. Power plants and transportation costs are critical factors influencing the market. Renewable energy sources are increasingly being adopted to reduce carbon emissions, making aluminum smelting more sustainable. The aluminum market is diverse, with applications ranging from consumer goods like lightweight mobile phones and beverage cans to heavy machinery such as agricultural, construction, and mining equipment.

- Aluminum's corrosion resistance and lightweight properties make it a popular choice for industries like construction, aerospace, and automotive. The aerospace industry uses aluminum for aircraft bodies and structural components to reduce fuel consumption and increase efficiency. In the automotive sector, aluminum is used to manufacture lightweight vehicles, helping to reduce overall weight and improve fuel efficiency. Energy-efficient buildings and electric vehicles also rely on aluminum for their lightweight and durable frames. Advancements in smelting technologies, such as automation and the integration of renewable energy sources, are driving innovation In the aluminum industry. The market for primary, secondary, and alloy aluminum continues to grow, with applications in various industries, including electrical, pharmaceutical, electrical vehicles, OEM, real estate, and more.

What challenges does the Aluminum Smelting Industry face during its growth?

High energy consumption and costs are key challenges affecting the industry growth.

- The market faces escalating operational costs due to the energy-intensive Hall-Heroult process used to extract aluminum from alumina. This process requires substantial electricity, accounting for approximately 40% of total production expenses. Rising global energy prices, driven by geopolitical tensions, supply chain disruptions, and the shift towards renewable energy sources, intensify the pressure on aluminum smelters to manage these costs. Furthermore, environmental regulations aimed at reducing greenhouse gas emissions necessitate investments in cleaner technologies or alternative energy sources.

- Aluminum is a versatile metal used extensively in various industries, including consumer goods such as lightweight mobile phones and beverage cans, construction equipment, agricultural equipment, mining equipment, machinery, and industries like construction, aerospace, automotive, energy-efficient buildings, and electrical applications. The demand for aluminum continues to grow, driven by the need for lightweight materials in various sectors. Aluminum is valued for its corrosion resistance, strength, and recyclability.

Exclusive Customer Landscape

The aluminum smelting market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the aluminum smelting market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, aluminum smelting market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aditya Birla Management Corp. Pvt. Ltd.

- AECOM

- Alcoa Corp.

- Aleris International Inc.

- Aluar

- Aluminum Crop. of China Ltd.

- AMAG Austria Metall AG

- BlueScope Steel Ltd.

- Capral Ltd.

- China Hongqiao Group Ltd.

- Constellium SE

- Garmco

- Golden Aluminum

- Kaiser Aluminum Corp.

- Kobe Steel Ltd.

- Nanshan Group Singapore Co. Pte. Ltd.

- Norsk Hydro ASA

- Resonac Holdings Corp.

- Rio Tinto Ltd.

- United Co. RUSAL

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the production of primary and secondary aluminum through various processes, including the Hall-Heroult process. This process involves the electrolytic reduction of alumina in a reduction pot, utilizing an electrode conductor and an electrolyte solution in a carbon-lined bed. The resulting aluminum is then shaped and formed into various products for diverse industries. The demand for aluminum in the market is driven by its unique properties, such as lightweight, corrosion resistance, and high strength-to-weight ratio. These attributes make aluminum an ideal choice for numerous applications in sectors like consumer goods, transportation, construction, and aerospace and defense. Aluminum is extensively used in the manufacturing of lightweight mobile phones, consumer electronics, and beverage cans.

In the transportation sector, aluminum is employed in the production of automobiles, buses, and aircraft, contributing to the reduction of greenhouse gas emissions and the development of energy-efficient vehicles. In the construction industry, aluminum is used for fencing, roofing, and window frames due to its durability and low maintenance requirements. Additionally, it is used in the manufacturing of agricultural and construction equipment, machinery, and mining equipment. The aluminum market is influenced by several factors, including smelting technologies, renewable energy sources, and automation. The increasing focus on reducing carbon emissions has led to the adoption of renewable energy sources in aluminum smelting, such as hydroelectric and wind power.

In addition, this shift towards cleaner energy sources is expected to drive the growth of the market. Moreover, the increasing demand for lightweight materials in various industries, such as healthcare facilities, food and packaging, pharmaceuticals, electrical, and OEM, is expected to fuel the growth of the aluminum market. Furthermore, the inflow of Foreign Direct Investment (FDI) in various sectors, particularly real estate, is also expected to contribute to the growth of the market. The aluminum market is segmented into primary aluminum, secondary aluminum, and alloy aluminum. Primary aluminum is produced from raw bauxite ore, while secondary aluminum is produced from recycled aluminum scrap.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

187 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.1% |

|

Market growth 2024-2028 |

USD 28.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.8 |

|

Key countries |

US, France, China, Germany, Canada, India, UK, Japan, Brazil, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Aluminum Smelting Market Research and Growth Report?

- CAGR of the Aluminum Smelting industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the aluminum smelting market growth of industry companies

We can help! Our analysts can customize this aluminum smelting market research report to meet your requirements.