Amphibious Vehicle Market Size 2024-2028

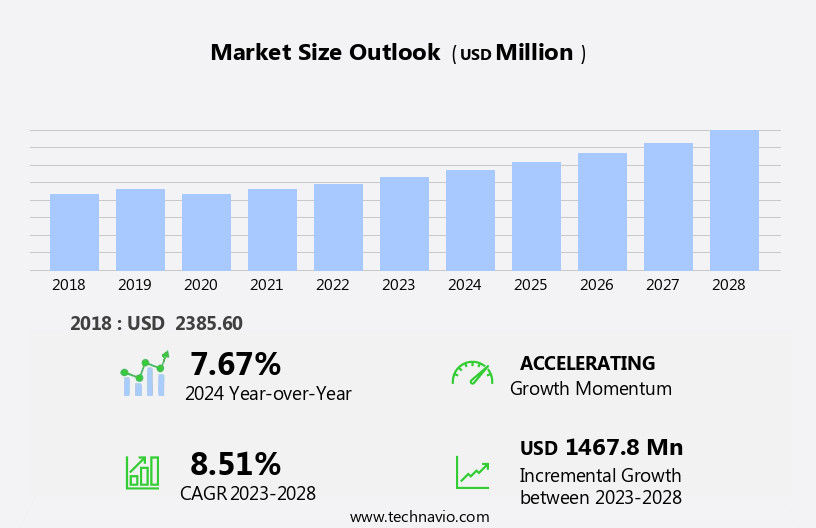

The amphibious vehicle market size is forecast to increase by USD 1.47 billion at a CAGR of 8.51% between 2023 and 2028.

What will be the Size of the Amphibious Vehicle Market During the Forecast Period?

How is this Amphibious Vehicle Industry segmented and which is the largest segment?

The amphibious vehicle industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Defense

- Commercial

- Geography

- North America

- US

- APAC

- China

- India

- Europe

- Germany

- France

- Middle East and Africa

- South America

- North America

By End-user Insights

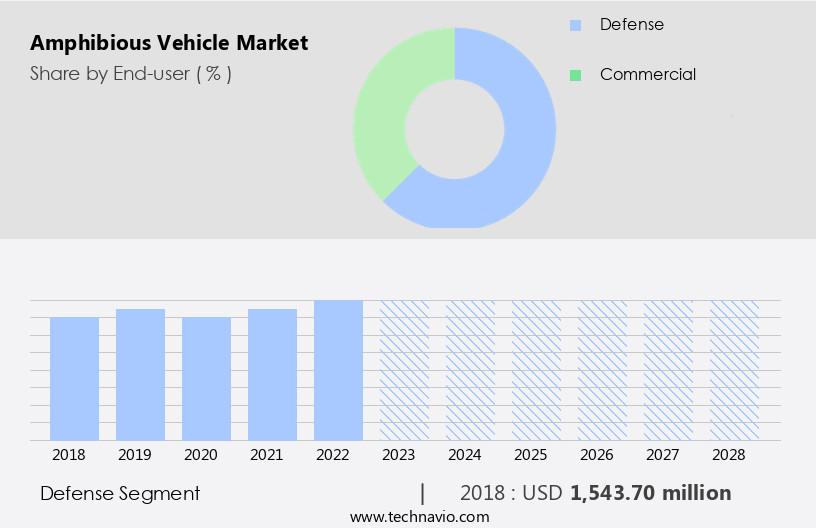

- The defense segment is estimated to witness significant growth during the forecast period.

The market caters to both defense and commercial sectors. In the defense segment, amphibious combat vehicles (ACVs) are utilized for military applications. These vehicles offer the unique capability to traverse both land and water, making them indispensable for defense forces. The versatility of ACVs lies In their ability to provide survivability, adaptability, and future growth potential. Advanced military systems such as Unmanned Aircraft Systems (UAS), electronic warfare, and reconnaissance can be integrated into these vehicles as technology advances. Initially designed to facilitate the movement of marines from ships to land, ACVs have evolved into a multi-purpose platform. In the commercial sector, amphibious vehicles find applications in various industries including transportation, excavation, and water transportation.

These vehicles offer versatility, enabling usage in diverse applications such as surveillance, dredging, and cargo transportation.

Get a glance at the Amphibious Vehicle Industry report of share of various segments Request Free Sample

The Defense segment was valued at USD 1.54 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

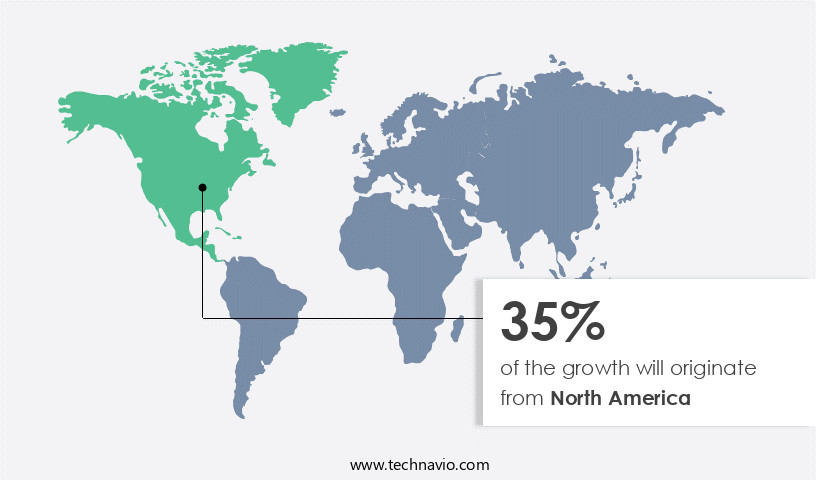

- North America is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America, with the United States as the primary consumer and exporter, is experiencing significant growth due to the country's focus on enhancing its military capabilities and ensuring national security. These vehicles' versatility in navigating both land and water makes them indispensable for various applications, including defense, transportation, excavation, and surveillance. In December 2021, BAE Systems secured contracts worth over USD1.15 billion to supply the US Marine Corps with Amphibious Combat Vehicles (ACVs). The demand for advanced military systems, such as autonomy, high-speed vehicles, advanced technology, and survivability features, is driving market expansion. Additionally, commercial applications, such as cargo transportation, water transportation, and environmental clean-ups, contribute to the market's growth.

Key players In the market include leading defense industry manufacturers and innovators, focusing on developing cutting-edge solutions for diverse applications.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Amphibious Vehicle Industry?

Upgrade of defense capabilities to counter emerging security threats is the key driver of the market.

What are the market trends shaping the Amphibious Vehicle Industry?

Increasing penetration of AI in defense applications is the upcoming market trend.

What challenges does the Amphibious Vehicle Industry face during its growth?

Defense budget cuts affecting procurement patterns is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The amphibious vehicle market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the amphibious vehicle market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, amphibious vehicle market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

BAE Systems Plc - Amphibious combat vehicles, including the ACV R, ACV C, and ACV 30, represent a significant segment of the global military vehicle market. These versatile vehicles offer the unique capability to traverse both land and water environments, expanding operational flexibility for military forces. Manufacturers focus on enhancing their designs to address the demands of various terrains and mission requirements, ensuring optimal performance and survivability. The market is driven by factors such as increasing geopolitical tensions, ongoing military modernization programs, and the need for versatile military platforms. This market is expected to grow steadily In the coming years, as military forces seek to maintain a technological edge and expand their operational capabilities.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BAE Systems Plc

- Bland Group

- DAT BV

- EIK Engineering SDN BHD

- General Dynamics Corp.

- Hanjin Heavy Industries and Construction Holdings Co. Ltd.

- Hitachi Construction Machinery Co. Ltd.

- Hydratrek Inc.

- Lockheed Martin Corp.

- Marsh Buggies Inc.

- Remu Oy

- Rheinmetall AG

- Ultratrek Machinery SDN BHD

- Water car

- Wetland Equipment Co.

- Wilco Manufacturing LLC

- Wilson Marsh Equipment Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Amphibious vehicles, which possess the ability to traverse both land and water, have gained significant attention in various industries due to their versatility and utility. These vehicles offer unique advantages, particularly in scenarios where traditional transportation methods may be limited or ineffective. The market encompasses a diverse range of applications, including defense and commercial sectors. In the defense industry, amphibious vehicles are utilized for military transportation, amphibious assault, and surveillance operations. They provide militaries with the capability to access hard-to-reach areas, such as river beds, swamps, lakes, ponds, and reservoirs. These vehicles can be instrumental in dredging applications, border security, and counter-terrorism activities.

In the commercial sector, amphibious vehicles find applications in cargo transportation, water transportation, and excavation activities. They are employed in waterway constructions, power line construction, and environmental clean-ups. Amphibious excavators are used for land reclamation, water mud removal, and dredging purposes. These vehicles are particularly useful in areas with complex terrain, where traditional vehicles may struggle to operate. The market is driven by the increasing demand for versatile transportation solutions. The ability to traverse both land and water offers significant advantages in various industries, from military applications to commercial uses. Modern electronics and advanced technology have played a crucial role in enhancing the performance and functionality of these vehicles.

Amphibious vehicles come in various configurations, including high-speed hydroplanes and track-based vehicles. Hydroplanes, which rely on water jets or screw propellers for propulsion, offer high-speed capabilities on water. Track-based vehicles, on the other hand, provide superior traction and maneuverability on land. The market is diverse and constantly evolving. From military forces to commercial enterprises, these vehicles offer unique solutions for a wide range of applications. The future of this market looks promising, with ongoing research and development focusing on improving performance, increasing efficiency, and expanding capabilities. In conclusion, the market represents a growing and dynamic industry, offering versatile transportation solutions for various applications.

From military operations to commercial uses, these vehicles provide significant advantages in scenarios where traditional transportation methods may be limited or ineffective. The ongoing advancements in technology and the increasing demand for versatile solutions are expected to drive the growth of this market In the coming years.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

134 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.51% |

|

Market growth 2024-2028 |

USD 1467.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.67 |

|

Key countries |

US, China, Germany, India, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Amphibious Vehicle Market Research and Growth Report?

- CAGR of the Amphibious Vehicle industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the amphibious vehicle market growth of industry companies

We can help! Our analysts can customize this amphibious vehicle market research report to meet your requirements.