Anesthesia Devices Market Size 2025-2029

The anesthesia devices market size is forecast to increase by USD 4.39 billion at a CAGR of 11.5% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing number of surgeries that necessitate the use of general anesthesia. This trend is particularly prominent in developed regions with aging populations and rising healthcare expenditures. Another key driver is the integration of anesthesia machines with hospital information management systems, enabling more efficient and accurate patient care. However, the high cost of anesthesia devices poses a significant challenge for market growth, particularly for smaller hospitals, clinics, and healthcare providers. These institutions, often operating under budget constraints, find it difficult to invest in expensive equipment, which can hinder their ability to provide optimal care. To capitalize on this market opportunity, companies should focus on developing cost-effective solutions while maintaining high-quality standards, ensuring that devices remain accessible to a broader range of healthcare settings.

- Additionally, investments in research and development to create advanced anesthesia devices with enhanced features, such as improved patient safety and more efficient monitoring of blood parameters, will be crucial in gaining a competitive edge. These innovations can help improve clinical outcomes by reducing risks associated with anesthesia administration and promoting better patient care during surgery. By addressing both cost concerns and technological advancements, companies can contribute to the growth of the healthcare sector while enhancing overall patient well-being. Overall, the market presents significant opportunities for growth, particularly in the areas of cost-effective solutions, integration with hospital information systems, and advanced technology development. Companies that can effectively navigate these challenges will be well-positioned to succeed in this dynamic market.

What will be the Size of the Anesthesia Devices Market during the forecast period?

- The market encompasses a range of technologies and equipment used to deliver anesthesia and monitor patients during surgical procedures. This market is driven by the increasing demand for safer and more efficient anesthesia delivery methods, as well as the ongoing development of new anesthetic agents and technologies. Key trends in the market include the focus on anesthesia device standardization to ensure interoperability and integration with electronic health records, as well as the prioritization of sterilization, cleaning, and maintenance to maintain high levels of patient safety. Regulatory compliance, including certification and adherence to anesthesia device standards, is also a significant factor in market growth.

- Innovations in anesthesia algorithms, neuromuscular blocking agents, and muscle relaxants continue to shape the market, alongside advances in anesthesia gases, volatile and non-volatile, and the integration of cybersecurity measures to protect against potential vulnerabilities. Anesthesia care providers are continually seeking to improve workflow and calibration processes to optimize patient care and outcomes. Overall, the market is characterized by ongoing innovation, regulatory compliance, and a focus on patient safety and efficiency.

How is this Anesthesia Devices Industry segmented?

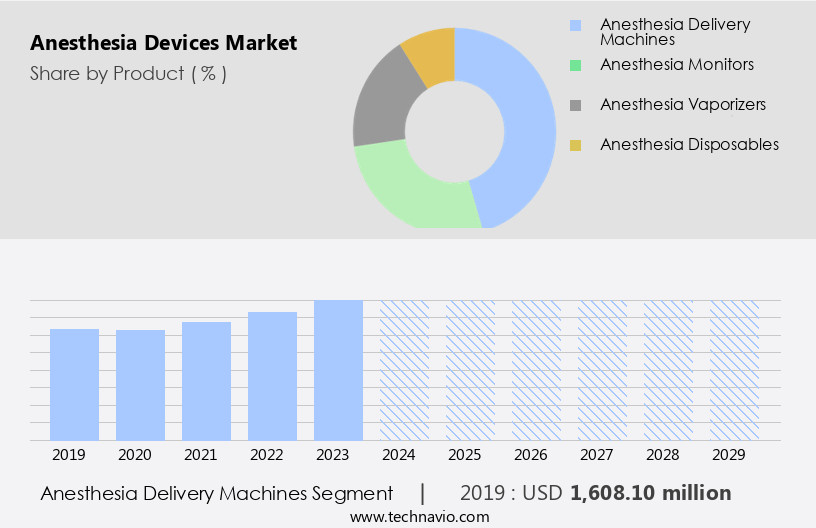

The anesthesia devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Anesthesia delivery machines

- Anesthesia monitors

- Anesthesia vaporizers

- Anesthesia disposables

- End-user

- Hospitals

- Ambulatory service centers

- Clinics

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Asia

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Product Insights

The anesthesia delivery machines segment is estimated to witness significant growth during the forecast period. Anesthesia delivery systems play a crucial role in medical procedures by administering anesthetic agents to patients and ensuring proper ventilation. These devices consist of mobile and standalone anesthesia delivery machines. Mobile anesthesia delivery machines, such as GE Healthcare's Carestation 650, are compact and easily transportable, making them suitable for remote community hospitals and field use. Their mobility and ease of use enhance accessibility to anesthesia services in various healthcare settings. Patient safety is a top priority in anesthesia care, and regulatory approvals ensure the safety and efficacy of anesthesia delivery devices. Advanced technologies, including electrocardiogram (ECG) monitoring, blood pressure monitoring, pulse oximetry, temperature monitoring, and vital signs monitoring, are integrated into these systems to provide real-time patient data.

Inhaled anesthetics, gas anesthesia, regional anesthesia, local anesthesia, and patient-controlled analgesia are administered through these devices. Biomedical engineering innovations, such as closed-loop anesthesia, robotic anesthesia, and automated drug delivery systems, improve anesthesia safety and precision medicine. Medical technology advancements, including artificial intelligence (AI), machine learning, data analytics, and digital health, are integrated into anesthesia delivery systems for improved patient monitoring, pain management, and drug delivery. Minimally invasive surgery, emergency medicine, outpatient surgery, and critical care settings benefit from these advancements. Remote monitoring, cloud computing, and connected healthcare enable real-time patient data access and analysis, reducing adverse drug events and anesthesia complications.

Syringe pumps, intravenous pumps, and drug infusion systems facilitate accurate and controlled drug delivery. The integration of anesthesia machines with healthcare IT systems enhances data sharing, analysis, and reporting, improving overall patient care and outcomes. Veterinary medicine also benefits from anesthesia delivery systems, with similar safety features and technologies applied to animal patients. Clinical trials and personalized anesthesia further advance the field, ensuring optimal patient care and comfort.

Get a glance at the market report of share of various segments Request Free Sample

The Anesthesia delivery machines segment was valued at USD 1.61 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Asia is estimated to contribute 32% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is experiencing significant growth due to several factors. Improved healthcare infrastructure, an increasing number of surgeries under general anesthesia, and the rising prevalence of chronic diseases are key drivers. The region's market growth is further fueled by the increasing number of hospitals and ambulatory surgery centers (ASCs), leading to a higher demand for advanced anesthesia delivery systems. In 2023, over 2.3 million surgeries were performed in Canada, marking a 5% increase compared to pre-pandemic levels. Patient safety remains a top priority in the market. Technological advancements, such as closed-loop anesthesia, precision medicine, and artificial intelligence (AI), are being integrated into anesthesia delivery systems to improve patient outcomes.

These innovations enable real-time monitoring of vital signs, including ECG, blood pressure, pulse oximetry, and temperature, ensuring optimal patient safety during surgical procedures. Anesthesia devices support various types of anesthesia, including gas anesthesia, inhaled anesthetics, local anesthesia, and regional anesthesia. Minimally invasive surgery and emergency medicine also benefit from these advanced technologies. Syringe pumps, intravenous pumps, and automated drug delivery systems facilitate controlled drug infusion, reducing the risk of adverse drug events and drug interactions. Medical technology advancements, such as machine learning and data analytics, enable personalized anesthesia and pain management. Remote monitoring and connected healthcare solutions allow for real-time patient monitoring, enabling timely intervention and improving patient care.

The integration of cloud computing in healthcare IT systems further enhances the capabilities of anesthesia devices, enabling seamless data sharing and analysis. The market caters to various end-users, including hospital operating rooms, outpatient surgery centers, emergency medicine, veterinary medicine, and clinical trials. The market also supports a wide range of applications, including pain management, critical care, and postoperative pain management. Overall, the market in North America is expected to continue its growth trajectory, driven by advancements in medical technologies, increasing healthcare demand, and a focus on patient safety.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Anesthesia Devices Industry?

- An increasing number of surgeries requiring general anesthesia is the key driver of the market. Anesthesia devices play a crucial role in medical procedures, enabling patients to undergo surgeries with minimal consciousness and post-operative pain. These devices are primarily used for major surgeries, including knee and hip replacements, heart surgeries, cancer treatments, brain surgeries, lung surgeries, and procedures on major arteries. In the US alone, around 350,000 pacemakers and 120,000 implantable cardioverter-defibrillators (ICDs) are implanted each year. Furthermore, approximately 18,000 to 22,000 cardiac rhythm management devices are implanted in Australia annually.

- The rising prevalence of chronic conditions and diseases is driving the need for more surgeries, consequently increasing the demand for anesthesia devices. The US and Australia represent significant markets for these devices due to their high rates of implantation.

What are the market trends shaping the Anesthesia Devices Industry?

- Integration of anesthesia machines with hospital information management systems is the upcoming market trend. Anesthesia machines have evolved to include advanced features such as integrated monitoring and recording facilities and seamless integration with hospital information management systems (HIMS). For example, Dragerwerk's Fabius GS premium anesthesia machine can be synchronized with a user's existing hospital information system. Anesthesia Information Management Systems (AIMS) serve as electronic health records (EHR) systems, automatically collecting data from anesthesia machines and transmitting it to the patient's EHR.

- These systems offer real-time decision support, more accurate data capture, and enhanced data access. Furthermore, some AIMS are integrated with Clinical Decision Support Systems (CDSS), which can identify potential misdiagnoses or other clinical workflow issues. These advanced technologies aim to improve patient safety and clinical efficiency in healthcare settings.

What challenges does the Anesthesia Devices Industry face during its growth?

- The high cost of anesthesia devices is a key challenge affecting the industry's growth. Anesthesia devices are essential medical equipment used to administer anesthesia to patients undergoing surgeries or invasive medical procedures. The market for these devices is driven by several factors, including the increasing number of surgeries and the growing preference for minimally invasive procedures. However, the high cost of anesthesia devices is a significant barrier to their adoption, with prices ranging from USD 5,000 to USD 100,000, depending on the features and technology level. End-users also face additional expenses on maintenance and device-specific accessories and consumables, such as CO2 absorber cartridges, IBF, breathing circuits, and endotracheal tubes, which need to be replaced after a certain number of uses.

- The typical product shelf life of anesthesia systems ranges from eight to ten years. As a result, only healthcare facilities with high patient volumes can afford to invest in advanced anesthesia machines. This market dynamic underscores the importance of cost-effective solutions and innovative business models to expand market penetration and reach a broader customer base.

Exclusive Customer Landscape

The anesthesia devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the anesthesia devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, anesthesia devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ambu AS - The company offers anesthesia devices such as Bronchoscopes, Video Laryngoscopes, and Resuscitators.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ambu AS

- B.Braun SE

- Becton Dickinson and Co.

- Beijing Aeonmed Co. Ltd.

- BPL Ltd.

- Dragerwerk AG and Co. KGaA

- Fisher and Paykel Healthcare Corp. Ltd.

- General Electric Co.

- Getinge AB

- ICU Medical Inc.

- Intersurgical Ltd.

- Koninklijke Philips NV

- Life Support Systems

- Medline Industries LP

- Medtech Devices

- Medtronic Plc

- OSI Systems Inc.

- Shenzhen Mindray BioMedical Electronics Co. Ltd

- Teleflex Inc.

- Vyaire Medical Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Anesthesia devices have been a critical component of medical care for decades, enabling healthcare professionals to administer anesthesia safely and effectively during various surgical procedures. These devices play a pivotal role in enhancing patient safety and improving the overall quality of care delivered in hospitals and ambulatory surgical centers. The market encompasses a diverse range of products, including anesthesia delivery systems, syringe pumps, and intravenous pumps. These devices facilitate the administration of anesthetics, such as inhaled anesthetics, local anesthetics, and intravenous anesthetics, to ensure optimal patient comfort and pain management during surgical procedures. Biomedical engineering advancements have significantly influenced the market, leading to the development of innovative technologies like closed-loop anesthesia, precision medicine, and robotic anesthesia.

These technologies aim to enhance patient safety, minimize anesthesia complications, and improve the accuracy and efficiency of anesthesia delivery. Anesthesia delivery systems have evolved to incorporate advanced features like automated drug delivery, remote monitoring, and real-time data analytics. These features enable healthcare professionals to closely monitor patients' vital signs, such as blood pressure, pulse oximetry, and temperature, during surgical procedures. Medical technologies continue to evolve, with artificial intelligence and machine learning being integrated into anesthesia machines to enhance patient safety and optimize anesthesia delivery. Additionally, the integration of cloud computing and healthcare IT solutions allows for seamless data sharing and analysis, enabling more informed decision-making and personalized anesthesia care. Patient safety remains a top priority in the market. Regulatory approvals ensure that these devices meet stringent safety standards and undergo rigorous testing to minimize the risk of adverse drug events, drug interactions, and other complications.

The use of volatile anesthetics and non-volatile anesthetics requires strict adherence to anesthesia protocols to ensure patient safety and effective outcomes. The anesthesia workflow is often managed by anesthesia technicians, who are responsible for the operation and maintenance of complex anesthesia equipment. Regular anesthesia equipment maintenance and anesthesia device calibration are essential to ensure that devices are functioning correctly. Additionally, proper anesthesia device sterilization and anesthesia device cleaning protocols are necessary to prevent cross-contamination and maintain a sterile environment. Anesthesia device training and anesthesia device certification programs help technicians stay up-to-date with the latest equipment and techniques. As anesthesia device integration and anesthesia device interoperability become increasingly important, manufacturers must ensure their devices are compatible with other systems in the operating room. Furthermore, anesthesia device cybersecurity is a growing concern to protect sensitive patient data. Anesthesia device regulations ensure safety standards are met, while anesthesia device patents encourage anesthesia device innovation, driving advancements in the field. Through continuous improvement and attention to these key factors, anesthesia practices can be optimized for both safety and efficiency.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.5% |

|

Market growth 2025-2029 |

USD 4.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.1 |

|

Key countries |

US, Germany, China, UK, Canada, Japan, France, India, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Anesthesia Devices Market Research and Growth Report?

- CAGR of the Anesthesia Devices industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the anesthesia devices market growth and forecasting

We can help! Our analysts can customize this anesthesia devices market research report to meet your requirements.