Animal Disinfectant Market Size 2025-2029

The animal disinfectant market size is forecast to increase by USD 1.63 billion at a CAGR of 7% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing prevalence of infectious diseases in animals. This trend is fueling the demand for effective and reliable animal disinfectants to maintain animal health and prevent the spread of diseases. Moreover, the focus on new product launches in the market is adding to the growth momentum. However, regulatory compliance and standards pose challenges for market participants. Stringent regulations regarding the use of animal disinfectants ensure the safety and efficacy of these products, but they also add to the production costs and complexities. Supply chain inconsistencies, particularly in emerging markets, temper the growth potential of the market. The market is witnessing significant growth due to its extensive applications in various industries, particularly in the production of high-purity grades for use in solvents, pharmaceuticals, and personal care products.

- To capitalize on the market opportunities and navigate these challenges effectively, companies need to stay informed about the latest regulatory requirements and invest in robust supply chain management systems. Additionally, continuous research and development efforts to create innovative and cost-effective animal disinfectants will be crucial for market success. However, the market faces challenges such as volatility in crude oil prices, which impact the production costs.

What will be the Size of the Animal Disinfectant Market during the forecast period?

- The market is witnessing significant activity and trends as the need for effective biosecurity measures intensifies in the context of increasing food safety regulations and animal welfare concerns. Immunity plays a crucial role in animal health, making odor control and disinfection essential for preventing the spread of diseases and maintaining a healthy environment. Cold fogging and electrostatic spraying are gaining popularity as effective disinfection methods in precision livestock farming, while biocontrol agents offer sustainable alternatives to traditional antimicrobials in addressing antimicrobial resistance. Microbiological testing and veterinary diagnostics are integral components of disease surveillance programs, ensuring the microbial load is within acceptable limits. IPA is a versatile solvent used in numerous applications, including as a raw material in the production of acetone, glycerol, and isopropyl acetate. In the plastics industry, IPA acts as a solvent and a plasticizer

- Environmental monitoring, water quality, and feed hygiene are critical aspects of biofilm control and stress management. Veterinary services and animal handling practices are undergoing continuous improvement to enhance animal welfare and optimize production systems. UV disinfection and ozone disinfection are effective disinfection methods for animal housing and water treatment, respectively. Aerosol disinfection and UVC technology are increasingly being used for disinfecting animal transport vehicles and facilities. Animal traceability and biosecurity audits are essential for maintaining supply chain integrity and ensuring regulatory compliance. Gut health is a significant focus area for the market, with studies on disinfection efficacy and biofilm control contributing to the development of innovative solutions.

- Sustainable farming practices, such as the use of natural antimicrobial alternatives, are gaining traction as a means of reducing reliance on synthetic chemicals and minimizing environmental impact. Animal behavior and stress management are also essential considerations in the market, as stress can negatively impact animal health and productivity. The market is expected to continue evolving as new technologies and regulations emerge, driven by the need for effective, sustainable, and humane animal health solutions.

How is this Animal Disinfectant Industry segmented?

The animal disinfectant industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Liquid disinfectant

- Powder disinfectant

- Application

- Poultry farming

- Dairy farming

- Others

- Animal Type

- Livestock

- Companion animal

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

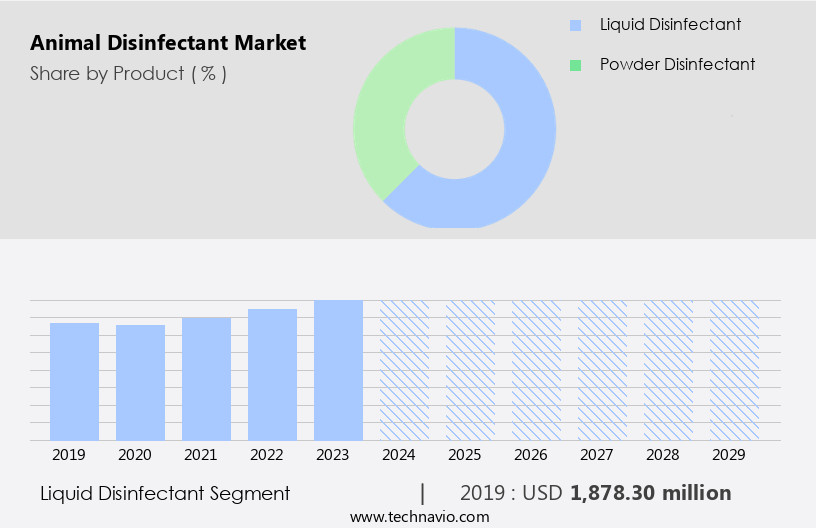

The liquid disinfectant segment is estimated to witness significant growth during the forecast period. Liquid disinfectants, formulated with quaternary ammonium compounds and other active ingredients, are widely used in various applications within the animal industry. These products, often available in ready-to-use formats, eliminate the need for end-users to dilute, reducing potential errors and cost. Adopted for foot dips, footbaths, aerial disinfection, foam-based sprays, and water-system disinfection, these disinfectants offer rapid action against a broad spectrum of pathogens, including bacteria, fungi, and viruses. Biosecurity protocols in animal housing rely on their consistent efficacy, which is not affected by external factors like water hardness. In the realm of disease control, liquid disinfectants play a crucial role in water treatment, ensuring the prevention of infection and maintaining milk and meat quality.

Antimicrobial stewardship and label compliance are essential aspects of their use in veterinary pharmaceuticals and pet care. Liquid disinfectants' versatility and efficacy make them indispensable tools in the animal industry. Their role in disease control, water disinfection, animal housing, and food safety, among other applications, underscores their importance in maintaining herd health and ensuring the highest standards of animal welfare and food quality.

The Liquid disinfectant segment was valued at USD 1.88 billion in 2019 and showed a gradual increase during the forecast period. Application rates are critical for optimal efficacy, and safety data sheets guide their use. Animal transport and feed additives also benefit from their disinfecting properties, contributing to herd health and growth performance. Regulations governing biocide usage necessitate efficacy testing and resistance management to minimize animal mortality and ensure animal welfare. Contact time and therapeutic treatment considerations are essential factors in their application. Surface disinfection and air disinfection are additional applications, enhancing overall animal hygiene and disease prevention. Precision agriculture, food safety, and production efficiency are further areas where liquid disinfectants contribute. IPA is also used as an astringent in various cosmetics and skincare products. As a chemical intermediate, IPA is used in the production of agrochemicals, contributing to the agricultural sector's growth. Data analytics and remote monitoring facilitate informed decision-making, while digital platforms and machine learning optimize application rates.

Regional Analysis

Asia is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia is experiencing significant growth due to the large-scale livestock production, increasing pet ownership, and heightened focus on biosecurity. In 2024, China produced 96.63 million tonnes of meat, a 0.2% year-on-year increase, making it a major contributor to the market. The country's vast meat industry, particularly in poultry and swine farming, necessitates the use of disinfectants to prevent disease outbreaks. Poultry farming requires stringent disinfection protocols due to the high bird density, which increases susceptibility to diseases like avian influenza. Quaternary ammonium compounds are commonly used in spray applications for water disinfection and surface disinfection in animal housing.

Efficacy testing and safety data sheets are essential for ensuring the efficacy and safety of these disinfectants. Animal welfare and resistance management are crucial considerations in the application rate and choice of disinfectants. Animal transport and feed additives also contribute to the market, with egg production and biocide regulation playing significant roles. Artificial intelligence, contact time, therapeutic treatment, and infection prevention are key trends in the market. Environmental impact, animal health, milk quality, and meat quality are essential factors in the use of disinfectants. Precision agriculture, production efficiency, data analytics, remote monitoring, veterinary pharmaceuticals, animal hygiene, and herd health are also driving market growth.

Machine learning and digital platforms are being used to optimize application rates and improve preventive measures. Broad-spectrum disinfectants and antimicrobial stewardship are essential for disease outbreak prevention and growth performance. The market is subject to biocide regulation and label compliance, with a focus on animal hygiene and farm animals.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Animal Disinfectant market drivers leading to the rise in the adoption of Industry?

- The rising incidence of infectious diseases in animals is the primary factor fueling market growth in this sector. The market is driven by the increasing need for effective disease control in livestock production. Quaternary ammonium compounds are commonly used in animal disinfectants due to their broad-spectrum antimicrobial properties. Biosecurity protocols are essential in preventing the spread of diseases among livestock, and water disinfection and spray application are crucial methods for maintaining a healthy environment. Efficacy testing is crucial to ensure the safety and effectiveness of animal disinfectants. Diseases such as avian influenza, African swine fever, brucellosis, East Coast fever, African animal trypanosomiasis, Newcastle disease, porcine reproductive and respiratory syndrome (PRRS), and foot-and-mouth disease (FMD) can result in significant animal mortality and economic losses.

- For instance, African swine fever and African animal trypanosomiasis can cause mortality rates as high as 100 percent. In the United States, diseases like brucellosis and African animal trypanosomiasis continue to pose a significant economic burden on the livestock industry, with annual costs estimated between USD400 million and USD500 million and USD600 million and USD650 million, respectively. Animal welfare and resistance management are critical considerations in the use of animal disinfectants. Application rates must be carefully monitored to ensure animal safety and minimize the risk of resistance development. Animal transport also necessitates the use of effective disinfectants to prevent disease transmission.

What are the Animal Disinfectant market trends shaping the Industry?

- The focus on new product launches is a significant market trend. It is essential for businesses to stay informed and prepared for introducing innovative offerings to maintain competitiveness. The market is experiencing significant growth due to the increasing focus on infection prevention and therapeutic treatment in various animal industries, including egg production and milk quality. Feed additives are increasingly being used to enhance animal health and reduce the need for therapeutic interventions. Biocide regulation is a key consideration for market participants, with a focus on contact time and environmental impact. Advanced technologies, such as artificial intelligence, are being employed to optimize disinfection processes and improve animal housing conditions.

- Prophylactic treatment is becoming increasingly common to prevent the spread of diseases and maintain herd health. Manufacturers are responding to these trends by launching new, advanced formulations, such as Neogen Farm Fluid MAX, which offers dual-action disinfection capabilities and supports coccidiosis control. These developments underscore the importance of infection prevention and animal health in the market.

How does Animal Disinfectant market faces challenges face during its growth?

- Compliance with regulatory standards is a significant challenge that can impede industry growth. Adhering to various regulations and maintaining high standards is not only mandatory but also essential for businesses to operate effectively and sustainably within their respective industries. The market is driven by the need for antimicrobial stewardship, ensuring meat quality, and maintaining food safety in various industries. Surface disinfection and air disinfection are essential practices for preventing the spread of diseases among animals and humans. Water treatment is another critical application area, as it helps maintain hygiene in livestock farming and pet care. Regulatory compliance is a significant challenge in this market, with various regulatory bodies enforcing safety and environmental standards. In the US, the Environmental Protection Agency (EPA) regulates animal disinfectants under the Federal Instrumented, Fungicide, and Rodenticide Act (FIFRA). Manufacturers must adhere to these regulations, submitting comprehensive data on product safety, effectiveness, and environmental impact for market approval.

- Moreover, precision agriculture, production efficiency, data analytics, remote monitoring, and veterinary pharmaceuticals are emerging trends in the market. These technologies enable farmers and veterinarians to optimize their operations, reduce costs, and improve animal health and welfare. With population growth and increasing demand for plastics, resins, fertilizers, pesticides, and other chemical products, the market is poised for expansion. Overall, the market is a dynamic and evolving industry, with a focus on innovation, sustainability, and regulatory compliance.

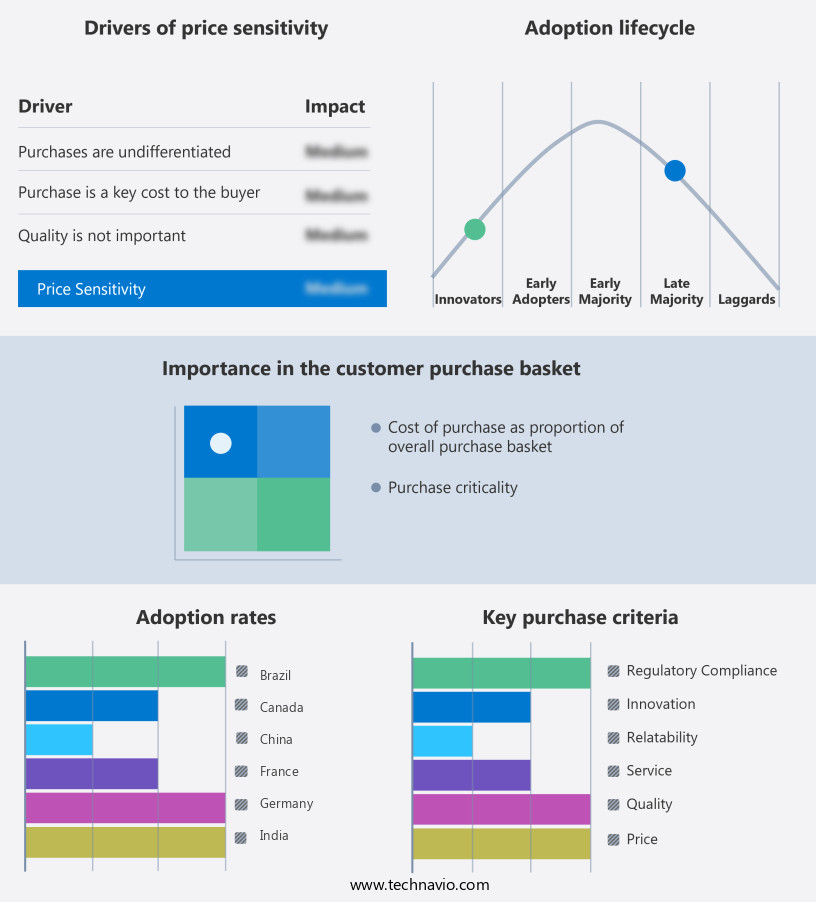

Exclusive Customer Landscape

The animal disinfectant market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the animal disinfectant market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, animal disinfectant market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

CID LINES NV - The company specializes in providing a range of animal disinfectants, including Virocid, Iocid 30, and D 50.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- CID LINES NV

- DeLaval International AB

- Diversey Inc.

- Evans Vanodine International Plc

- Evonik Industries AG

- FINKTEC GmbH

- GEA Group AG

- KERSIA GROUP

- Lanxess AG

- PCC SE

- Sanosil AG

- Solenis

- Solvay SA

- Stepan Co.

- Steroplast Healthcare Ltd

- Virbac Group

- Virox Technologies Inc.

- Zoetis Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Animal Disinfectant Market

- In February 2024, DuPont Animal Nutrition and Health launched a new disinfectant product, Accelerate H2O, designed for use in poultry production. This innovative solution combines hydrogen peroxide and peracetic acid to provide a more effective and sustainable disinfection process (DuPont Press Release, 2024).

- In May 2025, Lonza Group, a leading supplier of animal health products, announced a strategic partnership with Bio-Techne Corporation to expand their offering in the market. This collaboration will enable Lonza to leverage Bio-Techne's expertise in microbial control and detection, enhancing their product portfolio and strengthening their position in the market (Lonza Press Release, 2025).

- In October 2024, Heska Corporation, a veterinary diagnostics and pharmaceutical company, completed the acquisition of Animal Health International, a leading provider of animal health disinfectants and sanitizers. This acquisition will enable Heska to expand its product offerings and broaden its customer base in the animal health industry (Heska Press Release, 2024).

- In March 2025, the European Commission approved the use of chlorhexidine gluconate as a disinfectant for use in livestock farming. This approval marks a significant shift towards the adoption of more effective and sustainable disinfection methods in the European animal farming sector (European Commission Press Release, 2025).

Research Analyst Overview

The market continues to evolve, driven by the ongoing need for effective disease control and biosecurity protocols in various sectors. Quaternary ammonium compounds remain a popular choice for water disinfection and spray application in animal housing, egg production, and milk quality enhancement. However, the market's dynamics are influenced by numerous factors, including biocide regulation, resistance management, and animal welfare concerns. Artificial intelligence and data analytics are increasingly integrated into animal disinfectant solutions, optimizing application rates, contact time, and therapeutic treatment. Precision agriculture and production efficiency are key focus areas, with remote monitoring and digital platforms enabling real-time animal health assessment and antimicrobial stewardship. This uncertainty in crude oil prices poses a significant challenge for the market. It is also used in formulating polyvinyl butyral (PVB), alkaloids, and essential oils. The oil and gas industry, which directly produces propylene from oil or its derivatives like naphtha or liquefied petroleum gas, has been compelled to implement cost-cutting measures due to the decline in oil prices in recent years.

Environmental impact is another critical consideration, with a shift towards eco-friendly disinfectants and efficient water treatment systems. Animal housing and animal health are interconnected, with prophylactic treatment and infection prevention essential for herd health and meat quality. Safety data sheets and efficacy testing are mandatory for animal disinfectant products, ensuring regulatory compliance and minimizing animal mortality. The market's continuous unfolding is shaped by disease outbreaks, growth performance, and the evolving role of veterinary pharmaceuticals and animal hygiene. The application of animal disinfectants extends to pet care, food safety, and air disinfection, with broad-spectrum solutions addressing various microbial threats. The market's future direction is influenced by the ongoing development of machine learning and label compliance, enabling more effective disease prevention and animal welfare enhancement.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Animal Disinfectant Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

215 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7% |

|

Market growth 2025-2029 |

USD 1.63 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.7 |

|

Key countries |

US, China, India, Germany, France, Japan, UK, South Korea, Canada, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Animal Disinfectant Market Research and Growth Report?

- CAGR of the Animal Disinfectant industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Asia, Europe, North America, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the animal disinfectant market growth of industry companies

We can help! Our analysts can customize this animal disinfectant market research report to meet your requirements.