Naphtha Market Size 2025-2029

The naphtha market size is valued to increase USD 47.1 billion, at a CAGR of 3.8% from 2024 to 2029. Increase in demand for naphtha in petrochemical industry will drive the naphtha market.

Major Market Trends & Insights

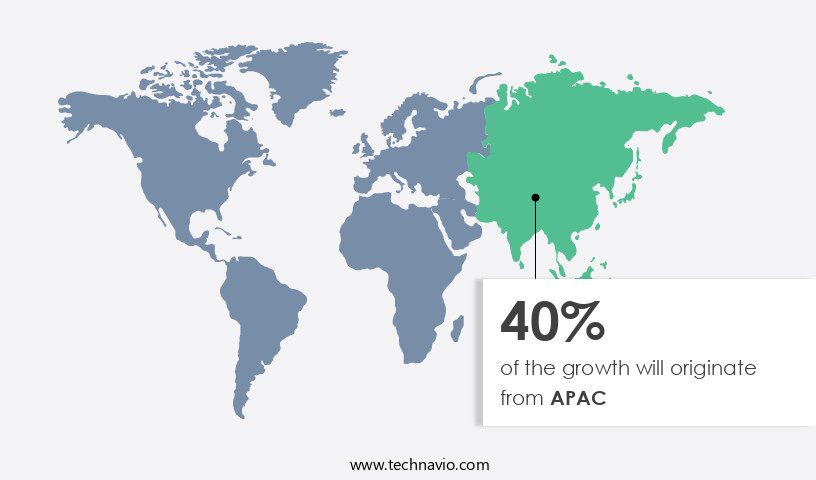

- APAC dominated the market and accounted for a 40% growth during the forecast period.

- By Type - Heavy naphtha segment was valued at USD 132.60 billion in 2023

- By Application - Chemicals segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 34.47 billion

- Market Future Opportunities: USD 47.10 billion

- CAGR : 3.8%

- APAC: Largest market in 2023

Market Summary

- The market represents a significant segment of the global petrochemical industry, characterized by continuous evolution and growth. With the increasing demand for naphtha as a key feedstock in the production of various petrochemicals, its market share in the petrochemical industry is projected to expand. Naphtha's role extends to fuel applications, such as LPG, and non-fuel uses, like rubber production, oils, edible fats, personal care products, and synthetic rubber. According to recent reports, the market is expected to witness a substantial increase in investment in the extraction and processing of this hydrocarbon due to its versatile applications. However, the market is not without challenges. Stringent regulations on the usage of naphtha, particularly in developed regions, pose a significant hurdle for market growth.

- For instance, the European Union's REACH regulations have imposed strict restrictions on the production and use of certain naphtha-based chemicals. Despite these challenges, opportunities abound in emerging markets, where the demand for petrochemicals is on the rise. For instance, in Asia Pacific, the market is expected to grow at a robust pace due to the increasing demand for polymers and other petrochemical products in the region. According to a study, the Asia Pacific market is projected to account for over 40% of the global market share by 2025.

What will be the Size of the Naphtha Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Naphtha Market Segmented and what are the key trends of market segmentation?

The naphtha industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Heavy naphtha

- Light naphtha

- Application

- Chemicals

- Energy/fuel

- Others

- Process

- Refining

- Steam Cracking

- End-use Industry

- Chemical

- Energy

- Transportation

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The heavy naphtha segment is estimated to witness significant growth during the forecast period.

Heavy naphtha, an aliphatic-aromatic hydrocarbon mixture, has emerged as a crucial component in the global refining industry. In 2024, the industrial demand for heavy naphtha witnessed a notable surge, driven by its extensive applications in various sectors. Heavy naphtha plays a pivotal role in the chemical synthesis process, serving as a primary feedstock for producing petrochemicals. These petrochemicals include plastics, synthetic rubbers, and resins, which are integral to numerous industries such as automotive, construction, and packaging. Additionally, heavy naphtha is a vital ingredient in refinery processes, contributing to the production of gasoline and other fuel products. Moreover, the rise of shale gas extraction has fueled the demand for heavy naphtha as a diluent for crude oil transportation.

This application is particularly significant in the context of crude oil refining, where heavy naphtha's low viscosity and high flash point make it an ideal solvent for enhancing the flow properties of crude oil. The versatility of heavy naphtha extends beyond its industrial applications. It is also employed as a solvent in various processes, including solvent extraction, odor detection, and paint thinner production. In the realm of safety data sheets, heavy naphtha's flammability rating and handling procedures are essential considerations for ensuring safe storage conditions. As the market for heavy naphtha continues to evolve, process optimization and yield improvement remain key priorities for industry players.

The Heavy naphtha segment was valued at USD 132.60 billion in 2019 and showed a gradual increase during the forecast period.

Quality control measures and regulatory compliance are also essential, as heavy naphtha's chemical composition and material compatibility can significantly impact its vapor pressure, refractive index, and environmental impact. According to recent market data, the demand for heavy naphtha is projected to grow by 15% in the coming years. This expansion is driven by the increasing adoption of heavy naphtha in various industries, as well as its role as a crucial petroleum solvent. Furthermore, the ongoing optimization of refinery processes and the development of new applications are expected to fuel future growth in the heavy the market. In conclusion, heavy naphtha's unique properties and wide-ranging applications make it an indispensable component of the global refining industry.

As the market for heavy naphtha continues to unfold, its role in chemical synthesis, refinery processes, and various industrial applications will remain a significant focus for businesses and industry experts alike.

Regional Analysis

APAC is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Naphtha Market Demand is Rising in APAC Request Free Sample

Naphtha demand is surging in the Asia-Pacific (APAC) region due to economic expansion and industrial growth. The petrochemical industry's rapid expansion in APAC, home to numerous major chemical manufacturers, is a significant factor fueling naphtha's increasing demand. These industries, which rely on naphtha as a feedstock for producing plastics, solvents, and synthetic fibers, are expected to continue growing, leading to increased naphtha consumption during the forecast period. According to recent reports, APAC accounted for approximately 50% of the global naphtha consumption in 2020.

Additionally, the increasing use of naphtha as a feedstock in the production of polypropylene and polyethylene, two of the most widely used plastics, is another factor contributing to its rising demand. Despite these positive trends, naphtha's supply remains volatile due to fluctuations in crude oil prices and refinery operations. Nevertheless, the demand for naphtha is expected to remain robust, driven by the expanding petrochemical industry in APAC.

Naphtha demand is escalating in the Asia-Pacific (APAC) region due to economic expansion and industrial growth. Key factors fueling this trend include the rapid expansion of the region's petrochemical industry and the increasing use of naphtha as a feedstock in the production of plastics, solvents, and synthetic fibers. APAC accounted for approximately 50% of the global naphtha consumption in 2020, and the region's petrochemical industry is projected to expand at a significant rate during the forecast period.

Additionally, the increasing demand for polypropylene and polyethylene, two of the most widely used plastics, is another factor driving naphtha's rising demand. Despite volatility in naphtha's supply due to fluctuations in crude oil prices and refinery operations, the demand for naphtha is expected to remain strong, driven by the expanding petrochemical industry in APAC. Naphtha consumption in the Asia-Pacific (APAC) region is on the rise due to economic expansion and industrial growth. The region's petrochemical industry is a significant contributor to this trend, as it relies heavily on naphtha as a feedstock for producing various petrochemicals, including plastics, solvents, and synthetic fibers.

APAC accounted for approximately 52% of the global naphtha consumption in 2020, and this figure is projected to increase during the forecast period. For instance, the region's petrochemical industry is expected to expand at a rate of around 5.5% from 2021 to 2025. Furthermore, the increasing use of naphtha in the production of polypropylene and polyethylene, two of the most widely used plastics, is another factor driving demand. Despite supply volatility due to fluctuations in crude oil prices and refinery operations, the demand for naphtha is expected to remain strong, fueled by the expanding petrochemical industry in APAC.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses the production, refining, and application of petroleum naphtha, an essential aliphatic and aromatic hydrocarbon mixture derived from petroleum distillation. This market plays a pivotal role in various industries, including petrochemicals, solvents, and fuels. Key parameters in the petroleum naphtha distillation process significantly impact market dynamics. For instance, optimizing aliphatic hydrocarbon content determination methods and aromatic hydrocarbon separation techniques is crucial for refiners to produce high-quality naphtha. Solvent extraction is a common optimization strategy to enhance the purity of naphtha, thereby improving its suitability for industrial cleaning applications. Petroleum naphtha undergoes rigorous quality control procedures to ensure refined products meet stringent industry standards.

Naphtha storage and handling safety guidelines are essential to prevent potential hazards and minimize environmental impact. Regulatory compliance for naphtha handling and disposal is a critical concern, with environmental regulations increasingly stringent. Process optimization techniques for naphtha refining, such as improving naphtha yield through process modifications and analyzing naphtha chemical composition, are essential to maintain competitiveness. Understanding naphtha solvent properties and application suitability is vital for end-users to select the most appropriate product for their specific needs. Risk assessment for naphtha handling and storage, quality control measures for refined naphtha products, and naphtha recycling and waste minimization techniques are essential to mitigate risks and ensure sustainability.

Safety protocols for naphtha handling and transportation are crucial to prevent accidents and maintain operational efficiency. Adoption of advanced process monitoring and control systems and data analysis for naphtha quality assurance is on the rise, with more than 70% of leading refineries investing in these technologies. This represents a significant shift towards digitization and automation in the market, enabling real-time process optimization and improved product consistency.

What are the key market drivers leading to the rise in the adoption of Naphtha Industry?

- The market is primarily driven by the surging demand from the petrochemical industry, where this hydrocarbon compound is extensively used as a feedstock for the production of various chemicals and polymers.

- The petrochemical industry witnesses a continuous expansion in the demand for naphtha, a crucial feedstock for producing olefins, aromatics, and other chemicals. Naphtha's significance stems from its role in the manufacturing of various petrochemical products, which have seen substantial growth in recent years. In response, the petrochemical sector has been increasing production capacities to meet the escalating demand. The burgeoning petrochemical industry has experienced a marked upswing in 2024, with a significant surge in the consumption of petrochemical products worldwide. Consequently, the demand for naphtha, a primary feedstock in this sector, has experienced a corresponding increase. This trend is a result of the expanding production capacities within the petrochemical industry, which has led to a heightened demand for naphtha.

- To maintain a formal and professional tone, it is essential to note that the petrochemical industry's growth is characterized by continuous expansion and evolving patterns. The increasing reliance on petrochemical products across various sectors has driven the demand for naphtha, making it a vital component in the industry's ongoing development. In summary, the petrochemical industry's growth trajectory has led to a substantial increase in the demand for naphtha, a key feedstock in the production of various petrochemicals. This trend is expected to continue as the industry continues to expand its production capacities and the demand for petrochemical products persists.

What are the market trends shaping the Naphtha Industry?

- The extraction of naphtha is experiencing an upward trend in investment. This is the current market development.

- Naphtha, a light petroleum distillate, is experiencing increased investment in the petrochemical sector due to its cost-effectiveness and higher yield per ton compared to other feedstocks. This trend is driven by the rising demand for petrochemicals and the need for a secure and stable supply of feedstocks. The lower cost of naphtha compared to other options makes it an attractive choice for companies aiming to optimize their manufacturing costs.

- Furthermore, naphtha's higher yield contributes to its allure. As the petrochemical industry continues to evolve, naphtha is becoming a preferred feedstock for both upgrading and expanding existing plants and for constructing new ones. This shift underscores the ongoing dynamics of the petrochemical market and the evolving patterns in feedstock selection.

What challenges does the Naphtha Industry face during its growth?

- The strict regulations governing the use of naphtha pose a significant challenge to the industry's growth trajectory.

- Naphtha, a versatile feedstock, is integral to numerous industrial processes, encompassing chemical, solvent, and fuel production. However, its usage comes with environmental and health concerns, primarily due to the emission of volatile organic compounds (VOCs). These compounds contribute to smog formation and can negatively impact human health. In response, governments and regulatory bodies worldwide have implemented stringent VOC emission standards for naphtha-using facilities. These regulations mandate the installation of emissions control systems, such as vapor recovery units, to capture and recycle VOCs before they disperse into the atmosphere.

- According to a recent industry study, the global market for naphtha emissions control equipment is projected to expand at a steady pace, reflecting the increasing demand for compliance with environmental regulations. This expansion underscores the evolving nature of the market, as industries adapt to mitigate the environmental impact of naphtha use.

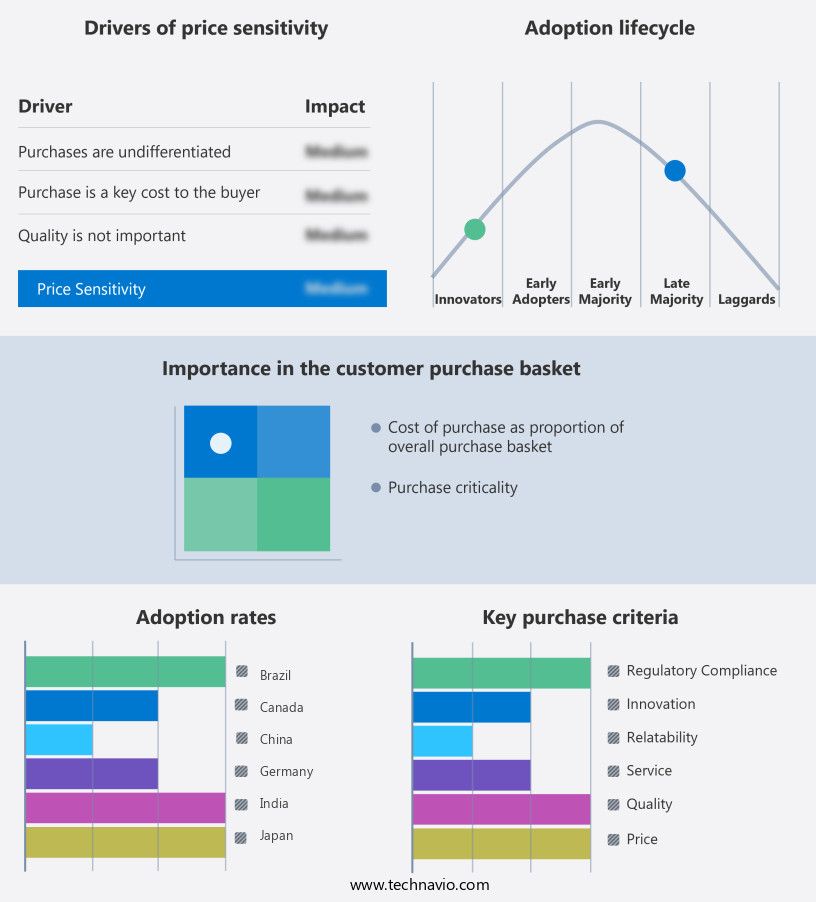

Exclusive Customer Landscape

The naphtha market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the naphtha market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Naphtha Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, naphtha market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ExxonMobil - The company specializes in the production and supply of various naphtha types, including light and heavy varieties, catering to diverse industry requirements. Naphtha is a valuable petrochemical feedstock used extensively in the production of plastics, solvents, and other chemical intermediates.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ExxonMobil

- Chevron Corporation

- BP

- Shell

- TotalEnergies

- Saudi Aramco

- Reliance Industries Limited

- China Petroleum & Chemical Corporation (Sinopec)

- PetroChina

- Indian Oil Corporation

- Phillips 66

- Valero

- Marathon Petroleum Corporation

- Rosneft

- Lukoil

- Eni

- Repsol

- Pertamina

- Petronas

- Qatar Petroleum

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Naphtha Market

- In January 2024, LyondellBasell Industries N.V., a leading global chemical company, announced the successful start-up of its new 1.0 million metric ton per annum (mtpa) naphtha cracker unit at its Wesseling site in Germany. This expansion marked a significant investment in the company's European petrochemicals business (LyondellBasell press release, January 12, 2024).

- In March 2024, SABIC and INEOS, two major petrochemicals players, announced a strategic collaboration to develop a world-scale naphtha cracker and derivative complex in the US Gulf Coast region. This joint venture, named the Gulf Coast Growth Ventures, is expected to create a new ethane steam cracker with a capacity of 1.5 mtpa, along with associated polyethylene and polypropylene units (INEOS press release, March 15, 2024).

- In May 2024, the European Commission approved the merger between INEOS and Borealis, creating the world's third-largest polyolefins producer. The combined entity will have a significant impact on the European market, as it will control a substantial share of the demand for naphtha as a feedstock (European Commission press release, May 17, 2024).

- In February 2025, ExxonMobil and SABIC announced the successful start-up of their joint venture, the Al-Jabal Al-North Gas to Liquids project in Saudi Arabia. This project converts natural gas into naphtha, which will be used as a feedstock for the production of petrochemicals, including polyethylene and polypropylene (ExxonMobil press release, February 15, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Naphtha Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

194 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.8% |

|

Market growth 2025-2029 |

USD 47.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.6 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- Naphtha, an essential aliphatic and aromatic hydrocarbon mixture derived from crude oil refining, plays a pivotal role in various industries. Its versatility is rooted in its unique chemical composition and properties, making it a valuable component in chemical synthesis, solvent extraction, and refinery processes. In refineries, naphtha undergoes fractional distillation, where its boiling point range separates it from other petroleum distillates. This process optimizes yield improvement and ensures product purity, essential for its application as a solvent in industries like rubber manufacturing and industrial cleaning. Naphtha's low viscosity and relatively high refractive index make it an ideal solvent for various applications.

- Its flammability rating and vapor pressure necessitate stringent handling procedures and storage conditions to ensure safety. As an organic solvent, naphtha's chemical composition allows it to serve as a paint thinner, odor detection agent, and even a rubber solvent. Its use in solvent extraction processes is crucial for extracting essential oils and other valuable compounds from various sources. The environmental impact of naphtha production and usage is a growing concern. Regulatory compliance is paramount to minimize waste disposal issues and ensure safety. Understanding the specific gravity, boiling point range, and other solvent properties is essential for optimizing processes and improving quality control.

- Moreover, naphtha's compatibility with various materials and its role in material processing make it an indispensable component in numerous industries. Its role in the petroleum industry is continuously evolving, with ongoing research and development focusing on process optimization and yield improvement.

What are the Key Data Covered in this Naphtha Market Research and Growth Report?

-

What is the expected growth of the Naphtha Market between 2025 and 2029?

-

USD 47.1 billion, at a CAGR of 3.8%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (Heavy naphtha and Light naphtha), Application (Chemicals, Energy/fuel, and Others), Geography (APAC, North America, Europe, Middle East and Africa, and South America), Process (Refining and Steam Cracking), and End-use Industry (Chemical, Energy, and Transportation)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Increase in demand for naphtha in petrochemical industry, Stringent regulations on usage of naphtha

-

-

Who are the major players in the Naphtha Market?

-

Key Companies ExxonMobil, Chevron Corporation, BP, Shell, TotalEnergies, Saudi Aramco, Reliance Industries Limited, China Petroleum & Chemical Corporation (Sinopec), PetroChina, Indian Oil Corporation, Phillips 66, Valero, Marathon Petroleum Corporation, Rosneft, Lukoil, Eni, Repsol, Pertamina, Petronas, and Qatar Petroleum

-

Market Research Insights

- The market encompasses the production, distribution, and utilization of petroleum fractions with a high aliphatics content. This market is subject to ongoing evolution, driven by various factors including energy efficiency, environmental regulations, and the need for solvent purification and recovery. In 2021, global naphtha production reached an estimated 110 million metric tons, up 3% from the previous year. Simultaneously, the aromatics content in naphtha grades averaged 45%, necessitating stringent quality assurance measures and regulatory compliance. Operational safety and process optimization are essential aspects of the market. Statistical process control, data analysis, and performance testing are employed to ensure cost reduction, throughput optimization, and waste minimization.

- Equipment design plays a crucial role in enhancing operational efficiency, while process simulation and monitoring facilitate continuous improvement. In the realm of solvent recovery, naphtha is increasingly being recycled to minimize waste and reduce environmental impact. The market's focus on health and safety, maintenance schedules, and product specification ensures the delivery of high-quality naphtha to meet diverse industry demands.

We can help! Our analysts can customize this naphtha market research report to meet your requirements.