Aquaculture Feed Market Size 2024-2028

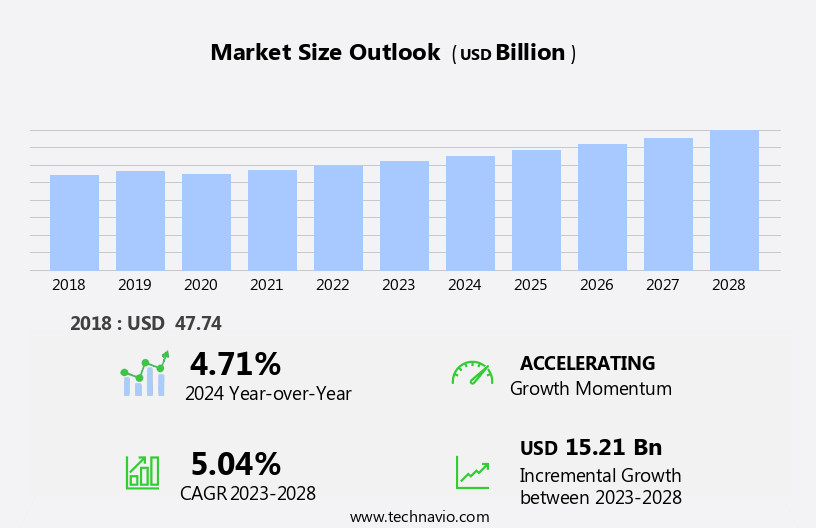

The aquaculture feed market size is forecast to increase by USD 15.21 billion, at a CAGR of 5.04% between 2023 and 2028.

- The market is characterized by dynamic growth, driven by frequent product launches and the expanding aquaculture production and consumption worldwide. This trend is fueled by the increasing demand for sustainable protein sources and the rising consumer preference for farmed seafood. However, the market faces significant challenges, including the instability in prices of aquaculture feed ingredients and additives. This volatility, caused by various factors such as weather conditions, disease outbreaks, and supply chain disruptions, poses a significant threat to the profitability of aquaculture businesses. To navigate these challenges, companies must focus on implementing strategic sourcing strategies, exploring alternative feed ingredients, and investing in research and development to improve feed efficiency and reduce reliance on volatile ingredients.

- Additionally, collaboration and partnerships with suppliers, governments, and research institutions can help mitigate risks and ensure a stable supply of raw materials. By staying agile and responsive to market trends and challenges, companies can capitalize on the opportunities presented by the growing aquaculture sector and maintain a competitive edge.

What will be the Size of the Aquaculture Feed Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the dynamic interplay of various factors. Feed efficiency is a key focus, with ongoing research and innovation in feed formulation and technology. Soybean meal and fish oil remain staples, but single-cell protein and other alternative protein sources are gaining traction. Renewable energy sources, such as wind and solar, are being integrated into feed production to reduce reliance on fossil fuels. Feed pelleting and extrusion technologies are advancing, enabling more precise control over nutrient delivery and improving feed quality. Artificial intelligence (AI) and machine learning (ML) are being employed to optimize feed formulation and improve production efficiency.

Disease resistance is another critical area, with a growing emphasis on preventative measures and vaccines. Product certification and regulatory compliance are essential for market access and consumer trust. Aquaculture sustainability is a top priority, with a shift towards circular economy principles and remote sensing technologies to monitor water quality and environmental impact. Energy density is a key consideration, with efforts underway to reduce the energy intensity of feed production. The supply chain is undergoing significant changes, with a focus on transparency and traceability. Distribution channels are expanding, with e-commerce platforms and direct-to-consumer sales becoming more common. Food safety is a major concern, with strict regulations and quality control measures in place.

Aquaculture economics are complex, with a range of factors influencing profitability, including market demand, pricing, and input costs. Waste management is an ongoing challenge, with efforts underway to develop more sustainable and efficient methods for handling and utilizing waste products. Overall, the market is a dynamic and evolving landscape, with ongoing innovation and adaptation to meet the changing needs of the industry.

How is this Aquaculture Feed Industry segmented?

The aquaculture feed industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

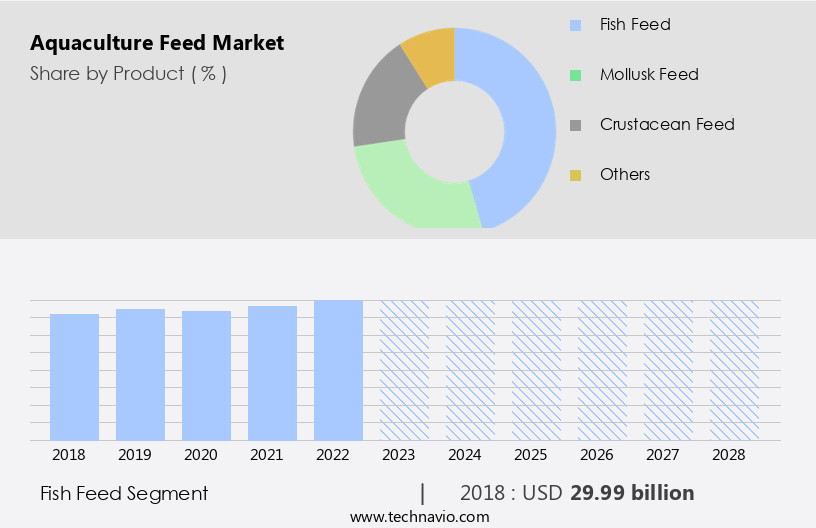

- Product

- Fish feed

- Mollusk feed

- Crustacean feed

- Others

- Form Factor

- Wet

- Dry

- Geography

- North America

- US

- Europe

- Norway

- APAC

- China

- India

- Vietnam

- Rest of World (ROW)

- North America

By Product Insights

The fish feed segment is estimated to witness significant growth during the forecast period.

In the thriving aquaculture industry, fish feed plays a significant role, accounting for a substantial market share. This feed is predominantly manufactured using a blend of ingredients, including fish meal, fish oil, vegetable proteins, such as soybean meal and corn gluten meal, and animal proteins. Essential additives like amino acids, vitamins, minerals, and feed acidifiers are also incorporated. The primary consumers of fish feed are various fish species, including trout, Atlantic salmon, pink salmon, sea bass, turbot, carp, catfish, and tilapia. The escalating aquaculture production of these fish and the growing investments in establishing new fisheries globally are the primary growth drivers for the fish feed market.

Moreover, the integration of advanced technologies, such as precision farming, renewable energy, artificial intelligence (AI), and sensor technology, is revolutionizing fish farming practices. These technologies enhance feed efficiency, optimize feed formulation, improve disease resistance, and ensure food safety. Additionally, the circular economy concept is gaining momentum, with the focus on waste management and the reuse of by-products, such as wheat middlings and insect meal, as fish feed ingredients. Regulatory compliance, product certification, and quality control are also essential aspects of the market, ensuring sustainable and environmentally responsible aquaculture practices. The increasing market demand for aquaculture products, driven by their economic viability and desirable nutritional properties, further bolsters the growth of the fish feed market.

The Fish feed segment was valued at USD 29.99 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, with APAC being a key contributor. In 2023, APAC accounted for a substantial market share, with major producers being India, Japan, Indonesia, China, Malaysia, Vietnam, and Thailand. China leads as the largest producer, followed by Vietnam and India. Companies in the region are advancing technology-based production centers in countries like India, Vietnam, and Thailand to deliver high-quality feeds. Sustainable aquaculture practices are gaining momentum, leading to an increase in demand for feeds with higher protein content, such as soybean meal, single-cell protein, and fish oil. Renewable energy sources are being integrated into feed production, making it more environmentally friendly.

Intensive aquaculture practices necessitate feed pelleting and extrusion for efficient feeding. Major players are focusing on feed formulation, incorporating amino acids, corn gluten meal, shrimp meal, and growth promoters to enhance feed efficiency and productivity. Regulatory compliance and product certification are crucial in ensuring aquaculture sustainability and food safety. Innovations in aquaculture technology, such as artificial intelligence (AI) and machine learning (ML), are being employed to optimize feed delivery, disease resistance, and precision farming. Remote sensing and data analytics are used to monitor water quality and environmental impact. Waste management and economic viability are also essential considerations in the circular economy.

Insect meal is emerging as a promising alternative protein source. The supply chain is being streamlined through distribution channels and sensor technology to ensure timely feed delivery and quality control. The market demand for aquaculture feed is expected to continue growing due to the increasing global population and the need for sustainable sources of protein.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Aquaculture Feed Industry?

- The consistent introduction of new products serves as the primary catalyst for market growth.

- The market is experiencing significant growth due to the continuous advancements in sustainable and extensive aquaculture production. Companies are investing in research and development to enhance the nutritional value and efficiency of their feed products. New product launches in this sector include the use of alternative ingredients, such as soybean meal and single-cell protein, to increase the protein content and reduce reliance on fish oil. In addition, the development of species-specific feeds and the incorporation of new processing technologies are improving the digestibility and absorption of nutrients. For instance, Skretting (Nutreco) recently opened a new shrimp and fish feed facility in India to cater to the growing demand for sustainable aquaculture feeds.

- Aquaculture economics are influenced by various factors, including the supply chain, fatty acids, and the price of key ingredients like soybean meal and fish oil. The market dynamics are harmonious, with companies emphasizing innovation to meet the evolving needs of the aquaculture industry.

What are the market trends shaping the Aquaculture Feed Industry?

- The global market trend reflects an increasing demand for aquaculture, with both production and consumption continuing to grow. Aquaculture's expanding role in worldwide food production is a significant development in the industry.

- The market is experiencing significant growth due to the increasing demand for aquaculture products worldwide. Aquaculture, an intensive farming practice, requires high-quality feed to ensure the production of healthy and sustainable aquatic species. Major consumers of aquaculture feed include carps, marine shrimps, tilapias, salmons, trouts, and freshwater crustaceans. The cultivation of these species has been on the rise, driven by the need for renewable protein sources and the growing consumer preference for sustainable and eco-friendly food options. The production of aquaculture feed involves the use of raw materials such as corn gluten meal, amino acids, shrimp meal, and others.

- The feed manufacturing process includes feed pelleting and feed extrusion to ensure optimal nutrient absorption and lipid content. Precision farming techniques and regulatory compliance are essential to maintain the quality and safety of aquaculture feed. The circular economy concept is gaining popularity in the aquaculture feed industry, with a focus on reducing waste and maximizing the use of by-products and renewable resources. The use of renewable energy sources such as wind and solar power in feed manufacturing is also on the rise. In conclusion, The market is driven by the increasing demand for sustainable and healthy aquaculture products, the rise in the production of major aquaculture species, and the adoption of circular economy principles and renewable energy sources in feed manufacturing.

What challenges does the Aquaculture Feed Industry face during its growth?

- The instability in the prices of aquaculture feed ingredients and additives poses a significant challenge to the industry's growth trajectory. This volatility in pricing can negatively impact profitability and sustainability for aquaculture businesses, making it a critical issue that requires ongoing attention and management.

- The market faces instability in the prices of key ingredients and additives, which may hinder market expansion during the forecast period. Soybean, corn, fish meal, fish oil, rice, wheat, and others are commonly utilized ingredients in aquaculture feed. The volatility in the prices of these components has significantly influenced the cost of aquaculture feed worldwide. To optimize feed efficiency and enhance the value of aquaculture feed, feed formulation plays a crucial role. Advanced aquaculture technology, including artificial intelligence (AI), is being employed to develop disease-resistant feed formulations. Product certification, ensuring sustainability, and maintaining water quality are essential factors driving market growth.

- Remote sensing and distribution channels are essential for monitoring water quality and ensuring efficient feed distribution. Energy density is another critical factor in aquaculture feed, as it directly impacts the productivity and profitability of aquaculture operations. Ensuring the environmental impact of aquaculture feed is minimal is also a priority for market participants.

Exclusive Customer Landscape

The aquaculture feed market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the aquaculture feed market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, aquaculture feed market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aller Aqua AS - This company specializes in producing aquaculture feed for diverse marine species, including Atlantic salmon, rainbow trout, meagre, and sea bass.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aller Aqua AS

- Alltech Inc.

- Archer Daniels Midland Co.

- Avanti Feeds Ltd.

- BRF SA

- Cargill Inc.

- Charoen Pokphand Foods PCL

- Godrej and Boyce Manufacturing Co. Ltd.

- Grand Fish Feed

- Growel Feeds Pvt. Ltd.

- IB Group

- Land O Lakes Inc.

- National Aquaculture Group

- Nutreco N.V.

- Olmix SA

- Ridley Corp. Ltd.

- Schouw and Co.

- The Waterbase Ltd.

- Tyson Foods Inc.

- Viet Uc Seafood Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Aquaculture Feed Market

- In January 2024, Cargill, a leading global provider of aqua nutrition, announced the launch of EWOS Aquaculture Innovation Centre in Norway. This state-of-the-art facility focuses on research and innovation to develop sustainable feed solutions for the aquaculture industry (Cargill press release).

- In March 2024, Nutreco, a global leader in animal nutrition and aquafeed, entered into a strategic partnership with BioMar, a Danish aquaculture feed producer. The collaboration aimed to strengthen their combined position in the global aquaculture market and expand their product offerings (Nutreco press release).

- In May 2024, Skretting, a Norwegian aquaculture feed company, secured a significant investment of â¬150 million from its parent company, Nutreco. The funds were earmarked for the expansion of its production capacity and the development of innovative feed solutions (Skretting press release).

- In February 2025, the European Commission approved the use of microalgae as a feed ingredient for farmed fish. This decision marked a significant milestone in the aquaculture industry, as microalgae-based feeds offer numerous benefits, including improved nutritional value and reduced environmental impact (European Commission press release).

Research Analyst Overview

- The market is shaped by various factors, including consumer preferences, policy frameworks, investment opportunities, and technological innovation. Consumer demand for sustainable and high-quality aquaculture products drives the need for feeds that enhance nutritional value, selective breeding, and species diversity. Policy frameworks, such as international standards and regulations, influence the industry's approach to disease control, worker welfare, and environmental sustainability. Technological innovation in aquaculture genetics, water usage, and feed production offers opportunities for improving feed efficiency and reducing the carbon footprint. Industry collaboration and consumer education are essential for addressing social impact, food security, and ecosystem services. Land use optimization and supply chain transparency are critical for reducing waste and ensuring sustainable practices.

- Policy frameworks and industry collaboration also play a role in parasite management, habitat restoration, and ecosystem services. Disease control and health management are crucial for maintaining worker safety and ensuring the sustainability of the industry. Occupational safety and global trade regulations are essential for ensuring a responsible and ethical supply chain. Investment in research and development in areas such as genetic engineering, aquaculture biodiversity, and ecosystem services can lead to significant advancements in the industry. Water usage efficiency and carbon footprint reduction are essential for addressing the environmental impact of aquaculture feed production. Overall, the market is a dynamic and complex industry that requires a holistic approach to addressing the challenges and opportunities it presents.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Aquaculture Feed Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.04% |

|

Market growth 2024-2028 |

USD 15.21 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.71 |

|

Key countries |

China, Norway, US, Vietnam, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Aquaculture Feed Market Research and Growth Report?

- CAGR of the Aquaculture Feed industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the aquaculture feed market growth of industry companies

We can help! Our analysts can customize this aquaculture feed market research report to meet your requirements.