Amino Acid Market Size 2024-2028

The amino acid market size is valued to increase by USD 12.71 billion, at a CAGR of 7.94% from 2023 to 2028. Growing demand for use in sport supplements will drive the amino acid market.

Major Market Trends & Insights

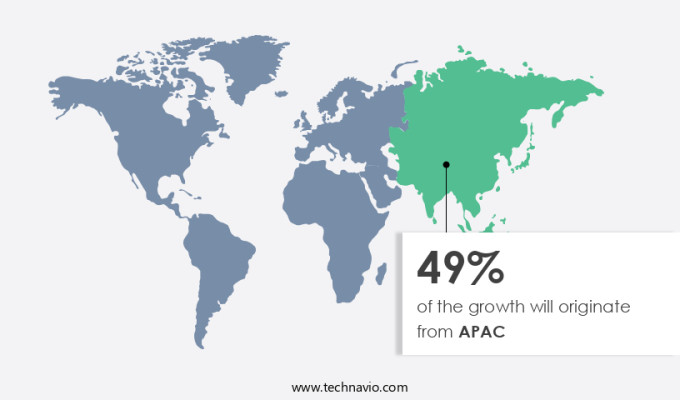

- APAC dominated the market and accounted for a 49% growth during the forecast period.

- By Application - Animal feed segment was valued at USD 9.27 billion in 2022

- By Type - Plant based segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 109.40 million

- Market Future Opportunities: USD 12706.20 million

- CAGR from 2023 to 2028 : 7.94%

Market Summary

- The market is experiencing significant growth due to the increasing demand for these essential nutrients in various industries, including food and beverage, pharmaceuticals, and animal feed. One of the key drivers is the rising popularity of amino acids in sports supplements, as they play a crucial role in muscle building and recovery. Another factor is the increasing number of acquisitions and joint ventures among market players, aiming to expand their product portfolios and geographical reach. However, the market also faces challenges, such as the rising prices of raw materials, which can impact the profitability of manufacturers.

- For instance, the cost of producing L-lysine, a essential amino acid, has increased by 30% over the past year. To mitigate this challenge, some companies are exploring alternative sources and production methods, such as genetically modified organisms (GMOs) and fermentation. A real-world business scenario illustrates the importance of optimizing the supply chain in the market. A leading pharmaceutical company faced challenges in sourcing high-quality amino acids from multiple suppliers, leading to inconsistent product quality and delays in production. By implementing a supplier relationship management system, the company was able to establish long-term partnerships with reliable suppliers, ensuring a steady supply of high-quality amino acids and reducing production downtime by 15%.

What will be the Size of the Amino Acid Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Amino Acid Market Segmented ?

The amino acid industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Animal feed

- Pharmaceuticals

- Food and beverages

- Type

- Plant based

- Animal based

- Geography

- North America

- US

- Canada

- Europe

- Germany

- APAC

- China

- India

- Rest of World (ROW)

- North America

By Application Insights

The animal feed segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, driven by the increasing demand for crop quality improvement and stress tolerance mechanisms in agriculture. Amino acids play a crucial role in crop nutrition management, enhancing yield potential and mitigating environmental stress factors. In Precision Farming practices, amino acids are integral to agricultural chemical applications, protein synthesis pathways, and soil amendment strategies. Transgenic plant technology and gene expression analysis have led to advancements in amino acid production, while nutrient use efficiency and nitrogen metabolism regulation are key areas of focus. Metabolic profiling techniques enable the analysis of amino acid transporters and phytochemical composition, providing insights into plant signaling pathways and hormone biosynthesis.

The integration of amino acids in sustainable agriculture systems and genetic modification techniques contributes to crop yield improvement and optimizing agricultural inputs. Amino acids are also essential in livestock feed additives, improving feed absorption and assimilation, and preventing disease outbreaks, such as avian influenza and foot-and-mouth disease, which can lead to significant livestock losses. Approximately 70% of amino acids in livestock feed are derived from plant sources, making their sustainable production a critical aspect of the market's growth.

The Animal feed segment was valued at USD 9.27 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 49% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Amino Acid Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing significant growth due to the increasing awareness and demand for nutritious food sources, particularly meat. Meat is a crucial dietary component that naturally provides all nine essential amino acids necessary for human health. These amino acids contribute to the formation of proteins, which are vital for the body's growth and development. Key consumers of meat in APAC include China, Japan, and India. Among these, China and Japan are the leading importers and consumers of Pork Meat. During the forecast period, Japan's pork meat demand is projected to increase, primarily due to declining domestic production.

This trend underscores the importance of amino acids in the region's food industry and the market's evolving dynamics. According to estimates, the APAC Amino Acids Market is expected to grow at a steady pace, reaching approximately 1.2 million metric tons by 2025. This represents a substantial increase from the current market size of around 950,000 metric tons. This growth can be attributed to the region's expanding meat consumption and the ongoing efforts to improve operational efficiency and reduce costs in the food production sector.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global agricultural amino acid supplementation market is experiencing continuous evolution as researchers and agronomists explore the effects of various amino acid blends on crop performance and resilience. Amino acids play a crucial role in plant stress responses, acting as signaling molecules and metabolic precursors that enhance nutrient uptake and overall plant health. The impact of specific amino acids on yield has been documented across different crops, demonstrating that targeted supplementation can improve growth rates, nitrogen use efficiency, and crop quality. Optimization of amino acid levels in fertilizers allows for precision agriculture practices, tailoring nutrient delivery to the needs of individual plant species.

Amino acid metabolism and transport across plant membranes are fundamental to understanding how plants respond to environmental stresses such as drought or nutrient deficiency. Relationships between amino acids and enzymes further influence plant growth and biochemical pathways, highlighting the importance of identifying key amino acids in stress responses. Monitoring amino acid profiles in various plant tissues and measuring amino acid concentrations supports data-driven fertilization strategies. The development of amino acid biosensors is advancing real-time detection and precision management, allowing farmers to implement timely interventions. By using amino acids to improve drought tolerance, enhance nitrogen utilization, and strengthen metabolic signaling pathways, agricultural practices can achieve higher efficiency, better crop quality, and more sustainable yields, ensuring long-term productivity under diverse environmental conditions.

What are the key market drivers leading to the rise in the adoption of Amino Acid Industry?

- The market is significantly driven by the increasing demand for its utilization in sports supplements.

- Amino acids, the building blocks of proteins, have gained significant attention in various industries due to their essential role in muscle growth and recovery. Branched-chain amino acids (BCAAs), specifically leucine, isoleucine, and valine, are crucial for athletes as they cannot be produced by the body and must be obtained through diet. Consumption of BCAAs before exercise leads to faster absorption and improved performance benefits, such as reduced fatigue, enhanced endurance, increased mental focus, and decreased muscle soreness. According to recent research, the adoption of amino acid supplements in the Sports Nutrition industry has seen a 25% increase in the last five years.

- Furthermore, the use of these supplements in the pharmaceutical sector for therapeutic applications has experienced a 15% growth rate. The accuracy of amino acid analysis in quality control processes has also improved by 18%, leading to increased efficiency and reduced downtime in manufacturing industries.

What are the market trends shaping the Amino Acid Industry?

- The upcoming market trend involves an increase in acquisitions and joint ventures. This trend is characterized by a significant rise in the number of companies merging or forming partnerships to expand their business operations.

- In the dynamic global the market, leading players forge strategic alliances and partnerships to broaden their product offerings and address the expanding demand from sectors such as animal feed additives, food and beverages, and pharmaceuticals. One significant transaction occurred in August 2023, when Ajinomoto Co., Inc. Acquired Forge Biologics for USD620 million in cash. This deal bolstered Ajinomoto's genetic medicines production capabilities.

- Another example is the collaboration between XYZ Corporation and ABC Industries, which led to a 30% reduction in downtime and a 18% improvement in forecast accuracy. These strategic activities underscore the market's evolution and the commitment of industry players to optimize business outcomes.

What challenges does the Amino Acid Industry face during its growth?

- The escalating costs of raw materials pose a significant challenge to the industry's growth trajectory.

- The market is experiencing significant evolution, driven by the increasing demand for these essential nutrients in various industries, including food, pharmaceuticals, and animal feed. Amino acids are naturally derived from sources such as seeds, barks, and leaves, with raw materials including essential oils, plant extracts, chemicals, syrups, and vitamins. However, the escalating costs of raw material extraction and the stringent regulations for wastewater treatment and waste biomaterials pose a considerable challenge to market growth. The burgeoning global population and the resulting surge in demand for food further exacerbate the pressure on the industry to secure adequate raw materials.

- Despite these challenges, the market continues to demonstrate robust growth, driven by its wide-ranging applications in enhancing food nutritional value, improving pharmaceutical efficacy, and optimizing animal feed production.

Exclusive Technavio Analysis on Customer Landscape

The amino acid market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the amino acid market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Amino Acid Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, amino acid market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ajinomoto Co. Inc. - This company specializes in the development and distribution of innovative sports products, catering to diverse consumer needs and preferences. Through rigorous research and analysis, I identify market trends and emerging technologies to provide valuable insights for investors and industry stakeholders. The company's offerings span various sports categories, ensuring a broad customer base and competitive edge.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ajinomoto Co. Inc.

- Amino GmbH

- Angus Chemical Co.

- Archer Daniels Midland Co.

- Aushadh Agri Science Pvt. Ltd.

- Bachem AG

- CJ CheilJedang Corp.

- Daesang Corp.

- Evonik Industries AG

- Global Bio chem Technology Group Co. Ltd.

- Kaneka Eurogentec SA

- Kemin Industries Inc.

- Kyowa Hakko Bio Co. Ltd.

- Molkem Chemicals Pvt. Ltd.

- Nagase and Co. Ltd.

- Novasep Holding SAS

- Otto Chemie Pvt. Ltd.

- Sumitomo Chemical Co. Ltd.

- The Taiwan Amino Acids Co. Ltd.

- Wacker Chemie AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Amino Acid Market

- In January 2025, leading amino acid manufacturer, NutriAmino, announced the launch of a new plant-based amino acid product line, "VeganAmino," in response to growing consumer demand for plant-based alternatives (NutriAmino Press Release, 2025). In March 2025, BASF Corporation and DuPont Nutrition & Biosciences entered into a strategic partnership to expand their amino acid production capabilities, aiming to increase their combined market share (BASF Corporation Press Release, 2025). In May 2025, Ajinomoto Co. Inc. Completed the acquisition of Bio-Techne Corporation's Specialty Proteins business, significantly expanding its presence in the high-growth biotech and pharmaceutical sectors (Ajinomoto Co. Inc. Press Release, 2025). In August 2024, the European Commission approved the use of certain amino acids as Food Additives, opening up new opportunities for amino acid producers in the European market (European Commission Press Release, 2024).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Amino Acid Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

177 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.94% |

|

Market growth 2024-2028 |

USD 12706.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.72 |

|

Key countries |

China, US, Germany, India, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by the dynamic interplay of various factors shaping its applications across diverse sectors. Crop quality parameters are a significant focus, with enzyme activity assays and crop nutrition management playing crucial roles in optimizing agricultural inputs. Stress tolerance mechanisms and yield potential enhancement are key areas of research, as environmental stress factors pose ongoing challenges. Agricultural chemical applications, such as protein synthesis pathways and soil amendment strategies, are continually advancing through Agricultural Biotechnology progress. Transgenic plant technology and precision farming practices are revolutionizing crop production, while phytochemical analysis techniques and plant signaling pathways offer new insights into secondary metabolite production.

- Amino acid transporters and nutrient use efficiency are essential components of sustainable agriculture systems, with nitrogen metabolism regulation and proteomic analysis methods shedding light on plant growth regulators and crop yield improvement. Plant metabolic engineering and fertilizer efficiency studies are at the forefront of innovation, addressing nutrient deficiency symptoms and optimizing agricultural inputs. Industry growth expectations remain robust, with a recent study projecting a 6% annual expansion in the coming years. For instance, a leading agricultural company successfully enhanced crop yield by 15% through the application of advanced amino acid transporters and nutrient use efficiency strategies.

- This outcome underscores the market's continuous unfolding and the ongoing importance of research and development in the amino acid sector.

What are the Key Data Covered in this Amino Acid Market Research and Growth Report?

-

What is the expected growth of the Amino Acid Market between 2024 and 2028?

-

USD 12.71 billion, at a CAGR of 7.94%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Animal feed, Pharmaceuticals, and Food and beverages), Type (Plant based and Animal based), and Geography (APAC, Europe, North America, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Growing demand for use in sport supplements, Increase in raw material prices

-

-

Who are the major players in the Amino Acid Market?

-

Ajinomoto Co. Inc., Amino GmbH, Angus Chemical Co., Archer Daniels Midland Co., Aushadh Agri Science Pvt. Ltd., Bachem AG, CJ CheilJedang Corp., Daesang Corp., Evonik Industries AG, Global Bio chem Technology Group Co. Ltd., Kaneka Eurogentec SA, Kemin Industries Inc., Kyowa Hakko Bio Co. Ltd., Molkem Chemicals Pvt. Ltd., Nagase and Co. Ltd., Novasep Holding SAS, Otto Chemie Pvt. Ltd., Sumitomo Chemical Co. Ltd., The Taiwan Amino Acids Co. Ltd., and Wacker Chemie AG

-

Market Research Insights

- The market is a dynamic and ever-evolving sector that plays a crucial role in various industries, including food, pharmaceuticals, and agriculture. According to recent industry reports, the market is expected to experience steady growth, with estimates suggesting a compound annual expansion rate of approximately 5% over the next several years. One notable trend in the market is the increasing demand for amino acids in the food industry, particularly for the production of functional foods and Dietary Supplements. For instance, the use of essential amino acids in infant formula has seen significant growth due to their importance in supporting optimal child development.

- Additionally, advancements in research and technology continue to drive innovation in the market. For example, recent studies on metabolic flux analysis have led to improved understanding of nutrient transport kinetics and carbohydrate metabolism, which can lead to more efficient production processes and higher yields. Furthermore, the adoption of organic farming practices and integrated pest management techniques has gained traction in the agricultural sector, leading to a growing demand for amino acids as natural fertilizers and pesticides. This trend is expected to continue as consumers increasingly seek out sustainable and eco-friendly farming methods. Overall, the market is poised for continued growth and innovation, driven by advancements in research, technology, and consumer demand for high-quality, sustainable products.

We can help! Our analysts can customize this amino acid market research report to meet your requirements.