Artificial Heart Market Size 2024-2028

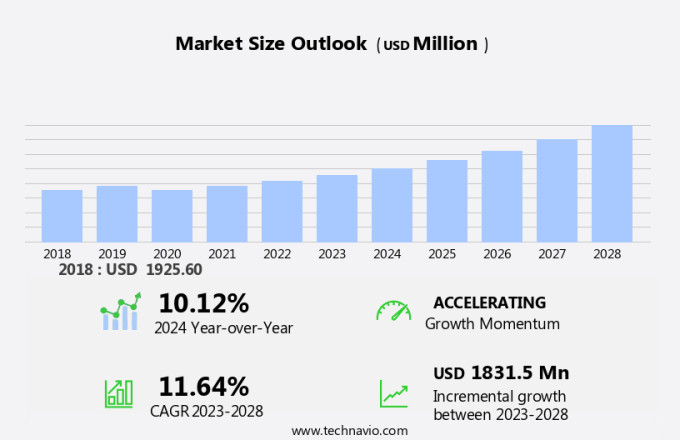

The artificial heart market size is forecast to increase by USD 1.83 billion, at a CAGR of 11.64% between 2023 and 2028.

- The market is driven by the increasing prevalence of heart failure and associated risk factors, fueling the demand for advanced replacement solutions. This trend is further accentuated by ongoing clinical trials for the development of Total Artificial Hearts (TAHs), which offer a viable alternative to heart transplants for certain patient populations. However, the high cost of artificial hearts poses a significant challenge for both patients and healthcare systems, potentially limiting market growth.

- Despite this obstacle, companies can capitalize on the market's potential by focusing on cost reduction strategies, collaborating with healthcare providers to offer affordable financing options, and continuing to innovate in the field of artificial heart technology to improve patient outcomes and reduce long-term costs.

What will be the Size of the Artificial Heart Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and the growing need for mechanical circulatory support in various sectors. Regulatory compliance remains a critical factor, with stringent guidelines ensuring the safety and efficacy of these devices. Control systems have improved, enabling better infection prevention and enhancing patient quality of life. Hemolysis reduction and device durability are key areas of focus, with ongoing research aimed at reducing hemolysis and increasing device lifespan. Total artificial hearts and ventricular assist devices have become essential tools in heart failure treatment, with surgical technique and patient selection criteria continually refined to optimize outcomes.

Device cost-effectiveness and patient monitoring are also crucial considerations, with advancements in remote monitoring and post-operative care enabling more efficient and cost-effective care. Tissue engineering and biocompatible materials are transforming the field, with a focus on reducing thrombosis and improving biomechanical testing and clinical trials. Cardiovascular implants are being developed with an emphasis on cardiac output, durability assessment, and ejection fraction. Power sources and data acquisition systems are also advancing, enabling more precise and effective mechanical circulatory support. The market is characterized by ongoing innovation, with a focus on improving patient outcomes and reducing complications.

Thrombosis prevention, material compatibility, and power source efficiency are key areas of research, with the ultimate goal of creating a reliable and effective long-term solution for patients with ventricular dysfunction. Bioprosthetic heart valves and stroke volume optimization are also areas of active research, with the potential to significantly improve the quality of life for patients with heart failure. The regulatory landscape is continually evolving, with ongoing assessments of device failure modes and biocompatibility ensuring the safety and efficacy of these life-saving technologies. As the field advances, the focus on patient-centered care and cost-effectiveness will continue to drive innovation and growth in the market.

How is this Artificial Heart Industry segmented?

The artificial heart industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- VAD

- TAH

- Geography

- North America

- US

- Europe

- France

- Germany

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Product Insights

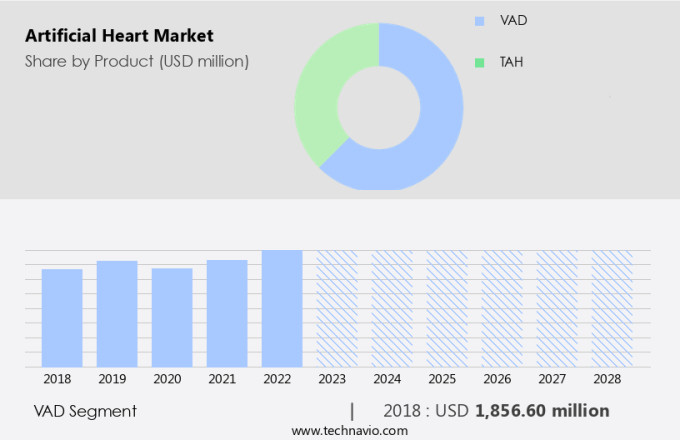

The vad segment is estimated to witness significant growth during the forecast period.

Artificial hearts and ventricular assist devices (VADs) are advanced cardiovascular implants designed to enhance the heart's function or replace it entirely. Regulatory compliance is crucial in ensuring the safety and efficacy of these devices. The control system of VADs is intricate, requiring precise blood flow dynamics and pressure regulation. Infection prevention is a significant concern, with biocompatible materials and rigorous sterilization methods essential. Quality of life and hemolysis reduction are key considerations, as prolonged use of these devices can impact patient well-being. Device durability and long-term outcomes are essential, with ongoing research focusing on improving device lifespan and reducing complications.

Total artificial hearts and VADs are complex cardiovascular implants, requiring meticulous implantation procedures. Surgical technique and patient selection criteria are critical factors in ensuring successful implantation and optimal patient outcomes. Tissue engineering and biomechanical testing are essential in advancing the technology and improving patient care. Heart failure treatment often involves the use of VADs as a mechanical circulatory support. Cardiac output, stroke volume, and ejection fraction are vital metrics in assessing the effectiveness of these devices. Thrombosis prevention and power source are essential considerations in maintaining the functionality of the devices. Patient monitoring and post-operative care are crucial components of successful VAD implantation.

Remote monitoring and data acquisition are essential in ensuring timely intervention and addressing any potential issues. Clinical trials and bioprosthetic heart valves are also integral to advancing the field and improving patient outcomes. Device cost-effectiveness and material compatibility are ongoing concerns, with ongoing research focused on reducing costs and improving material compatibility. Durability assessment and device failure modes are essential in ensuring the reliability and safety of these devices. Heart transplantation and rehabilitation programs are often utilized in conjunction with VADs to optimize patient care. In the field of artificial hearts and VADs, innovation and advancements continue to emerge.

From improving surgical techniques to enhancing patient monitoring and reducing complications, the focus remains on delivering optimal patient outcomes and advancing the field of mechanical circulatory support.

The VAD segment was valued at USD 1.86 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is witnessing significant growth due to the region's high prevalence of heart failure (HF) and associated risk factors, favorable reimbursement policies, improved healthcare infrastructure, and access to advanced treatments. The increasing initiatives for raising awareness about cardiovascular diseases (CVDs) and the high gross domestic product (GDP) of countries in North America are also contributing to market expansion. Established companies in the region, including those providing regulatory compliance, control systems, infection prevention, and hemolysis reduction technologies, are driving innovation in the market. Tissue engineering, heart failure treatment, and mechanical circulatory support solutions are gaining popularity, with a focus on improving quality of life, durability assessment, and long-term outcomes.

The use of biocompatible materials, bioprosthetic heart valves, and thrombosis prevention techniques is also increasing to enhance device lifespan and reduce complications. The market is also witnessing advancements in surgical techniques, implantation procedures, and post-operative care, leading to improved patient monitoring and rehabilitation programs. Clinical trials and biomechanical testing are essential for assessing device performance, cardiac output, stroke volume, and ejection fraction. Power sources, data acquisition, and remote monitoring are also critical factors in the market, ensuring optimal blood flow dynamics and blood pressure regulation. Despite these advancements, device failure modes and material compatibility remain key challenges.

The market is expected to continue evolving, with a focus on cost-effectiveness, patient selection criteria, and minimizing complication rates.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is witnessing significant growth due to advancements in technology leading to the development of more durable and effective heart devices. Durability testing of artificial heart valves is a crucial aspect of ensuring the longevity of these devices. Minimally invasive heart implant procedures using biocompatible materials have reduced the risk of complications, making total artificial heart lifespans longer. Ventricular assist device failure analysis and left ventricular assist system complication studies are ongoing to improve the design and functionality of these systems. Bioprosthetic heart valve thrombosis prevention measures are being integrated into mechanical circulatory support systems to enhance patient safety. Cardiovascular implant material selection plays a vital role in heart failure treatment clinical trials, with a focus on reducing hemolysis and improving blood flow dynamics in artificial hearts. Hemolysis reduction in artificial hearts is essential for minimizing patient discomfort and potential complications. Artificial heart patient selection criteria are being refined to optimize device effectiveness and cost-effectiveness. Artificial heart device cost effectiveness is a critical consideration for market adoption, with ongoing research focusing on pump technology integration and power source optimization. Patient monitoring systems and remote diagnostics are also being developed to enhance artificial heart functionality and ensure regulatory compliance for the market, adhering to market research report standards.

What are the key market drivers leading to the rise in the adoption of Artificial Heart Industry?

- The rising prevalence of heart failure (HF) and related risk factors serves as the primary market driver, underpinned by the increasing global burden of cardiovascular diseases.

- Artificial hearts have emerged as a crucial solution for individuals suffering from heart failure (HF), a condition that affects an estimated 20,000 people in Europe and 10,000 to 20,000 in Western countries out of one million, with an average incidence of 7,500 per million persons each year. In the US, approximately 800,000 to a million new cases are diagnosed annually, with a projected increase to nearly 7.65 million by 2025. Hospital admissions due to HF are also on the rise. Artificial hearts offer mechanical circulatory support to patients, mitigating the risk of heart failure-related complications.

- These devices are designed with advanced features such as thrombosis prevention systems, power sources, and data acquisition systems. Bioprosthetic heart valves ensure material compatibility and improve blood pressure regulation. Remote monitoring enables healthcare professionals to closely monitor device performance and patient health, reducing complication rates. However, device failure modes, such as power failure and thrombosis, remain concerns. Ongoing research focuses on improving the durability and reliability of these devices, as well as minimizing the risk of complications. Incorporating advanced technologies, such as artificial intelligence and machine learning, can enhance the performance and functionality of artificial hearts.

- These advancements aim to provide a more immersive and harmonious user experience, ultimately improving patient outcomes.

What are the market trends shaping the Artificial Heart Industry?

- The development of TAHs (Total Artificial Heart systems) is currently a significant trend in clinical trials. This innovative technology, which replaces the failing heart with an artificial one, is gaining increasing attention in the medical community due to its potential to improve patient outcomes and extend life.

- Artificial hearts are advanced medical devices designed to replace the function of the human heart in patients with end-stage biventricular heart failure who are not eligible for transplantation. Several companies are investing significantly in research and development to create innovative total artificial hearts (TAHs) that offer superior control systems, infection prevention, and improved quality of life for patients. One notable example is CARMAT, which is developing an auto-regulating bioprosthetic TAH. This device, called CARMAT, is designed to provide a long-term therapeutic solution for patients with advanced heart failure. Its unique feature includes surfaces in contact with blood made of biocompatible materials, which reduces the risk of thromboembolic events.

- Moreover, it is the first intelligent TAH that can respond automatically to the patient's metabolic needs. Another company, SynCardia Systems, is conducting clinical trials for its SynCardia 70cc TAH as a destination therapy for patients with end-stage heart failure who are ineligible for heart transplantation. The focus on regulatory compliance, infection prevention, hemolysis reduction, and device lifespan is crucial for ensuring the long-term outcomes of these patients. These innovations aim to provide a more harmonious and immersive experience for patients, improving their overall quality of life.

What challenges does the Artificial Heart Industry face during its growth?

- The high cost of artificial hearts poses a significant challenge to the growth of the industry. This expense, a major concern for manufacturers and healthcare providers alike, hinders the widespread adoption and accessibility of these life-saving devices.

- Artificial hearts and valves have emerged as crucial solutions for managing ventricular dysfunction and heart failure treatment. However, their high cost is a significant barrier to their widespread adoption, with the cost of Ventricular Assist Devices (VADs) ranging from USD 100,000 and above, and Total Artificial Hearts (TAHs) costing between USD 125,000 and USD 150,000, including annual maintenance costs of approximately USD 18,000. Procedural costs for artificial hearts can vary significantly depending on factors such as device type, surgery extent, surgeon expertise, complications, hospital costs, and insurance coverage.

- Post-operative care involves ongoing device adjustments and battery replacement, adding to the overall expense. Tissue engineering and advancements in blood flow dynamics hold promise for improving cost-effectiveness and expanding patient selection criteria. Patient monitoring and post-operative care are essential components of managing artificial heart patients, ensuring optimal cardiac output and minimizing risks.

Exclusive Customer Landscape

The artificial heart market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the artificial heart market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, artificial heart market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - This research focuses on a leading medical device firm specializing in cardiovascular innovations.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Berlin Heart GmbH

- BiVACOR Inc.

- Boston Scientific Corp.

- Calon Cardio Technology Ltd.

- CARMAT SA

- Corcym Srl

- CorWave SA

- Cryolife Inc.

- Edwards Lifesciences Corp.

- Evaheart Inc.

- Jarvik Heart Inc.

- JenaValve Technology Inc.

- Johnson and Johnson Services Inc.

- LivaNova PLC

- Medtronic Plc

- MyLVAD Foundation LTD.

- Quest Diagnostics Inc.

- SynCardia Systems LLC

- Terumo Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Artificial Heart Market

- In January 2024, Medtronic, a leading medical technology company, announced the successful implantation of the HeartMate 3 LVAS (Left Ventricular Assist System) in over 10,000 patients worldwide, marking a significant milestone in the adoption of artificial hearts (Medtronic Press Release, 2024).

- In March 2024, Abbott Laboratories and Boston Scientific Corporation, two major players in the cardiovascular industry, announced a strategic collaboration to co-develop an artificial heart system, combining Abbott's expertise in heart failure therapies with Boston Scientific's experience in cardiovascular devices (Abbott and Boston Scientific Press Releases, 2024).

- In May 2024, SynCardia Systems, Inc., a pioneer in total artificial heart technology, raised USD50 million in a Series D funding round, bringing the total investment in the company to USD180 million. The funds will be used to expand production capacity and support clinical trials for their Total Artificial Heart (SynCardia Systems Press Release, 2024).

- In April 2025, the European Commission granted marketing authorization for the HeartMate 3 LVAS, enabling its commercialization in the European Union. This approval marks a significant expansion for Medtronic in the European market, which is expected to account for over 30% of the market share by 2027 (European Commission Press Release, 2025).

Research Analyst Overview

- The market is experiencing significant advancements, with a focus on system integration and complication management. Wearable sensors and minimally invasive surgery are key trends, enabling early detection and remote diagnostics. Patient selection and procedural techniques are under scrutiny for optimal clinical outcomes and cost analysis. Prosthetic heart valves and heart pump technology are advancing, with a shift towards energy efficiency and long-term durability. Device safety and regulatory approval remain top priorities, with risk mitigation strategies and surgical planning essential for successful implantation.

- Bioartificial hearts and longitudinal studies are paving the way for failure prediction and biomechanical modeling, while clinical validation and patient education are crucial for post-surgical recovery. Surgical training and data analysis are also vital for improving clinical outcomes and refining procedural techniques.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Artificial Heart Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.64% |

|

Market growth 2024-2028 |

USD 1831.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.12 |

|

Key countries |

US, Germany, France, Japan, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Artificial Heart Market Research and Growth Report?

- CAGR of the Artificial Heart industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the artificial heart market growth of industry companies

We can help! Our analysts can customize this artificial heart market research report to meet your requirements.