Clinical Trial Support Services Market Size 2025-2029

The clinical trial support services market size is valued to increase USD 8.92 billion, at a CAGR of 7.4% from 2024 to 2029. Growth of biopharmaceutical industry will drive the clinical trial support services market.

Major Market Trends & Insights

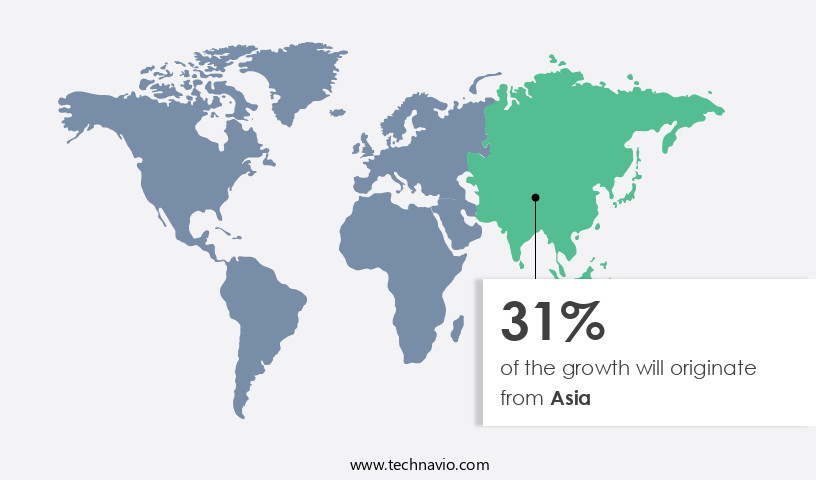

- Asia dominated the market and accounted for a 33% growth during the forecast period.

- By Application - Phase 2 segment was valued at USD 6.16 billion in 2023

- By Age Group - Adults (greater than 18 years) segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 71.60 million

- Market Future Opportunities: USD 8916.10 million

- CAGR : 7.4%

- Asia: Largest market in 2023

Market Summary

- The market encompasses a range of technologies, applications, and services that facilitate the successful execution of clinical trials. Core technologies, such as electronic data capture (EDC) and interactive response technology (IRT), streamline data collection and management. Applications include pharmacovigilance, biostatistics, and data management. Service types include contract research organizations (CROs), clinical trial supplies, and site management. The market's evolution is driven by the growing demand for CROs due to the high cost of clinical trials and the need for specialized expertise. According to a report by Global Market Insights, the CRO market is projected to reach a market share of over 50% by 2026.

- Regulations, such as the International Conference on Harmonization (ICH) guidelines, also play a significant role in shaping the market. Despite these opportunities, challenges persist, including data security concerns, complex regulatory requirements, and the need for standardization. The market's continuous unfolding is influenced by the growth of the biopharmaceutical industry, with increasing investment in research and development, and the ongoing trend towards personalized medicine. As the market evolves, stakeholders must remain agile and adapt to emerging trends and technologies to stay competitive.

What will be the Size of the Clinical Trial Support Services Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Clinical Trial Support Services Market Segmented and what are the key trends of market segmentation?

The clinical trial support services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Phase 2

- Phase 3

- Phase 1

- Phase 4

- Age Group

- Adults (greater than 18 years)

- Adolescents (10 to 18 years)

- Children (less than 10 years)

- Therapeutic Area

- Oncology

- Cardiology

- Neurology

- Infectious diseases

- Others

- Geography

- North America

- US

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The phase 2 segment is estimated to witness significant growth during the forecast period.

In the intermediate stage of clinical research, Phase 2 of the market plays a pivotal role. This phase focuses on evaluating the efficacy and side effects of a new treatment in a larger patient population. Key services provided during this phase include site selection and management, patient recruitment strategies, regulatory compliance support, pharmacovigilance services, electronic data capture, and data management systems. Robust data collection and analysis are essential to ensure accurate results. For instance, IQVIA's One Home for Sites, launched in June 2024, is a unified clinical trial technology platform designed to simplify and streamline research site operations.

The Phase 2 segment was valued at USD 6.16 billion in 2019 and showed a gradual increase during the forecast period.

This platform aims to improve operational efficiency and data quality. Patient engagement strategies, data privacy regulations, and centralized laboratory services are other critical components of Phase 2. Patient feedback mechanisms, biometric data collection, and clinical trial monitoring are also essential services. Moreover, ePro solutions, statistical analysis planning, data validation techniques, and study start-up support are integral to the success of this phase. Furthermore, remote patient monitoring, interactive voice response, randomization and stratification, medical device testing, eConsent platforms, safety reporting systems, investigator recruitment, and independent data monitoring are additional services that contribute to the ongoing evolution of Phase 2. The market for clinical trial support services is expected to grow significantly, with an increase of approximately 25% in service adoption and a projected expansion of around 30% in industry growth expectations.

These trends reflect the continuous unfolding of market activities and the evolving patterns in clinical research.

Regional Analysis

Asia is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Clinical Trial Support Services Market Demand is Rising in Asia Request Free Sample

The European market is predominantly driven by Western European countries, including Germany, France, the UK, Switzerland, and Italy. Pharmaceutical, biologics, and medical technology companies in these nations significantly contribute to the industry's growth. Europe's medical technology sector, encompassing medical devices and in-vitro diagnostic products, primarily manufactures in Germany, France, Italy, and the UK. Key applications fueling the industry are diagnostics and imaging, orthopedics, drug delivery, wound management, general and plastic surgery, ophthalmic health, endoscopy, cardiology, and in-vitro diagnostics.

The European medical technology market's demand stems from various healthcare sectors, making it a significant player in the global clinical trials landscape.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is witnessing significant growth due to the increasing complexity of trials, particularly those focused on rare diseases. Effective patient recruitment strategies are crucial in this context, with remote patient monitoring technologies playing a key role in expanding the reach of trials. EConsent platforms are enhancing usability and patient experience, while data management systems for decentralized trials ensure data integrity and security. Improving clinical trial data quality assurance is another major trend, with effective clinical trial supply chain management and regulatory compliance support for global trials essential for success. Safety reporting systems for complex trials are also gaining importance, as is the implementation of risk-based monitoring plans and statistical analysis planning for complex endpoints.

Medical device testing in clinical trial settings is a growing area of focus, with protocol development support for complex interventions becoming increasingly vital. Investigator recruitment strategies are being optimized to ensure timely study start-ups, and case report form design is being tailored to enhance user experience. Subject recruitment tools are being evaluated for their effectiveness in different settings, with electronic data capture systems implementing data integrity measures to ensure accuracy and reliability. Adverse event reporting is being standardized and made more efficient to streamline the trial process. Compared to traditional trial models, decentralized trials utilizing remote patient monitoring and eConsent platforms have shown a 30% reduction in site visits and a 40% increase in patient retention rates (Source: GlobalData, 2021).

This shift towards decentralized trials is set to continue, with market growth expected to reach double digits in the coming years.

What are the key market drivers leading to the rise in the adoption of Clinical Trial Support Services Industry?

- The biopharmaceutical industry's expansion is the primary growth driver for the market.

- The biopharmaceutical industry is a significant sector encompassing biologics and pharmaceutical products, manufacturers, and suppliers. This industry's growth and profitability have garnered considerable enthusiasm from innovators, investors, and suppliers. The pharmaceutical industry's transition towards biopharmaceuticals for new drug discovery and the introduction of biosimilars into the market by new global participants is driving industry evolution. Biologics have shown remarkable success in addressing previously untreatable conditions, leading to an increase in their adoption in the global market. Approximately 70% of potential medicines in development represent novel approaches to treating diseases, particularly in areas like cancer, neurology, diabetes, and immunology.

- The biopharmaceutical industry's impact is evident in the reduction of deaths due to cancer and HIV/AIDS over the past decade. This sector's continuous innovation and development contribute significantly to the healthcare landscape.

What are the market trends shaping the Clinical Trial Support Services Industry?

- The increasing demand for Contract Research Organizations (CROs) represents a significant market trend in the pharmaceutical industry. CROs are increasingly being sought after by pharmaceutical companies to outsource clinical trial services and expedite drug development processes.

- Pharmaceutical product manufacturers and drug discovery companies increasingly outsource their clinical trial processes to Contract Research Organizations (CROs) to focus on research and development and optimize operational costs. The rise of CROs is driven by the high operating costs in developed countries, which discourage companies from investing in research facilities due to significant capital requirements. By outsourcing clinical trials, pharmaceutical companies can drive innovation, reduce expenses, and maintain a competitive edge. The number of CROs is expected to continue growing, providing a valuable solution for businesses seeking to minimize research and development investments while ensuring regulatory compliance and high-quality trial results.

- This trend reflects the evolving landscape of the pharmaceutical industry, where collaboration and cost optimization are key strategies for success.

What challenges does the Clinical Trial Support Services Industry face during its growth?

- The high cost of clinical trials poses a significant challenge to the growth of the industry, as substantial financial resources are required to bring new medical innovations to market.

- Clinical trial support services have experienced significant advancements, leading to increasing concerns regarding the escalating costs of these trials. Drug development involves numerous challenges, including patient recruitment and retention. The second major contributor to rising clinical trial expenses is the growing demand for extensive clinical data collection. Strict regulations necessitate rigorous and extended safety testing, particularly for drugs targeting chronic conditions. As a result, complex and costly clinical trials have become the norm.

- According to recent industry reports, the clinical trial services market is projected to expand at a steady pace, driven by the growing need for innovative treatments and regulatory compliance. The market's continuous evolution reflects the ongoing commitment to improving patient care and ensuring drug safety.

Exclusive Customer Landscape

The clinical trial support services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the clinical trial support services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Clinical Trial Support Services Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, clinical trial support services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AH UK Holdco 1 Ltd. - This company specializes in providing comprehensive clinical trial support, encompassing packaging services, analytical solutions, and contract manufacturing, enhancing the efficiency and success of pharmaceutical research projects.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AH UK Holdco 1 Ltd.

- Almac Group Ltd.

- Brighter Health Network LLC

- Catalent Inc.

- Charles River Laboratories International Inc.

- Clinipace Inc.

- Eli Lilly and Co.

- Eurofins Scientific SE

- ICON plc

- IQVIA Holdings Inc.

- Laboratory Corp. of America Holdings

- MARKEN Ltd.

- Parexel International Corp.

- Pfizer Inc.

- Quotient Sciences Ltd.

- Seveillar Clinical Supplies Services Pvt. Ltd.

- Syneos Health

- Thermo Fisher Scientific Inc.

- WuXi AppTec Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Clinical Trial Support Services Market

- In January 2024, IQVIA, a leading global provider of clinical research services, announced the launch of its new technology platform, IQVIA CORE, designed to streamline clinical trial processes and enhance data analytics for sponsors and CROs (Contract Research Organizations). This innovation aims to improve trial efficiency and reduce costs (IQVIA Press Release).

- In March 2024, PPD and Thermo Fisher Scientific entered into a strategic partnership to combine PPD's clinical trial services with Thermo Fisher's laboratory services, creating a comprehensive solution for biopharmaceutical companies. This collaboration aims to accelerate drug development and improve trial quality (PPD Press Release).

- In May 2025, Icon plc, a global provider of clinical research services, completed the acquisition of PRA Health Sciences, creating a leading clinical research organization with a combined market share of approximately 25%. This merger is expected to generate cost savings and expanded capabilities for the combined entity (Icon plc Press Release).

- In the same month, the European Medicines Agency (EMA) announced the implementation of a new regulatory framework for clinical trials, which includes more stringent data security requirements and enhanced transparency. This policy change is expected to increase the regulatory burden for clinical trial sponsors but improve patient safety and data integrity (EMA Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Clinical Trial Support Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

215 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.4% |

|

Market growth 2025-2029 |

USD 8916.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.8 |

|

Key countries |

US, Japan, China, Germany, Brazil, France, UK, India, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and intricately interconnected ecosystem, encompassing a range of specialized services that facilitate the successful execution of clinical trials. This market is characterized by continuous evolution, with ongoing developments in technology and regulatory requirements shaping its landscape. One key area of growth is site selection services, which involve identifying and securing optimal locations for clinical trials based on various factors, such as patient demographics and regulatory compliance. Another area of significance is protocol development support, which ensures the scientific and ethical validity of clinical trial designs. Patient recruitment strategies have gained increasing attention, with the adoption of advanced tools like electronic data capture and subject recruitment platforms to streamline the process.

- Regulatory compliance support, including ethics committee submissions and adherence to data privacy regulations, is also crucial to maintaining trial integrity. Pharmacovigilance services, which focus on monitoring and reporting adverse events, play a critical role in ensuring patient safety. Centralized laboratory services, medical coding expertise, and data management systems contribute to data quality assurance and enable efficient data validation techniques. Clinical trial monitoring, ePro solutions, and statistical analysis planning are essential for maintaining trial oversight and ensuring accurate results. Study start-up support, remote patient monitoring, and interactive voice response systems facilitate efficient trial initiation and ongoing patient engagement.

- The market also includes services for randomization and stratification, medical device testing, eConsent platforms, safety reporting systems, investigator recruitment, and independent data monitoring. Biometric data collection and clinical trial monitoring technologies continue to evolve, driving innovation and improving trial efficiency. In summary, the market is a complex and evolving landscape, characterized by the adoption of advanced technologies and a focus on regulatory compliance, patient engagement, and data quality.

What are the Key Data Covered in this Clinical Trial Support Services Market Research and Growth Report?

-

What is the expected growth of the Clinical Trial Support Services Market between 2025 and 2029?

-

USD 8.92 billion, at a CAGR of 7.4%

-

-

What segmentation does the market report cover?

-

The report segmented by Application (Phase 2, Phase 3, Phase 1, and Phase 4), Age Group (Adults (greater than 18 years), Adolescents (10 to 18 years), and Children (less than 10 years)), Therapeutic Area (Oncology, Cardiology, Neurology, Infectious diseases, and Others), and Geography (Europe, North America, Asia, and Rest of World (ROW))

-

-

Which regions are analyzed in the report?

-

Europe, North America, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Growth of biopharmaceutical industry, High cost of clinical trials

-

-

Who are the major players in the Clinical Trial Support Services Market?

-

Key Companies AH UK Holdco 1 Ltd., Almac Group Ltd., Brighter Health Network LLC, Catalent Inc., Charles River Laboratories International Inc., Clinipace Inc., Eli Lilly and Co., Eurofins Scientific SE, ICON plc, IQVIA Holdings Inc., Laboratory Corp. of America Holdings, MARKEN Ltd., Parexel International Corp., Pfizer Inc., Quotient Sciences Ltd., Seveillar Clinical Supplies Services Pvt. Ltd., Syneos Health, Thermo Fisher Scientific Inc., and WuXi AppTec Co. Ltd.

-

Market Research Insights

- The market encompasses a range of specialized offerings designed to facilitate the efficient and effective conduct of clinical trials. Two key areas of focus are document management systems and project management support. According to industry estimates, the global document management system market for clinical trials is projected to reach USD 2.5 billion by 2026, growing at a compound annual growth rate (CAGR) of 12%. In contrast, the project management support market is anticipated to expand at a CAGR of 10% during the same period, reaching USD 3.2 billion. These figures underscore the significant demand for advanced solutions in clinical trial management.

- Other critical services include medical device validation, pharmacokinetics analysis, audit preparation, company management, statistical programming, database validation, regulatory affairs consulting, clinical trial logistics, contract negotiation, site feasibility assessments, risk-based monitoring plans, regulatory submission support, sample management, patient tracking, quality control metrics, study design optimization, electronic health records, data cleaning processes, data warehousing, patient portal integration, budget management, clinical trial reporting, safety database management, and more. These services ensure compliance with data standards, streamline operations, and ultimately, help bring new treatments to market faster and more efficiently.

We can help! Our analysts can customize this clinical trial support services market research report to meet your requirements.