All-Terrain Vehicle (ATV) Steering System Market Size 2025-2029

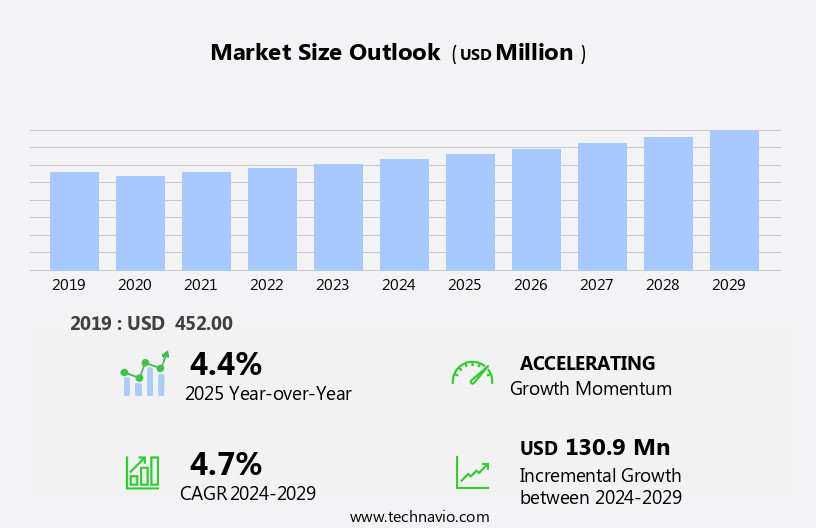

The all-terrain vehicle (atv) steering system market size is forecast to increase by USD 130.9 million, at a CAGR of 4.7% between 2024 and 2029.

- The market is driven by advancements in technology, which enable superior handling and maneuverability in various terrains. These technological improvements cater to the evolving consumer demand for more efficient and responsive ATVs. A notable trend shaping the market is the increasing preference for all-electric ATVs, which offer reduced emissions and enhanced performance. Another key trend is the increasing popularity of all-electric ATVs, as consumers seek more environmentally-friendly alternatives to traditional gasoline-powered vehicles. However, environmental concerns arising from the use of ATVs pose a significant challenge. The growing awareness of the ecological impact of these vehicles may lead to stricter regulations, potentially increasing production costs and limiting market growth.

- Companies in the ATV steering system market must stay abreast of these trends and challenges to effectively capitalize on opportunities and navigate potential obstacles. Adapting to consumer preferences for electric ATVs and implementing eco-friendly production methods can help mitigate environmental concerns and ensure long-term market success.

What will be the Size of the All-Terrain Vehicle (ATV) Steering System Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market is a continually evolving landscape, shaped by dynamic market forces and advancements in technology. This market encompasses a wide range of applications, from recreational use to commercial operations, including side-by-sides (SxS), utility vehicles, and mud-focused ATVs. Steering systems are integral components of these vehicles, enabling maneuverability and control across various terrains. The market's ongoing evolution is reflected in the integration of advanced features, such as hydraulic systems, throttle control, and ground clearance, which enhance performance and safety. Mud guards, cargo racks, roll cages, electrical systems, fuel systems, seat belts, rider comfort, user interface, exhaust systems, and fuel efficiency are essential elements of modern ATV steering systems.

These components are not static but rather evolve alongside market demands, with a focus on improving safety standards, emissions compliance, and user experience. Consumer demand for higher payload capacities, top speeds, and improved ground clearance continues to shape the market. Additionally, commercial applications, such as agricultural use, require robust steering systems that can handle heavy loads and operate efficiently in challenging conditions. The supply chain, fueled by ongoing research and development, plays a crucial role in the market's continuous evolution. Performance tuning, safety enhancements, and the integration of advanced technologies are key areas of focus, ensuring that ATV steering systems meet the evolving needs of consumers and industries alike.

How is this All-Terrain Vehicle (ATV) Steering System Industry segmented?

The all-terrain vehicle (ATV) steering system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- OEM

- Aftermarket

- Type

- Tie-rod steering

- Crossover steering

- Others

- Application

- Recreational

- Agriculture

- Military and defense

- Industrial

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

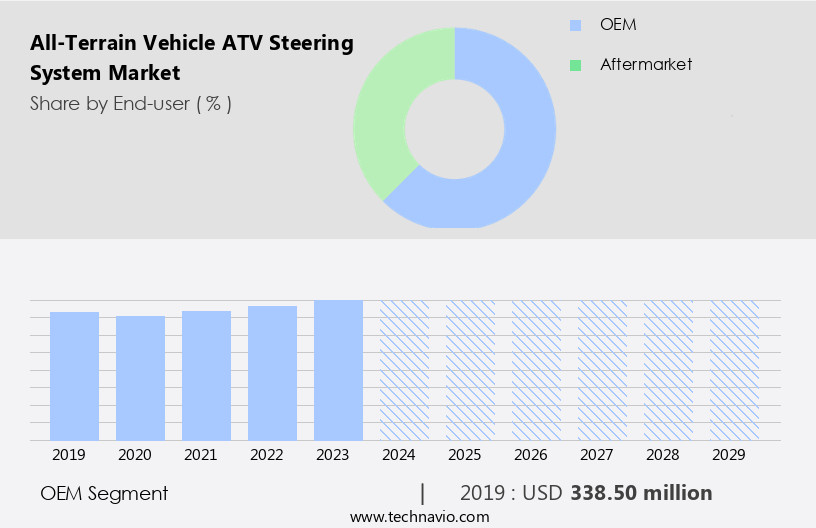

The oem segment is estimated to witness significant growth during the forecast period.

The global market for All-Terrain Vehicle (ATV) steering systems is driven by the significant demand from original equipment manufacturers (OEMs). This segment includes both off-the-shelf systems purchased from steering system manufacturers and in-house systems developed by ATV manufacturers. Given that every ATV is equipped with a steering system, the OEM segment holds a dominant position in the market. Steering system manufacturers are dedicated to research and development, focusing on enhancing handling, reducing driver effort, and prioritizing safety. For example, some OEMs provide a range of ATVs, such as side-by-side ATVs (SxS) and single-seater ATVs, which come with handlebars or steering wheels.

SxS ATVs boast increased power, the ability to carry multiple passengers, and steering capabilities. Engine displacement, four-wheel drive (4WD), top speed, and payload capacity are essential factors influencing the design and development of ATV steering systems. Safety features, such as hand guards, roll cages, seat belts, and rider comfort, are increasingly becoming essential considerations. Commercial use, agricultural applications, and recreational use further expand the market potential for ATV steering systems. The supply chain for these systems involves various components, including hydraulic systems, electrical systems, fuel systems, and cooling systems. Performance tuning and consumer demand for fuel efficiency and reduced braking distance are also key trends.

Safety standards, emissions regulations, and regulatory compliance are critical factors shaping the market. Suspension systems, steering wheels, and user interfaces are other essential components that influence the design and functionality of ATV steering systems. Mud guards, cargo racks, lighting systems, and exhaust systems are additional features that add value to the market. The market for ATV steering systems is expected to grow as the demand for versatile and efficient off-road vehicles continues to rise.

The OEM segment was valued at USD 338.50 million in 2019 and showed a gradual increase during the forecast period.

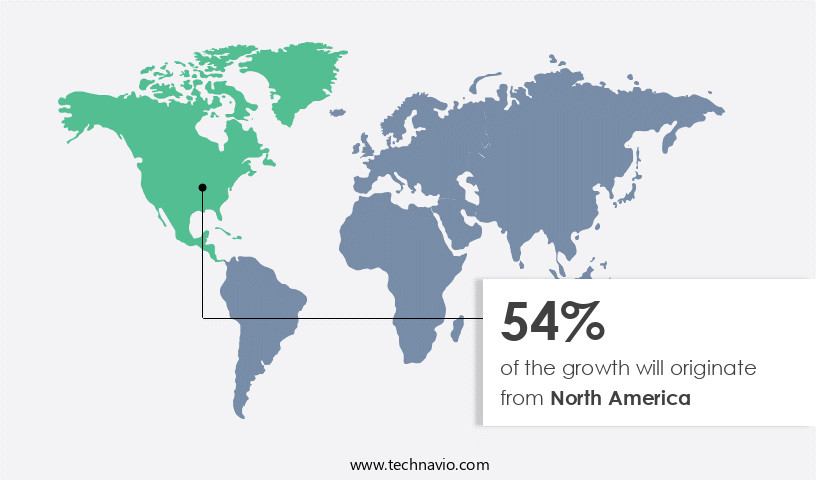

Regional Analysis

North America is estimated to contribute 54% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The ATV steering system market in North America experiences significant growth, driven by the US and Canada's substantial contributions. Off-road rallying events, abundant in the region, provide a substantial boost to the market. Major Original Equipment Manufacturers (OEMs) like Yamaha Motor, Kawasaki, and Honda Motor, based in the US, offer a wide range of ATV models in various categories, including dirt, adventure, off-road, and dual-sport. Newer ATV models, electric-powered, and hybrid ATVs are anticipated to propel the market's expansion during the forecast period. Notably, off-road racing series such as Moto America and the Grand National Cross Country (GNCC) racing series, held in the region, attract a large following and contribute to market momentum.

Safety standards, commercial use, payload capacity, and performance tuning are essential factors influencing consumer demand for advanced steering systems in utility vehicles and side-by-side (SxS) models. The supply chain is streamlined by hydraulic systems, ground clearance, and suspension systems, ensuring optimal rider comfort and control. The market also prioritizes safety features, including hand guards, seat belts, roll cages, and user interfaces, to cater to the evolving needs of the market. Additionally, electrical systems, fuel systems, exhaust systems, cooling systems, braking systems, and lighting systems are integral components of modern ATVs, enhancing overall performance and functionality. The market's expansion is further fueled by the growing demand for ATVs in agricultural use and recreational applications.

Market Dynamics

The Global ATV Steering System Market is experiencing dynamic growth, driven by continuous advancements in ATV steering technology. The increasing adoption of Electric Power Steering (EPS) systems (ATV) is a major trend, significantly enhancing ATV power steering capabilities, leading to reduced rider fatigue (ATV) and enhanced ATV control. While traditional systems remain, the market is also exploring futuristic concepts like steer-by-wire systems (ATV) and even automated steering (ATV). Key ATV steering system components, such as tie-rod steering systems (ATV), are crucial for both OEM ATV steering systems and the growing aftermarket ATV steering segment. These innovations cater to both recreational ATVs and robust utility ATVs. The Global ATV Market expansion, coupled with a focus on ATV safety features, is influencing ATV steering system manufacturers and shaping overall ATV steering market trends.

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of All-Terrain Vehicle (ATV) Steering System Industry?

- The advancements in ATV (All-Terrain Vehicle) steering system technology serve as the primary catalyst for market growth. These innovations enhance the vehicle's maneuverability and control, making ATVs more appealing to consumers and driving demand in the market.

- The aftermarket demand for ATV steering systems and related components, including Electric Power Steering (EPS), remains robust due to the growing consumer preference for performance tuning and safety standards in utility vehicles. EPS upgrades, which include electric motors, universal links, steering columns, mounting clamps, and electric feed intelligent power modules, are gaining popularity as they enhance vehicle handling and maneuverability. These kits are manufactured according to Original Equipment Manufacturer (OEM) specifications for seamless integration with existing ATV models. The highest-selling ATV models drive the demand for such upgrades. While manual linkage steering remains common in project-based ATVs and Baja Motorsports, the cost of EPS upgrades has significantly decreased over the past decade, making them more accessible to consumers.

- The supply chain for these components is well-established, ensuring timely delivery and high-quality products. The focus on safety standards and payload capacity continues to influence consumer demand for advanced steering systems, further fueling market growth. Hydraulic systems and ground clearance are other essential factors that impact the performance and functionality of ATV steering systems.

What are the market trends shaping the All-Terrain Vehicle (ATV) Steering System Industry?

- The all-electric ATV segment is experiencing significant growth, positioning it as the emerging trend in the off-road vehicle market. This trend reflects the increasing demand for eco-friendly and high-performance alternatives to traditional gasoline-powered ATVs.

- The global ATV steering system market is experiencing significant advancements in ATV powertrains and the introduction of new all-electric models. These developments are propelling market growth, as ATVs continue to evolve with bulky designs and powerful engines. Manufacturers are focusing on enhancing ATV performance and rider comfort through improvements in powertrains and drivetrains. The adoption of all-electric powertrains is gaining traction, with major ATV Original Equipment Manufacturers (OEMs) launching their electric ATV versions. For instance, Kawasaki introduced the KX65 and KX112 electric two-wheeler ATVs for kids in India in July 2023.

- Additionally, the market is witnessing advancements in user interface, mud guards, cargo racks, roll cages, electrical systems, fuel systems, seat belts, exhaust systems, fuel efficiency, and rider comfort to cater to the evolving needs of consumers. These factors are expected to contribute to the growth of the ATV steering system market during the forecast period.

What challenges does the All-Terrain Vehicle (ATV) Steering System Industry face during its growth?

- The growth of the ATV industry is significantly impacted by environmental concerns related to their use.

- All-Terrain Vehicles (ATVs) are popular for their ability to navigate rough terrains and off-road surfaces. However, their use comes with environmental concerns. Soil compaction is a significant issue caused by ATVs, leading to diminished vegetation growth and reduced water infiltration. This occurs due to the vehicle's weight compressing the soil, altering its structure and hindering root systems. The increased soil strength and permeability can lead to longer braking distances, making the riding experience less safe. The suspension and brake systems of ATVs can further contribute to soil damage.

- Moreover, agricultural use of ATVs intensifies the issue due to the larger surface area covered. The lighting system and cooling system are other components that can impact the environment, particularly through energy consumption and potential pollution. Addressing these challenges requires advancements in ATV technology, such as lighter materials for reduced soil impact and energy-efficient systems for lighting and cooling.

Exclusive Customer Landscape

The all-terrain vehicle (atv) steering system market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the all-terrain vehicle (atv) steering system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, all-terrain vehicle (atv) steering system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Allient Inc. - The ATV steering system market encompasses components such as power steering assist actuators, extensively utilized in marine, agricultural, and material handling vehicles. This research focuses on analyzing market trends, growth drivers, and competitive dynamics in this sector.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allient Inc.

- Bombardier Recreational Products Inc.

- Dorman Products Inc.

- Faurecia SE

- Global Steering Systems LLC

- Hitachi Ltd.

- HL Mando Co. Ltd.

- Honda Motor Co. Ltd.

- JTEKT Corp.

- Kawasaki Heavy Industries Ltd.

- KYB Corp.

- Nexteer Automotive corp

- NSK Ltd.

- Polaris Inc.

- QuadBoss

- Robert Bosch GmbH

- Suzuki Motor Corp.

- thyssenkrupp AG

- Yamaha Motor Co. Ltd.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in All-Terrain Vehicle (ATV) Steering System Market

- In January 2024, Magna International, a leading automotive technology supplier, announced the launch of its new electronic power steering system for All-Terrain Vehicles (ATVs), offering improved fuel efficiency and reduced emissions (Magna International Press Release).

- In March 2024, Argo AI, a self-driving technology company, and Polaris Industries, a major ATV manufacturer, announced a strategic partnership to integrate Argo AI's self-driving technology into Polaris' ATVs, aiming for commercial deployment by 2026 (Polaris Industries Press Release).

- In April 2025, Honda Motor Co. Ltd. Received approval from the European Union for its new electric ATV model, featuring a high-performance hydraulic steering system, marking its entry into the European ATV market (Honda Motor Co. Ltd. Press Release).

- In May 2025, Textron Inc.'s Textron Specialized Vehicles division completed the acquisition of ShockWorx, a leading suspension technology company, to enhance its ATV product offerings and improve steering system performance (Textron Inc. Press Release).

Research Analyst Overview

- The market exhibits intricate dynamics, with distribution networks and retail channels playing pivotal roles in shaping consumer access to these vehicles. Environmental concerns have led to a growing emphasis on safety gear, autonomous features, and alternative fuels, including electric and hybrid ATVs. Training programs and customer preferences are driving the demand for performance upgrades and riding apparel. Meanwhile, lightweight materials and advanced composites are revolutionizing product development, while data acquisition and remote monitoring tools facilitate maintenance and repair.

- Aftermarket parts and rental services cater to the diverse needs of ATV enthusiasts, with supply chain management ensuring efficient delivery and availability. The market for ATVs continues to evolve, with a focus on enhancing the riding experience while minimizing environmental impact.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled All-Terrain Vehicle (ATV) Steering System Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

223 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.7% |

|

Market growth 2025-2029 |

USD 130.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, Canada, Mexico, Germany, UK, France, Italy, China, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this All-Terrain Vehicle (ATV) Steering System Market Research and Growth Report?

- CAGR of the All-Terrain Vehicle (ATV) Steering System industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the all-terrain vehicle (ATV) steering system market growth of industry companies

We can help! Our analysts can customize this all-terrain vehicle (ATV) steering system market research report to meet your requirements.