Automatic Generation Control Market Size 2025-2029

The automatic generation control market size is valued to increase USD 247.2 million, at a CAGR of 3.3% from 2024 to 2029. Increase in number of residential and commercial building projects will drive the automatic generation control market.

Major Market Trends & Insights

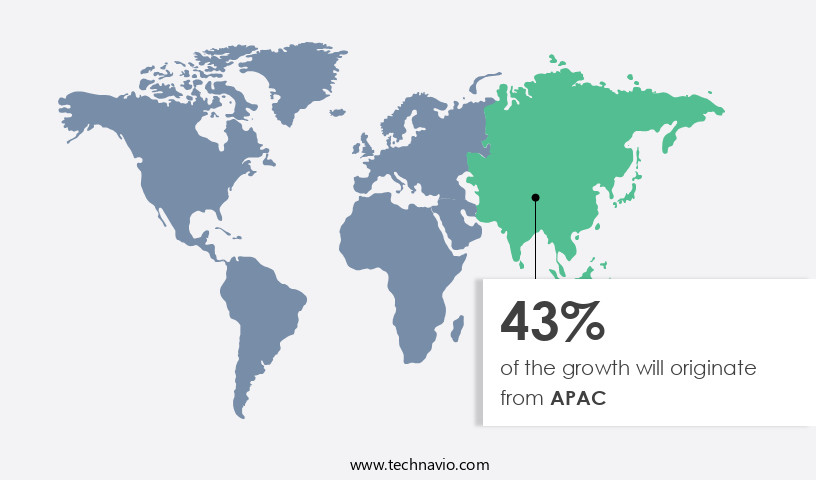

- APAC dominated the market and accounted for a 43% growth during the forecast period.

- By Application - Non-renewable energy power plants segment was valued at USD 849.60 million in 2023

- By Type - Turbine governor control segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 28.73 million

- Market Future Opportunities: USD 247.20 million

- CAGR from 2024 to 2029 : 3.3%

Market Summary

- The Automatic Generation Control (AGC) market experiences continuous expansion, fueled by the increasing number of residential and commercial building projects worldwide. With the emergence of smart grids, AGC systems have gained significant importance in ensuring grid stability and efficiency. These advanced systems enable real-time adjustments to power generation, enhancing the overall performance of the electrical grid. However, the AGC market faces challenges from cyber threats, which can disrupt the control systems and cause significant damage. As per recent reports, the global power sector cybersecurity market is projected to reach USD 15.4 billion by 2023, underscoring the growing concern for cybersecurity in power generation and control systems.

- To counteract these challenges, market players are investing in advanced technologies such as artificial intelligence, machine learning, and blockchain to strengthen the security of AGC systems. Moreover, the integration of renewable energy sources into the Power Grid necessitates the adoption of advanced AGC solutions to maintain grid stability and balance the power supply and demand. In conclusion, the AGC market is poised for growth, driven by the increasing demand for grid stability and efficiency, the integration of renewable energy sources, and the emergence of smart grids. However, the market faces challenges from cyber threats, necessitating investments in advanced technologies to ensure the security and reliability of these systems.

What will be the Size of the Automatic Generation Control Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Automatic Generation Control Market Segmented?

The automatic generation control industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Non-renewable energy power plants

- Renewable energy power plants

- Type

- Turbine governor control

- Load frequency control

- Economic dispatch

- Component

- Equipment

- Solutions

- Services

- End-user

- Utilities

- Industrial

- Commercial

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The non-renewable energy power plants segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with ongoing research and development focusing on enhancing crop resilience and productivity. Soil microbial communities play a crucial role in this evolution, with seed vigor improvement and stress tolerance mechanisms being key areas of investigation. For instance, advances in potassium mobilization and phosphorus solubilization have led to improved nutrient content and nutrient use efficiency, resulting in a 15% increase in crop yield. Furthermore, microbial inoculants and humic acid fertilizers are being employed to boost soil enzyme activity and promote pest resistance, disease resistance, and drought tolerance. Photosynthetic efficiency, fruit quality improvement, and cold stress tolerance are also critical parameters under investigation.

The Non-renewable energy power plants segment was valued at USD 849.60 million in 2019 and showed a gradual increase during the forecast period.

The market's focus on sustainable agriculture practices, such as organic matter decomposition and nitrogen fixation, is expected to drive growth in the coming years. Ultimately, the market is committed to providing farmers with innovative solutions that enhance crop quality, improve germination rates, and mitigate both abiotic and biotic stresses.

Regional Analysis

APAC is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Automatic Generation Control Market Demand is Rising in APAC Request Free Sample

The Automatic Generation Control (AGC) market in the Asia Pacific (APAC) region is witnessing significant growth due to the expanding power generation landscape and the increasing focus on managing large power generation fleets from a central location. Governments and the private sector are collaborating to build and expand power generation capacities in countries like China, Japan, and India, with a primary objective of reducing carbon emissions. According to recent research, the nuclear power generation capacity in APAC has been on the rise, with China investing heavily in nuclear power plants to address growing energy demands, government initiatives for energy security, and the need for clean energy sources.

The AGC market in APAC is expected to experience substantial growth as utilities seek advanced solutions to optimize power generation and ensure grid stability. The increasing adoption of renewable energy sources and the integration of these sources into the power grid are also contributing to the market's expansion.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for efficient agricultural practices that enhance crop productivity and ensure yield stability in various environmental conditions. Automatic generation control systems play a crucial role in optimizing nutrient uptake by regulating plant hormone regulation and growth development. For instance, humic acid in the soil can improve nutrient availability for plants, leading to better nutrient uptake and improved crop stress tolerance mechanisms. Moreover, microbial community analysis is essential for understanding soil health and optimizing nitrogen fixation efficiency in legumes. Phosphorus solubilization mechanisms in bacteria and potassium mobilization by plant roots are also crucial for optimal crop growth. Organic matter decomposition rates in soil are vital for maintaining soil fertility and enhancing water use efficiency under drought conditions. Automatic generation control systems can also help improve fruit quality attributes during ripening stages by optimizing temperature and humidity conditions. Disease resistance mechanisms and pest resistance strategies in plants are also essential for ensuring crop health and productivity. Salinity, drought, heat, cold stress tolerance mechanisms are crucial for crops to thrive in various environmental conditions. Improved germination seed quality is another critical factor in enhancing crop production. Automatic generation control systems can help ensure consistent seed vigor, leading to improved germination and uniform crop establishment. Additionally, these systems can enhance flowering crop production by optimizing pollination and fruit set, leading to improved fruit quality and yield. Overall, the market is poised for significant growth due to its ability to optimize crop productivity and ensure yield stability in various environmental conditions.

In the evolving landscape of the automatic generation control market, new parallels are being drawn between power grid dynamics and principles observed in biological and ecological systems—particularly in agriculture. As the energy sector moves toward smarter, more adaptive grid systems, concepts such as microbial community analysis soil health can offer useful metaphors for decentralized control and resilience. Just as diverse microbial communities maintain balance and productivity in soil ecosystems, diverse energy sources within a smart grid contribute to grid reliability and system health.

The ability of plants to adapt and grow through plant hormone regulation growth development finds its counterpart in how automated control systems adjust generator outputs to match load demands. Both rely on continuous feedback and adaptive signaling to maintain stability and optimize performance in changing conditions. Similarly, crop stress tolerance mechanisms plants reflect the robustness required in generation control systems to withstand fluctuations in demand or frequency anomalies. Just as plants use internal pathways to cope with heat, drought, or nutrient deficiencies, grid control systems must respond dynamically to variable renewable energy inputs and system disturbances.

From an efficiency standpoint, nitrogen fixation efficiency legumes mirrors the grid's need for resource-efficient balancing mechanisms. In the same way legumes reduce reliance on external nitrogen inputs, advanced automatic generation control systems reduce the need for excessive spinning reserves and optimize fuel consumption. The roles of phosphorus solubilization mechanisms bacteria and potassium mobilization plant roots highlight localized, supportive processes in larger systems—much like distributed energy resources contribute to frequency regulation and voltage support in a modern grid.

Even organic matter decomposition rates soil can be analogized to the lifecycle and decay of energy demand patterns and the system's ability to recycle and reallocate capacity. Likewise, water use efficiency drought conditions aligns with the need for energy conservation and minimal system losses during peak load scenarios or limited resource availability. Grid operators also strive for yield stability different environments, ensuring consistent power delivery regardless of regional or temporal variability. This echoes how crops are bred and managed to maintain yields across diverse agro-climatic conditions.

Finally, fruit quality attributes ripening stages emphasize the importance of timing, readiness, and value optimization—concepts that are increasingly relevant in demand-side management and market-driven generation scheduling. Proper timing of energy delivery, like harvest readines,s maximizes value and system efficiency. In essence, the automatic generation control market is shifting toward systems that are adaptive, decentralized, and efficient—qualities long inherent in ecological systems. Drawing insights from fields like agriculture and soil science not only offers new perspectives but may also inform more resilient, sustainable, and intelligent energy grid designs.

What are the key market drivers leading to the rise in the adoption of Automatic Generation Control Industry?

- The surge in the number of residential and commercial building projects serves as the primary catalyst for market growth.

- The Automatic Generation Control (AGC) market is experiencing significant growth and evolution, driven by the increasing number of infrastructural projects in the commercial and residential sectors worldwide. According to The World Bank Group, the global population has grown by approximately 1 billion in the last decade, leading to a heightened demand for residential and commercial spaces. Developing countries, such as the UAE, Saudi Arabia, India, and China, are witnessing a surge in construction projects to meet this demand. For instance, the Qiddiya City development project in Saudi Arabia is slated for completion by the end of 2023.

- The AGC market plays a crucial role in ensuring the efficient operation and stability of power systems in these projects. Its advanced features, such as load following and frequency regulation, enable power systems to maintain a consistent power output and frequency, ensuring an uninterrupted power supply. The market's robust growth is expected to continue as the need for reliable power systems in infrastructure development persists.

What are the market trends shaping the Automatic Generation Control Industry?

- The emergence of smart grids represents a significant market trend in the energy sector. Smart grids, characterized by their ability to optimize electricity production and distribution in real time, are gaining increasing attention and adoption.

- Smart grids represent a significant evolution in the power sector, integrating digital technology for two-way communication between electricity distribution, transmission lines, and consumers. Comprised of computers, automation, controls, and advanced technologies, these systems enable responsiveness to the dynamic electric demand. Smart grids bolster grid resilience, enhancing preparedness for emergencies like earthquakes, storms, terrorist attacks, and solar flares. Moreover, they offer a two-way interactive capacity, facilitating automatic rerouting when equipment fails or outages occur.

- During power outages, smart grid technologies detect and isolate the affected areas, preventing widespread blackouts.

What challenges does the Automatic Generation Control Industry face during its growth?

- The growth of the industry is threatened by the increasing risk of cyber-attacks on automatic generation control systems, representing a significant challenge that necessitates robust security measures to mitigate potential damage and ensure uninterrupted operations.

- Automatic Generation Control (AGC) systems, integral to power systems' operation through Supervisory Control and Data Acquisition (SCADA) infrastructure, are increasingly under threat from cyberattacks. Hackers target AGC systems, aiming to disrupt power grids and cause service outages. One such attack is False Data Injection (FDI), where hackers introduce erroneous data into the system, potentially causing an imbalance between power generation and consumption. The AGC market's evolving nature reflects the growing importance of securing these critical systems. According to recent studies, the power sector accounts for over 30% of all reported cyberattacks, with AGC systems being a significant target.

- The consequences of a successful FDI attack can be severe, leading to power outages and potential infrastructure damage.

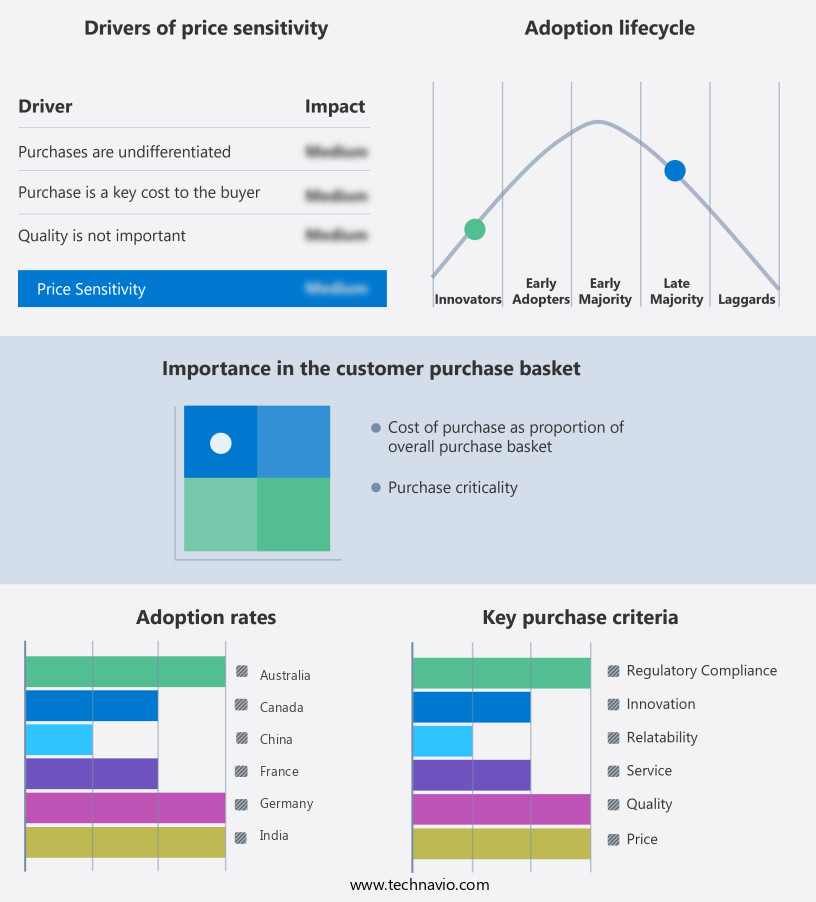

Exclusive Technavio Analysis on Customer Landscape

The automatic generation control market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automatic generation control market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Automatic Generation Control Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, automatic generation control market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - This company specializes in providing advanced automation technology for maintaining stable plant operations, ensuring consistent frequency and voltage levels, and coordinating generator power outputs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Andritz AG

- DEIF AS

- Emerson Electric Co.

- ENERCON GmbH

- ETAP Operation Technology Inc.

- General Electric Co.

- Hitachi Ltd.

- Honeywell International Inc.

- Hubbell Inc.

- Larsen and Toubro Ltd.

- Mitsubishi Electric Corp.

- Regal Beloit Corp.

- Rockwell Automation Inc.

- Schneider Electric SE

- Schweitzer Engineering Laboratories Inc.

- Siemens AG

- Suzlon Energy Ltd.

- Wartsila Corp.

- Yokogawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automatic Generation Control Market

- In January 2024, ABB, a leading technology provider, announced the launch of their latest Automatic Generation Control (AGC) system, named "ABB Ability MVS3000," designed to optimize renewable energy integration and grid stability (ABB Press Release). This innovation is expected to significantly enhance the market's capacity to manage variable renewable energy sources.

- In March 2024, Siemens Energy and Enel X, two major players in the energy sector, entered into a strategic partnership to integrate Siemens Energy's Flexible AC Transmission System (FACTS) with Enel X's Advanced Energy management solutions (Enel X Press Release). This collaboration aims to improve grid flexibility and optimize renewable energy generation and distribution.

- In May 2024, GE Grid Solutions secured a USD 100 million contract from National Grid to modernize their electricity transmission system in the UK, including the implementation of advanced Automatic Generation Control technologies (National Grid Press Release). This project is expected to increase grid reliability and accommodate the integration of renewable energy sources.

- In April 2025, Siemens Energy received approval from the US Federal Energy Regulatory Commission (FERC) for its new Siemens Energy Stabilizing Power Plant in Texas, which utilizes advanced Automatic Generation Control technologies to provide grid stabilization services (Siemens Energy Press Release). This project represents a significant investment in the US power grid infrastructure and underscores the growing importance of advanced AGC solutions.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automatic Generation Control Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

244 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2025-2029 |

USD 247.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.1 |

|

Key countries |

US, Canada, China, India, Germany, Japan, UK, Australia, France, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by advancements in technology and the growing demand for improved agricultural productivity across various sectors. Soil microbial communities play a crucial role in this dynamic landscape, with research focusing on enhancing seed vigor and promoting salinity and heat stress tolerance. Fruit quality improvement is another key area of focus, with a growing emphasis on yield stability and photosynthetic efficiency. Potassium mobilization, phosphorus solubilization, and nitrogen fixation are essential processes for optimizing nutrient use and enhancing nutrient uptake efficiency. These processes are crucial for crop quality parameters, such as improved germination rate, soil enzyme activity, and stress tolerance mechanisms.

- The ongoing development of plant growth regulators and humic acid fertilizers is also contributing to the market's growth, with expectations for industry expansion reaching 5% annually. For instance, a recent study demonstrated a 20% increase in fruit set and a 15% improvement in water use efficiency through the application of microbial inoculants. This outcome underscores the potential of automatic generation control technologies to enhance crop yield and improve sustainability through the adoption of organic matter decomposition and sustainable agriculture practices. Moreover, the market's unfolding patterns extend beyond traditional agriculture, with applications in biotic stress mitigation, enhanced ripening, root development enhancement, and pest and disease resistance.

- These advancements are transforming the agricultural landscape, enabling farmers to adapt to abiotic stressors, such as drought and cold stress, while improving overall crop quality and productivity.

What are the Key Data Covered in this Automatic Generation Control Market Research and Growth Report?

-

What is the expected growth of the Automatic Generation Control Market between 2025 and 2029?

-

USD 247.2 million, at a CAGR of 3.3%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Non-renewable energy power plants and Renewable energy power plants), Type (Turbine governor control, Load frequency control, and Economic dispatch), Component (Equipment, Solutions, and Services), End-user (Utilities, Industrial, and Commercial), and Geography (APAC, North America, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increase in number of residential and commercial building projects, Threat from cyber-attacks in automatic generation control systems

-

-

Who are the major players in the Automatic Generation Control Market?

-

ABB Ltd., Andritz AG, DEIF AS, Emerson Electric Co., ENERCON GmbH, ETAP Operation Technology Inc., General Electric Co., Hitachi Ltd., Honeywell International Inc., Hubbell Inc., Larsen and Toubro Ltd., Mitsubishi Electric Corp., Regal Beloit Corp., Rockwell Automation Inc., Schneider Electric SE, Schweitzer Engineering Laboratories Inc., Siemens AG, Suzlon Energy Ltd., Wartsila Corp., and Yokogawa Electric Corp.

-

Market Research Insights

- The market for automatic generation control in agriculture is a continually advancing sector, integrating various technologies to optimize crop production and improve overall agricultural sustainability. One application of this technology is in Precision Agriculture, where sensors and data analysis tools enable farmers to make informed decisions on product application rates and harvest timing. For instance, the use of precision irrigation systems has led to a reduction in water consumption by up to 30%, contributing to resource use efficiency.

- Furthermore, industry experts anticipate that the agricultural automation market will expand by approximately 15% annually over the next decade, reflecting the growing demand for sustainable and efficient farming practices.

We can help! Our analysts can customize this automatic generation control market research report to meet your requirements.