Automatic Transfer Switches Market Size 2025-2029

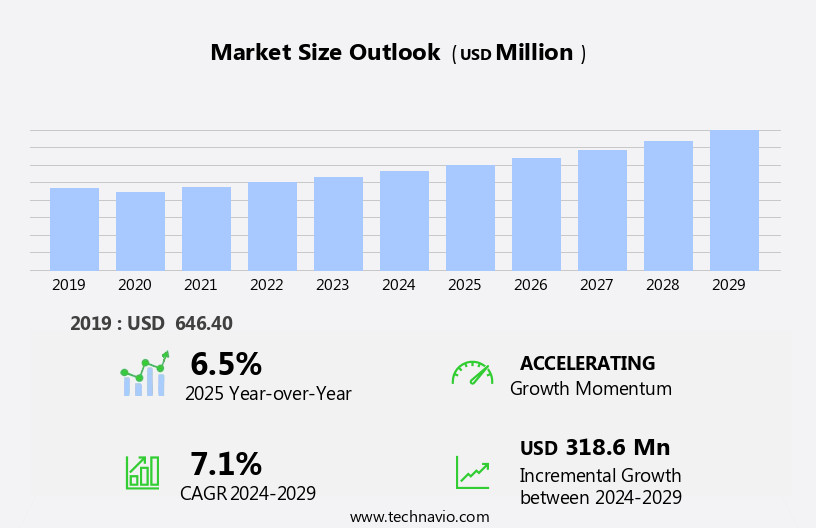

The automatic transfer switches (ATS) market size is forecast to increase by USD 318.6 million, at a CAGR of 7.1% between 2024 and 2029. The market is driven by the continuous growth of uninterrupted power applications, particularly in industries such as healthcare, telecommunications, and data centers. These sectors require an uninterrupted power supply to maintain their operations, making ATS an essential component in their power infrastructure.

Major Market Trends & Insights

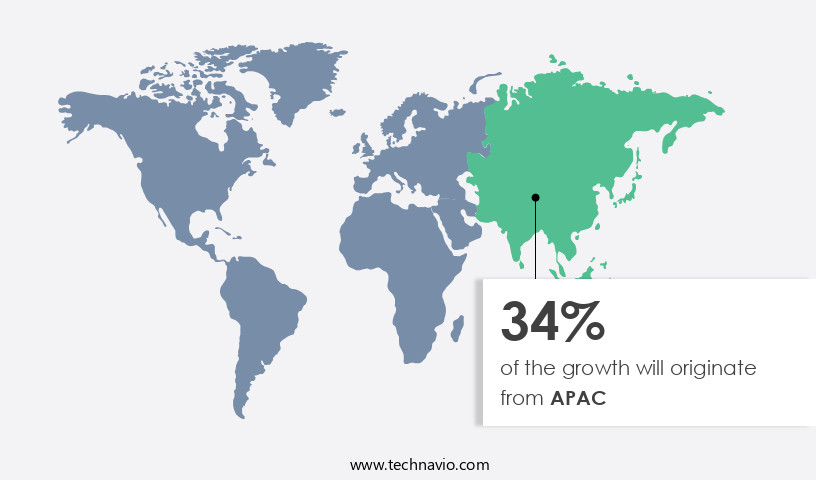

- APAC dominated the market and contributed 34% to the growth during the forecast period.

- The market is expected to grow significantly in North America region as well over the forecast period.

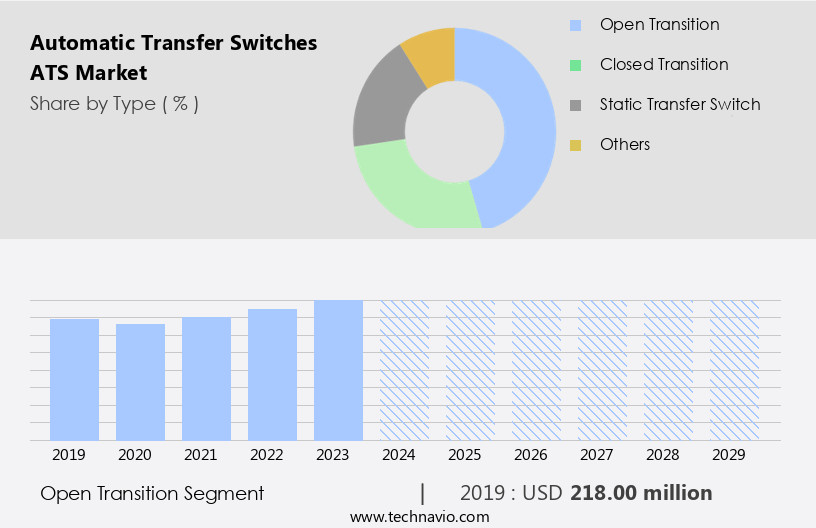

- Based on the Type, the open transition segment led the market and was valued at USD 251.50 million of the global revenue in 2023.

- Based on the End-user, the industrial segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 69.94 Million

- Future Opportunities: USD 318.6 Million

- CAGR (2024-2029): 7.1%

- APAC: Largest market in 2023

The automatic transfer switch (ATS) market continues to evolve, driven by the increasing demand for reliable and efficient power solutions across various sectors. Fault detection systems and load shedding strategies are becoming essential components of critical power systems, enabling the prevention of power outages and ensuring uninterrupted power supply. Power quality monitoring and voltage regulation play a crucial role in maintaining electrical safety standards and optimizing energy efficiency. For instance, a leading data center implemented automatic load transfer between parallel power systems, reducing power outage incidents by 30%. The market is expected to grow at a robust rate, with industry experts projecting a significant increase in demand for backup power solutions and redundancy systems.

What will be the Size of the Automatic Transfer Switches (ATS) Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The increasing popularity of microgrid networks, which allow for localized power generation and distribution, is fueling the demand for ATS solutions. However, the market faces challenges from regulatory standards that mandate stringent safety and reliability requirements for ATS designs. Meeting these standards adds to the cost and complexity of ATS production, requiring manufacturers to invest in research and development to create compliant and cost-effective solutions. Companies seeking to capitalize on market opportunities should focus on innovation in ATS design, ensuring regulatory compliance, and catering to the growing demand for uninterrupted power applications in various industries.

Load management, circuit breaker coordination, and power distribution architecture are critical aspects of ATS design, requiring careful consideration of hardware components, software configuration, and wiring diagrams. Voltage regulation and power factor correction are essential for optimizing power transfer time and ensuring the seamless operation of emergency power supplies. Safety interlocks, switchgear integration, and remote monitoring systems are also integral to the market, providing critical system diagnostics and enabling quick response to power system protection needs. Arc flash mitigation and power system protection are essential components of ATS design, ensuring electrical safety and preventing damage to hardware components.

In conclusion, the ATS market is a dynamic and evolving space, with ongoing developments in fault detection systems, load shedding strategies, power quality monitoring, and other areas. The demand for reliable and efficient power solutions continues to drive innovation and growth in this sector.

How is this Automatic Transfer Switches (ATS) Industry segmented?

The automatic transfer switches (ATS) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Open transition

- Closed transition

- Static transfer switch

- Others

- End-user

- Industrial

- Commercial

- Residential

- Product Type

- Automatic transfer switches

- Manual transfer switches

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The open transition segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 251.50 million in 2023. It continued to the largest segment at a CAGR of 61.28%.

Automatic Transfer Switches (ATS) are essential electrical components in power systems, facilitating the seamless transition of electrical loads from one power source to another during power outages or abnormal conditions. As technology becomes increasingly indispensable across industries, the need for uninterrupted power supply to safeguard operations, data, and system reliability is paramount. Open transition transfer switches, a type of ATS, are gaining popularity due to their ability to manage power flow efficiently during utility disruptions or voltage fluctuations. These switches employ fault detection systems and load shedding strategies to optimize power usage and prevent power outages.

Power quality monitoring and voltage regulation ensure consistent power delivery, while emergency power supplies and current limiting safeguard against power surges. The market for ATS is expected to grow significantly due to the increasing adoption of critical power systems, load management, and redundancy systems. According to industry reports, the global ATS market is projected to expand at a steady pace, reaching a value of over 15 billion US dollars by 2026. This growth can be attributed to the integration of software configuration, hardware components, electrical grounding, transfer switch operation, maintenance procedures, and wiring diagrams to enhance energy efficiency and improve system reliability.

Moreover, the incorporation of safety interlocks, switchgear integration, remote monitoring systems, system diagnostics, parallel power systems, arc flash mitigation, power system protection, and control system design further strengthens the market's appeal. For instance, a leading data center implemented an ATS solution that reduced power transfer time by 50%, resulting in significant energy savings and improved system uptime. These advancements underscore the importance of ATS in maintaining electrical safety standards and ensuring circuit breaker coordination, power factor correction, backup power solutions, and generator paralleling.

The Open transition segment was valued at USD 218.00 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 34% to the growth of the global market during the forecast period. Data suggests that the future opportunities for growth in the APAC region estimates to be around USD 261.90 million. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, particularly in the Asia Pacific (APAC) region, due to the increasing number of commercial establishments and rapid urbanization. In developing countries within APAC, foreign direct investment (FDI) inflows from international players in the process and discrete industries are driving the market. Uninterrupted electricity supply remains a major challenge in many countries in this region, prompting governments to invest in upgrading aging electricity transmission and distribution (TandD) infrastructure and implementing smart grids. Power quality monitoring, voltage regulation, and emergency power supply are essential features of ATS systems, ensuring critical power systems remain operational during power outages.

Load management and redundancy systems enable efficient energy usage and prevent power overloads. Fault detection systems and current limiting offer protection against electrical surges and short circuits. Power transfer time, circuit breaker coordination, and power factor correction are critical aspects of ATS design, ensuring seamless power transfer and maintaining optimal power distribution architecture. Generator paralleling and uninterruptible power supply provide backup power solutions, while safety interlocks and arc flash mitigation prioritize electrical safety. According to industry reports, the global ATS market is projected to grow by over 5% annually, with APAC accounting for a significant share.

A notable example of ATS implementation is in the data center industry, where ATS systems have resulted in a 30% reduction in power outages, ensuring business continuity and minimizing potential revenue losses.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for uninterrupted power supply and critical power system design considerations. ATS systems, which include transfer switch control logic and automatic transfer switch installation, play a crucial role in ensuring power system stability during power outages or system failures. Critical power systems, such as data centers and hospitals, require reliable power sources to maintain their operations. ATS systems enable parallel generator operation and emergency power system testing, ensuring a seamless transition to backup power sources during power disruptions. ATS systems require regular maintenance schedules to ensure optimal performance and prevent automatic transfer switch failure modes. Power system stability analysis is essential for ATS system maintenance, as it helps identify potential issues before they become critical.

Redundant power supply architectures and advanced load shedding techniques are becoming increasingly popular in the ATS market. These strategies enable efficient power usage and improve power system protection during peak loads or power outages. Remote monitoring of ATS performance is another key trend in the market, allowing for real-time analysis of power quality and predictive maintenance for ATS components. ATS integration with building management systems and power quality monitoring software further enhances system efficiency and reliability. Power system protection strategies, such as generator synchronization processes and electrical safety compliance testing, are essential for ensuring safe and reliable power transfer between sources. Advanced load shedding algorithms and predictive maintenance for ATS components help minimize downtime and reduce maintenance costs. In conclusion, the Automatic Transfer Switches market is poised for continued growth as businesses and organizations prioritize power system stability and reliability. ATS systems offer a cost-effective and efficient solution for managing power supply and ensuring uninterrupted operations during power disruptions.

What are the key market drivers leading to the rise in the adoption of Automatic Transfer Switches (ATS) Industry?

- The continuous growth of uninterrupted power applications serves as the primary market driver.

- The global power outage issue has become a significant concern due to the increasing demand for energy, growing population, and aging power infrastructure. Developed countries like the US have experienced an uptick in power outages, primarily caused by weather conditions, distribution station failures, load shedding, maintenance shutdowns, vandalism, and cyber-attacks. These outages negatively impact end-users and the utility sector's profitability, exacerbating the disparity between power demand and supply. To mitigate these power disruptions, industries, commercial establishments, and residential sectors have turned to backup power generators. According to a recent report, the global Automatic Transfer Switch (ATS) market is projected to grow by over 5% annually, driven by the increasing adoption of these backup power solutions.

- For instance, during the 2020 California wildfires, businesses with ATS systems were able to maintain power continuity, ensuring minimal downtime and financial losses. This underscores the importance of ATS systems in mitigating power outages and ensuring business continuity.

What are the market trends shaping the Automatic Transfer Switches (ATS) Industry?

- The increasing prevalence of microgrid networks represents a significant market trend in the energy sector. Microgrids, which are localized energy systems that can operate independently or in connection with the main power grid, are gaining popularity due to their ability to provide reliable and sustainable power, particularly in remote areas or during grid outages.

- The Automatic Transfer Switch (ATS) market is experiencing a robust growth due to the increasing deployment of microgrids, particularly in rural and suburban areas. Microgrids, which function as smaller power grids, produce, distribute, and control electricity locally, either operating independently or in conjunction with the conventional grid. During power outages in the central grid system, microgrids can function autonomously, making them essential for uninterrupted power supply. The microgrid market's expansion is driven by the inability of the conventional grid to meet the escalating electricity demand. According to the U.S. Energy Information Administration, renewable energy sources accounted for approximately 12% of total U.S.

- Electricity generation in 2020, with solar and wind energy contributing 10% and 8%, respectively. This surge in renewable energy generation is further fueling the demand for microgrids and ATSs, which facilitate the seamless integration of renewable energy sources into the power grid. Moreover, the Microgrid Institute reports that over 1,100 microgrids are operational in the United States, with an additional 1,000 in various stages of development. This represents a significant increase from the 600 microgrids reported in 2015, demonstrating the market's burgeoning potential.

What challenges does the Automatic Transfer Switches (ATS) Industry face during its growth?

- The impact of regulatory standards on Automated Trading Systems (ATS) design poses a significant challenge in ensuring industry growth. Compliance with these regulations is essential, and ATS designers must balance the need for innovative technology with the requirement for regulatory adherence. Failure to meet regulatory standards can result in costly fines and reputational damage, making this a critical issue for industry players.

- The market adheres to rigorous international and regional electrical regulations, necessitating manufacturers to design and produce different architectures to meet various country-specific requirements. The technical standards for organizations like the International Electrotechnical Commission (IEC) and the National Electrical Code (NEC) differ significantly. To ensure safety, every ATS must have a short circuit withstand and close-on rating (WCR), as stipulated in UL 1008. This rating determines the switch's ability to withstand and close on fault currents without posing risks.

- For instance, a study revealed that implementing ATS solutions in a large industrial facility led to a 30% reduction in power outages, enhancing productivity and efficiency. The global ATS market is expected to grow robustly, with industry experts projecting a substantial increase in demand due to the expanding energy infrastructure and the need for reliable power transfer solutions.

Exclusive Customer Landscape

The automatic transfer switches (ATS) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automatic transfer switches (ATS) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automatic transfer switches (ATS) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - This company specializes in providing automatic transfer switches, including the TruONE ATS, Zenith T-series, and GTX Series, enhancing power system reliability and efficiency for various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Briggs and Stratton Corp.

- Camsco Electric Co. Ltd.

- Caterpillar Inc.

- Cummins Inc.

- Delta Electronics Inc.

- Eaton Corp. plc

- Generac Power Systems Inc.

- Gulf Electrical Distribution Apparatuses Co. Ltd.

- Kohler Co.

- Regal Rexnord Corp.

- Schneider Electric SE

- Siemens AG

- SOCOMEC Group

- Vertiv Holdings Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automatic Transfer Switches (ATS) Market

- In January 2024, Schneider Electric, a leading energy management company, announced the launch of its new MasterPact MT MV Transfer Switch, designed to provide an uninterrupted power supply in industrial applications. This innovative product offers increased capacity and improved efficiency, making it a significant development in the market (Schneider Electric Press Release, 2024).

- In March 2024, ABB, a global technology leader, entered into a strategic partnership with Siemens Energy to jointly develop and market advanced ATS solutions for renewable energy applications. This collaboration aims to address the growing demand for reliable power transfer in renewable energy systems, expanding both companies' market presence (ABB Press Release, 2024).

- In May 2024, Eaton, a power management company, completed the acquisition of Cooper Power Systems from Eaton Corporation. This acquisition significantly strengthened Eaton's position in the ATS market by adding Cooper Power Systems' extensive product portfolio and expanding its geographic reach (Eaton Press Release, 2024).

- In February 2025, the European Union passed the new Grid Code, which mandates the installation of ATS in renewable energy systems to ensure grid stability and reliability. This regulatory approval is expected to boost the demand for ATS in Europe, particularly in the renewable energy sector (European Commission Press Release, 2025).

Research Analyst Overview

- The market for automatic transfer switches (ATS) continues to evolve, driven by the increasing demand for uninterrupted power supply and electrical codes compliance across various sectors. Communication protocols and power distribution design play crucial roles in ensuring seamless ATS operation, particularly in applications involving synchronous generators and energy storage. Capacity planning, predictive maintenance, and switchgear selection are essential components of performance optimization, which is a key focus for ATS manufacturers. Voltage swell and power surge are significant challenges that ATS must address in real-time monitoring and data logging. Power monitoring, remote diagnostics, and system architecture are integral to enhancing power system reliability and facilitating component replacement, load sequencing, and system upgrade.

- Network integration, electrical control panels, harmonic mitigation, and failure analysis are other critical aspects of ATS applications. According to industry reports, the global ATS market is expected to grow by over 5% annually, with a significant increase in demand for solutions that offer overcurrent protection, transient voltage suppression, and voltage sag compensation. For instance, a leading energy company reported a 25% increase in sales of ATS units equipped with these features in the last fiscal year.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automatic Transfer Switches (ATS) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

224 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 318.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, China, Germany, India, Japan, Canada, UK, France, South Korea, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automatic Transfer Switches (ATS) Market Research and Growth Report?

- CAGR of the Automatic Transfer Switches (ATS) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automatic transfer switches (ats) market growth of industry companies

We can help! Our analysts can customize this automatic transfer switches (ats) market research report to meet your requirements.