Automotive Balance Shaft Market Size 2024-2028

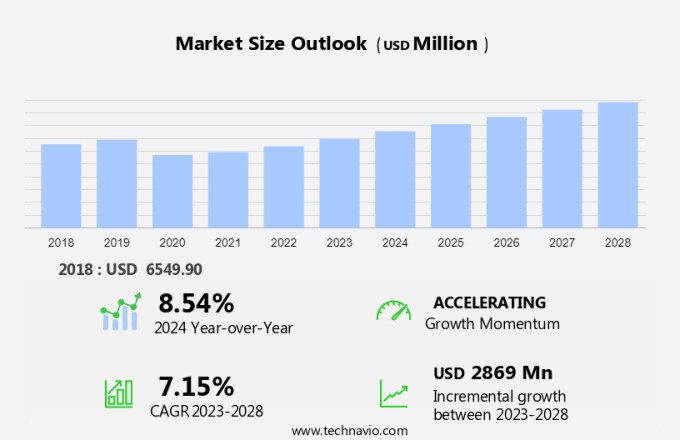

The automotive balance shaft market size is forecast to increase by USD 2.87 billion at a CAGR of 7.15% between 2023 and 2028. The market is driven by the advancements in engine technology, particularly in the design of inline 4-cylinder engines. Eccentric weights in these engines help counteract centrifugal forces, improving engine performance and reducing carbon emissions. Fuel efficiency is a significant trend in the automotive industry, leading to the development of more efficient engines. Additionally, the rise of electric vehicles and luxury vehicles is impacting the market, as these vehicles often employ sophisticated balance shaft systems to ensure smooth engine operation. The integration of smart mobility solutions, such as car-sharing services and ride-hailing apps, is also contributing to a decline in car ownership, which may impact market growth.

The United States is witnessing significant growth due to the increasing demand for efficient and high-performing engines in passenger vehicles. A balance shaft system is a crucial component in an engine, responsible for reducing vibrations and ensuring smooth engine operation. The integration of balance shafts in vehicle engines contributes to improved engine efficiency and power generation. As consumers prioritize fuel efficiency and reduced carbon emissions, the demand for balance shaft systems is on the rise. The system's ability to provide a superior customer experience by minimizing engine noise and enhancing overall vehicle performance is another key factor driving market growth.

Moreover, environmental concerns and climate considerations are increasingly influencing automotive trends in the US. The adoption of balance shaft systems in fuel-efficient vehicles, including electric and hybrid models, is expected to gain momentum. Luxury vehicles and sports utility vehicles (SUVs) are also incorporating balance shaft technology to deliver a smoother ride and reduced emissions. The manufacturing process for balance shafts involves casting, which ensures the production of high-quality and durable components. The sales channel for balance shaft systems includes Original Equipment Manufacturers (OEMs) and aftermarket sales. The market in the US encompasses various vehicle types, including passenger cars, light commercial vehicles, and heavy commercial vehicles.

Furthermore, the market's growth is not limited to developed economies; emerging nations are also showing interest in this technology due to increasing vehicle ownership and growing environmental awareness. In conclusion, the market in the US is experiencing steady growth due to the increasing demand for fuel-efficient, high-performing engines and the need to reduce carbon emissions. The integration of balance shaft systems in various vehicle types, including passenger cars, SUVs, and electric vehicles, is expected to continue driving market growth.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- In-line 4-cylinder engine

- In-line 3-cylinder engine

- Others

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

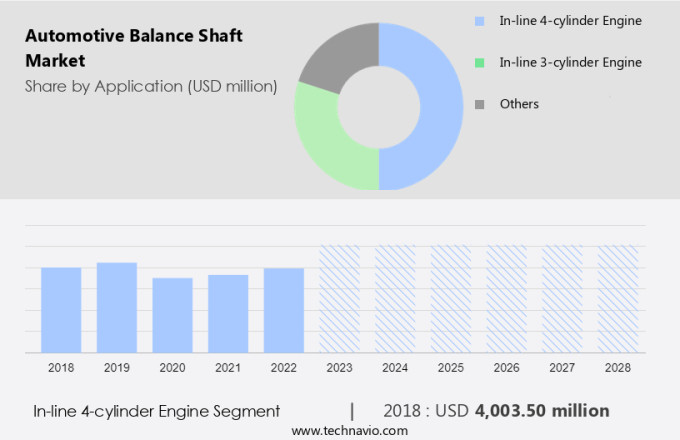

The in-line 4-cylinder engine segment is estimated to witness significant growth during the forecast period. The United States market is experiencing significant growth due to the increasing popularity of heavy commercial vehicles and original equipment manufacturers (OEMs) in the LAMEA (Latin America, Middle East, and Africa) region. Climate concerns and the push for fuel-efficient vehicles have led to an increased focus on flex fuel engine-based solutions. In-line 4-cylinder engines, in particular, are gaining traction as they offer improved fuel efficiency and reduced emissions. Leading automakers, such as Alfa Romeo, Audi, BMW, and Hyundai, are offering a range of in-line 4-cylinder engines in their compact and mid-segment vehicles.

Moreover, these engines, with displacements ranging from 1.6 to 3.0 liters, are not only fuel-efficient but also offer impressive performance. Schaeffler AG, a leading global automotive and industrial supplier, is a key player in this market, providing innovative solutions for engine systems, including in-line 4-cylinder engines. In summary, the United States market is witnessing growth due to the increasing demand for heavy commercial vehicles and fuel-efficient in-line 4-cylinder engines. Companies such as Schaeffler AG are at the forefront of providing advanced engine solutions to meet these demands.

Get a glance at the market share of various segments Request Free Sample

The in-line 4-cylinder engine segment was valued at USD 4 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

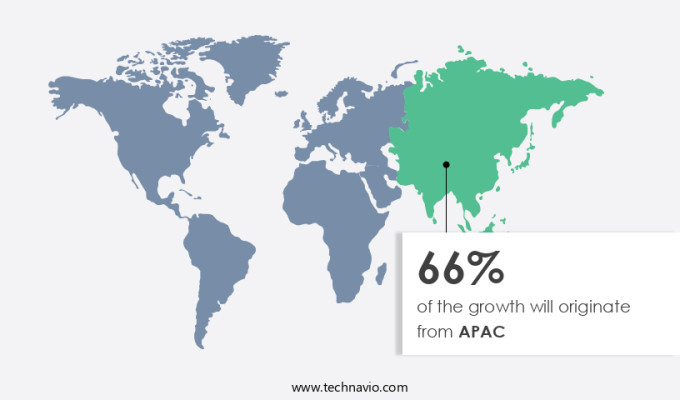

APAC is estimated to contribute 66% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Asia Pacific (APAC) region is a significant contributor to the global automotive industry, with key players such as China, Japan, South Korea, and India leading in automobile production. The increasing number of automobile manufacturing facilities in these countries drives the demand for automotive components, including automotive balance shafts. Factors like economic growth, rising incomes, and urbanization in APAC countries are fueling the growth of the automotive market, resulting in a corresponding increase in demand for vehicles. In turn, this demand leads to an increased requirement for automotive components, like balance shafts, to support vehicle production. Furthermore, APAC countries are making substantial investments in automotive research and development, leading to the adoption of advanced engine technologies.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Technological advancements in automotive engine design is the key driver of the market. In the automotive industry, the significance of balance shaft systems in modern engines continues to grow as engine sizes decrease to boost fuel efficiency and minimize emissions. These smaller engines frequently employ turbocharging to preserve power output. However, the increased pressure and mechanical stress generated by turbocharged engines can lead to heightened vibrations. To ensure seamless engine operations, automotive balance shafts are employed to counteract these vibrations. By doing so, they provide a more refined driving experience without sacrificing power. Moreover, engines with higher compression ratios can deliver enhanced fuel efficiency and power. Thus, the demand for automotive balance shafts remains strong in the US market, particularly in the luxury vehicle segment, as consumers seek superior engine performance and smooth operation.

Market Trends

The development of modular automotive engines is the upcoming trend in the market. Modular engine designs offer numerous advantages in the automotive industry, including enhanced manufacturing efficiency, cost savings, and flexibility. These engines are engineered to incorporate common components and architectures across various models and engine configurations, including automotive balance shafts. The standardization of modular engines allows for their use in a wide range of vehicles, from fuel-efficient compact cars to luxury and high-performance models. Automotive balance shafts play a crucial role in maintaining engine stability by counteracting centrifugal forces caused by the movement of eccentric weights. As engine designs have evolved, they have become more efficient through the use of advanced materials, such as all-aluminum construction, and forced induction systems.

This efficiency not only benefits fuel economy but also reduces carbon emissions. Moreover, the automotive industry is witnessing the emergence of electric vehicles, which require different engine designs. Modular engine designs offer the flexibility to adapt to these new powertrains, ensuring that manufacturers can continue to produce a diverse range of vehicles to meet the evolving needs of consumers. In conclusion, modular engine designs offer numerous benefits, including improved manufacturing efficiency, flexibility, and cost savings. The shared use of components like automotive balance shafts across different models and engine configurations allows for standardization and scalability, making it an essential aspect of modern engine design. Additionally, these engines can be adapted to meet the demands of various vehicle classes, from fuel-efficient compact cars to luxury and high-performance models, and even electric vehicles.

Market Challenge

Smart mobility solutions leading to a decline in car ownership is a key challenge affecting the market growth. The automotive industry is undergoing significant changes with the rise of innovative mobility solutions, such as car-sharing and e-hailing services. Companies like Lyft and Uber are leading this transformation, expanding their on-demand mobility offerings on a global scale. By 2025, these data-driven services are projected to shape the future of the automotive market, potentially reducing the need for individual car ownership. Currently, shared mobility services are in their introductory phase, but they are poised to make a substantial impact on the global automotive sector. As customer preferences shift towards more sustainable and cost-effective transportation options, environmental concerns and improved customer experience will continue to drive the adoption of these services. Both passenger cars and light commercial vehicles will benefit from this trend.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

American Axle and Manufacturing Holdings Inc. - The company offers automotive balance shafts such as Rear beam axles, Disconnecting driveline technology, Torque transfer devices, Rear drive modules, Power transfer units, Engine isolation pulleys, and others.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Engine Power Components Inc.

- Hirschvogel Holding GmbH

- J L AUTOPARTS PVT LTD

- Liaoning Borui Machinery Co. Ltd.

- Linamar Corp.

- Marposs Spa

- MAT Foundry Group Ltd.

- Musashi Seimitsu Industry Co. Ltd.

- Ningbo Jingda Hardware Manufacture Co. Ltd.

- OTICS Co. Ltd.

- Precision Camshaft Ltd.

- SAC Engine Components Pvt. Ltd.

- Sansera Engineering Ltd.

- Schaeffler AG

- SHARPOWER

- AB SKF

- TFO Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is driven by the increasing demand for vehicles, particularly in the passenger car and light commercial vehicle segments. The integration of balance shaft systems in vehicle engines enhances engine efficiency by reducing vibrations and improving power generated. With growing customer focus on fuel efficiency and environmental concerns, the market for automotive balance shafts is expected to witness significant growth. Luxury vehicles and sports utility vehicles are also contributing to the market growth due to their high power requirements and demand for smooth vehicle performance. The manufacturing process of balance shafts involves the use of materials like cast iron and steel, with eccentric weights used to counteract centrifugal forces.

Moreover, the balance shaft system plays a crucial role in vehicle performance and customer experience, as it reduces noise and improves driving experience. The market is witnessing the emergence of flex fuel engine-based vehicles and electric vehicles, which are expected to create new opportunities for balance shaft manufacturers. The market is influenced by various factors, including business confidence, climate concerns, and fuel efficiency regulations. The sales channel for automotive balance shafts includes OEMs and aftermarket. The market in LAMEA is expected to witness significant growth due to the increasing vehicle production in emerging nations. The future estimations indicate that the market for automotive balance shafts will continue to grow, with investment pockets in manufacturing processes and technology innovations. However, the market may face challenges due to economic uncertainties and changing consumer preferences.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.15% |

|

Market Growth 2024-2028 |

USD 2.86 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.54 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 66% |

|

Key countries |

China, US, Japan, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

American Axle and Manufacturing Holdings Inc., Engine Power Components Inc., Hirschvogel Holding GmbH, J L AUTOPARTS PVT LTD, Liaoning Borui Machinery Co. Ltd. , Linamar Corp., Marposs Spa, MAT Foundry Group Ltd., Musashi Seimitsu Industry Co. Ltd., Ningbo Jingda Hardware Manufacture Co. Ltd., OTICS Co. Ltd., Precision Camshaft Ltd., SAC Engine Components Pvt. Ltd., Sansera Engineering Ltd., Schaeffler AG, SHARPOWER, AB SKF, and TFO Corp. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch