Automotive Dual Variable Valve Timing Market Size 2024-2028

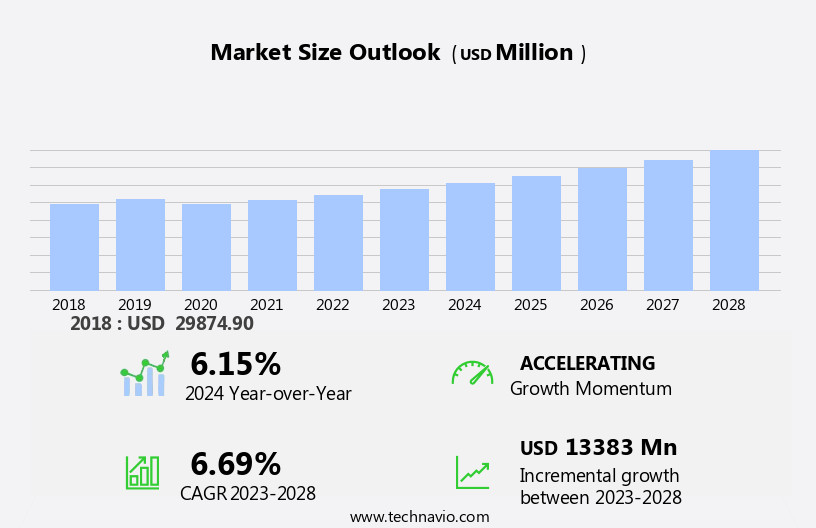

The automotive dual variable valve timing market size is forecast to increase by USD 13.38 billion at a CAGR of 6.69% between 2023 and 2028.

- The automotive dual variable valve timing (VVT) market is experiencing significant growth due to several key factors. One of the primary drivers is the increasing demand for fuel-efficient vehicles, leading to the adoption of advanced technologies like dual VVT systems. Another trend influencing the market is the development of electric dual VVT technology, which is expected to gain popularity In the electric vehicle (EV) sector. These systems, applicable to both gasoline and diesel engines in passenger vehicles and commercial vehicles, enhance fuel efficiency and reduce greenhouse gas emissions, such as carbon dioxide and methane. Furthermore, the global focus on the adoption of EVs is creating opportunities for market growth. These trends are shaping the future of the automotive VVT market and are expected to drive market growth In the coming years.

What will be the Size of the Automotive Dual Variable Valve Timing Market During the Forecast Period?

- The automotive dual variable valve timing (VVT) market encompasses advanced technologies, including cam-phasing and cam-phasing plus changing, that optimize engine performance and reduce emissions in various vehicle types. Regulatory bodies worldwide continue to enforce stringent emission standards, driving market growth. Dual VVT systems play a crucial role in start-stop systems, improving idling stability and reducing emissions during light acceleration. The market's expansion extends to battery-powered vehicles, where VVT systems contribute to improving engine efficiency during regenerative braking. Overall, the automotive dual VVT market is poised for strong growth, catering to the evolving demands for sustainable and efficient transportation solutions.

How is this Automotive Dual Variable Valve Timing Industry segmented and which is the largest segment?

The automotive dual variable valve timing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger cars

- Commercial vehicles

- Type

- Hydraulic cam phaser

- Electric cam phaser

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- France

- North America

- US

- Middle East and Africa

- South America

- APAC

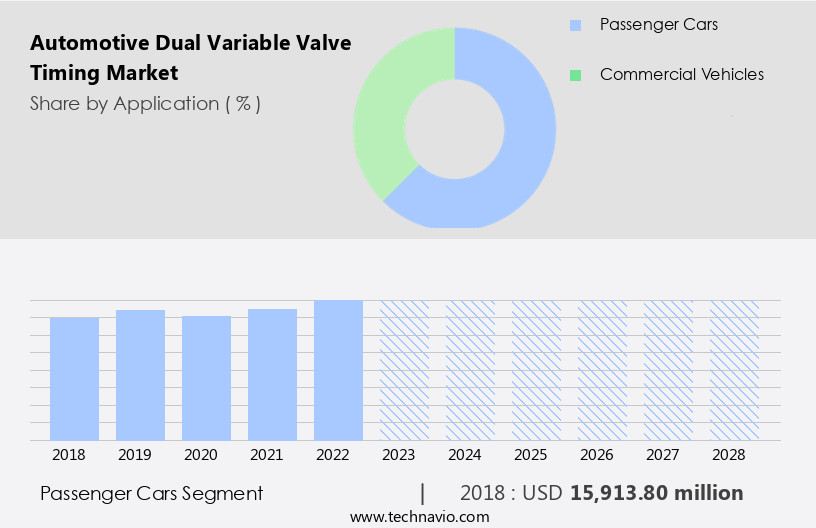

By Application Insights

- The passenger cars segment is estimated to witness significant growth during the forecast period.

The global automotive dual variable valve timing (VVT) market experienced significant growth In the passenger cars segment in 2022, driven by the increasing demand for fuel-efficient and eco-friendly vehicles. Dual VVT technology is a crucial feature in modern passenger cars, optimizing engine performance, enhancing fuel economy, and reducing greenhouse gas emissions, particularly methane and carbon dioxide. Developing economies, such as China, India, and Southeast Asian nations, are witnessing a growth in passenger vehicle sales, further fueling market growth.

For instance, China's passenger car market saw an increase in sales in 2022, with electric vehicles (EVs) playing a significant role. In addition, regulatory bodies are implementing stricter emission norms, leading to the adoption of advanced VVT systems in passenger cars and commercial vehicles. The market is expected to continue growing, with trends such as mergers and acquisitions, the integration of start-stop systems, and the development of intelligent start-stop systems shaping the future of the industry. The increasing demand for fuel-efficient vehicles, coupled with technological breakthroughs, is expected to further boost market growth.

Get a glance at the Automotive Dual Variable Valve Timing Industry report of share of various segments Request Free Sample

The passenger cars segment was valued at USD 15.91 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

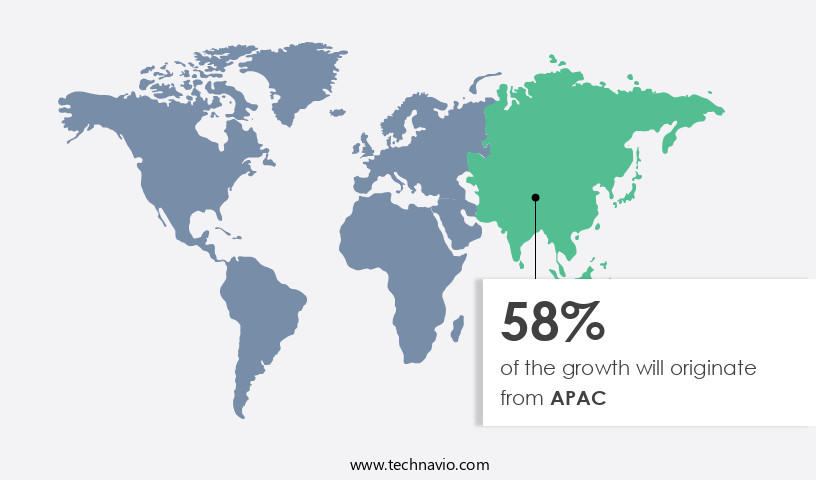

- APAC is estimated to contribute 58% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The APAC automotive market witnesses significant growth In the adoption of dual variable valve timing (VVT) systems due to the region's extensive automotive industry and increasing demand for fuel-efficient vehicles. Stringent emission regulations, such as China's shift to the China 6 emission standard in 2020, are driving the need for emission control technologies. VVT systems, including cam-phasing, cam-phasing plus changing, and valvetrains (SOHC and DOHC), are essential components in reducing emissions in both passenger cars and light commercial vehicles.

Furthermore, these systems optimize engine performance, improve fuel economy, and reduce greenhouse gas emissions, including methane and carbon dioxide. The market's growth is further fueled by the electrification of vehicles, urbanization, and the increasing demand for fuel-efficient and eco-friendly vehicles. Technological breakthroughs, such as cylinder deactivation, intelligent start-stop, and hybridization, are also contributing to the market's growth. The APAC automotive dual VVT market's key players include Analog Devices, Maxim Integrated, and various automakers. The market's growth is expected to continue as consumers prioritize environmental concerns and fuel costs over high-performance models and purchasing power in developing regions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Dual Variable Valve Timing Industry?

Increasing demand for fuel-efficient vehicles is the key driver of the market.

- The automotive industry is responding to growing environmental concerns and increasing fuel prices by adopting dual VVT systems to enhance engine performance and fuel economy. These systems, which include cam-phasing, valvetrains, and cylinder deactivation, are essential for reducing greenhouse gas emissions, particularly carbon dioxide, which contributes significantly to climate change. According to the United States Environmental Protection Agency (EPA), transportation accounts for approximately 28% of total greenhouse gas emissions, making it a critical sector for reduction efforts. Dual VVT systems are being integrated into various vehicle types, including passenger cars, light commercial vehicles, and even heavy commercial vehicles, to improve fuel efficiency and meet regulatory requirements.

- The electrification of vehicles, including electric and hybrid models, is also driving the demand for these systems as they help optimize engine combustion and power output. The market dynamics for dual VVT systems are influenced by factors such as fuel-efficient vehicle demand, technological breakthroughs, and the electrification synergy between battery-powered vehicles and traditional gasoline and diesel engines. Companies are employing merger and acquisition strategies to expand their offerings and stay competitive in this evolving market. Intelligent start-stop systems and cylinder deactivation technologies are also gaining traction as consumers seek more eco-friendly and cost-effective solutions.

What are the market trends shaping the Automotive Dual Variable Valve Timing Industry?

Development of electric dual VVT technology is the upcoming market trend.

- The global market for Automotive Dual Variable Valve Timing (VVT) systems is witnessing significant growth due to the increasing demand for fuel-efficient and eco-friendly vehicles. VVT systems, also known as variable cam timing, are essential components in modern engines that optimize engine performance and reduce emissions. Both gasoline and diesel engines use VVT systems to improve fuel economy, power output, and engine efficiency. In recent years, the focus on reducing greenhouse gases, methane, and carbon dioxide emissions has led regulatory bodies to set stringent emission norms. As a result, automakers are investing heavily in advanced VVT technologies, such as electric dual variable valve timing (eDVVT), to meet these regulations. EDVVT systems offer several advantages over traditional hydraulic VVT systems. They provide precise and dynamic control over valve timing, optimizing engine combustion and reducing energy losses. Moreover, eDVVT systems use electric actuators instead of hydraulic systems, enabling faster and more accurate adjustments. The trend towards electrification of vehicles, including passenger cars, light commercial vehicles, and electric vehicles, is also driving the growth of the Automotive DVVT market. Start-stop systems, cylinder deactivation, and intelligent start-stop are some of the applications of VVT technology in modern vehicles.

- Moreover, the increasing demand for fuel-efficient and eco-friendly vehicles, coupled with technological breakthroughs, is expected to fuel the growth of the Automotive DVVT market In the coming years. Valves, valvetrains, SOHC valvetrains, and DOHC valvetrains are essential components of VVT systems. Cam-phasing and cam-phasing plus changing are techniques used to optimize valve timing in engines. The growing demand for high-performance models, urbanization, and the increasing purchasing power in developing regions are some of the other factors driving the growth of the Automotive DVVT market. The market is expected to witness significant merger and acquisition activity as automakers and technology companies seek to expand their product portfolios and enhance their capabilities in this area. In summary, the market is witnessing significant growth due to the increasing demand for fuel-efficient and eco-friendly vehicles, regulatory requirements, and technological advancements. Electric dual variable valve timing systems are a significant trend in this market, offering several advantages over traditional hydraulic systems. The market is expected to witness significant growth In the coming years, driven by the increasing demand for fuel-efficient and eco-friendly vehicles, urbanization, and technological breakthroughs.

What challenges does the Automotive Dual Variable Valve Timing Industry face during its growth?

Increasing focus on adoption of EVs globally is a key challenge affecting the industry growth.

- The Automotive Dual Variable Valve Timing (VVT) Market has gained significant traction due to increasing environmental concerns and the need for fuel-efficient vehicles. VVT systems, utilized in both gasoline and diesel engines, optimize engine performance, fuel economy, and reduce emissions. This technology, which includes cam-phasing, cam-phasing plus changing, and valvetrains, is applied to passenger cars and light commercial vehicles. Regulatory bodies worldwide have imposed stringent emissions standards, driving automakers to invest in VVT technology. For instance, SOHC and DOHC valvetrains are increasingly used in fuel-efficient vehicles and eco-friendly vehicles. The integration of VVT systems in start-stop systems further enhances fuel savings during idling and light acceleration.

- Methane and carbon dioxide are major greenhouse gases contributing to air pollution. By optimizing engine combustion through VVT systems, automakers can minimize these emissions. Moreover, the electrification of vehicles, including electric vehicles, is accelerating, leading to the development of Dual VVT systems in the hybridization of vehicles. The merger & acquisition strategy among automakers to expand their product portfolios and enhance technological capabilities further boosts the market growth. Technological breakthroughs, such as cylinder deactivation, intelligent start-stop, and fuel-efficient vehicle demand, are also significant market drivers. In summary, the market is expected to grow substantially due to the increasing demand for fuel-efficient and eco-friendly vehicles, stringent emissions regulations, and technological advancements.

Exclusive Customer Landscape

The automotive dual variable valve timing market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive dual variable valve timing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive dual variable valve timing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AISIN CORP.

- BorgWarner Inc.

- Cummins Inc.

- DENSO Corp.

- Eaton Corp. Plc

- Ford Motor Co.

- General Motors Co.

- Hitachi Ltd.

- Honda Motor Co. Ltd.

- Hyundai Motor Co.

- MAHLE GmbH

- Mitsubishi Electric Corp.

- Precision Camshaft Ltd.

- Renault SAS

- Schaeffler AG

- Stellantis NV

- Tenneco Inc.

- Toyota Motor Corp.

- Volkswagen AG

- Zhejiang Geely Holding Group Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The automotive industry continues to evolve, driven by advancements in technology and increasing consumer demand for fuel-efficient and eco-friendly vehicles. One area of significant focus is the development and implementation of Variable Valve Timing (VVT) systems in both gasoline and battery-powered vehicles. VVT systems enable engines to optimize valve timing based on engine load and speed, improving engine performance, fuel economy, and reducing emissions. These systems have become increasingly important as regulatory bodies impose stricter emissions standards and consumers express growing concerns about greenhouse gases, such as methane and carbon dioxide. Passenger vehicles and commercial vehicles, including diesel and gasoline models, have adopted VVT technology to meet these demands. The technology is also being integrated into electric vehicles, contributing to their overall efficiency and performance. The market for VVT systems is dynamic, with automakers employing various merger and acquisition strategies to expand their offerings and stay competitive. Start-stop systems, which use VVT technology to improve fuel efficiency during idling and light acceleration, have gained popularity, further boosting the demand for VVT systems. Valve lift events and valves play a crucial role in VVT systems, with SOHC (Single Overhead Camshaft) and DOHC (Double Overhead Camshaft) valvetrains being commonly used.

Consequently, cam-phasing and cam-phasing plus technologies are also employed to optimize valve timing and improve engine combustion, resulting in increased power output. Fuel-efficient vehicles and eco-friendly vehicles are gaining traction In the market, driven by consumer preferences and environmental concerns. The electrification of vehicles, urbanization, and electrification synergy are also influencing the demand for VVT systems. The automotive production industry and international trade are significant factors In the VVT market, with technological breakthroughs and innovations continuing to shape the landscape. Companies specializing in VVT technology, such as Analog Devices and Maxim Integrated, are at the forefront of this evolution. As the market for fuel-efficient and eco-friendly vehicles grows, the demand for VVT systems is expected to continue increasing. Automakers are investing in research and development to improve engine performance, fuel economy, and reduce emissions, making VVT systems an essential component In the future of the automotive industry.

Thus, consumers, driven by environmental concerns, fuel costs, and the desire for high-performance models, are demanding more fuel-efficient and eco-friendly vehicles. Developing regions are also experiencing an increase in purchasing power, further fueling the demand for these types of vehicles. Passenger cars, light commercial vehicles, and heavy commercial vehicles are all adopting VVT technology to meet the demands of consumers and regulatory bodies. Hybridization of vehicles is also becoming more common, further increasing the importance of VVT systems In the automotive industry. In summary, the market for VVT systems In the automotive industry is dynamic and driven by various factors, including consumer demand, regulatory requirements, and technological advancements. The adoption of VVT systems in gasoline, diesel, and electric vehicles is essential for improving engine performance, fuel economy, and reducing emissions. The future of the automotive industry is electric, and VVT systems will play a crucial role in its evolution.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

189 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.69% |

|

Market growth 2024-2028 |

USD 13.38 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.15 |

|

Key countries |

China, US, Japan, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Dual Variable Valve Timing Market Research and Growth Report?

- CAGR of the Automotive Dual Variable Valve Timing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive dual variable valve timing market growth of industry companies

We can help! Our analysts can customize this automotive dual variable valve timing market research report to meet your requirements.