Automotive Electric Side View Mirror Market Size 2024-2028

The automotive electric side view mirror market size is forecast to increase by USD 9.10 billion at a CAGR of 10.76% between 2023 and 2028.

- The market is experiencing dynamic growth, driven by the increasing demand for advanced safety and convenience features in vehicles. One standout innovation is image definition enhancement, which refines mirror clarity, particularly in low-light conditions, improving driver awareness. Another transformative trend is the integration of LED lighting in side mirrors, enhancing illumination while boosting energy efficiency. The rise of electric vehicles is further propelling demand, as these cars increasingly adopt high-tech electric mirror systems for seamless functionality. Notably, both the front and back glass surfaces of electric side mirrors play a crucial role in their design and performance.

- The front glass surface is responsible for providing a clear view of the road, while the back surface houses various electronic components, such as cameras and rain sensors. According to FADA-sourced industry statistics, the adoption of electric side view mirrors in electric vehicles is expected to increase, leading to a reduction in CO2 emissions. Additionally, government regulations regarding automotive mirrors, such as those related to blind spot detection and the vehicle's backlight, are stringent and continue to evolve, further fueling market growth. Overall, the market for electric side view mirrors is poised for continued expansion due to these factors.

What will be the Automotive Electric Side View Mirror Market Size During the Forecast Period?

- The market is witnessing significant advancements, driven by the integration of sophisticated technologies to enhance safety and convenience for both passenger cars and commercial vehicles. These mirrors, an essential automotive component, are integral to ensuring drivers have a clear view of their surroundings. Electric side view mirrors are designed with various features, including auto-dimming, blind spot indicators, automatic folding, and heatable mirrors. These features cater to the evolving needs of consumers and the automotive industry. Automotive OEMs are increasingly focusing on integrating these advanced technologies into their vehicles to meet the growing demand for safer and more comfortable driving experiences.

- Moreover, the electronic components used in the manufacturing of electric side view mirrors include memory storage mirrors and foldable mirrors. Memory storage mirrors enable drivers to save their preferred mirror positions, while foldable mirrors help reduce the risk of damage during parking and maneuvering in tight spaces. The casing of the mirror is designed to be wedge-shaped with a thicker edge, providing a more aerodynamic design and improved visibility. Automotive technology continues to advance, leading to the development of camera-based side mirrors. These mirrors use multiple cameras to provide 360-degree viewing angles, eliminating blind spots and enhancing safety.

How is this Automotive Electric Side View Mirror Industry segmented and which is the largest segment?

The automotive electric side view mirror industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger cars

- Commercial vehicles

- Type

- Memory storage

- Foldable

- Heatable

- Geography

- APAC

- China

- Japan

- South Korea

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Application Insights

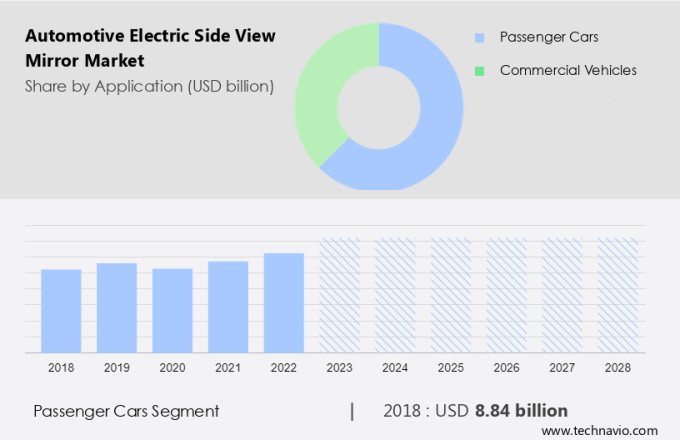

- The passenger cars segment is estimated to witness significant growth during the forecast period.

In the global automotive industry, electric side view mirrors have gained significant traction, particularly in mid-segment and luxury vehicles. According to the International Organization of Motor Vehicle Manufacturers, a total of 57 million passenger cars were produced in 2021. This number is projected to increase during the forecast period. In India, electric side view mirrors are also used in entry-level vehicles. The Indian passenger automobile market, valued at USD 32.7 billion in 2021, is expected to grow at a CAGR of over 9% between 2022 and 2027, reaching a value of USD 54 billion. These mirrors consist of a front glass surface for viewing the road behind the vehicle and a back surface for accommodating electronic components.

Get a glance at the Automotive Electric Side View Mirror Industry report of share of various segments Request Free Sample

The passenger cars segment was valued at USD 8.84 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

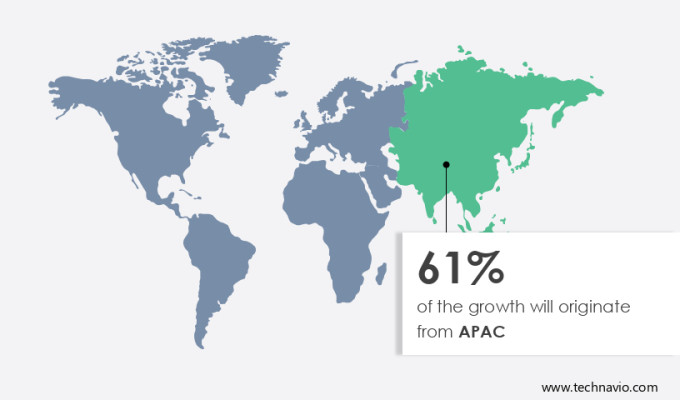

- APAC is estimated to contribute 61% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is witnessing significant growth, particularly in the Asia Pacific (APAC) region. With a high volume of passenger car sales and increasing adoption of advanced safety and comfort features, APAC is becoming a key player in the global market. Major countries in APAC, including China, India, South Korea, and Japan, are driving the demand for electric side view mirrors due to their widespread use in passenger cars. These mirrors are increasingly being offered as standard or optional features by automotive original equipment manufacturers (OEMs) in the region. The electric side view mirrors provide enhanced safety and convenience, with features such as auto-dimming, blind spot indicators, and automatic folding. These features are becoming increasingly important to consumers, making electric side view mirrors a must-have in modern vehicles. The market is expected to continue its growth trajectory in the coming years, with APAC leading the charge.

Market Dynamics

Our automotive electric side view mirror market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Automotive Electric Side View Mirror Industry?

Increasing preference for safe and convenient features in vehicles is the key driver of the market.

- In today's automotive industry, there is a growing emphasis on safety features in vehicles. Over the past decade, both passenger cars and commercial vehicles have seen an increase in the integration of advanced safety technologies. This trend is driven by the rising number of traffic accidents and the resulting demand for enhanced visibility and awareness. Side view mirrors, in particular, have become an essential exterior component in modern vehicles. Premium automakers and luxury vehicle manufacturers are incorporating camera technologies into their mirror systems to provide drivers with real-time information about their surroundings.

- Additionally, these additional safety measures, such as lane departure warning systems and blind-spot recognition, contribute to a safer driving experience. Consumers are willing to invest in vehicles equipped with these advanced safety features rather than opting for base models lacking such technologies. Stringent government programs aimed at improving road safety further fuel this demand. In summary, the integration of advanced safety features, including side view mirror systems, is a key trend in the automotive industry, driven by the need for enhanced visibility and awareness on the road.

What are the market trends shaping the Automotive Electric Side View Mirror Industry?

The emergence of surround-view mirror systems is the upcoming trend in the market.

- In the automotive industry, side view mirrors have evolved from traditional designs to advanced image definition enhancement systems, such as surround-view mirrors or 360-degree camera systems. These innovative technologies consist of multiple cameras strategically placed around the vehicle, which feed real-time footage to the driver. The system combines these inputs into a single, bird's-eye view, providing the driver with a more comprehensive understanding of their surroundings. Moreover, these systems integrate advanced features like sonar technologies to detect the distance between adjacent vehicles or obstacles. When an obstacle is detected, the system alerts the driver with audio signals, ensuring increased safety and awareness. One such example is Magna International Inc.'s upcoming 3D Surround View System, which includes next-generation cameras and electronic control units.

- According to FADA-sourced industry statistics, the integration of LED lamps in electric vehicles is a significant factor driving the growth of the side view mirror market. Additionally, the reduction of CO2 emissions is a primary concern for automotive manufacturers, making these advanced mirror systems a desirable solution due to their energy efficiency. The automotive side view mirror market is witnessing significant advancements with the integration of surround-view mirror systems and advanced technologies. These innovations offer improved safety, energy efficiency, and enhanced driver visibility, making them an essential component in modern vehicles.

What challenges does Automotive Electric Side View Mirror Industry face during the growth?

Stringent government regulations regarding automotive mirrors are a key challenge affecting the industry growth.

- The market is subject to stringent regulations that mandate the inclusion of side view mirrors in vehicles. These regulations have resulted in an increase in production costs for vehicle manufacturers, leading them to offer electric side view mirrors primarily in premium segment vehicles. The automotive industry has experienced rapid technological advancements, with developments outpacing regulatory systems in various countries.

- Additionally, this has limited the ability of vehicle manufacturers to equip vehicles with innovative technologies, as regulatory authorities in countries such as China, South Korea, and India lack testing procedures for evaluating the integrity and reliability of new automotive technologies. Technological advancements in the automotive mirror industry include surround-view mirror systems, digital mirrors, Bluetooth-enabled automatic-dimming mirrors, and HomeLink integrated buttons. High-performance electronic mirrors, controlled by Electronic Control Units and domain controllers, are also gaining popularity.

Exclusive Customer Landscape

The automotive electric side view mirror market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry. The automotive electric side view mirror industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BEEKAY AUTOMOTIVES

- Fiem Industries Ltd.

- Gentex Corp.

- INMESA

- Magna International Inc.

- MEKRA Lang GmbH and Co. KG

- MinebeaMitsumi Inc.

- Mitsuba Corp.

- Murakami Corp.

- Panasonic Holdings Corp.

- Prakant Electronics Pvt. Ltd.

- Rosco Inc.

- Sakae Riken Kogyo Co. Ltd.

- Samsung Electronics Co. Ltd.

- Samvardhana Motherson International Ltd.

- Schaeffler AG

- SL Corp.

- Stoneridge Inc.

- Tokai Rika Co. Ltd.

- Valeo SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for advanced safety and comfort features in both passenger cars and commercial vehicles. Automakers are integrating innovative technologies such as auto-dimming, blind spot indicators, automatic folding, and homelink integrated buttons into side mirrors to enhance the driving experience. Safety is a major concern in the automotive industry, leading to the adoption of side mirrors with camera technologies and surround-view mirror systems. These systems provide 360-degree viewing angles, improving visibility and reducing the risk of accidents. Moreover, the trend towards premium vehicles and luxury cars is driving the demand for high-performance electronic mirrors with image definition enhancement, LED lamps, and Bluetooth-enabled automatic-dimming mirrors.

Additionally, the electric vehicles segment is also expected to witness significant growth due to the increasing popularity of electric vehicles. Exterior component manufacturers are focusing on developing thinner and lighter mirrors with wedge-shaped casings and thicker edges to reduce aerodynamic drag and improve fuel efficiency. The use of electronic control units, domain controllers, and memory storage mirrors is also increasing to provide drivers with a better view in various weather conditions, including rainy seasons. Stringent government programs aimed at reducing CO2 emissions and improving safety standards are also expected to drive the growth of the market. The market is expected to witness significant growth in the coming years due to the increasing demand for advanced features and the shift towards electric and autonomous vehicles.

|

Automotive Electric Side View Mirror Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.76% |

|

Market growth 2024-2028 |

USD 9.10 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.92 |

|

Key countries |

US, China, Japan, South Korea, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Automotive Electric Side View Mirror industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch