Automotive Floor Mats Market Size 2024-2028

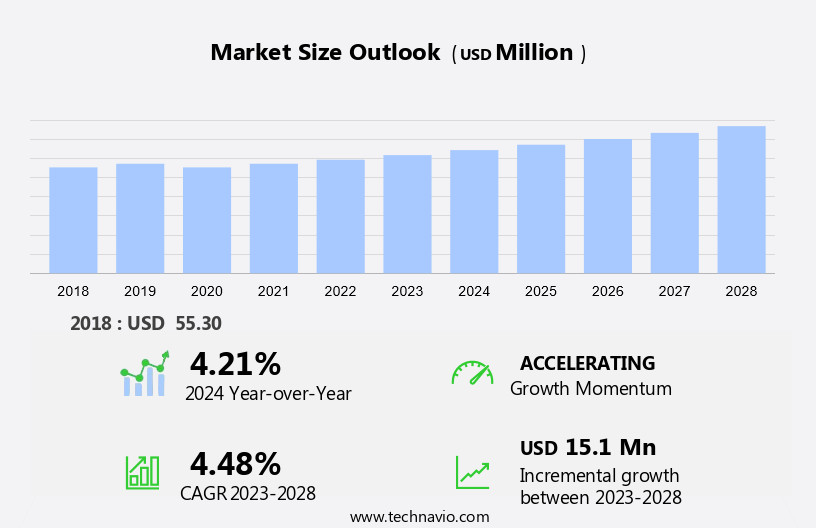

The automotive floor mats market size is forecast to increase by USD 15.1 million at a CAGR of 4.48% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for customized vehicle interiors in Western markets. High-quality materials, such as rubber, vinyl, textile, recycled plastic, and natural fibers, are being used to manufacture these floor mats to meet the diverse needs of consumers. The market is an essential component of the vehicle industry, catering to the needs of various types of vehicles, including luxury cars, vans, and trucks. However, uncertainties In the automotive supply chain pose a challenge to market growth. Dirt, debris, moisture, and wear and tear are common issues that automotive floor mats must address to ensure customer satisfaction. To cater to this need, manufacturers are exploring innovative materials like bio-based materials to create durable and eco-friendly floor mats. The use of these materials not only enhances the aesthetic appeal but also provides superior protection against damage. The market is expected to continue its growth trajectory, driven by the rising demand for customization and the adoption of advanced materials in automotive floor mats.

What will be the Size of the Automotive Floor Mats Market During the Forecast Period?

- This market encompasses a wide range of floor mat options, including rubber, vinyl, textile, and carpet mats, designed to protect vehicle interiors from dirt, debris, moisture, and wear and tear. Rubber and vinyl mats are popular choices due to their durability and ease of cleaning. They are suitable for high-traffic areas, such as the driver's side and rear seats, and can effectively prevent damage caused by heavy foot traffic and spills. Textile mats, on the other hand, offer a more aesthetic appeal with their customizable designs and textures, making them a preferred choice for those seeking to enhance the look of their vehicle interiors. Customization trends have significantly influenced the market, with an increasing focus on functionality, aesthetics, and acoustic performance. Heating elements and massage functions are becoming increasingly popular features in high-end floor mats, providing added comfort and convenience for vehicle occupants.

- Further, floor mats made of fiber-based trim components are also gaining popularity due to their eco-friendly nature. These mats are made from renewable resources and can effectively reduce the carbon footprint of the automotive industry. The market is driven by the increasing production of vehicles and the growing demand for advanced floor mat technologies. Vehicle interiors are becoming more sophisticated, and floor mats are no exception. Manufacturers are focusing on developing floor mats that offer superior protection, durability, and design options to cater to the diverse needs of consumers. Thus, the market is a dynamic and evolving industry, driven by consumer preferences, technological advancements, and environmental concerns. With a focus on functionality, aesthetics, and eco-friendliness, floor mats continue to play a crucial role in protecting and enhancing the interiors of vehicles.

How is this Automotive Floor Mats Industry segmented and which is the largest segment?

The automotive floor mats industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Rubber

- Textile

- Plastic

- Others

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- France

- North America

- US

- South America

- Middle East and Africa

- APAC

By Type Insights

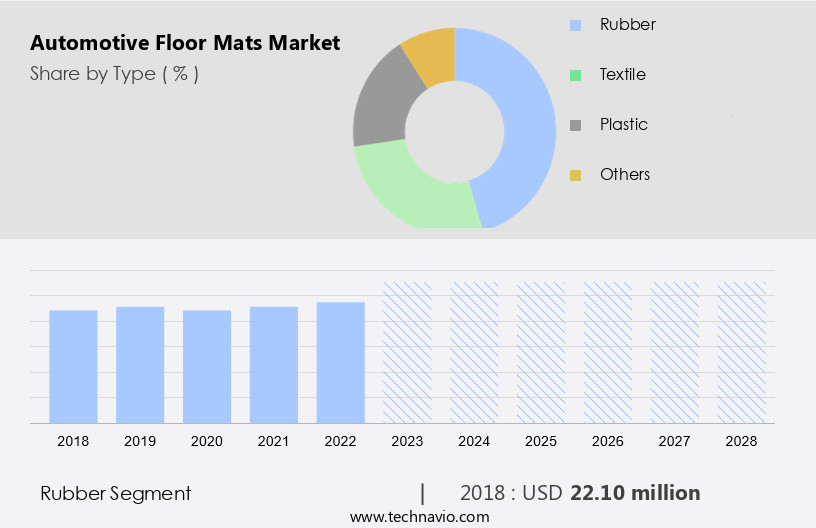

- The rubber segment is estimated to witness significant growth during the forecast period.

Automotive floor mats are a significant accessory in terms of sales volume In the automotive industry. These floor mats are popular due to their affordability, ease of maintenance, and wide availability. They serve essential functions beyond hygiene, enhancing the aesthetics of vehicle interiors. Most automotive floor mats are removable and can be effortlessly replaced when necessary. They are manufactured using synthetic rubber with unique shapes and designs to prevent dirt and water from entering the vehicle. These mats provide a firm grip on the vehicle carpet, preventing it from moving or slipping during use. Moreover, modern floor mats offer advanced features such as anti-fatigue properties, heating elements, and massage functions.

Customization trends have led to the production of floor mats with fiber-based trim components and carpets, adding to their appeal. The acoustic performance of these mats is another factor that makes them desirable, as they help reduce noise levels within the vehicle. The global floor mats market size was valued at USD 5.2 billion in 2020 and is expected to grow at a CAGR of 5.1% from 2021 to 2028. These reports focuses on the increasing demand for floor mats with advanced features and customization options. Thus, automotive floor mats are a crucial accessory that offers both functionality and aesthetics to vehicle interiors. With the growing trend towards customization and advanced features, the floor mats market is expected to continue its growth trajectory In the coming years.

Get a glance at the Automotive Floor Mats Industry report of share of various segments Request Free Sample

The rubber segment was valued at USD 22.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

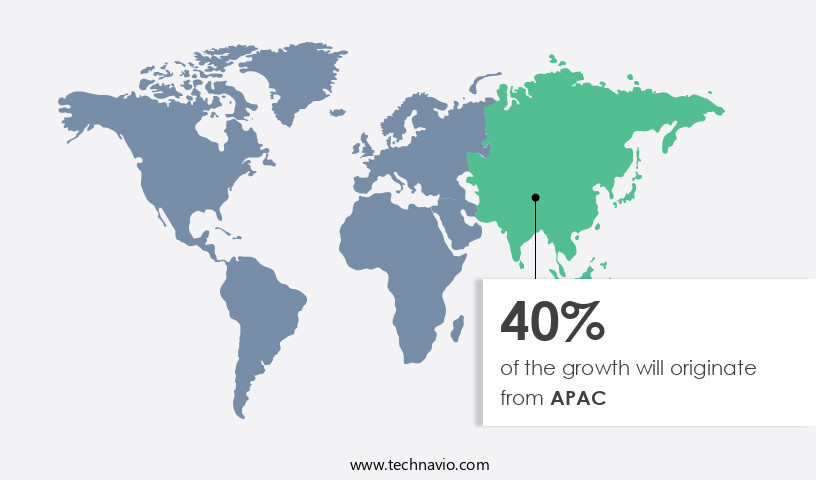

- APAC is estimated to contribute 40% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC held a significant share of the global market in 2023 and is projected to maintain its dominance throughout the forecast period. The escalating demand for automobiles in China, India, and South Korea is fueling the growth of the market in APAC. Rapid industrialization and urbanization In these countries are leading to total economic transformation, which is boosting the sales of automobiles. Consequently, the demand for automotive floor mats is increasing in tandem with the automobile market in APAC. This market growth is primarily driven by Original Equipment Manufacturers (OEMs) In the region.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Floor Mats Industry?

Rising demand for vehicle customization in Western markets is the key driver of the market.

- The automotive aftermarket industry is witnessing significant growth due to increasing consumer preference for customizing their vehicle interiors. This trend is particularly prominent in luxury vehicle segments, where consumers seek to enhance the aesthetics of their cabins. The integration of advanced technologies such as airbags, anti-lock brakes, start-stop technology, and others in vehicles has led to an increased focus on maintaining their interior condition.

- As a result, the demand for aftermarket floor mats, available in rubber, textile, and plastic materials, has grown. Customized car accessories have become increasingly popular, with consumers in North America and Europe leading the way. These regions are home to numerous aftermarket companies catering to the needs of customers for custom interiors and exteriors. In summary, the automotive aftermarket industry is experiencing growth due to rising consumer disposable income, increasing awareness, and the availability of a wide range of aftermarket products and solutions.

What are the market trends shaping the Automotive Floor Mats Industry?

Use of high-quality materials in automotive floor mats is the upcoming market trend.

- Floor mats are a crucial accessory for automobiles, widely favored by consumers due to their affordability, convenience, and accessibility. These mats serve multiple purposes, including maintaining cleanliness, enhancing vehicle aesthetics, and shielding the floor from damage caused by debris and moisture. Similar to door mats, they effectively trap dirt and particles, making them effortless to clean or replace when necessary. Floor mats come in various materials such as rubber, vinyl, textile, recycled plastic, natural fibers, and bio-based materials. Each material offers unique benefits, catering to diverse consumer preferences. Rubber mats, for instance, provide excellent durability, while vinyl mats offer a sleek appearance.

- Textile mats offer a plush feel, and natural fibers add an eco-friendly touch. Bio-based materials offer sustainability, making them an attractive choice for environmentally-conscious consumers. Investing in floor mats is a wise decision for car owners, ensuring that their vehicles remain clean, protected, and visually appealing. These mats are an essential investment for maintaining the overall health and longevity of the vehicle.

What challenges does the Automotive Floor Mats Industry face during its growth?

Uncertainties in the automotive supply chain are a key challenge affecting the industry's growth.

- The automotive industry's supply chain is intricate, involving various stakeholders including suppliers, companies, and Original Equipment Manufacturers (OEMs). These entities are dedicated to optimizing their roles In the value chain, as consumer preferences and technological advancements in automotive manufacturing continue to evolve. Furthermore, globalization adds complexity to the automotive supply chain. Shared mobility models and the increasing use of public transportation have created uncertainty regarding automotive demand In the upcoming years. This uncertainty may result in either underproduction or overproduction, leading to inefficiencies within the supply chain. OEMs are focusing on producing automotive floor mats that cater to various vehicle types, including passenger cars, vans, and trucks.

- Product types include those with oil resistance and noise & vibration insulation properties. These features enhance the driving experience and contribute to the overall value of the vehicle. In the US market, the demand for automotive floor mats remains strong due to their essential role in maintaining vehicle cleanliness and comfort. As the automotive industry continues to evolve, it is crucial for stakeholders to stay informed about market trends and consumer preferences to ensure an efficient and effective supply chain.

Exclusive Customer Landscape

The automotive floor mats market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive floor mats market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive floor mats market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Auto Custom Carpets Inc.

- Auto tech non wovens

- Autoform

- BDKUSA INC

- Covercraft Industries LLC

- ExactMade LLC

- GAHH LLC

- German auto tops Inc.

- Husky Liners Inc

- KK Motors Inc.

- LCI Industries

- Lloyd Mats Inc.

- MaxLinear Inc.

- RACEMARK International LLC.

- STINZO AUOTMOTIVES PVT LTD

- Vaccess India Pvt. Ltd.

- WeatherTech Direct LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market caters to the demand for interior protection and comfort in passenger cars and commercial vehicles. These mats come in various materials such as rubber, vinyl, textile, recycled plastic, natural fibers, bio-based materials, and recycled nylon yarn. The market offers both OEM and aftermarket options, catering to the needs of vehicle assembly and vehicle customization. The passenger cars segment dominates the market due to the increasing demand for comfort and convenience features. Floor mats provide functionality in terms of oil resistance, noise & vibration insulation, and durability. Customization trends have led to the production of mats with premium fabrics, resilient compositions, anti-fatigue properties, heating elements, and massage functions. Floor mats play a crucial role in vehicle interiors, enhancing aesthetics while ensuring safety. They protect vehicle cabins from dirt, debris, moisture, and wear and tear.

In commercial vehicles, floor mats contribute to weight savings during vehicle assembly and provide versatility for various applications. The market also caters to LCVs (light commercial vehicles) and HCVs (heavy commercial vehicles), offering polymer-based mats for durability and acoustic performance. Fiber-based trim components, such as carpets and inner dashes, are also part of the market offerings. Safety features like airbags and anti-lock brakes have led to the integration of floor mats with start-stop technology. In shared mobility models and public transportation, floor mats ensure vehicle cleanliness and durability, making them essential components for vehicle maintenance. The market continues to evolve, offering innovative solutions for various vehicle types and applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

136 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.48% |

|

Market growth 2024-2028 |

USD 15.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.21 |

|

Key countries |

China, US, Japan, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Floor Mats Market Research and Growth Report?

- CAGR of the Automotive Floor Mats industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive floor mats market growth of industry companies

We can help! Our analysts can customize this automotive floor mats market research report to meet your requirements.