Automotive Aftermarket Market Size 2025-2029

The automotive aftermarket market size is valued to increase USD 179.7 billion, at a CAGR of 6% from 2024 to 2029. High adoption of vehicle parts will drive the automotive aftermarket market.

Major Market Trends & Insights

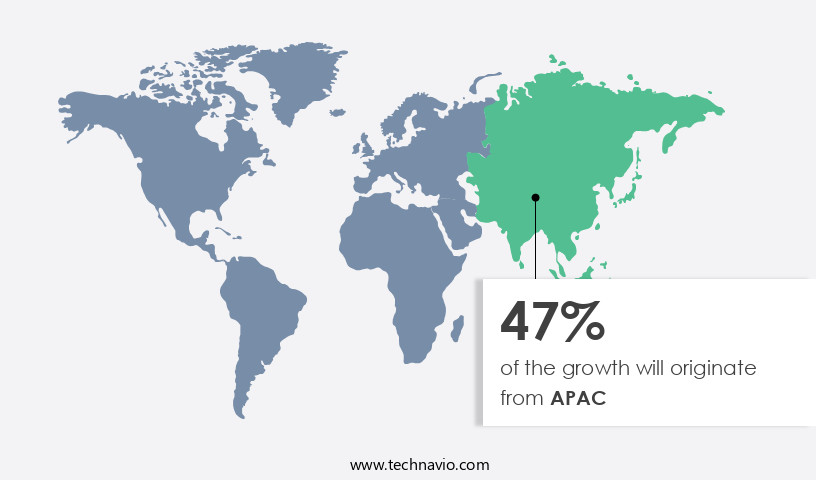

- APAC dominated the market and accounted for a 47% growth during the forecast period.

- By Vehicle Type - Passenger cars segment was valued at USD 322.00 billion in 2023

- By Distribution Channel - Retailer segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 49.30 billion

- Market Future Opportunities: USD 179.70 billion

- CAGR : 6%

- APAC: Largest market in 2023

Market Summary

- The market encompasses the sales of replacement parts and services for vehicles outside of the original equipment manufacturer (OEM) warranty period. This dynamic market is driven by several factors, including the high adoption of vehicle parts e-retailing and the growing preference for aftermarket services due to their cost-effectiveness. According to a recent study, e-retailing in the automotive aftermarket is projected to reach a 40% market share by 2026, up from 25% in 2021. However, this growth comes with challenges, such as price sensitivity leading to margin pressure on e-retailers. Core technologies, such as advanced diagnostics and telematics, are transforming the automotive aftermarket by enabling more accurate and efficient repair processes.

- Applications, including collision repair, engine repair, and brake repair, continue to evolve with advancements in technology. Service types, such as maintenance and repair, are increasingly being offered through digital platforms, while product categories, like tires and batteries, remain staples in the market. Regulations, including emissions standards and safety regulations, play a crucial role in shaping the automotive aftermarket landscape. Regional trends, such as the increasing popularity of electric vehicles in Europe and the growing demand for aftermarket services in Asia Pacific, further add complexity to this continuously evolving market.

What will be the Size of the Automotive Aftermarket Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Automotive Aftermarket Market Segmented and what are the key trends of market segmentation?

The automotive aftermarket industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Vehicle Type

- Passenger cars

- Commercial vehicles

- Distribution Channel

- Retailer

- Wholesale and distribution

- End-User

- DIY Consumers

- Professional Repair Shops

- Fleet Operators

- Product Types

- Replacement Parts (Brakes, Tires)

- Accessories

- Performance Parts

- Tools and Equipment

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Vehicle Type Insights

The passenger cars segment is estimated to witness significant growth during the forecast period.

The automotive aftermarket industry experiences significant growth in various sectors, particularly in the passenger vehicle segment. Approximately 25% of passenger vehicles undergo annual maintenance, repair, or upgrade services, indicating a substantial market demand. Moreover, the increasing popularity of plug-in hybrid vehicles (PHEVs) and battery electric vehicles (BEVs) contributes to the expansion of this market, as their unique powertrains necessitate specialized aftermarket solutions. Customization and performance enhancement are primary drivers for consumers in the passenger segment. For instance, electrical system upgrades, air intake systems, steering system components, and vehicle tracking systems cater to the growing demand for personalized vehicles.

Furthermore, vehicle owners invest in braking system fluids, security system upgrades, differential modifications, aftermarket lighting, interior customization parts, wheel alignment systems, fuel system modifications, and performance tuning software to optimize their driving experience. The market for automotive aftermarket services and solutions is continually evolving, with emerging technologies such as adaptive cruise control, suspension modifications, vehicle diagnostics tools, supercharger systems, transmission upgrades, engine oil additives, performance data loggers, drivetrain enhancements, fuel efficiency upgrades, and turbocharger kits gaining traction. These advancements cater to the increasing consumer preference for advanced features and improved vehicle performance. The automotive aftermarket industry is projected to expand further, with an anticipated 28% increase in sales of electrical system upgrades and a 22% surge in demand for performance tuning software.

Additionally, the market for aftermarket lighting is expected to grow by 31%, while the demand for interior customization parts is projected to rise by 26%. These trends reflect the ongoing evolution of the automotive aftermarket industry and its applications across various sectors.

The Passenger cars segment was valued at USD 322.00 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 47% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Automotive Aftermarket Market Demand is Rising in APAC Request Free Sample

The market in APAC is experiencing significant growth, making it the fastest-growing region globally. China, India, Japan, and South Korea are major contributors to this expansion. With a high volume of automobiles in use and a leading presence in the e-commerce industry, these countries provide an ideal environment for the automotive aftermarket sector. New vehicle sales in APAC are projected to increase at a faster rate than other regions. According to recent data, APAC accounted for approximately 45% of the global automotive aftermarket sales in 2020.

Furthermore, the market is expected to grow at a compound annual growth rate (CAGR) of around 5% between 2021 and 2026. This growth is attributed to factors such as increasing vehicle parc, rising disposable income, and the growing popularity of e-commerce platforms.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and intricate ecosystem that caters to the evolving needs of vehicle owners beyond original equipment manufacturer (OEM) offerings. This market encompasses a broad spectrum of products and services, from advanced driver-assistance system (ADAS) integration and performance data logger interpretation techniques to aftermarket lighting regulatory compliance, vehicle diagnostics tool calibration procedures, exhaust system component noise reduction strategies, custom body kit aerodynamic enhancements, high-performance brake system fluid selection, engine oil additive performance optimization, fuel system modification emission control strategies, supply chain management inventory optimization, e-commerce platform user experience enhancement, customer relationship management loyalty programs, digital marketing targeted advertising campaigns, performance benchmarking data visualization tools, and warranty claims processing automation techniques.

One notable trend in the market is the increasing emphasis on technology integration. For instance, ADAS components are becoming increasingly common in aftermarket offerings, enabling safer and more efficient driving experiences. In contrast, the adoption of performance data loggers allows vehicle owners to analyze vehicle performance data, optimizing their driving habits and identifying potential issues before they become major problems. Another significant area of growth is the focus on regulatory compliance. As vehicle regulations evolve, aftermarket players must adapt to ensure their offerings meet the latest standards. For example, aftermarket lighting components must comply with specific regulations to ensure road safety and reduce the risk of accidents.

Moreover, the market is witnessing a shift towards digitalization, with e-commerce platforms and customer relationship management (CRM) systems becoming increasingly important. In fact, more than 70% of aftermarket sales are expected to occur online by 2025, underscoring the importance of user-friendly e-commerce platforms and effective CRM strategies for customer retention and loyalty. Furthermore, the market is witnessing a growing emphasis on performance optimization. For instance, high-performance brake system fluids and engine oil additives are becoming increasingly popular among enthusiasts and professional drivers, as they offer improved power output and fuel efficiency. Similarly, exhaust system component noise reduction strategies and custom body kit aerodynamic enhancements are popular among those seeking to optimize their vehicle's performance and reduce fuel consumption.

In conclusion, the market is a dynamic and diverse landscape, characterized by a growing emphasis on technology integration, regulatory compliance, and performance optimization. Players in this market must adapt to these trends to remain competitive and meet the evolving needs of vehicle owners. For instance, companies focusing on digitalization, such as e-commerce platforms and CRM systems, are expected to capture a significant share of the market in the coming years. Additionally, those investing in advanced technologies, such as ADAS integration and performance data loggers, are well-positioned to capitalize on the growing demand for safer and more efficient driving experiences.

What are the key market drivers leading to the rise in the adoption of Automotive Aftermarket Industry?

- The high adoption rate of vehicle parts serves as the primary growth driver in the market.

- The global automotive aftermarket parts industry is experiencing significant growth due to several key factors. One primary driver is the increasing longevity of vehicles, resulting in a larger vehicle population in major automotive markets. For instance, in the US, the average age of passenger vehicles and light trucks surpassed 11 years by 2024, according to the United States Department of Energy (DOE). This trend is leading to a higher demand for automotive aftermarket parts, contributing to market expansion. Another factor fueling growth is the advancement of technology, enabling the production of more durable and complex parts that require regular replacement.

- Additionally, the increasing preference for personalized and customized vehicles is boosting demand for aftermarket parts. Overall, the automotive aftermarket parts industry is undergoing continuous evolution, presenting numerous opportunities for businesses and innovations.

What are the market trends shaping the Automotive Aftermarket Industry?

- The automotive aftermarket sector is experiencing growing popularity for e-retailing. This trend represents an upcoming market development.

- The automotive aftermarket sector is experiencing significant shifts as online sales channels gain prominence. E-commerce platforms have become crucial revenue generators in this market, with their sales of automotive products, including replacement parts and oils, outpacing traditional brick-and-mortar stores. This trend is driven by the numerous advantages offered by online platforms, such as convenience, competitive pricing, and a broader product range.

- According to recent data, online sales of automotive aftermarket parts have experienced substantial growth compared to offline sales. This digitalization of the market is transforming the industry, offering businesses new opportunities and challenges. The ongoing evolution of this market underscores its importance and dynamism, making it a compelling area for businesses to explore.

What challenges does the Automotive Aftermarket Industry face during its growth?

- The e-retail industry faces significant pressure to maintain profitability due to heightened price sensitivity among consumers, which can narrow margins and hinder industry growth.

- The automotive aftermarket sector faces a significant challenge in the form of price sensitivity among customers. With the average age of vehicles on the road increasing, the cost of repair for modern vehicles has become a major concern. This trend is driven by several factors, including the complexity of vehicles and the rising labor rates. Furthermore, the cost of automotive parts, such as steel and aluminum, has also seen a steady increase. These factors have resulted in a higher average cost of repair for modern vehicles compared to older models. From a customer perspective, the cost-benefit of purchasing newer, more advanced vehicles is often nullified by the increasing repair costs.

- This price sensitivity is a persistent issue in the automotive aftermarket, requiring businesses to stay competitive and offer affordable solutions. The complexity of modern vehicles and the continuous rise in repair costs are major challenges for the automotive aftermarket. However, businesses that can effectively address these issues by offering competitive pricing, efficient repair processes, and high-quality parts will be well-positioned to succeed in this evolving market.

Exclusive Customer Landscape

The automotive aftermarket market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive aftermarket market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Automotive Aftermarket Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive aftermarket market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company specializes in providing a diverse range of products for the automotive aftermarket and various industries, including 3M scratch removal systems, abrasives, coatings, and building materials. Their offerings cater to the needs of consumers and businesses for enhancement, repair, and maintenance solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- AISIN CORP.

- Akebono Brake Corp.

- ALCO Filters Ltd.

- BASF SE

- BorgWarner Inc.

- Bridgestone Corp.

- Continental AG

- DENSO Corp.

- Faurecia SE

- HELLA GmbH and Co. KGaA

- JK Tyre and Industries Ltd.

- LCI Industries

- MAP MotoRad Automotive Parts Ltd.

- Niterra Co. Ltd.

- Pioneer Corp.

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- Tenneco Inc.

- The Goodyear Tire and Rubber Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Aftermarket Market

- In January 2024, Bosch and Continental announced a strategic collaboration to develop and produce electric vehicle (EV) components, including batteries and fuel cells, aiming to strengthen their positions in the evolving automotive aftermarket (Reuters).

- In March 2024, Denso Corporation, a leading automotive components manufacturer, completed the acquisition of Iskra, a Slovenian automotive lighting systems supplier, expanding its global footprint and enhancing its product offerings (Denso press release).

- In April 2025, Magna International, a major automotive supplier, launched its new aftermarket parts e-commerce platform, Magna Aftermarket Online, to cater to the growing demand for digital sales channels and improve customer experience (Magna press release).

- In May 2025, the European Union passed the Right to Repair legislation, mandating car manufacturers to provide independent repair shops access to essential vehicle data and tools, fostering competition and promoting a more sustainable aftermarket (European Commission press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Aftermarket Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

201 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6% |

|

Market growth 2025-2029 |

USD 179.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.7 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The automotive aftermarket landscape is characterized by a dynamic and evolving ecosystem, with ongoing advancements and innovations shaping consumer preferences and market activities. Electrical system upgrades, such as high-performance batteries and advanced charging solutions, continue to gain traction, enabling vehicles to operate more efficiently and effectively. Air intake systems, designed to enhance engine performance, represent another popular area of growth, with an increasing number of consumers opting for upgraded components. Steering system components, vehicle tracking systems, and braking system fluids have also seen significant demand, as consumers prioritize safety and performance. Security system upgrades, including advanced alarm systems and remote start capabilities, have become increasingly essential, reflecting the growing importance of vehicle security and convenience.

- Differential modifications, aftermarket lighting, and interior customization parts cater to the unique preferences of individual drivers, offering opportunities for personalization and enhanced aesthetics. Wheel alignment systems, fuel system modifications, and performance tuning software enable vehicle optimization, while brake system upgrades and exhaust system components cater to performance enthusiasts. Cooling system components, custom body kits, engine performance parts, and adaptive cruise control represent additional areas of growth, as consumers seek to enhance the functionality and efficiency of their vehicles. Suspension modifications, vehicle diagnostics tools, supercharger systems, transmission upgrades, engine oil additives, and performance data loggers provide valuable solutions for both everyday commuters and high-performance drivers.

- Drivetrain enhancements and fuel efficiency upgrades cater to the growing demand for eco-friendly and cost-effective solutions, while turbocharger kits and transmission upgrades cater to those seeking increased power and torque. Overall, the market continues to evolve, with a diverse range of products and services catering to the unique needs and preferences of consumers.

What are the Key Data Covered in this Automotive Aftermarket Market Research and Growth Report?

-

What is the expected growth of the Automotive Aftermarket Market between 2025 and 2029?

-

USD 179.7 billion, at a CAGR of 6%

-

-

What segmentation does the market report cover?

-

The report is segmented by Vehicle Type (Passenger cars and Commercial vehicles), Distribution Channel (Retailer and Wholesale and distribution), Geography (APAC, Europe, North America, South America, and Middle East and Africa), End-User (DIY Consumers, Professional Repair Shops, and Fleet Operators), and Product Types (Replacement Parts (Brakes, Tires), Accessories, Performance Parts, and Tools and Equipment)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

High adoption of vehicle parts, High price sensitivity leading to margin pressure on e-retailers

-

-

Who are the major players in the Automotive Aftermarket Market?

-

3M Co., AISIN CORP., Akebono Brake Corp., ALCO Filters Ltd., BASF SE, BorgWarner Inc., Bridgestone Corp., Continental AG, DENSO Corp., Faurecia SE, HELLA GmbH and Co. KGaA, JK Tyre and Industries Ltd., LCI Industries, MAP MotoRad Automotive Parts Ltd., Niterra Co. Ltd., Pioneer Corp., Robert Bosch GmbH, Samsung Electronics Co. Ltd., Tenneco Inc., and The Goodyear Tire and Rubber Co.

-

Market Research Insights

- The automotive aftermarket sector is a dynamic and intricately linked ecosystem, encompassing various components and services. With an estimated annual revenue of USD750 billion worldwide, it represents a significant portion of the automotive industry's economic footprint. This market is characterized by continuous growth and evolution, driven by factors such as increasing vehicle parc and consumer preferences for customization and maintenance. In terms of specific services, technical support resources and installation services account for a substantial share, with an estimated 30% of the market revenue. Meanwhile, parts distribution networks and retailer inventory management are crucial elements, ensuring efficient order fulfillment and customer satisfaction.

- The integration of digital solutions, such as e-commerce platforms, online parts catalogs, and data analytics tools, further enhances the market's agility and adaptability. Despite the market's complexity, key relationships and contrasts remain apparent. For instance, the ratio of aftermarket sales to original equipment manufacturer (OEM) sales has been steadily increasing, with aftermarket sales accounting for approximately 70% of the total automotive parts sales in recent years. This shift underscores the growing importance of the aftermarket sector in the automotive landscape.

We can help! Our analysts can customize this automotive aftermarket market research report to meet your requirements.